Could $1,400 Stimulus Checks Lift Air Travel Demand?

President Joe Biden's massive $1.9 trillion stimulus package took a giant step toward becoming reality today as the Senate narrowly voted to approve the measure. Squeaking by with a final tally of 51-50--Vice President Kamala Harris cast the tie-breaking vote--the resolution includes $1,400 checks to individuals earning under $50,000, expand federal unemployment benefits and raise the minimum wage to $15 an hour.

By Frank Holmes

CEO and Chief Investment Officer

U.S. Global Investors

President Joe Biden’s massive $1.9 trillion stimulus package took a giant step toward becoming reality today as the Senate narrowly voted to approve the measure. Squeaking by with a final tally of 51-50—Vice President Kamala Harris cast the tie-breaking vote—the resolution includes $1,400 checks to individuals earning under $50,000, expand federal unemployment benefits and raise the minimum wage to $15 an hour.

The resolution now moves on to the House and, if approved there, will be legislated in as many as 25 different committees across both chambers of Congress.

It’s highly doubtful that the final bill will be a carbon copy of the resolution—to the relief of budget hawks—but it’s hoped that an extra $1,400 in the pockets of everyday Americans may help support lagging consumption. U.S. consumer spending fell slightly for a second straight month in December.

I believe the stimulus may also help support commercial air travel. With vaccine distribution scheduled to improve, a greater number of travel-starved individuals and families may jump at the chance to book a well-needed vacation, possibly as early as this summer.

This, in turn, may prompt investors to book a flight on airlines stocks, which are already recovering steadily along with U.S. government bond yields. Yields go up, remember, when safe-haven demand for Treasuries goes down.

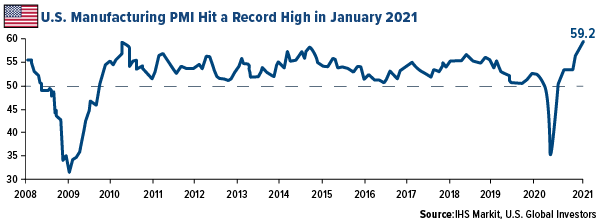

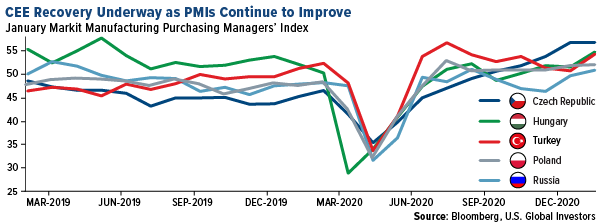

Another positive sign that the economy is recovering is the stellar manufacturing report for January. The IHS Markit U.S. Manufacturing PMI clocked in at 59.2, the highest level in the series’ history. This is bullish not just for the airline industry but also industrial metals and raw materials.

Commercial aviation still has some challenging times ahead of it, but I believe the worst is behind us, meaning now may be an opportune time to get exposure to an industry that’s on sale right now at a deep discount.

Below are five additional reasons why I think airline stocks could be a buy in 2021.

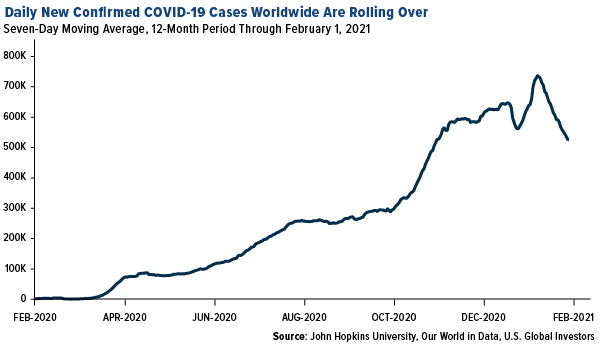

Globally, new virus cases are starting to roll over.

Worldwide, new daily cases of infection appear to be declining, according to data from John Hopkins University. From its peak in January, the seven-day rate has slowed to its lowest level since early November. In the U.S., the number of total daily hospitalizations has also been falling pretty steadily since early January.

Not every country’s cases are dropping, though. Hotspots include Southern and Central Europe—particularly Portugal, Spain and Italy—and South America.

New variants of COVID-19 are also concerning and could contribute to a longer delay in the airline industry’s recovery.

The good news is that the vaccines already being distributed so far appear to work against the mutations.

2. Vaccine distribution in the U.S. is about to ramp up.

I was fortunate enough to receive my first dose of the vaccine last month—I shared my experience with Kitco’s David Lin, which you can watch here—but too many Americans have hit roadblocks trying to get theirs.

That may be set to change in the coming weeks and months. The Biden administration said recently that it would be sending a minimum of 10.5 million doses of the vaccine per week for the next three weeks across of the U.S. Starting next week, many of these doses will be going directly to pharmacies such as CVS and Walgreens.

The hope is that by the end of summer, 300 million Americans will have been fully vaccinated against the virus. As of Monday, some 26.5 million people had already gotten their shots, so I believe this goal, while ambitious, is achievable.

This makes me incredibly bullish of summer travel demand in general and commercial air demand specifically. Getting exposure now to beaten-down carriers could pay off later when vaccinated families start booking flights for summer vacation.

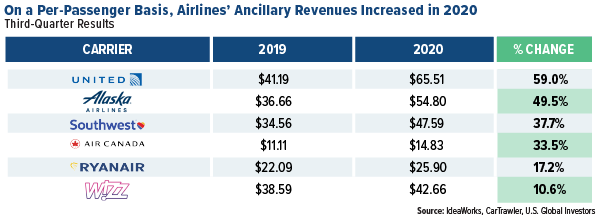

3. Airlines’ ancillary revenues actually increased in 2020 on a per-passenger basis.

I’ve written about the importance of airlines’ ancillary revenues before. These are the fees that passengers choose to pay for add-ons like extra baggage, assigned seating, credit cards and more.

