Could Trump’s Tariff Revenues Fund a New U.S. Sovereign Wealth Fund?

Markets, as many of you are aware, don’t like uncertainty. And right now, there’s a lot of uncertainty surrounding U.S. trade policy.

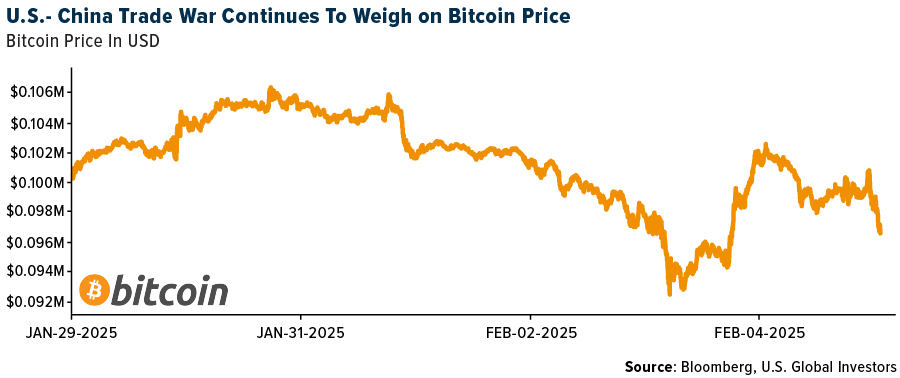

While the Trump administration’s tariffs on Mexico and Canada have been delayed for a month, the 10% tariff on Chinese goods has gone into effect. The move has rattled markets, leaving many American businesses and consumers wondering what comes next.

Tariffs are a double-edged sword. On the one hand, they can serve as a powerful negotiating tool, as President Donald Trump has pointed out. The U.S. economy is the largest in the world, and many countries rely on American consumers to buy their goods. The idea is that, by imposing tariffs, the U.S. can pressure trading partners into more favorable deals and protect domestic industries from unfair competition.

How Key Industries Could Feel the Impact

On the other hand, tariffs raise costs for businesses and consumers. About half of America’s annual imports—more than $1.3 trillion annually—come from China, Canada and Mexico.

Certain sectors will be hit harder than others. The automotive industry, for instance, relies heavily on parts from Mexico and Canada. Energy prices could spike as well, given that over 70% of U.S. crude oil imports come from these two countries. Gas prices in the Midwest alone could rise by as much as $0.50 per gallon, according to the Council on Foreign Relations.

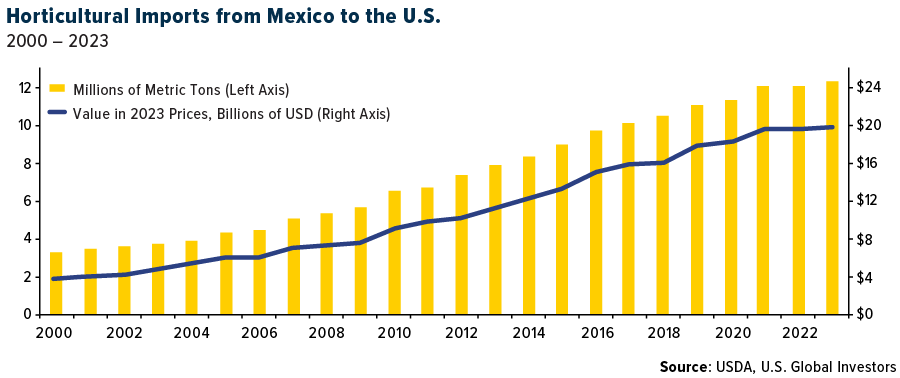

And then there’s food. Mexico supplies over 60% of the fresh vegetables and nearly half of all fruit and nuts consumed in the U.S. Higher import costs could mean higher prices at the grocery store.

A Historical Perspective on Tariffs

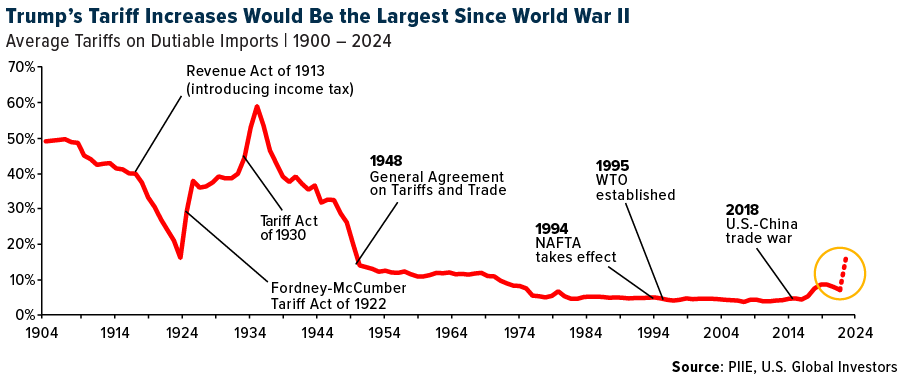

As a historical background, tariffs used to be a major source of government revenue. Between 1798 and 1913, they accounted for anywhere from 50% to 90% of federal income.

But times have changed. Over the past 70 years, tariffs have rarely contributed more than 2% of federal revenue. Last year, for example, U.S. Customs and Border Protection collected $77 billion in tariffs—just 1.57% of total government income.

