Copper and Gold Soar as Trump’s Trade War Reshapes Global Markets

Longtime Investor Alert readers have often seen me say that government policy is a precursor to change. What this means is that, when policymakers act—whether through subsidies, sanctions, tariffs or regulations—markets can sometimes respond swiftly and dramatically. We’re seeing that play out right now in real time, especially in the copper market.

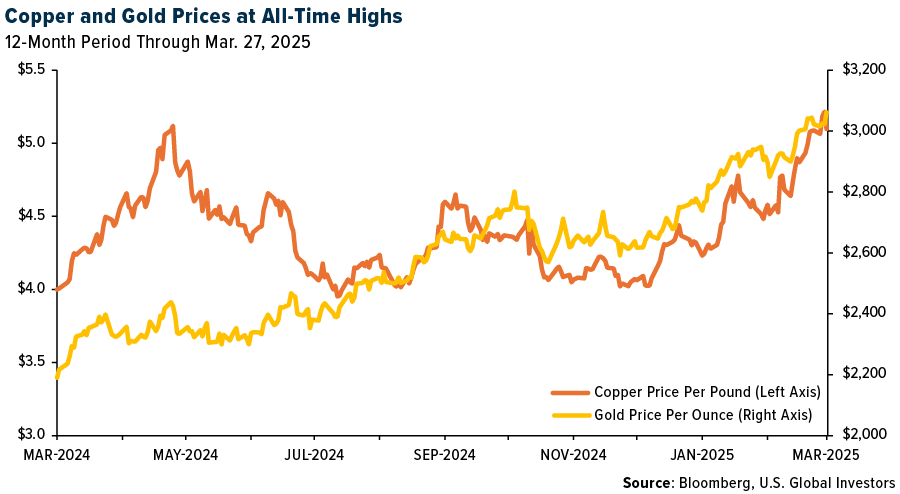

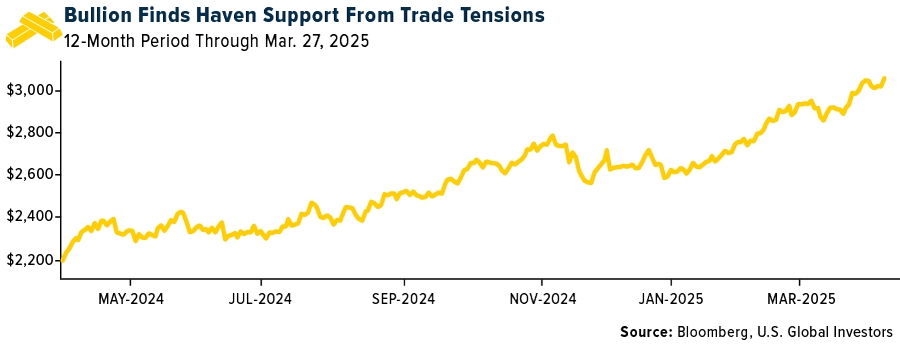

The headlines have been dominated by soaring gold prices, and rightly so. Today, the metal touched a new all-time high of $3,083 per ounce, driven by geopolitical uncertainty, massive central bank buying and President Donald Trump’s tariff agenda.

But while gold captures the spotlight, copper is quietly stealing the show.

On Wednesday, copper prices in New York hit a record high following reports that the Trump administration may impose 25% tariffs on copper imports in the coming weeks—months ahead of Wall Street’s expectations.

Traders scrambled to front-run the announcement, stockpiling the metal before what Trump is calling “Liberation Day,” the April 2 deadline when many of the new tariffs are expected to take effect.

This rally is being driven by more than just demand increases for wiring or plumbing—though that’s a huge contributor. I believe it’s a full-blown policy-driven price spike, with implications that stretch across the global economy.

Why Copper? Why Now?

Copper isn’t just another base metal—it’s a vital building block of the modern world. The red metal is found in everything: construction, consumer electronics, renewable energy systems, and, perhaps most crucially, the electrical wiring and grid upgrades needed to power our 21st-century lives.

It’s also one of the very few critical minerals that’s found in all clean energy technologies. Whether it’s electric vehicles (EVs), solar panels, wind turbines or battery storage systems, copper is indispensable.

That’s why some major trading houses now forecast that copper could exceed $12,000 per metric ton this year. It’s already flirting with $11,000 in London trading.