Between 2010 and 2019, revenues from such services consistently grew year-over-year as people became more willing to pay extra for a more comfortable flying experience.

It should surprise no one that the pandemic squeezed this revenue stream. Total global ancillary sales plunged 47% in 2020 to an estimated $58.2 billion, from $109.5 billion a year earlier.

What may surprise you to know, however, is that ancillary revenues actually rose for the year on a per-passenger basis, according to research from IdeaWorks and CarTrawler.

United Airlines’ fees rose the most, from around $41 per passenger in the third quarter of 2019 to as much as $65 in the same quarter a year later—representing an remarkable increase of 59%. Alaska, Southwest, Air Canada, Ireland’s Ryanair and Hungary’s Wizz Air also saw double-digit growth.

Writes Aileen McCormack, CarTrawler’s chief commercial officer, this increase suggests that “an outstanding customer experience is not only recession-proof, but also pandemic-proof.”

One carrier in particular is attributing ancillary revenues to its profitability in 2020. VietJet Air, a low-cost international carrier operating in Vietnam and one of the very few to make money during the pandemic, reported an after-tax profit of $3 million last year after moving to boost its cargo capacity and ancillary services.

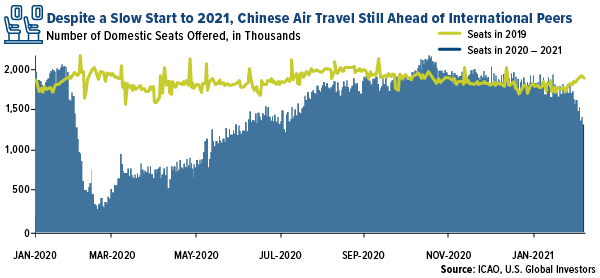

4. Leisure travel is expanding in China and other Asian regions that have successfully contained the virus.

China is the only major economy to report economic growth in 2020, and its domestic commercial aviation industry has rapidly rebounded following stringent lockdowns in early 2020. (International flights are another story.) As such, I believe the country serves as an interesting model of what we may be able to expect here in the U.S. and elsewhere once we get the virus under control.

As you can see above, the number of seats offered on domestic flights in China quickly rebounded, eventually surpassing 2019 levels by late summer/early fall. Despite a slowdown at the start of this year, they’re still well ahead of other regions on a relative basis.

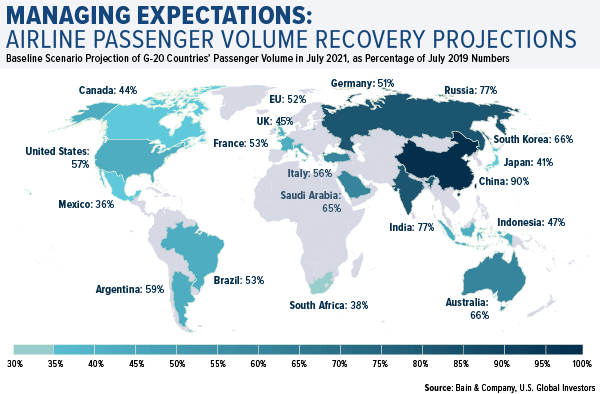

Looking ahead five to six months, consultancy group Bain & Company sees China’s aviation industry recovering the fastest among other G-20 nations. By the end of July, the country’s airline passenger volume is projected to be at 90% of pre-pandemic levels. Compare that to the U.S., which is projected to be at 57% capacity relative to 2019.

5. We’re seeing airlines adding routes, hiring new pilots and making capital investments—all signs that they’re confident in the future.

One of the surest signs that companies are betting on a turnaround in business conditions is when they start expanding and making capital investments. While certainly not all airlines are in expansion mode right now—in fact, too many are still having to make dramatic spending cuts—I’m seeing a number of corporate decisions being made that give me optimism.

For one, airlines are beginning to add new routes to their networks to take advantage of voids left by competitors due to the pandemic.

This is precisely Southwest’s strategy. The Dallas-based carrier is pushing into two large airports, Chicago’s O’Hare International Airport and Houston’s George Bush Intercontinental Airport, both historically dominated by rivals United and American. For the first time in five years, United will be returning to New York’s John F. Kennedy International Airport this year, having already adding over a dozen new flights, including one from Denver to Belize City, Belize.

Incredibly, some carriers are hiring new pilots at this time, including American’s PSA Airlines and low-cost Frontier Airlines.

Other carriers, meanwhile, are making capital investments, including taking delivery of new aircraft. JetBlue has just unveiled a revamp of its popular luxury Mint suites, allowing passengers to make transatlantic flights for the first time in comfort and style.

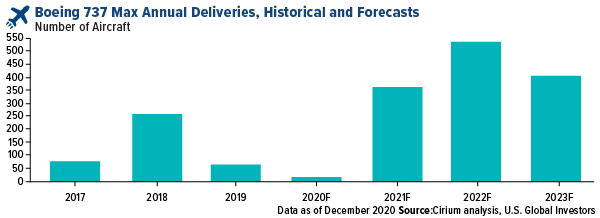

As for new aircraft, travel analytics firm Cirium expects the recently ungrounded Boeing 737 Max to see its best years following a dismal 2020. Says Cirium’s Max Kingsley-Jones, “Boeing is aiming to ship around half of its surplus of undelivered aircraft during 2021 and most of the remainder through 2022, with the pre-built backlog fully cleared during 2023.”

Keep in mind that airline stocks, particularly now, can be highly volatile compared to the broader market. The daily volatility, or standard deviation, of airline stocks is ±4%, versus ±1% for the S&P 500 Index.

To learn more, watch my video on tips for buying airline stocks by clicking here! Wheels up!