Since the 1930s, the U.S. has moved away from protectionism in favor of trade liberalization.

Agreements like the General Agreement on Tariffs and Trade (GATT) and its successor, the World Trade Organization (WTO), have dramatically lowered global tariffs. Today, roughly 70% of all products enter the U.S. duty-free.

Trump’s approach marks a shift back toward tariffs as a policy tool. And while it’s true that the U.S. has more leverage than most countries—many economies depend on access to the U.S. market—tariffs aren’t without consequences.

China has already retaliated, imposing its own tariffs on U.S. goods. These include a 15% duty on coal and liquefied natural gas (LNG), as well as 10% tariffs on agricultural machinery, crude oil and some vehicles. Beijing has also launched an antitrust investigation into Google—likely as a form of economic retribution.

The Case for a U.S. Sovereign Wealth Fund

In light of these developments, President Trump has floated an interesting idea: using tariff revenue to fund a U.S. sovereign wealth fund (SWF).

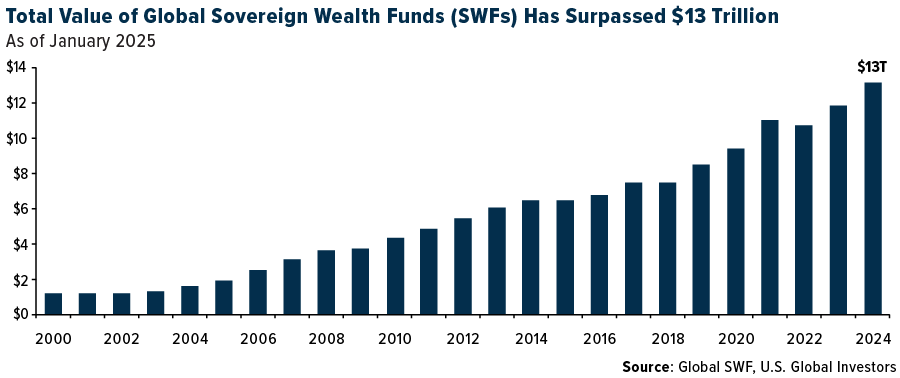

For those unaware, SWFs are government-owned investment funds, typically built from trade surpluses, resource exports or public savings. They serve as long-term savings vehicles, investing in assets like stocks, bonds and infrastructure to benefit future generations. Unlike pension funds, which individuals tap into for personal needs, SWFs are designed to generate national wealth.

Globally, SWFs hold just under $13 trillion in assets—more than ETFs, private equity or hedge funds.

The largest SWF belongs to Norway, which has accumulated a staggering $1.8 trillion thanks to oil and gas revenue. This fund owns roughly 1.5% of all publicly traded stocks worldwide, making it a financial powerhouse. Today, it’s worth four times the country’s GDP—comparable to the entire economy of Australia.

Could the U.S. benefit from a similar investment vehicle? I think an SWF could help finance infrastructure projects, advanced manufacturing, medical research, national security initiatives and more. If structured properly, it could provide long-term economic stability and reduce dependence on debt-financed government spending.

Could the U.S. Wealth Fund Hold Bitcoin?

Of course, there are challenges. Unlike Norway, the U.S. does not run a persistent trade surplus, nor does it generate excess revenue from oil exports. Most SWFs are built from surpluses, but the U.S. runs a trade deficit, meaning we import more than we export. Last year, the country ran a $1.2 trillion trade deficit, a new record.

An intriguing possibility is incorporating Bitcoin. Trump has previously hinted at the idea of a Strategic Bitcoin Reserve. This would align with broader trends of Bitcoin being treated as digital gold.

As always, the key takeaway is to remain diversified. Trade policy changes can create volatility, but long-term opportunities exist in sectors resilient to tariffs. Gold, energy, infrastructure and select equities may benefit from current market conditions.

Explore our interactive infographic about tariffs by clicking here!

Index Summary

- The major market indices finished down this week. The Dow Jones Industrial Average 0.54%. The S&P 500 Stock Index fell 0.22%, while the Nasdaq Composite fell 0.53%. The Russell 2000 small capitalization index lost 0.33% this week.

- The Hang Seng Composite gained 4.44% this week and the KOSPI rose 0.18%.

- The 10-year Treasury bond yield fell 5 basis points to 4.488%.

Airlines and Shipping

Strengths

- The best performing airline stock for the week was Expedia, up 18.4%. Embraer has signed a comprehensive purchase agreement with Flexjet for the acquisition of up to 212 bizjets, as well as a services and support package. The agreement amounts to up to $7 billion and includes the Praetor 500, Praetor 600 and Phenom 300E models, according to JP Morgan.

- Port of LA volumes were up 24% year-over-year in December, supported by front loading, given U.S. East Coast port strike risks and looming U.S. import tariff hikes. Congestion is at 10.5% of fleet, up 200 basis points versus mid -January and at a three-month high with delays across all key regions, with a notable surge in China, Bank of America reports.