Supply Shocks

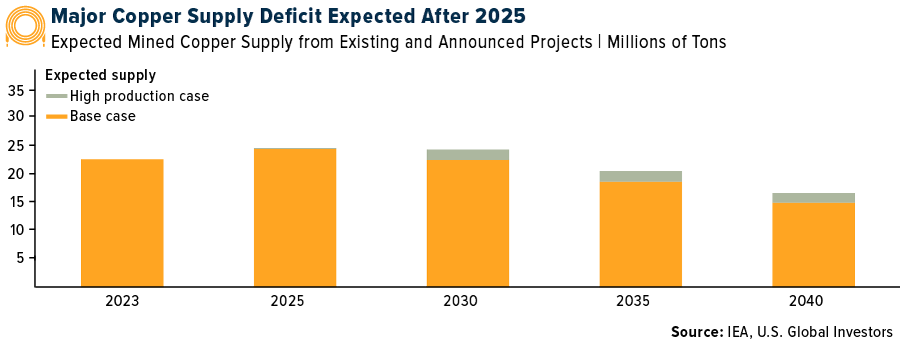

Demand is rising, but what about supply? According to the International Energy Agency (IEA), even under the most optimistic mining forecasts, we’re facing a significant copper supply shortfall by the end of this decade.

The IEA sees a potential gap of 4.5 million metric tons by 2030 in its most aggressive clean energy scenario. Even the base case shows we’ll need 80% more copper by 2040 just to meet the world’s current policy commitments.

New mining projects take years—sometimes decades—to get off the ground. Between permitting delays, environmental reviews and rising capital costs, supply will have a hard time catching up to demand fast enough.

Now, layer in Trump’s America First policy shift. A 25% tariff on copper imports could create short-term scarcity in the U.S., widening the price gap between New York and London. That spread ballooned to over $1,900 per ton, by the way.

The result? A copper-buying frenzy. Mercuria, one of the world’s top commodity traders, estimates that about 500,000 tons of copper are now on their way to the U.S.—nearly eight times the normal monthly import level. That surge could tighten global supply, especially in China, the world’s largest copper consumer, and send prices into uncharted territory.

Tariffs, EVs and Inflation Risk

Some argue that tariffs are inflationary—and they’re right, to a degree. Copper is embedded in thousands of products, from air conditioners to automobiles.

For EVs, the impact is particularly pronounced. According to Bloomberg analysts Steve Man and Peter Lau, a 25% copper tariff could add $275 in raw material costs per electric vehicle, compared to about $68 for gasoline-powered cars. Why the difference? EVs use about four times more copper.

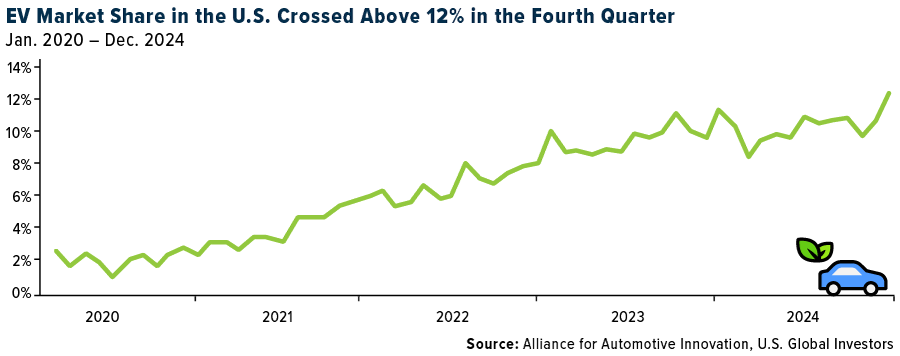

These cost pressures come as global EV sales hit a record 17 million units last year, with December marking the fourth straight month of record volume. U.S. EV sales also hit an all-time high in Q4 2024, with market share jumping to 12.3% in December alone, according to the Alliance for Automotive Innovation, a trade and lobby group.

That’s despite then-President-Elect Trump promising to pull back federal support for EV adoption. The demand is being driven by state-level incentives and falling battery costs, not mandates from Washington.