Gold Market

This week spot gold closed the week at $1,814.11, down $3.54 per ounce, or 1.82%. Gold stocks, as measured by the NYSE Arca Gold Miners Index, ended the week essentially unchanged. The S&P/TSX Venture Index came in up 10.91%. The U.S. Trade-Weighted Dollar rose 0.41%.

| Date | Event | Survey | Actual | Prior |

|---|---|---|---|---|

| Jan-31 | Caixin China PMI Mfg | 52.6 | 51.5 | 53.0 |

| Feb-1 | ISM Manufacturing | 60.0 | 58.7 | 60.5 |

| Feb-3 | CPI Core YoY | 0.9% | 1.4% | 0.2% |

| Feb-3 | ADP Employment Change | 07k | 174k | -78k |

| Feb-4 | Initail Jobless Claims | 930k | 779k | 812k |

| Feb-4 | Durable Goods Orders | 0.2% | 0.5% | 0.2% |

| Feb-5 | Change in Nonfarm Payrolls | 105k | 49k | -227k |

| Feb-10 | Germany CPI YoY | 1.0% | — | 1.0% |

| Feb-10 | CPI YoY | 1.5% | — | 1.4% |

| Feb-11 | Initial Jobless Claims | 775k | — | 779k |

Strengths

- The best performing precious metal for the week was palladium, up 5.12%, despite hedge funds rolling out of palladium and into platinum according to the latest data. Silver futures on the Comex jumped as much as 13% on Monday and pushed prices above $30 an ounce briefly.

- Demand for physical precious metals remains strong. Gold coin sales at the U.S. Mint hit 220,500 ounces in January, the highest monthly total since 2009. The Mint also reported silver coin sales of 4.775 million ounces in January, a 24% increase and the highest for a January since 2017. On Tuesday, approximately $1.7 billion flowed into the iShares Silver Trust, flying past the all-time high set last Friday. Citigroup said silver could reach $33 an ounce by next week and possibly $36 to $38 an ounce in March if strong inflows continue into ETFs backed by the metal.

- The London Bullion Market Association (LBMA) released its annual price forecast report, and all four precious metals are expected to see double digit gains. LBMA analysts forecast the following: gold up 11.5%, silver up 38.7%, platinum up 28.2% and palladium up 11.2% for the year. With the gold market expected to be relatively tame through 2021, the LBMA said it expects all eyes to be on silver.

Weaknesses

- The worst performing precious metal for the week was gold, down 1.82%. Both gold and silver traded lower this week on a strengthening U.S. dollar and a steepening yield curve.

- Early in the week, silver spiked with the Reddit-fueled rush. Silver fell more than 5% after the CME Group increased margin requirements for futures. Margins were raised by 18% on Comex futures to $16,500 per contract.

- According to preliminary data released by the U.S. Geological Survey, gold output in 2020 fell for the first time in 12 years to around 3,200 metric tonnes, or 3% less than 2019. The production drop was largely caused by pandemic related shutdowns of mining operations. Kitco News notes the report found nine of the top 10 largest gold producing countries saw a decline.

Opportunities

- Turkey’s sovereign wealth fund (TWF) plans to invest $15 billion in energy, petrochemicals and gold mining as a part of a program designed to reduce the economy’s vulnerabilities, reports Bloomberg. The fund hopes to ramp up gold exploration in 20 license areas and plans to boost domestic gold production to as much as 150 tons per year, up from just 42 tons now.

- Zambia isn’t looking to take over more mining companies, nor is the government planning to nationalize the industry, according to Finance Minister Bwalya Ng’andu and as reported by Bloomberg News. The government has previously acquired Glencore and Vedanta’s local operations. This is positive news for other operators in Zambia such as First Quantum Minerals and Barrick Gold which have large copper mines.

- Northam Platinum, South Africa’s fourth largest platinum producer, is considering bidding for the Bokoni mine, which is jointly owned by Anglo American Platinum and Atlatsa Resources. Northam is hoping to boost output amid a bullish demand and price outlook for platinum group metals. This is positive for South Africa, which saw several mines close as producers struggled to contain costs.

Threats

- Bloomberg’s Jake Lloyd-Smith wrote this week that the outlook for gold is diminishing. “At the year’s outset, I was positive on gold… Such a view now looks misguided. With a test of $1,800 soon in the offing, bullion may be about to lose more altitude.” Llyod-Smith points out that gold has been left out of the broad rally in commodities so far in 2021.

- Burgeoning mining hotspot Ecuador is voting on Sunday, alongside presidential and legislative elections, to decide whether to ban major mining projects within municipal limits. Bloomberg reports there are no big mines operating in Cuenca in the southern Andes mountains, but the referendum threatens to derail more than 40 concessions seeking to mine gold, silver and copper reserves.

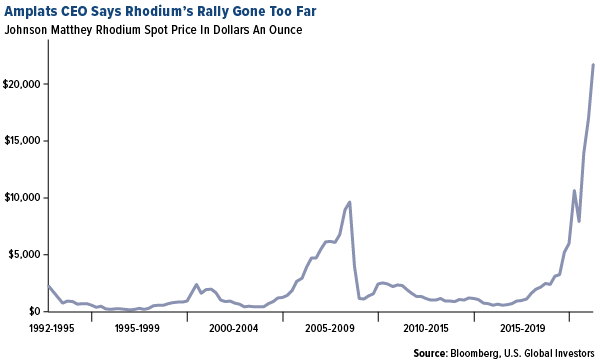

- Rhodium has skyrocketed to a record $21,900 an ounce, making it the world’s most expensive metal. Anglo American Platinum CEO Natascha Vilkoen says the 25% increase so far this year is unsustainable. “Even though we love the additional income, that’s not where we prefer it to stay,” Viljoen said in an interview on Wednesday. Rhodium has surged due to strong demand out of China for vehicles and water leaks shutting down processing facilities in South Africa several times last year, reports Bloomberg, creating a deficit.