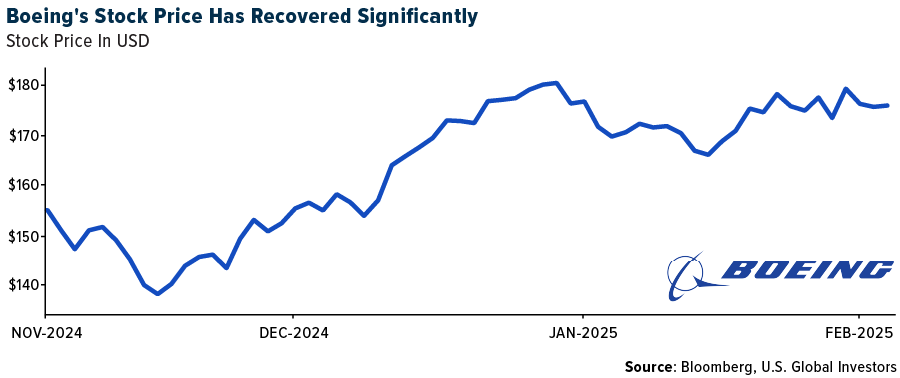

- Boeing delivered 41 MAX jets in January, reports UBS, the highest monthly number since December 2023 and above Boeing’s guidance for upper 30s. The company estimates 30 new-builds and 11 from inventory.

Weaknesses

- The worst performing airline stock for the week was Allegiant, down 11.7%. According to Raymond James, Allegiant wrote down Sunseeker. Allegiant wrote down $322 million and plans to pre-pay the $350 million construction loan. These actions could signal Allegiant is nearing a final sale.

- According to Shipping News, Drewry’s World Container Index (WCI) saw the steepest falls on its Asia-Europe routes. The WCI’s Shanghai-Rotterdam leg declined 5% this week, to end at $3,274 per 40 feet, while the Shanghai-Genoa leg declined 4% this week, to finish at $4,400 per 40 feet. Earlier in the week, Xeneta’s XSI Far East-North Europe route saw its spot rate decline 8.5%, to $3,713 per 40 feet.

- Hawaiian Airlines had the highest percent of cancellations occurring over the past week at 5.6% as a major windstorm triggered cancellations and delays across the state of Hawaii, reports Morgan Stanley.

Opportunities

- JP Morgan identified five potential IAG revenue tailwinds in 2025. Some of these include transatlantic pricing strength given constrained capacity, particularly on UK-US, along with revenue recovery from lower levels of BA disruption, with cancellation rates and delays still elevated in 2024.

- OPEC+ again extended production cuts into April. As a result, tanker demand should be slightly positive, although lower than Stifel previously expected. That compares to a very limited supply picture except for only 1% growth in 2025.

- Cirium believes commercial aircraft demand will continue to outpace supply for new aircraft until the 2028 timeframe with pricing remaining solid. In the leasing market, the aircraft supply/demand imbalance is expected to be supportive of lease rates over the medium-term. Business jet backlogs remain strong while production broadly hovers around pre-pandemic levels, creating pricing power for OEMs.

Threats

- Allegiant is one of the fastest-growing airlines in 2025 with scheduled growth of 16.0%. While this growth alone should put pressure on unit revenues, 50% of Allegiant’s growth is in the weaker shoulder periods with much less of the growth focused on the peak periods. Bank of America expects this to create more unit revenue pressure.

- President Trump’s new tariffs on China have included the withdrawal of the De Minimis exemption. Bank of America sees this putting at risk up to 5% of global air cargo trade assuming Chinese platforms shift more of their transport flows to ocean in-line with key global peers.

- RBC sees Bombardier as the most impacted by tariffs, given final completion of its aircraft occurs in Canada, and the U.S. accounted for 63% of the company’s revenues in 2023. Despite this, the company continues to see a meaningful long-term investment opportunity in Bombardier shares.

Luxury Goods and International Markets

Strength

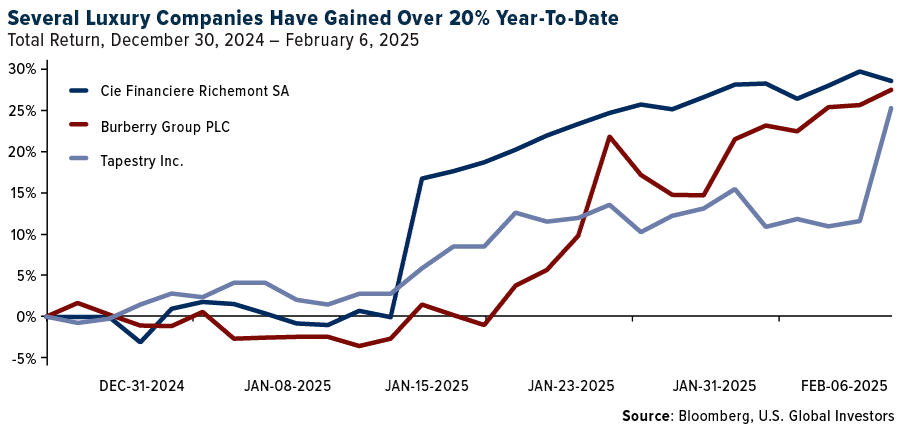

- Several luxury brands reported stronger-than-expected quarterly results, driving their stock prices higher. The week kicked off with impressive results from Ferrari, causing the company’s shares to jump by 7% in a single day. Shares of Ralph Lauren and Tapestry also saw notable gains, rising 12% and 9.7%, respectively, following their strong performance announcements.