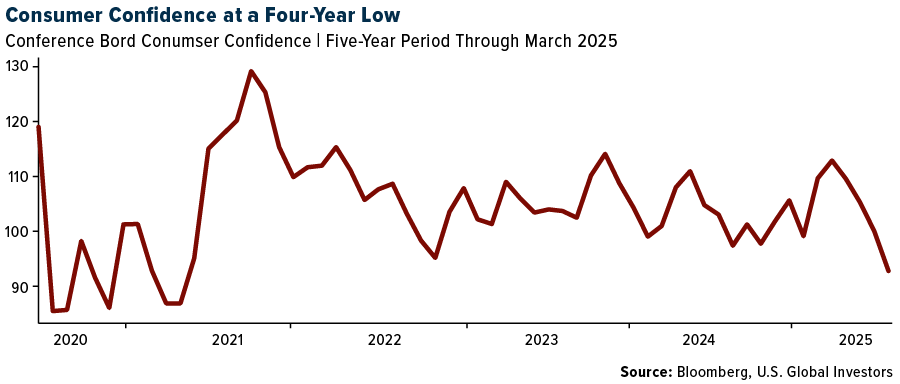

Still, the tariffs could create sticker shock for some American consumers and contribute to broader inflation concerns. We’ve already seen U.S. consumer confidence fall to its lowest level in over four years, according to the Conference Board. If prices rise and growth slows, stagflation could return to the conversation.

Copper Stocks Catch a Bid

It should come as no surprise that copper producers are catching a strong bid. The Solactive Global Copper Miners Index was up more than 12% year-to-date as of Tuesday before pulling back. It’s now up around 6%, with the list of best performers occupied by mostly Chinese and Japanese producers, including Nittetsu Mining (up 51.6% year-to-date), Zijin Mining (+27.6%) and JinChuan Group (+23.1%).

Lessons for Investors

Don’t underestimate the power of policy to move markets. Just as gold reacts to geopolitical uncertainty and central bank buying, copper prices are now responding to trade policy.

Even if copper prices retreat in the second half of 2025—as Citi analysts predict, citing potential economic headwinds—the long-term picture remains bullish, I believe. The supply gap is real, and I expect the clean energy buildout to continue accelerating.

On a final note, diversify into producers. We’ve long believed that the best way to play commodities is through the companies that mine, refine and distribute them. Unlike physical commodities, mining stocks offer leverage to rising prices and cash flow.

As always, I recommend staying focused on quality and remembering that the best opportunities often arise when politics and economics collide. Right now, it appears that that collision is happening in the commodities space—and copper is leading the charge.

Index Summary

- The major market indices finished down this week. The Dow Jones Industrial Average lost 0.96%. The S&P 500 Stock Index fell 1.53%, while the Nasdaq Composite fell 2.59%. The Russell 2000 small capitalization index lost 1.64% this week.

- The Hang Seng Composite lost 0.83% this week; while Taiwan was down 2.73% and the KOSPI fell 3.22%.

- The 10-year Treasury bond yield was flat at 4.25%.

Airlines and Shipping

Strengths

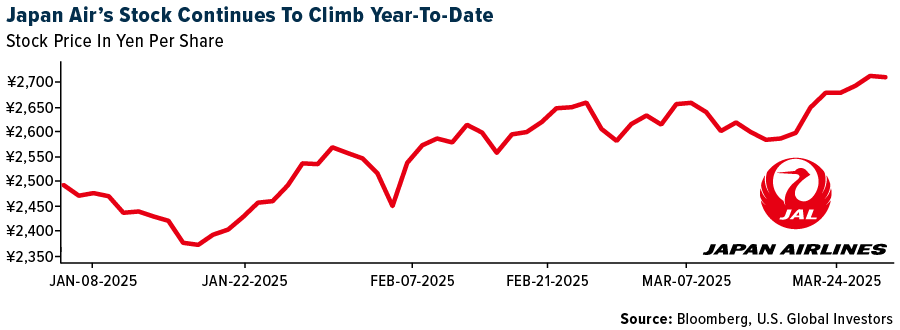

- The best performing airline stock for the week was Turkish, up 8.4%. Between 2026-2028, Japan Airlines intends to increase annual investment further to an average of ¥300 billion from the ¥220 billion in fiscal year 2025 guidance. For shareholder returns, it aims to raise the total payout ratio through a minimum dividend payout ratio of 35% and share buybacks, but considering the need for investment, it has set a FY2025 share buyback budget of just ¥20 billion, according to JP Morgan.