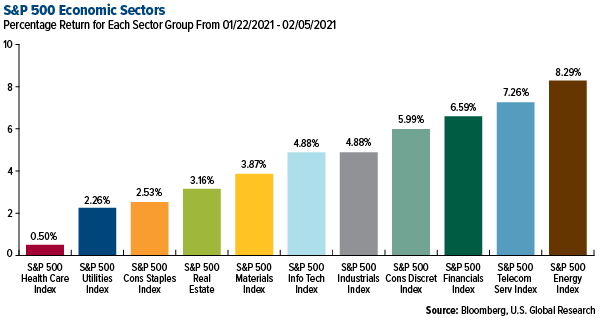

Index Summary

- The major market indices finished up this week. The Dow Jones Industrial Average gained 3.89%. The S&P 500 Stock Index rose 4.65%, while the Nasdaq Composite climbed 6.01%. The Russell 2000 small capitalization index gained 7.70% this week.

- The Hang Seng Composite gained 4.28% this week; while Taiwan was up 4.39% and the KOSPI rose 4.85%.

- The 10-year Treasury bond yield rose 10 basis points to 1.168%.

Blockchain and Digital Currencies

Strengths

- Of the cryptocurrencies tracked by CoinMarketCap, the best performer for the week was UMA, rising 207.53%.

- PayPal’s fourth quarter transaction revenue rose by 11.8% in its first quarterly report since adding cryptocurrencies to the platform. The company gained 16 million in net new active accounts and reported that customers who purchased cryptocurrencies through the platform logged into PayPal twice as much as they were before buying those assets. PayPal believes that it can leverage its position in the fintech ecosystem to increase payments through cryptocurrencies.

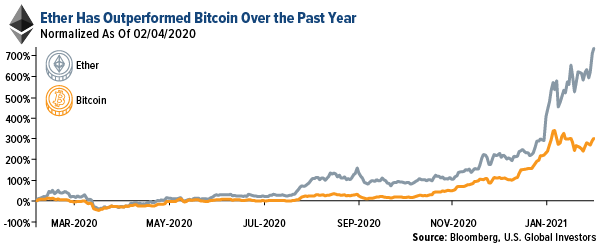

- Ethereum, the second-largest cryptocurrency by market capitalization, reached new highs as the digital asset traded above $1,750 for the first time. Over the past year, Ethereum has outperformed Bitcoin as shown in the chart below, rising above 700% compared to Bitcoin’s 290%.

click to enlarge

Weaknesses

- Of the cryptocurrencies tracked by CoinMarketCap, the worst performing for the week was Verge, down 15.21%.

- Cryptocurrency scammers are targeting users on Discord, the chat server platform popular within the gaming community, by promising them free Bitcoin or Ethereum on a fake exchange platform. Potential victims are asked to register with the exchange, extracting personal data in the process, and either make a small cryptocurrency deposit or go through a fake know-your-customer (KYC) identity check to complete the process. The exchange asks for a deposit into the victims’ account of about $750.

- Chainalysis, a blockchain research firm, said in a report that Russia and the U.S. were the source of over $248 million to illicit online marketplaces in 2020. According to the report, darknet marketplaces receive most of their money through peer-to-peer crypto marketplaces and centralized exchanges.

Opportunities

- Visa is piloting a suite of application programming interfaces (APIs) that will allow banks to offer bitcoin and other cryptocurrency services. This pilot program will let the banks connect with Anchorage, a federally chartered digital asset bank, and allow their customers to trade digital assets within their existing consumer experience.

- Metal Pay, a peer-to-peer crypto payments platform, has filed to become a national bank in the U.S. The company filed a charter application for “First Blockchain Bank and Trust, N.A.” with the Office of the Comptroller of the Currency (OCC). The company’s CEO, Marshall Hayner, said that Metal Pay is the first to pursue “full” banking licensure and that it wants to accept cash deposits alongside cryptocurrencies and have those deposits be insured by the FDIC.

- Chinese government-backed Blockchain-based Service Network (BSN) is planning on offering blockchain analytics and financial auditing services for Ethereum developers in its network through a new partnership with Ernst & Young (EY). EY will provide BSN’s Ethereum users in China with two compliance products – EY OpsChain and EY Blockchain Analyzer. EY OpsChain will integrate procurement and traceability functions into BSN and EY Blockchain Analyzer will offer blockchain analytics and financial statement audits to its users.

Threats

- The Central Bank of Nigeria (CBN) has ordered all the banks under its jurisdiction to close every account that transacts with cryptocurrencies. Officials from the CBN said that they wanted to remind banking institutions that dealing in cryptocurrencies or facilitating payments for cryptocurrency exchanges is prohibited.

- Estonia’s finance ministry is contemplating enacting stricter crypto licensing regulations. This comes after the authorities revoked licenses of around two-thirds of the cryptocurrency businesses operating in the country during 2020. The Estonian Ministry of Finance issued a draft legislation in January to increase regulation on the country’s growing crypto industry. Currently, there are 381 cryptocurrency businesses that hold license to operate in the country, but it is estimated that only 50 to 100 firms are positioned to comply with the proposed regulatory rule changes.

- Coinbase’s upcoming IPO is being dubbed as a “watershed moment” by the founder of Avanti Bank & Trust, Caitlin Long. She emphasized that the SEC would examine Coinbase’s prospectus in extreme details and that will shed light on pressing issues regarding regulations within the cryptocurrency space. The filing will compel SEC to make firm rulings regarding tokens that it might deem unlicensed security offerings. This concern comes from the recent delisting to Ripple’s XRP token from dozens of exchanges after the SEC alleged that it was an unlicensed offering.

Domestic Economy and Equities

Strengths

- The large service side of the U.S. economy grew faster in January and companies added more workers, signaling better times ahead as the record surge in coronavirus cases receded. A survey of top business leaders at non-manufacturing companies such as banks, hospitals and home builders rose to a two-year high of 58.7% from a revised 57.7% in the prior month, the Institute for Supply Management (ISM) said Wednesday.