- Hotel stocks performed well this week, especially Hilton Worldwide Holdings. Hilton reported fourth-quarter adjusted earnings per share of $1.76 exceeded analysts’ expectations. CEO Christopher Nassetta highlighted an increase in business travel demand and expressed confidence in continued growth moving forward.

- Li Auto, Chinese car maker, was the top-performing stock in the S&P Global Luxury sector, rising 12.3% over the past five days. Li Auto reported impressive vehicle delivery figures for recent months, indicating continued growth trajectory. And, Investment group Macquarie upgraded Li Auto’s stock from ‘neutral’ to ‘outperform’ on Thursday, February 6, 2025, causing the shares to trade up more than 6.7%.

Weaknesses

- The jobs data in the U.S. came out mixed. January nonfarm payrolls grew by 143,000 month-over month, below consensus for 170,000, while December and November revised higher by cumulative 100,000. Unemployment rate ticked lower to 4.0% from December’s unrevised 4.1%.

- Tesla registrations in Europe saw a significant decline in January 2025 compared to the same period in 2024. In Germany, registrations dropped by 59.5%, while the Netherlands and Sweden experienced decreases of 42.5% and 44%, respectively. Spain recorded the sharpest decline, with registrations plummeting by 75%.

- Estee Lauder was the worst-performing stock in the S&P Global Luxury Index, plummeting 21.9%. Share declined after company reported weaker-than-expected fincial results.

Opportunities

- Several luxury stocks have risen by more than 20% year-to-date, following stronger-than-expected sales during the holiday season. While last year was volatile for high-end brands, the worst may be behind us, and the sector is expected to return to growth this year. However, performance may vary significantly depending on each company’s revenue generation.

- LVMH currently operates three major factories in the U.S., producing handbags for the local market. With France facing potential tax increases and the looming threat of tariffs on imports to the U.S., LVMH may shift more of its production to the U.S. market. The company generates a quarter of its sales in the U.S.

- Indian Prime Minister Narendra Modi is scheduled to visit the United States from February 12 to 14, 2025, to meet with President Donald Trump. During this visit, he is also expected to meet with Elon Musk, CEO of Tesla and SpaceX. Musk may discuss with Modi the potential for Tesla to enter the Indian market and request regulatory approval to offer Starlink services to Indian customers.

Threats

- In the United States, many consumers are increasingly concerned that high inflation may be making a comeback. As a result, year-ahead inflation expectations have surged to 4.3%, up from 3.3% previously, marking the second consecutive month of this rise. Additionally, long-term inflation expectations have also increased, rising to 3.3% from 3.2%.

- Estee Lauder reported weaker-than-expected quarterly results, mainly due to a weak Asia travel retail business, depressed consumer sentiment in China and Korea, and evolving global geopolitical uncertainty. The company is forecasting net sales to fall between 10-12% in the three months ending on March 31, higher than analysts’ expectation of a 6.8% decline.

- Ferrari CEO Benedetto Vigna announced a crackdown on extravagant customization requests from wealthy buyers in order to protect the brand’s image, as the percentage of Ferraris in the traditional Rosso Corsa color has significantly decreased. Customization is a major revenue segment for Ferrari, with the company offering a wide range of options for customers to personalize everything from exterior color and interior materials to performance features—at a premium price.

Energy and Natural Resources

Strengths

- The best performing commodity for the week was natural gas, rising 8.64%. Natural gas continues to climb from a combination of factors. Russian attacks have forced Ukraine to buy natural gas from the European Union (EU), which already has faced lower-than-normal gas storage levels caused by a colder winter. This continued depletion in Europe will force aggressive buying of natural gas to restore storage level targets.

- Coffee prices continue their winning streak, with Arabica futures experiencing a record rally, driven by supply concerns in Brazil and a lack of clear information on global stockpiles, leading to increased speculation and potentially higher prices for consumers, according to Illy Caffè’s chairman, who suggests the market is currently “blind” on supply. The reduced visibility on available supply, coupled with weather worries in key growing regions, has amplified speculative activity and pushed prices upward.

- Saudi Arabia hiked the price of its flagship crude to Asia by the most in more than two years as the kingdom responds to surging premiums for Middle Eastern crude and improving refinery margins. State producer Saudi Aramco raised the price for its Arab Light oil to Asia for March by $2.40 a barrel, according to a price list seen by Bloomberg.

Weaknesses

- The worst performing commodity for the week was lithium carbonate, dropping 4.17%. Lithium’s woes of oversupply continue as companies are anticipating a market recovery and applying for new exploration permits in Chile, which would further push the supply glut. In addition, a potential U.S.-Ukraine deal involving access to Ukrainian minerals such as lithium, adds further uncertainty about long-term supply dynamics.

- U.S. crude oil continues to show weakness with its third consecutive week of losses due to concerns on President Donald Trump’s tariffs and their impact on economic growth. In addition, inventories rose sharply last week as demand softened on ongoing refinery maintenance, the Energy Information Agency (EIA) said. Gasoline stockpiles also rose more than expected, while distillate inventories declined.

- Trump’s proposed tariffs, particularly on Canada, a major potash supplier, threaten to increase fertilizer costs for U.S. farmers, which will likely be passed on to consumers, leading to increased food prices and contributing to food inflation. Further weighing on the agricultural sector, Bunge Global SA projects shrinking profits this year due to the trade war and other market uncertainties. The Bunge projection contributes to concerns about supply chain profitability and higher consumer costs.