- LNG shipping spot rates rose 30% this week and vessels are up over $30,000 per day from $7,500 in early February. With the start up over Plaquemines and the expansion of Corpus Christi, LNG production has increased by nearly 17 million tons per year of capacity so far, which is about a 4% move in cargo since the first of the year, Stifel reports.

- Cirium has tracked 27 deliveries for Gulfstream, 19 for Textron, and 13 for Bombardier; this implies both Textron and Bombardier are running ahead of consensus, according to UBS.

Weaknesses

- The worst performing airline stock for the week was Sabre, down 12.6%. U.S. citizen departures to Europe rose 13.8% versus 2019 while European citizen arrivals were down 15.2%, reports TD. In Asia, U.S. citizen departures were up 22.3% versus 2019, while Asian citizen arrivals were down 35.7%.

- Spot container rates have not been this low since the Red Sea crisis began in late 2023. The downward slide continued this week, with Asia-U.S. rates yet again declining more than Asia-Europe rates, Morgan Stanley reports.

- OAG reported that airline capacity between Canada and the U.S. has been reduced through October 2025, with the most significant cuts occurring during the peak travel months of July and August, with capacity reduced by 3.5%. Additionally, booking data shows passenger forward bookings on Canada – U.S. routes are currently down by 70% in every month through to the end of September compared to the same periods last year.

Opportunities

- According to Bank of America, Delta Air Lines lowered domestic capacity in May/June/July/August by -50/-220/-150/-530 basis points (bps) while United Airlines cut the same months by -50/-90/-360/-190bps. Spirit continued to cut domestic capacity with May/June schedules down -410/-570bps after cutting May domestic schedules by -1030bps last week. All these cuts could support domestic pricing.

- The quotes data for Shanghai -LA suggest high teens increases and mid-single digit increase for Shanghai – NY. UBS flags that in 10 of the last 15 years, the SCFI has sequentially improved in April to reflect the seasonality of volumes.

- According to JPMorgan, Ryanair may announce a potential new buyback. Over 90% of the current €800 million buyback tranche has been completed, so this could be finished by the results in May, with Ryanair widely expected to continue the program.

Threats

- A survey by Canadian market research firm Leger showed over half of Canadians are less likely to travel to the US. Destinations in Latin America have emerged as substitutes for sun and leisure trips, according to TD.

- Gene Seroka, executive director of the Port of Los Angeles, said during a press conference on Wednesday: “Given the substantial inventory already here and the uncertainty of tariffs, it’s possible that we could see a 10% drop in volume in the second half of this year.”

- UBS believes that mainly due to rising aircraft utilization after the launch of new intercontinental routes, some airlines’ plans could suggest priority on volume instead of pricing. On the demand side, they still see uncertainties given the trade friction overhang.

Luxury Goods and International Markets

Strengths

- Chanel has secured a 70% stake in the Italian luxury footwear brand Grey Mer, signaling its continued expansion and investment in high-end accessories. The remaining 30% remains with the founding Alessandri family.

- French luxury brand Jacquemus has collaborated with Air France to design exclusive pajamas for its premium passengers, blending fashion with travel luxury. Available in four sizes from small to extra-large, it will be available with two options for tops: a V-neck with a tailored fit or a crewneck with a regular fit.

- Ermenegildo Zegna, apparel desiner and distributor, was the top-performing stock in the S&P Global Luxury sector, with a 7.3% increase over the past five days. Shares gained after companu issued stronger guridance than expected. For 2027, the compnay guided revenue in the range of 2.2 billion to 2.4 billion euros.

Weaknesses

- Consumer confidence in the U.S. has plummeted to a 12-year low, with the Conference Board’s index falling 7.2 points in March to 92.9, driven by growing concerns over tariffs and inflation. The measure of short-term expectations for income, business and the job market dropped significantly to 65.2, well below the threshold of 80 that typically signals a potential recession, reflecting heightened anxiety about future economic conditions.

- The GDP growth projection for the U.S. in 2025 has been adjusted downward to 1.7% from 2.1%. Analysts are expecting a slowdown in economic expansion.

- Aston Martin, cat manufatcturer, was the worst-performing stock in the S&P Global Luxury Index, falling by 10.6%. Most shares of car manufacturers corrected this week, after President Donald Trump announed a 25% tariffs on car imports into the United States.