- U.S. manufacturers grew a bit slower in January as the coronavirus caused more work disruptions, but companies are still expanding rapidly and anticipating a stronger economy in 2021. The ISM said its manufacturing index slipped to 58.7% in January from 60.5% in the prior month. December’s reading was the highest in almost two and a half years and was close to a 16-year peak.

- L Brands was the best performing S&P 500 stock for the week, increasing 21.17 percent. The company announced it intends to sell or spin off Victoria’s Secret by August as the company works to separate its beleaguered lingerie chain from the growing Bath & Body Works business.

Weaknesses

- The recovery in the U.S. labor market disappointed for a second month in January with only modest job growth, highlighting the persistently difficult prospects for millions of unemployed and bolstering calls for more stimulus. Nonfarm payrolls increased by just 49,000 after a downwardly revised 227,000 December decrease, according to a Labor Department report Friday. The median estimates in a Bloomberg survey of economists called for a 105,000 gain in payrolls.

- The U.S. last year posted its biggest annual trade deficit since 2008 as the global health crisis depressed export markets for American companies. The gap in trade of goods and services widened to $678.7 billion in 2020 from $576.9 billion in 2019, according to Commerce Department data released Friday. The December deficit narrowed 3.5% from the prior month to $66.6 billion, but is wider than the $65.7 billion median estimate of economists.

- Clorox Company was the worst performing S&P 500 stock for the week, decreasing 8.69 percent. The stock declined after saying that sales would be flat over the next two quarters, increasing concerns about the company’s ability to maintain its robust growth after the pandemic.

Opportunities

- Johnson & Johnson asked for emergency authorization for its COVID-19 shot. The vaccine would become the third to reach the American people if it is approved by regulators. Meanwhile, the Food and Drug Administration (FDA) wants to make it quicker for vaccine developers to upgrade their shots.

- Kia’s shares jumped on rumors Apple might invest $3.6 billion. Korean media reported the rumored deal, saying the two firms will build Apple cars at Kia’s Georgia facility.

- Google enabled smartphone cameras to take vital signs. The Google Health team has developed a way to use Google’s Pixel smartphone camera to measure heart rate and respiratory rate, and it says it can do so with clinical-grade accuracy.

Threats

- New Relic shares tumbled on Friday after the application software company gave a fourth-quarter outlook that was below expectations, raising concerns about its transition to a consumption-based business model.

- Citi stepped away from its buy rating on Air Products, saying risk to shareholders is rising due to delays tied to increasingly complex projects in coal-gasification and green hydrogen. Analyst PJ Juvekar noted that APD’s future projects in Indonesia, China and Saudi Arabia all have higher levels of risk.

- Cognizant Technology Solutions reported fourth-quarter results that missed expectations, in what the IT services company said was related to “the exit of a large financial services engagement.” Societe Generale downgraded its view on the shares.

Energy and Natural Resources Market

Strengths

- The best performing commodity for the week was natural gas, up 12.09%. U.S. natural gas futures extended gains through the week, amid colder weather forecasts across the country for February. The spread between March and April natural gas futures — known as the widowmaker — flipped to positive on Monday for the first time since January, writes Bloomberg.

- Brent crude continues to make a comeback, trading near $60 a barrel, which was a low as $35 three months ago. OPEC+ said it will continue to quickly clear the oil surplus created by the pandemic and is currently withholding 7 million barrels a day of output, or around 7% of global supplies. China’s biggest offshore oil and gas producer said it will boost spending by 19% this year ahead of an expected production surge, in contrast to other global producers cutting spending.

- Credit Suisse upgraded the U.S. steel sector to overweight, predicting prices could remain above the historical average of $600 a ton through the year. Bloomberg notes the firm turned bullish on Nucor, Steel Dynamics and Stelco.

Weaknesses

- The worst performing commodity for the week was wheat, down 3.32% on light news flow. Iron ore had a third straight weekly loss as investors grappled with prospects for higher global supply, rising stockpiles in China and concerns over demand, reports Bloomberg. Top miners Tio Tinto Group, BHP Group and Vale SA all said they hope to boost supple in 2021 while China has vowed to curb steel output.

- A Russian court ruled that MMC Norilsk Nickel must pay $1.94 billion in compensation for its Arctic fuel spill last year, which would be Russia’s largest environmental penalty. Norilsk originally cited melting permafrost as the cause for the tank collapse, but investigations found faults in its construction. The miner has already spent more than 12 million rubles cleaning up the disaster. Vale SA reached a settlement with Brazilian authorities of $7.03 billion for a dam collapse that killed 270 people in 2019.

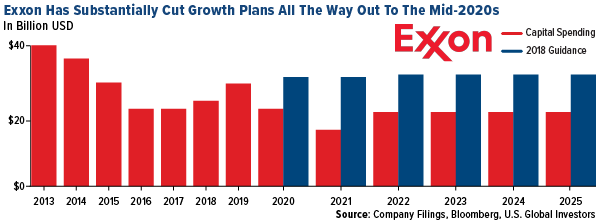

- Royal Dutch Shell reported fourth quarter earnings on Thursday of weak cash flow and net income that fell short of expectations. Shell reiterated its commitment to raise the divided by 4% in the first quarter. Exxon Mobil announced this week it plans to substantially cut capital spending until 2025. Both oil majors pledged to maintain its payout as well, but neither company generated enough cash from operations to cover capital expenditures and dividend payouts in the fourth quarter, reports Bloomberg.

Opportunities

- According to industry group RenewableUK, the country has 16.1 gigawatts of battery storage projects either in operation or in various stages of development, up from 10.5 gigawatts at the end of 2019. This would increase the U.K.’s capacity by more than 14 times what it is currently.

- Despite a volatile start to the year for precious metals, the London Bullion Market Association (LBMA) expects all four precious metals to see double digit gains. LBMA analysts forecast the following: gold up 11.5%, silver up 38.7%, platinum up 28.2% and palladium up 11.2% for the year. With the gold market expected to be relatively tame through 2021, the LBMA said it expects all eyes to be on silver.