Opportunities

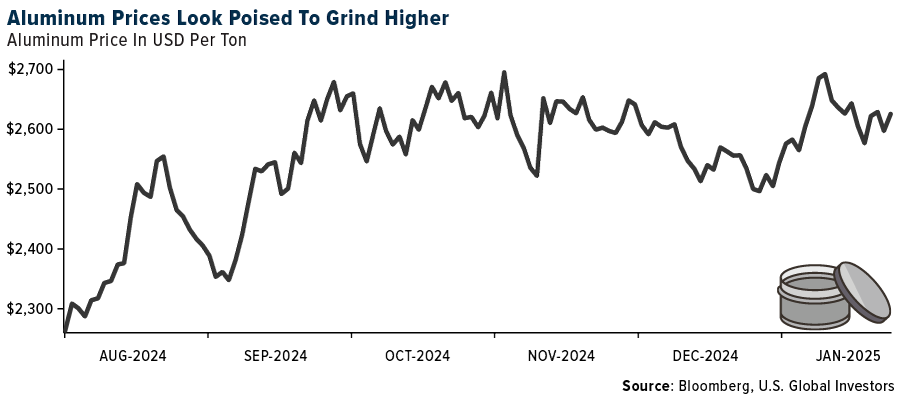

- Aluminum is likely to be the most heavily disrupted commodity, according to BMO. Canadian material made up 69% of all U.S. primary aluminum imports in 2023, with imports from Canada being over three times larger than domestic U.S. production. While trade flows will re-align in time to avoid tariffs, the short-term impact will likely be a spike in the U.S. midwestern premium until traders can resupply the region from other sources.

- There would be a few implications from a ban of nickel ore exports from the Philippines. Indonesia is also looking to reign in overcapacity and overproduction, a key driver of the weak nickel fundamentals; yet, as Indonesia’s government has been looking to constrain domestic nickel mine production, Indonesia’s nickel producers have sought to import more ores from the Philippines, which may ultimately become more difficult, according to Bank of America. Nickel prices could move higher as a result.

- Canada’s Natural Resources minister Jonathan Wilkinson suggested to form an “energy and critical mineral alliance” with the U.S., adding that Canada supplies significant quantities of critical minerals, including germanium, zinc, nickel, copper and graphite. Typically, the alternative source of supply to Canada is China, according to Bank of America.

Threats

- If the tariffs remain in place for longer, they could start to have a more negative impact on the oil price as weaker GDP and a stronger U.S. dollar hit oil demand. This was one of the downside risks UBS flagged at the start of the year versus their $75-per-barrel Brent base case for 2025.

- China put export controls on tungsten and other niche metals used in the electronics, aviation and defense industries as it retaliated in a targeted way against U.S. tariffs. Beijing also imposed export curbs on molybdenum, tellurium, bismuth and indium on Tuesday, according to Bloomberg.

- China Gas Co., one of the country’s biggest distributors of the fuel, said it would stop seeking new U.S. liquified natural gas (LNG) deals as profits are set to be squeezed by the new tariffs, according to a company source.

Bitcoin and Digital Assets

Strengths

- Of the cryptocurrencies tracked by CoinMarketCap, the best performer for the week was Bera, rising 730.27%.

- Geoffrey Kendrick, Head of Digital Assets Research at Standard Chartered, on Wednesday predicted that Bitcoin could reach $500,000 before the end of Donald Trump’s presidential term. Kendrick attributes this forecast to two key factors: improved investor access to Bitcoin under the current administration and a gradual decline in volatility due to maturing market infrastructure, writes Bloomberg.

- Federal Reserve Governor Christopher Waller said he’s supportive of stable coins because they are likely to propagate the dollar’s status as a reserve currency.

Weaknesses

- Of the cryptocurrencies tracked by CoinMarketCap, the worst performer for the week was WIF, down 42.09%.

- MicroStrategy said it didn’t buy any Bitcoin in the prior week, halting a string of 12 consecutive weekly purchases that began in late October. The company has raised funds through stock sales and debt offerings with hedge funds using convertible arbitrage strategies, according to Bloomberg.

- Bitcoin and other digital assets faced renewed selling pressure as trade tensions between the world’s two largest economies intensified, with the U.S. and China imposing fresh tariffs on each other. The renewed market turbulence erased gains from Monday’s relief rally, which came after a temporary agreement by the Trump administration to delay tariffs on Mexico and Canada by a month.

Opportunities

- Investors poured record sums into a leveraged ETF for Ether that had plummeted on Monday after U.S. President Donald Trump’s initial tariff announcements, reports Bloomberg. The 2x Ether ETF, which uses futures contracts to deliver twice the token’s daily performance, recorded $246.5 million in net inflows on Tuesday, by far the largest single day since the funds’ inceptions.

- BlackRock is preparing to list an exchange traded product tied directly to Bitcoin in Europe, following on the success of its $58 billion U.S. ETF tracking the cryptocurrency. The fund will likely be domiciled in Switzerland according to people familiar with the plans who were not authorized to discuss the matter.