Opportunities

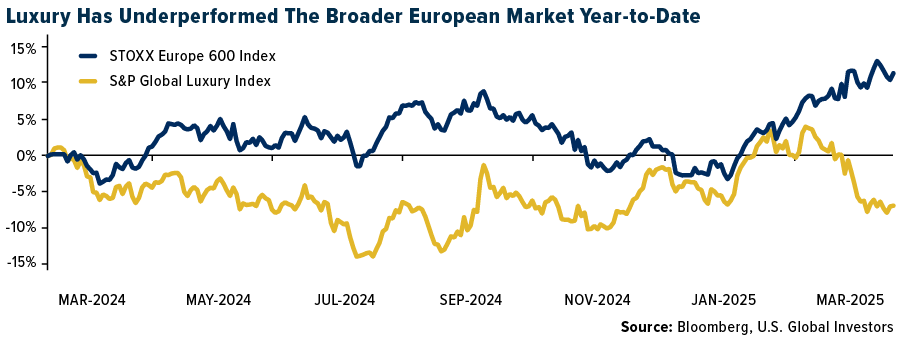

- Year-to-date, luxury stocks, many of which are traded in Europe, have underperformed the broader European market, partly due to Germany’s increased spending on infrastructure and defense. The S&P Global Luxury Index has dropped 2.4% so far this year, while the STOXX Europe 600 Index has risen by over 13%. However, technical analysis, using oscillators to measure stock movements, indicates that luxury equities are currently in oversold territory, suggesting a potential buying opportunity.

- The Eurozone Manufacturing PMI climbed to 48.7 in March 2025, marking a 26-month high and surpassing expectations, with Germany contributing significantly to this improvement. While still in contractionary territory, the manufacturing sector’s downturn has eased considerably, with output expanding for the first time in two years and at the fastest pace since May 2022, signaling a potential turnaround in the Eurozone’s industrial landscape

- China plans to increase the share of consumption in its GDP from the current 55% to 70% by 2035, aligning more closely with developed economies. This strategy, as advocated by Peng Sen, president of the China Society of Economic Reform, represents a shift from investment-heavy projects to prioritizing domestic consumption and improving citizens’ well-being

Threats

- President Trump’s recent announcement of a 25% tariff on imported automobiles and certain auto parts, set to take effect on April 2, 2025, has sent shockwaves through the global automotive industry. The move, aimed at boosting domestic manufacturing, threatens to significantly increase vehicle prices and disrupt complex international supply chains that have been established over years. Ford and General Motors have already seen their stock prices decline in response to the news.

- Goldman Sachs hosted a symposium in Paris on March 24-25, featuring companies such as Hermes, LVMH, Kering, EssilorLuxottica, and Remy Cointreau, among others. While the broker maintains a positive outlook on long-term growth opportunities, it highlights near-term challenges, including increased volatility in the U.S. in recent weeks and a slower-than-expected recovery in China.

- In February, both Volkswagen and BMW managed to surpass Tesla in electric vehicle (EV) sales across Europe, marking a significant shift in the region’s electric car market. Tesla, which had previously been a dominant player, saw a notable 40% drop in its EV sales during the month. This decline has had a major impact on Tesla’s position in the European market, resulting in a loss of market share to its competitors.

Energy and Natural Resources

Strengths

- The best performing commodity for the week was lumber, rising 13.33%. Lumber marched on with price hikes this week after President Trump remarked on 50% planned tariffs on Canadian softwood lumber, which would threaten to disrupt the supply of northern bleached softwood kraft pulp (NBSK), a key material in toilet paper and paper towel production. The U.S. imported about 2 million tons of Canadian NBSK last year, and industry experts warn the tariffs may lead to shortages or price hikes for these essential products, Bloomberg shares.

- Copper prices continued to climb, according to RBC, as the potential imposition of U.S. tariffs continues to drive strong demand. Bloomberg reported that 500,000 tons of copper are en route to the U.S., highlighting this potential demand acceleration.

- Oil prices rallied to just over $73 on new sanctions targeting Iranian and Venezuelan oil exports and a pick-up in macro growth pricing after a somewhat dovish Fed meeting and solid China activity data, according to Goldman. Supporting prices, the Trump administration announced new sanctions on Iranian oil exports and an additional 25% “secondary” tariff on all imports to the U.S. from countries that import any oil from Venezuela, leaving oil poised for a third weekly gain.

