Despite a Record Travel Boom, China’s Economic Rebound Falls Short

A little over a year ago, the world watched as China reopened its doors after three long years of strict pandemic lockdowns. Expectations were high for a robust economic recovery, fueled by pent-up demand and consumer spending.

The reality has been starkly different. Despite a bustling travel season around China’s Lunar New Year—with a record 9 billion domestic trips expected, 80 million by air—the anticipated economic rebound has largely failed to materialize, even as world markets have surged to record to near-record highs.

This downturn appears not to be just a temporary blip, but a sign of deeper structural issues within the Chinese economy. The nation’s gross domestic product (GDP) reportedly grew 5.2% in 2023, an admirable print at first glance, but it masks underlying challenges. A closer look reveals a significant slowdown from the pre-pandemic era of consistent +6% growth. Select industries such as electric vehicles (EVs) saw remarkable sales in China last year, but this strength hasn’t been enough to offset serious weaknesses in other sectors, particularly real estate, which remains a major drag on the economy.

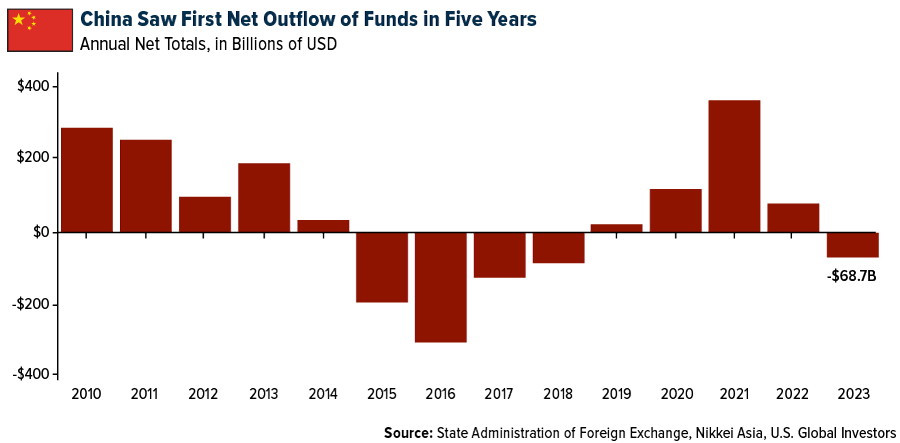

Our decision to close the China Region Fund last year was a move predicated on recognizing early signs of these economic challenges. It’s a decision that, in hindsight, has been vindicated. The ongoing property sector slump and regulatory uncertainties have further exacerbated investor apprehension, leading to a significant outflow of $68.7 billion in foreign direct investment (FDI) for the first time since 2018.

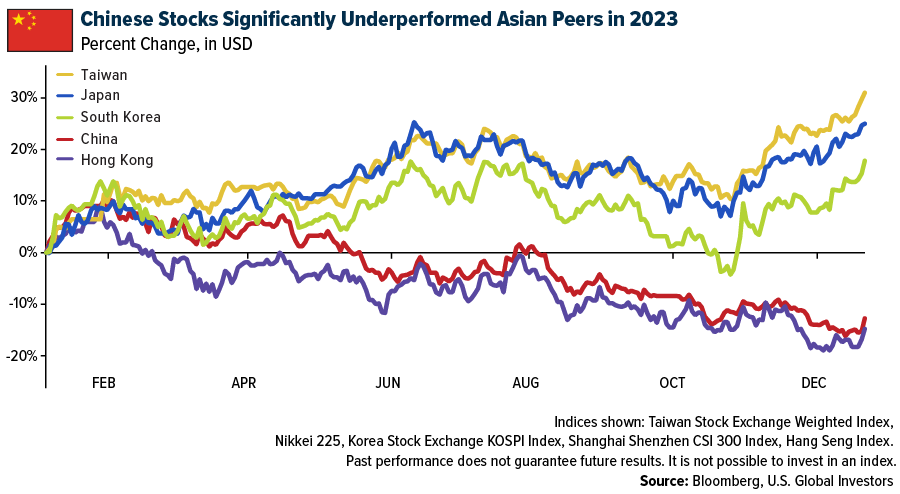

Chinese equities continue to underperform. Both mainland stocks and those listed in Hong Kong ended 2023 with losses, even as other Asia-Pacific markets rallied. Remarkably, Japan’s Nikkei 225 is poised to hit a new all-time high after 34 years.