- Some members of a special unit of 50 lawyers and staff assigned to regulate cryptocurrency are being reassigned within the agency. The SEC is moving to scale back a unit of more than 50 lawyers and staff that had been dedicated to bringing crypto enforcement actions, according to Bloomberg

Threats

- Ethereum reached the consensus needed to increase the network’s gas limit with 50% of the validators signaling for this change to help improve the networks’ scalability, explains Bloomberg. The gas limit is a critical parameter that dictates the network’s transaction capacity.

- Donald Trump’s new cryptocurrency has sparked a flood of imitators leading to warnings that investors risk being duped. More than 700 copycat and spam coins have been sent to Trump digital wallet, according to Bloomberg.

- India’s federal budget seeks to tighten scrutiny of cryptocurrencies while denying any tax respite for trading the volatile asset class, writes Bloomberg. The increased scrutiny may impact investors who have not disclosed their crypto assets to tax authorities.

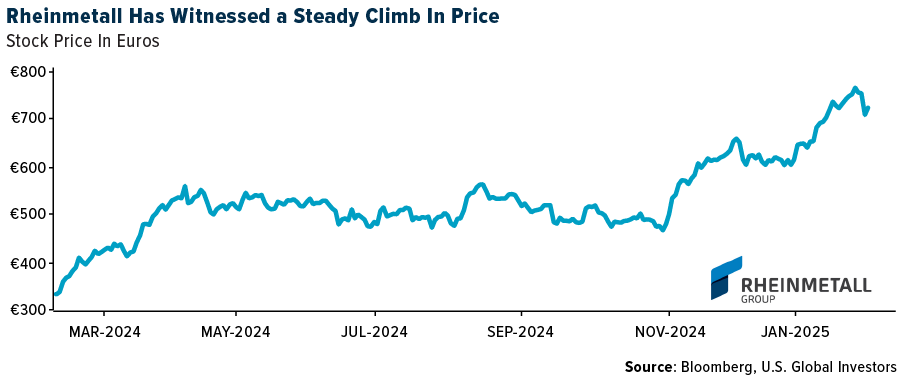

Defense and Cybersecurity

Strengths

- Rheinmetall secured a record €3.1 billion contract, the largest one yet, with the Bundeswehr. The contract will modernize Germany’s infantry forces by upgrading and expanding digital platoon systems, equipping soldiers with advanced IT, communication gear, optics, protective equipment, and integration with armored vehicles.

- Boeing has started assembling the first E-7A Wedgetail prototype for the U.S. Air Force under a $2.56 billion contract. Meanwhile, Lockheed Martin’s IRST21 sensor system has achieved Initial Operational Capability on the U.S. Navy’s F/A-18 Super Hornet, marking significant advancements in defense capabilities.

- The best performing stock in the XAR ETF this week was Triumph Group, rising 34.42%, after the company’s fiscal third-quarter earnings exceeded expectations. This was driven by strong military OEM and aftermarket sales, improved interiors profitability, and a rebound in commercial aftermarket, despite a decline in commercial OEM volumes.

Weaknesses

- Skyworks Solutions plunged 25% after revealing Apple will cut its reliance on the company for the iPhone 17, leading to analyst downgrades and concerns over a $525 million revenue hit, though Skyworks is already working on the iPhone 18 and other partnerships to recover in 2026-2027.

- Defense stocks dropped as reports emerged that a Putin-Trump meeting is being prepared and could happen soon. In addition, Ukraine just started new counteroffensive operation in Kursk (Russian region).

- The worst performing stock in the XAR ETF this week was Intuitive Machines, declining 15.13%, after a reported insider stock transaction to the

Opportunities

- Amazon announced plans to invest $100 billion in artificial intelligence in 2025, focusing on its cloud division, AWS, as part of a significant capital expenditure increase.

- Cisco completed its acquisition of SnapAttack, a cybersecurity spinoff from Booz Allen Hamilton, to enhance Splunk’s security capabilities and improve threat detection and response.

- Viasat, through its subsidiary Inmarsat Government, was awarded its first task order to provide satellite communications services to the U.S. Space Force under the Proliferated Low Earth Orbit contract, which involves 16 vendors and has a ceiling value of $13 billion.

Threats

- Microsoft addressed a critical vulnerability in its Azure AI Face service and integrated LinkedIn Audience Insights into its Performance Max platform for enhanced campaign targeting.

- China is building a massive 1,500-acre military command center near Beijing, nearly 10 times the size of the Pentagon, designed as a fortified bunker for top leadership and signaling its push for advanced nuclear warfighting capabilities.

- A preliminary report by Azerbaijan’s Ministry of Digital Development and Transport on the crash of an Embraer 190 operated by Azerbaijan Airlines near Aktau Airport confirms the aircraft was airworthy before experiencing hydraulic failures. The failures followed external noises over Grozny, leading to an emergency landing attempt that resulted in 38 fatalities. Investigators are analyzing foreign object damage and collaborating internationally to determine the cause.