Weaknesses

- The worst performing commodity for the week was wheat, dropping 5.33%. Wheat prices dropped to a seven-month low after Black Sea ceasefire talks, with Chicago wheat futures falling 1.7% to $5.23 per bushel and posting a 6.3% weekly decline. In addition, forecasts of improved rainfall in key growing regions like Russia, Ukraine and the U.S. Plains set up for more supply hitting the market, Bloomberg reports.

- Consumer sentiment fell to 57.0 from 67.4 in the prior month. Two-thirds of respondents expect unemployment to rise in the year ahead along with inflation expectations at 4.1%, as reported by Bloomberg. In addition, the latest Atlanta Fed GDP Now Forecast was reported on Friday and the “real time” estimate of GDP had dropped from -1.81% to -2.80%, reinforcing consumer sentiment.

- Chinese copper smelters are facing a tough situation, with many bringing forward maintenance to deal with shrinking profits. This move, affecting about 8% of last year’s total smelting capacity, comes as spot copper treatment charges hit a record low, potentially leading to tighter supply and higher prices in the Chinese market.

Opportunities

- The rush to cleaner energy in Europe has reinforced gas as a critical stopgap, with Hungary capitalizing on ambitions and Germany’s grid stability relying on flexible gas plants during renewable shortfalls. This rushed demand for natural gas in Europe serves a company such as TotalEnergies, with natural gas operations in Europe for increased demand.

- One of the highest-profile copper bulls is back predicting new price records, as Trump’s threat of tariffs drains global stocks and creates what he sees as unprecedented opportunities for trading profit. Kostas Bintas became one of the best-known metals traders during his years building Trafigura Group’s copper book into the world’s largest, before his departure in late 2023, according to Bloomberg.

- Rio Tinto is in talks with the Democratic Republic of Congo circulating around development for the biggest hard rock lithium deposits. This comes at a time when the Democratic Republic of Congo has proposed a minerals-for-security deal with the United States to combat paramilitary groups from Rwanda threatening the nation of the Democratic Republic of the Congo, Bloomberg reports.

Threats

- Microsoft’s cancellation of 2 gigawatts (GW) in data center projects—citing oversupply and reduced OpenAI demand—signals potential overbuilding in AI infrastructure, straining power grids and utilities reliant on projected growth. This pullback, alongside Meta and Google absorbing vacant capacity, suggests the AI boom may be outpacing real demand, potentially dampening forecasts for critical minerals like copper and rare earths used in data centers.

- Once-booming uranium stocks have been veering toward bust mode to start 2025. Escalating trade tensions between the U.S. and Canada, one of the world’s key producers of the nuclear fuel, are playing a major part. Lately, so are talks toward a ceasefire in Russia’s war in Ukraine, which raise the prospect of looser sanctions on Russian production of the radioactive metal and the potential for more supply, according to Bloomberg.

- China is rapidly cutting back on its seaborne gas imports, threatening growth forecasts that have driven multibillion-dollar spending on projects across the globe. Chinese purchases of liquefied natural gas will fall this year for the first time since 2022, according to BloombergNEF, which had earlier foreseen record-high deliveries.

Bitcoin and Digital Assets

Strengths

- According to CoinMarketCap, the best performing cryptocurrency for the week was Cronos, up 37.48%.

- Turkey’s crypto exchange, Paribu, has received regulatory approval to acquire digital media company Aposto, marking a rare merger between the crypto and media sectors in the country.

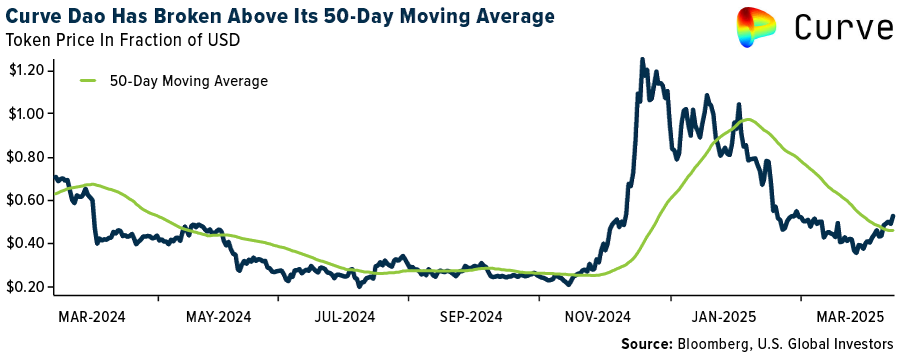

- Curve Dao has broken above its 50-day moving average, a positive technical move during a time when Bitcoin, Ethereum and Solana are all trading below their 50-day moving averages.