- A coalition of 10 large companies, including Shell, Toyota, and Hyundai, are teaming up to lobby for hydrogen energy—though not necessarily green hydrogen—on the grounds that the technology will help the U.S. cut carbon emissions and create new, good-paying jobs. The green hydrogen industry says it needs the Biden administration to help create demand for the new energy. Bloomberg notes the new administration has not yet released specifics on its environmental push.

Threats

- Kazatomprom, the world’s biggest uranium miner, is cautious on signing long-term contracts in 2021 after deals failed to materialized in 2020. “We do not plan our work expecting that to happen this year, but we are ready for it,” Kazatomprom CEO Galymzhan Pirmatov said in an interview on Monday with Bloomberg.

- Burgeoning mining hotspot Ecuador is voting on Sunday, alongside presidential and legislative elections, to decide whether to ban major mining projects within municipal limits. Bloomberg reports there are no big mines operating in Cuenca in the southern Andes mountains, but the referendum threatens to derail more than 40 concessions seeking to mine gold, silver and copper reserves.

- Gunvor Group Ltd. said crude oil likely won’t move above $60 a barrel because further gains would trigger an avalanche of shuttered supply. “Once you hit $60 a barrel, any oil production out there is profitable, and the incentive for oil producers to hold back erodes real fast,” Torbjorn Tornqvist, Gunvor’s chairman and chief executive officer, said in an email, reports Bloomberg. “The high-$50s are the higher end of our expectation for the first half, and we’re not sure we will see much higher,” the CEO added.

Airline Sector

Strengths

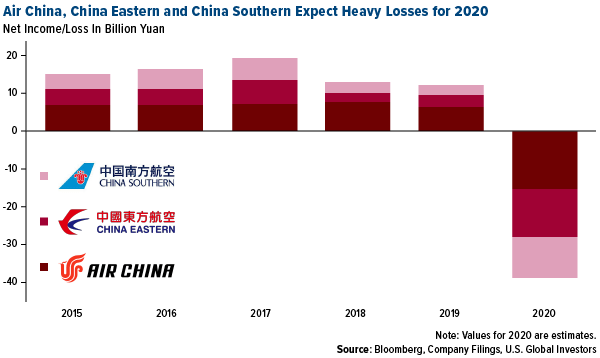

- The best performing airline stock for the week was Allegiant Air, up 16.8%. Capital markets continue to be open for airlines. China Eastern will be offering 2.49 billion shares at 4.34 Yuan each. This is a 13.4% increase in the company’s shareholder base. Funds will be used for general working capital purposes. Lufthansa successfully completed a $1.9 billion bond offering. This offering will repay a previous government bailout.

- Governments continue to backstop some airlines. Air France and Norwegian are petitioning for increased government support. Air France is looking for 6 billion Euros, on top of the 10 billion Euros already received. Norway is setting aside $176 million Euros for a potential loan to Norwegian Air Shuttle, in addition to $3 billion Euros set aside to fund a hybrid debt instrument to be issued by Norwegian.

- Volaris reported “only” a 17% drop in traffic in January, which is far better than any other airline in the world. Its load factor is 73.9%, also far better than other airlines. It is the third lowest carrier in the world and is taking share from buses in the six-hour-plus market and the luxury coach first class market. People are preferring to fly rather than take the bus because buses do not have HEPA filters and there is prolonged close contact within six feet of other passengers.

Weaknesses

- The worst performing airline stock for the week was American Airlines, down 3.9%. The association of Asia Pacific Airlines released data for 2020 showing that traffic collapsed 82% in 2020 due to the COVID pandemic. Capacity has been reduced by almost all of the airlines. Load factors dropped 20.2 points, to 60.8%.

- Ryanair reported a third-quarter loss of 306 million Euros. December traffic was down 83% due to virus-related lockdowns in the U.K. The company guided for an 850-950MM loss in 2021. The company plans to discontinue several domestic routes, as well as several non-EU flights from the U.K.

- Japan Airlines also reported results worse than estimates. The company expects to lose 300 billion yen in the current fiscal year on revenues of 460 billion yen. For the third quarter, Japan Airlines will have a net loss of 51.5 billion yen, worse than the 36.9 billion yen consensus. Japanese air traffic is at 27% of pre-pandemic levels, and international visitors to Japan are down 97%.

Opportunities

- Turkish Airlines is in the midst of growing its cargo business during the pandemic. It is right now number six in the world but has a goal of being in the top three with a 10% market share. Some passenger planes have been converted to cargo planes to achieve this goal.

- American Airlines is seeking to receive $1.12 billion as part of a share offering. Further details on the offering are not available currently.

- Ryanair continues to forecast demand recovery. The carrier expects to be flying at up to 70% of normal by late summer. The EU is currently forecast to be fully immunized by September.

Threats

- The large Chinese air carriers are warning of large losses in 2020, due to the pandemic. Travel in the first quarter is also likely to be subdued, as bookings are down 75% for the Lunar New Year.

- TAP Portugal indicated that it would suspend more routes than expected in February due to shutdowns in Europe. 93% of flights will be grounded, higher than the 73% forecast.

- United Airlines, in a letter to employees, warned that 14,000 jobs may be at risk in April when the current round of airline stimulus expires. This would apply to all employee groups except pilots. American Airlines also warned that 13,000 jobs may be at risk for the same reason. The Airline Industry Association is seeking additional payroll support through September 30.

Emerging Markets

Strengths

- The best performing country in emerging Europe for the week was the Czech Republic, gaining 4.5%. The best performing country in Asia this week was India, gaining 9.6%.

- The Turkish lira was the best performing currency in emerging Europe this week, gaining 3.5%. The Pakistani rupee was the best performing currency in Asia this week, gaining 24 basis points.