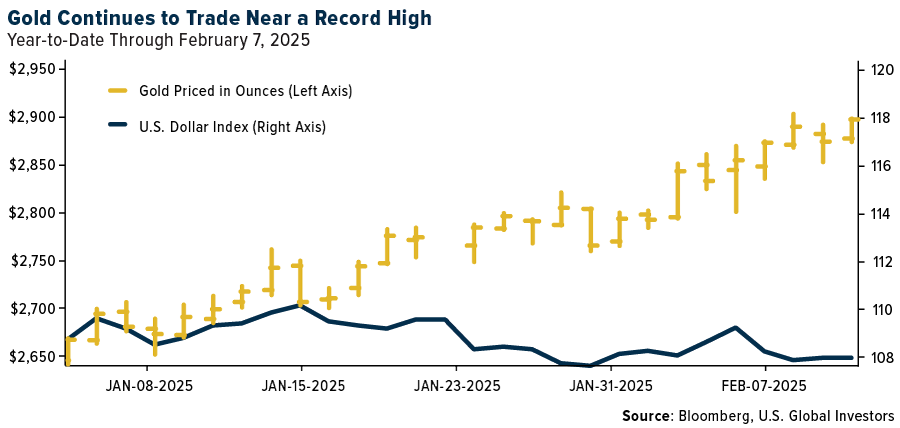

Gold Market

This week gold futures closed at $2,830.30, up $23.40 per ounce, or 0.84%. Gold stocks, as measured by the NYSE Arca Gold Miners Index, ended the week higher by 2.40%. The S&P/TSX Venture Index came in up 0.40%. The U.S. Trade-Weighted Dollar rose 0.90%.

Strengths

- The best performing precious metal for the week was gold, up 1.86%. Gold is showing strength this week, hitting a fresh record high as trade war worries bolster demand and the potential for tariffs reigniting inflation adds to its appeal. In addition, China announced it had expanded its gold reserves for a third month in January despite a series of record high prices. China’s National Financial Regulatory Administration also just cleared the path for insurance companies in China to invest in gold-related businesses as medium-and long-term investments to optimize their asset allocation, Bloomberg reports.

- Major bullion dealers like JPMorgan Chase & Co. are working to deliver over $4 billion of gold against futures contracts in New York amidst a rush to ship metal to the U.S. before potential import tariffs take effect. There’s unease about what lies ahead. Gold dealers in London were selling gold at more than a $5 discount to spot prices in a scramble to move the gold to New York.

- Russians bought a record amount of gold last year as they sought to protect their savings amid sanctions, obtaining the equivalent of about a fourth of the country’s annual output. Consumers purchased 75.6 metric tons (2.7 million ounces) of the yellow metal in bullion, coins and jewelry in 2024, the fifth biggest figure among all nations, according to World Gold Council data published Wednesday.

Weaknesses

- The worst performing precious metal for the week was palladium, down 8.66%, after climbing above $1,000 per ounce last week. Anglo American Platinum Ltd. said profit last year fell by as much as 52% after the price of palladium and rhodium slumped. Profit in 2024 is likely declined to between 6.3 billion rand and 7.6 billion rand, from 13 billion rand the previous year, according to Bloomberg.

- The plummeting demand for diamonds and a refusal to lower prices last year has left the owners of De Beers in a difficult place. Competition from synthetic stones has also capped prices in the once-lucrative industry of diamond production and marketing. China was the second largest market for diamonds, but demand there has dropped 50% since before the Covid pandemic.

- Barrick Gold Corp. Chief Executive Officer Mark Bristow said the company is “making progress” in its dispute with Mali’s military regime, but the advances have not come as fast as expected. The Canadian company last month suspended operations at the vast Loulo-Gounkoto complex in Mali after the government started removing gold from the nation’s biggest mine in the latest escalation of a months-long dispute, Bloomberg explains.

Opportunities

- The Silver Institute released its Silver Market Forecast, forecasting a significant deficit in 2025, with industrial demand as the main driver. Global silver demand is expected to remain stable in 2025 at 1,200 million ounces, with gains in industrial applications (700 million ounces). Global silver supply is expected to grow 3% to 1,050 million ounces, driven by a 2% rise in mine production (844 million ounces).

- The World Gold Council said in a report on Wednesday that demand for gold in the fourth quarter rose to a new quarterly high and that the outlook for 2025 was bright. “Central banks and ETF investors [are] likely to drive demand with economic uncertainty supporting gold’s role as a risk hedge,” the WGC said. “Emerging market banks are very committed to gold and well positioned to purchase more. Strategically, they will continue to be buyers,” said Joe Cavatoni, senior markets strategist with the World Gold Council, in an interview with Barron’s.

- “Record High Profitability, Record Low Valuations: A Coiled Spring in 2025” is the title of recent research report penned by Don MacLean, Senior Analyst at Paradigm Capital. Don notes gold sector equities are off to a good start in 2025, with all tiers – including the explorers –outperforming gold for the first time since 2020. In addition, Don expects further outperformance to come. Every gold equity tier still has a lot of catching up to do with the metal.

Threats

- The Malian government’s overhaul of its extraction industry risks deterring companies from investing in the nation that is home to the world’s second-largest gold mine, according to Anglo American Plc Chief Executive Officer Duncan Wanblad. Mali’s military rulers have demanded a greater share of income from the nation’s gold and other resources since seizing power four years ago, according to Bloomberg.

- Pandora A/S has suspended the roll out of lab-made diamonds in new markets due to a lack of demand, according to the Danish jeweler’s chief executive officer. Alexander Lacik, whose company makes more pieces of jewelry than any other in the world, said it has proved very difficult to introduce the lab-grown stones in new countries and the company will instead “double down” on existing markets such as North America, Bloomberg writes.