Weaknesses

- According to CoinMarketCap, the worst performing cryptocurrency for the week was PancakeSwap, down 23.35%.

- In the small Argentine town of San Pedro, thousands of residents were swept into a Ponzi-style crypto scheme called RainbowEx—fronted by a mysterious figure known as “La China”—pouring in millions of dollars in hopes of easy profits before the illusion collapsed. The scheme left behind financial ruin, arrests, and a community divided.

- Recent tariff threats from U.S. President Trump caused sharp declines in major cryptocurrencies like Dogecoin and XRP this week, highlighting the market’s sensitivity to geopolitical news and lack of insulation from broader economic pressures.

Opportunities

- President Trump’s crypto venture, World Liberty Financial, plans to launch a U.S. dollar–backed stablecoin called USD1, entering the competitive $238 billion market dominated by Tether and Circle. The hopes are to leverage Trump’s influence to secure key exchange partnerships amid rising regulatory scrutiny.

- Senate Republicans are racing to repeal Biden-era regulations using the Congressional Review Act before the early May deadline, recently sending a resolution to President Trump to block an IRS rule on crypto tax reporting. Additional disapproval measures are expected on environmental, financial, and emissions policies.

- The SEC has closed its investigation into crypto gaming firm Immutable and related parties without finding any wrongdoing. This marks a broad regulatory shift as the agency pauses or dismisses multiple crypto-related cases under the Trump administration’s more industry-friendly stance.

Threats

- Galaxy Digital will pay $200 million in penalties to settle charges from the New York Attorney General for promoting the failed Luna cryptocurrency without disclosing its intent to sell; despite claiming it was misled by Luna’s creators.

- GameStop shares plunged after the company announced a $1.3 billion convertible bond sale to fund Bitcoin purchases. The company is adopting a controversial strategy inspired by Michael Saylor as it seeks to diversify from its declining video game business amid rising investor skepticism.

- The rise of quantum computing threatens the cryptographic foundations of major blockchains like Bitcoin and Ethereum, as future quantum machines could potentially break the encryption securing wallets and transactions.

Defense and Cybersecurity

Strengths

- Kratos Defense & Security Solutions announced its inclusion in the S&P SmallCap 600 Index, highlighting the company’s growth and market position in the defense and national security sectors.

- The U.S. Navy is expected to announce the winner of the F/A-XX program, a next-generation carrier-based stealth fighter designed to replace the Super Hornet fleet and counter China’s military reach in the Indo-Pacific. The program involves Boeing and Northrop Grumman, with an initial contract valued in the single-digit billions and the potential to reach hundreds of billions over its lifecycle.

- The best-performing defense stock this week was Intuitive Machines, rising 13.82% after reporting strong year-over-year revenue growth and a record backlog in Q4, joining Tesla, AnaptysBio, Coherent and other major stocks climbing higher on Monday.

Weaknesses

- Microsoft has withdrawn from data center projects in the U.S. and Europe due to an oversupply of electricity and computers, impacting plans to support OpenAI’s workloads. Meanwhile, Dell Technologies has reduced its workforce by 10% as part of cost-cutting measures amid rising AI competition.

- Textron Inc. reported a critical safety incident where nitrogen entered the breathing air system, resulting in the death of an employee, and is cooperating with ongoing investigations.

- The worst-performing stock this week was Archer Aviation, falling 16.74% under the high volatility on the market.

Opportunities

- The Korea Fair Trade Commission has approved the $35 billion merger of Synopsys and Ansys, marking the largest tech acquisition since 2023, while Parsons Corporation has increased its stock buyback authorization to $250 million amid a significant stock price drop.