- Eurozone inflation recorded its first positive reading since July, the highest in 10 months after accelerating 0.9% year-over-year in January versus consensus of 0.5% and prior 0.3% decline. The core rate, which takes out volatile components such as energy and food, alcohol and tobacco, rose to 1.4% versus consensus 0.9% and prior 0.2%.

Weaknesses

- The worst relative performing country in emerging Europe for the week was Poland gaining 80 basis points. The worst relative performing country in Asia this week was China gaining 38 basis points.

- The Romanian ron was the worst performing currency in emerging Europe this week, losing 90 basis points. The Chinese renminbi (yuan) was the worst performing currency in Asia this week, losing 60 basis points.

- China released weaker-than-expected PMI data pointing to an economic slowdown. China Manufacturing PMI dropped to 51.3 in January from 51.9 in December. Non-Manufacturing PMI declined to 52.4 from 55.7 the prior month, bringing the Composite PMI to 52.8 (down from 55.1). Caixin PMIs, which measures level of production in smaller private Chinese companies, weakened as well in the month of January.

Opportunities

- Emerging Europe PMIs improved in the month of January, and now all major central emerging Europe countries have their PMIs in expansionary territory, above the 50 level. The worst might be over in Europe with COVID cases starting to decline and countries once again starting to remove the restrictive measures put in place to stop the spread of the infections.

- Russia’s gross domestic product contracted by 3.1% in 2020 versus expected contraction of 3.7%. The biggest dip in production was acquired in the first half of the last year when Russia imposed strict nationwide lockdowns. In the second half of the year, despite another wave of infections, the country avoided shutting down its economy. Russia increased oil production in January which should contribute positively to the country’s output as Russia generates most of its revenue from the sale of oil and gas.

- The Czech Republic kept borrowing costs unchanged after the economy proved more resilient to the pandemic than expected. The central bank indicated that it may start raising it again as early as the second half of 2021 to keep inflation in check and the coronavirus crisis subsides. The country kept its export-oriented economy mostly running during the pandemic, which helped to produce a smaller-than-expected recession last year.

Threats

- Europe is slowly distributing COVID vaccinations and there is shortage of the vaccine in Europe. European Commission spokesman Mamer, said that the EU has administered just 2.9 doses per 100 people, compared with 14.7 in the U.K. and 10 in the U.S. However, the supply and distribution should improve in the second quarter.

- A Russian court has sentenced the biggest opposition leader Alexei Novalny to two years and eight months in prison for failing to report to parole officers while he was in Germany recovering from a poisoning. Putin has ruled Russia for the past 20 years, but his popularity will continue to decline. President Macron said that Russia sentencing Novalny is unacceptable.

- China’s National Bureau of Statistics deputy director Sheng Laiyun warned China watchers not to be over optimistic on China’s growth this year. He said while China’s economy is improving, the country’s pandemic controls are effective, the world’s economy is getting better and last year’s base provides a low bar, he still warns that all of these factors will need close monitoring before having confidence in final growth.