- Eldorado Gold has released an update on the Skouries project which was highlighted by a delay of first production until Q1/26, with commercial production mid-2026, and $143 million increased capex estimates. With this release, the company has also provided updated three-year guidance, which demonstrates decreased production estimates compared to previous guidance and increased 2025 costs compared to BMO’s estimates.

U.S. Global Investors, Inc. is an investment adviser registered with the Securities and Exchange Commission (“SEC”). This does not mean that we are sponsored, recommended, or approved by the SEC, or that our abilities or qualifications in any respect have been passed upon by the SEC or any officer of the SEC.

This commentary should not be considered a solicitation or offering of any investment product. Certain materials in this commentary may contain dated information. The information provided was current at the time of publication. Some links above may be directed to third-party websites. U.S. Global Investors does not endorse all information supplied by these websites and is not responsible for their content. All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. The following securities mentioned in the article were held by one or more accounts managed by U.S. Global Investors as of (12/31/2024):

Anglo American Platinum

Eldorado Gold

Barrick Gold Corp.

Embraer

Boeing

Allegiant

Hawaiian Airlines

Allegiant Travel

Bombardier

Ferrari

Hilton

LVMH

Estee Lauder

Cie Financiere Richemont

*The above-mentioned indices are not total returns. These returns reflect simple appreciation only and do not reflect dividend reinvestment.

The Dow Jones Industrial Average is a price-weighted average of 30 blue chip stocks that are generally leaders in their industry. The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies. The Nasdaq Composite Index is a capitalization-weighted index of all Nasdaq National Market and SmallCap stocks. The Russell 2000 Index® is a U.S. equity index measuring the performance of the 2,000 smallest companies in the Russell 3000®, a widely recognized small-cap index.

The Hang Seng Composite Index is a market capitalization-weighted index that comprises the top 200 companies listed on Stock Exchange of Hong Kong, based on average market cap for the 12 months. The Taiwan Stock Exchange Index is a capitalization-weighted index of all listed common shares traded on the Taiwan Stock Exchange. The Korea Stock Price Index is a capitalization-weighted index of all common shares and preferred shares on the Korean Stock Exchanges.

The Philadelphia Stock Exchange Gold and Silver Index (XAU) is a capitalization-weighted index that includes the leading companies involved in the mining of gold and silver. The U.S. Trade Weighted Dollar Index provides a general indication of the international value of the U.S. dollar. The S&P/TSX Canadian Gold Capped Sector Index is a modified capitalization-weighted index, whose equity weights are capped 25 percent and index constituents are derived from a subset stock pool of S&P/TSX Composite Index stocks. The NYSE Arca Gold Miners Index is a modified market capitalization weighted index comprised of publicly traded companies involved primarily in the mining for gold and silver. The S&P/TSX Venture Composite Index is a broad market indicator for the Canadian venture capital market. The index is market capitalization weighted and, at its inception, included 531 companies. A quarterly revision process is used to remove companies that comprise less than 0.05% of the weight of the index, and add companies whose weight, when included, will be greater than 0.05% of the index.

The S&P 500 Energy Index is a capitalization-weighted index that tracks the companies in the energy sector as a subset of the S&P 500. The S&P 500 Materials Index is a capitalization-weighted index that tracks the companies in the material sector as a subset of the S&P 500. The S&P 500 Financials Index is a capitalization-weighted index. The index was developed with a base level of 10 for the 1941-43 base period. The S&P 500 Industrials Index is a Materials Index is a capitalization-weighted index that tracks the companies in the industrial sector as a subset of the S&P 500. The S&P 500 Consumer Discretionary Index is a capitalization-weighted index that tracks the companies in the consumer discretionary sector as a subset of the S&P 500. The S&P 500 Information Technology Index is a capitalization-weighted index that tracks the companies in the information technology sector as a subset of the S&P 500. The S&P 500 Consumer Staples Index is a Materials Index is a capitalization-weighted index that tracks the companies in the consumer staples sector as a subset of the S&P 500. The S&P 500 Utilities Index is a capitalization-weighted index that tracks the companies in the utilities sector as a subset of the S&P 500. The S&P 500 Healthcare Index is a capitalization-weighted index that tracks the companies in the healthcare sector as a subset of the S&P 500. The S&P 500 Telecom Index is a Materials Index is a capitalization-weighted index that tracks the companies in the telecom sector as a subset of the S&P 500.

The Consumer Price Index (CPI) is one of the most widely recognized price measures for tracking the price of a market basket of goods and services purchased by individuals. The weights of components are based on consumer spending patterns. The Purchasing Manager’s Index is an indicator of the economic health of the manufacturing sector. The PMI index is based on five major indicators: new orders, inventory levels, production, supplier deliveries and the employment environment. Gross domestic product (GDP) is the monetary value of all the finished goods and services produced within a country’s borders in a specific time period, though GDP is usually calculated on an annual basis. It includes all private and public consumption, government outlays, investments and exports less imports that occur within a defined territory.

The S&P Global Luxury Index is comprised of 80 of the largest publicly traded companies engaged in the production or distribution of luxury goods or the provision of luxury services that meet specific investibility requirements.

Drewry’s World Container Index (WCI) is a composite index that provides a snapshot of container freight rates on eight major routes to/from the US, Europe, and Asia.