This year isn’t off to a great start for Chinese stocks, either. The CSI 300 shed over 7% in January, while the Hang Seng lost over 9%.

“China seems to be divorced from the rest of the world,” Steve Sosnick, chief strategist at Interactive Brokers, told Bloomberg. “Part of the lack of equity response is that the global economy is doing OK without China.”

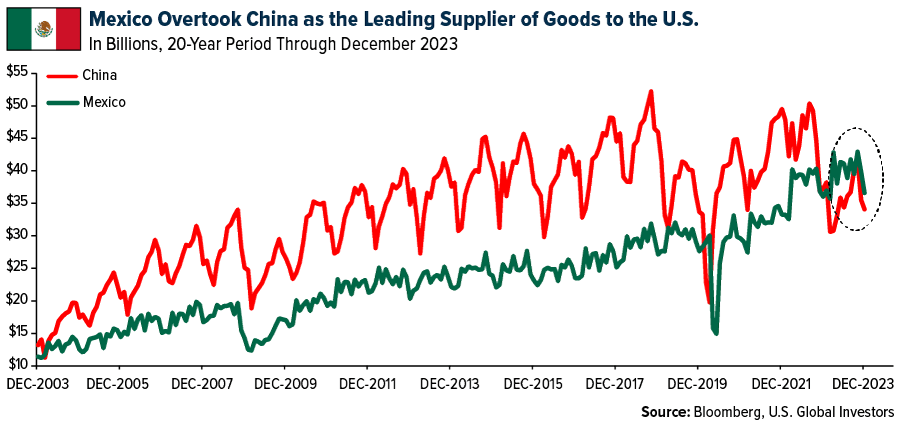

Mexico Surpasses China as America’s Top Import Source

Indeed, in a shift not seen in over 20 years, Mexico outpaced China last year to become the top supplier of imports to the U.S. This change highlights the escalating strains between Washington and Beijing, alongside American initiatives to source more goods from closer, more allied nations.

Recent data from the Commerce Department indicates that imports from Mexico to the U.S. increased nearly 5% from 2022 to 2023, reaching over $475 billion. Conversely, the import value from China saw a sharp decline of 20%, falling to $427 billion.

Will China’s Steps to Stabilize the Market Work?

Efforts to stabilize the Chinese market have so far failed to lift investor confidence. Last Tuesday, the China Securities Regulatory Commission (CSRC) announced plans to halt the practice of brokerages borrowing shares to lend them out and to limit the scope of what’s referred to as the securities re-lending market, in a move aimed at reining in short-selling activities.

This came a day after the regulator vowed “zero tolerance” against short sellers, warning them they could “lose their shirts and rot in jail,” according to reporting by Reuters.

These regulatory steps were introduced after the Chinese government declared in October 2023 that it would issue 1 trillion yuan ($140 billion) in Chinese Government Bonds (CGB) to support local government finances and fund infrastructure projects in areas affected by natural disasters over the past year.

The move was meant to send a signal to global markets that China is “pro-growth” again, but as Morgan Stanley’s Schuyler Hooper writes, the strategy is seen as “merely a repeat of China’s old policy playbook, where they rely on investment to prop up ‘economic’ growth, while growth in consumption, export, property and private investment remains sluggish.”

The risk, Hooper points out, “is a short-lived cyclical rebound amid a longer-term secular slowdown” in the Chinese market.

The Critical Role of Diversification

The Chinese government faces a daunting task in addressing the deep-seated issues within its economy. Chaos in the real estate market, local government debt and deflationary pressures are significant hurdles to sustained growth. Geopolitical tensions add another layer of complexity.

The situation serves as a reminder of the importance of diversification and the need to remain agile. I believe it’s more important than ever to rely on sound investment principles and a diversified portfolio.

Past performance does not guarantee future results. All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

The CSI 300 Index is a free-float weighted index that consists of 300 A-share stocks listed on the Shanghai or Shenzhen Stock Exchanges. The Nikkei 225 Stock Average is a price-weighted average of 225 top-rated Japanese companies listed in the First Section of the Tokyo Stock Exchange. The TWSE, or TAIEX, Index is a capitalization-weighted index of all listed common shares traded on the Taiwan Stock Ex