Leaders and Laggards

| Index | Close | Weekly Change($) |

Weekly Change(%) |

|---|---|---|---|

| 10-Yr Treasury Bond | 1.17 | +0.10 | +9.47% |

| Oil Futures | 56.96 | +4.76 | +9.12% |

| Hang Seng Composite Index | 4,715.98 | +193.67 | +4.28% |

| S&P Basic Materials | 462.08 | +17.23 | +3.87% |

| Korean KOSPI Index | 3,120.63 | +144.42 | +4.85% |

| S&P Energy | 321.10 | +24.58 | +8.29% |

| Nasdaq | 13,856.30 | +785.61 | +6.01% |

| DJIA | 31,148.24 | +1,165.62 | +3.89% |

| Russell 2000 | 2,233.33 | +159.69 | +7.70% |

| S&P 500 | 3,886.83 | +172.59 | +4.65% |

| Gold Futures | 1,811.40 | -38.90 | -2.10% |

| XAU | 141.52 | +2.93 | +2.11% |

| S&P/TSX VENTURE COMP IDX | 1,022.64 | +100.58 | +10.91% |

| S&P/TSX Global Gold Index | 306.56 | +3.04 | +1.00% |

| Natural Gas Futures | 2.87 | +0.31 | +12.09% |

| Index | Close | Monthly Change($) |

Monthly Change(%) |

|---|---|---|---|

| Korean KOSPI Index | 3,120.63 | +152.42 | +5.14% |

| 10-Yr Treasury Bond | 1.17 | +0.13 | +12.52% |

| Gold Futures | 1,811.40 | -101.60 | -5.31% |

| S&P Basic Materials | 462.08 | -18.19 | -3.79% |

| S&P 500 | 3,886.83 | +138.69 | +3.70% |

| DJIA | 31,148.24 | +318.84 | +1.03% |

| Nasdaq | 13,856.30 | +1,115.51 | +8.76% |

| Oil Futures | 56.96 | +6.33 | +12.50% |

| Hang Seng Composite Index | 4,715.98 | +325.61 | +7.42% |

| S&P/TSX Global Gold Index | 306.56 | -29.32 | -8.73% |

| XAU | 141.52 | -13.61 | -8.77% |

| Russell 2000 | 2,233.33 | +175.41 | +8.52% |

| S&P Energy | 321.10 | +12.65 | +4.10% |

| S&P/TSX VENTURE COMP IDX | 1,022.64 | +125.12 | +13.94% |

| Natural Gas Futures | 2.87 | +0.16 | +5.82% |

| Index | Close | Quarterly Change($) |

Quarterly Change(%) |

|---|---|---|---|

| XAU | 141.52 | -12.64 | -8.20% |

| S&P/TSX Global Gold Index | 306.56 | -69.17 | -18.41% |

| Gold Futures | 1,811.40 | -148.10 | -7.56% |

| DJIA | 31,148.24 | +2,758.06 | +9.71% |

| S&P 500 | 3,886.83 | +376.38 | +10.72% |

| Nasdaq | 13,856.30 | +1,965.37 | +16.53% |

| Korean KOSPI Index | 3,120.63 | +792.74 | +34.05% |

| Natural Gas Futures | 2.87 | -0.07 | -2.31% |

| S&P Basic Materials | 462.08 | +35.64 | +8.36% |

| Russell 2000 | 2,233.33 | +573.28 | +34.53% |

| Oil Futures | 56.96 | +18.17 | +46.84% |

| Hang Seng Composite Index | 4,715.98 | +619.42 | +15.12% |

| S&P/TSX VENTURE COMP IDX | 1,022.64 | +295.21 | +40.58% |

| S&P Energy | 321.10 | +97.74 | +43.76% |

| 10-Yr Treasury Bond | 1.17 | +0.40 | +52.88% |

U.S. Global Investors, Inc. is an investment adviser registered with the Securities and Exchange Commission ("SEC"). This does not mean that we are sponsored, recommended, or approved by the SEC, or that our abilities or qualifications in any respect have been passed upon by the SEC or any officer of the SEC.

This commentary should not be considered a solicitation or offering of any investment product.

Certain materials in this commentary may contain dated information. The information provided was current at the time of publication.

Some links above may be directed to third-party websites. U.S. Global Investors does not endorse all information supplied by these websites and is not responsible for their content.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. The following securities mentioned in the article were held by one or more accounts managed by U.S. Global Investors as of (12/31/2020):

Southwest Airlines Co.

American Airlines Group Inc.

United Airlines Holdings Inc.

Alaska Air Group Inc.

JetBlue Airways Corp.

Air Canada

Wizz Air Holdings Plc.

BHP Group Ltd

MMC Norilsk Nickel PJSC

Barrick Gold Corp

Johnson Matthey PLC

Anglo American PLC

The Clorox Co.

Apple Inc.

Alphabet Inc.

Cognizant Technology Solutions Corp.

*The above-mentioned indices are not total returns. These returns reflect simple appreciation only and do not reflect dividend reinvestment. The Dow Jones Industrial Average is a price-weighted average of 30 blue chip stocks that are generally leaders in their industry. The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies. The Nasdaq Composite Index is a capitalization-weighted index of all Nasdaq National Market and SmallCap stocks. The Russell 2000 Index® is a U.S. equity index measuring the performance of the 2,000 smallest companies in the Russell 3000®, a widely recognized small-cap index. The Hang Seng Composite Index is a market capitalization-weighted index that comprises the top 200 companies listed on Stock Exchange of Hong Kong, based on average market cap for the 12 months. The Taiwan Stock Exchange Index is a capitalization-weighted index of all listed common shares traded on the Taiwan Stock Exchange. The Korea Stock Price Index is a capitalization-weighted index of all common shares and preferred shares on the Korean Stock Exchanges. The Philadelphia Stock Exchange Gold and Silver Index (XAU) is a capitalization-weighted index that includes the leading companies involved in the mining of gold and silver. The U.S. Trade Weighted Dollar Index provides a general indication of the international value of the U.S. dollar. The S&P/TSX Canadian Gold Capped Sector Index is a modified capitalization-weighted index, whose equity weights are capped 25 percent and index constituents are derived from a subset stock pool of S&P/TSX Composite Index stocks. The S&P 500 Energy Index is a capitalization-weighted index that tracks the companies in the energy sector as a subset of the S&P 500. The S&P 500 Materials Index is a capitalization-weighted index that tracks the companies in the material sector as a subset of the S&P 500. The S&P 500 Financials Index is a capitalization-weighted index. The index was developed with a base level of 10 for the 1941-43 base period. The S&P 500 Industrials Index is a Materials Index is a capitalization-weighted index that tracks the companies in the industrial sector as a subset of the S&P 500. The S&P 500 Consumer Discretionary Index is a capitalization-weighted index that tracks the companies in the consumer discretionary sector as a subset of the S&P 500. The S&P 500 Information Technology Index is a capitalization-weighted index that tracks the companies in the information technology sector as a subset of the S&P 500. The S&P 500 Consumer Staples Index is a Materials Index is a capitalization-weighted index that tracks the companies in the consumer staples sector as a subset of the S&P 500. The S&P 500 Utilities Index is a capitalization-weighted index that tracks the companies in the utilities sector as a subset of the S&P 500. The S&P 500 Healthcare Index is a capitalization-weighted index that tracks the companies in the healthcare sector as a subset of the S&P 500. The S&P 500 Telecom Index is a Materials Index is a capitalization-weighted index that tracks the companies in the telecom sector as a subset of the S&P 500. The NYSE Arca Gold Miners Index is a modified market capitalization weighted index comprised of publicly traded companies involved primarily in the mining for gold and silver. The Consumer Price Index (CPI) is one of the most widely recognized price measures for tracking the price of a market basket of goods and services purchased by individuals. The weights of components are based on consumer spending patterns. The Purchasing Manager’s Index is an indicator of the economic health of the manufacturing sector. The PMI index is based on five major indicators: new orders, inventory levels, production, supplier deliveries and the employment environment. The S&P/TSX Venture Composite Index is a broad market indicator for the Canadian venture capital market. The index is market capitalization weighted and, at its inception, included 531 companies. A quarterly revision process is used to remove companies that comprise less than 0.05% of the weight of the index, and add companies whose weight, when included, will be greater than 0.05% of the index. Gross domestic product (GDP) is the monetary value of all the finished goods and services produced within a country’s borders in a specific time period, though GDP is usually calculated on an annual basis. It includes all of private and public consumption, government outlays, investments and exports less imports that occur within a defined territory.

The NYSE Arca Airlines Index is a modified equal-dollar weighted Index designed to measure the performance of highly capitalized and liquid U.S. passenger airline companies identified as being in the airline industry. Standard deviation is a measure of the dispersion of a set of data from its mean. The more spread apart the data, the higher the deviation. Standard deviation is also known as historical volatility.