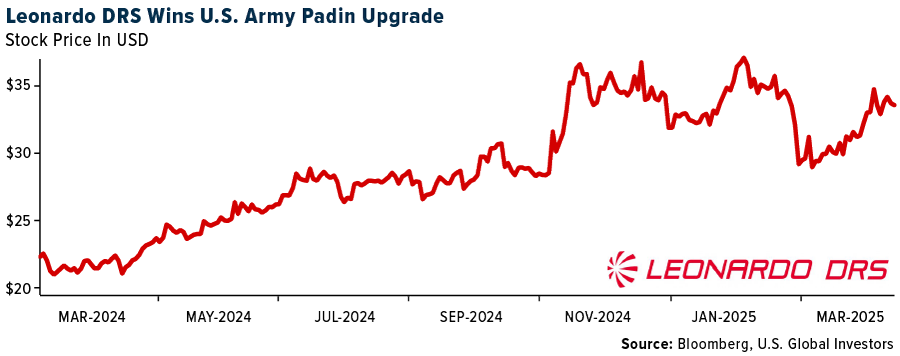

- Leonardo DRS announced the launch of its new Artificial Intelligence Processor, designed to enhance real-time threat detection and situational awareness for military vehicles.

- Viasat has been contracted to design and develop a Lunar Communication System for the European Space Agency’s Moonlight Project, in collaboration with Telespazio, with full operations targeted by 2030.

Threats

- Israel resumed its military operations in Gaza, leading to the deaths of two members of Hamas’s de facto leadership, amid ongoing domestic tensions and international efforts to reach a resolution that addresses Hamas’s political and military role.

- Cloudflare experienced a global service outage on March 21 due to a password rotation error that affected its R2 object storage and other services, causing 100% write and 35% read failures.

- Nvidia’s sales in China face a potential impact due to Beijing’s new energy efficiency rules, which the H20 chip currently does not meet, threatening Nvidia’s significant revenue from the Chinese market.

Gold Market

This week gold futures closed at $3110.80 up $62.40 per ounce, or 2.05%. Gold stocks, as measured by the NYSE Arca Gold Miners Index, ended the week higher by 2.33%. The S&P/TSX Venture Index came in down 0.81%. The U.S. Trade-Weighted Dollar fell 0.02%.

Strengths

- The best-performing precious metal for the week was silver, up 3.91% on the back of gold’s lift this week as precious metals got a boost from rising trade tensions, helping to send gold to another all-time high this week along with a new upgrade in year-end forecasted price gains by Goldman.

- Gold-backed exchange-traded funds continued to see big inflows, adding the most in more than three years on Monday. ETFs added 23 tons of gold in the trading session closed on Monday, the biggest one-day increase since 2022, according to data collected by Bloomberg.

- Gold has solidified its position as a safe-haven asset, rising 17% year-to-date to over $3,100 per ounce, driven by geopolitical uncertainty, inflation concerns and strong central bank demand. This surge has further boosted gold miners and funds that invest in gold miners, which have outperformed the S&P 500 year-to-date.

Weaknesses

- The worst performing precious metal for the week was platinum, down .25%. Platinum continues to face headwinds from other precious metals, such as gold and silver, which have had record years this year.

- Royalty valuations remain higher than the miners’, likely due to their insulation from the inflationary cost environment. The group is trading at 2.11x P/NAV, representing a 1.33x premium to operators (higher than the historical average of 0.50x), compared to a 1.77x P/NAV and a 1.01x premium to operators, according to Scotia.

- According to Bank of America, Harmony Gold Mining is a high-cost gold producer with a fourth quartile cost position. They have falling production and higher all-in sustaining costs (AISCs). Production is down in FY25 on lower production at Hidden Valley and Doornkop. They indicate the company’s track record on fatalities at its mining operations in the past is troubling. Despite the negative outlook. Harmony was a top 10 performer this week, gaining nearly 10%.

Opportunities

- Gold Fields has announced a non-binding indicative and conditional proposal to acquire 100% of Gold Road Resources. It has been rejected by the Gold Road Board. The proposal was for cash consideration of A$3.05 per share, comprising a fixed portion of A$2.27 plus a variable portion equal to the value of each shareholder’s proportion of GOR’s shareholding in De Grey Mining (DEG), according to Canaccord.

- According to Bank of America, China’s insurance industry can invest 1% of its assets in gold, equivalent to around 6% of the annual gold market. Central banks currently hold about 10% of their reserves in gold and could raise this figure to +30% to make their portfolios more efficient. Finally, retail investors have also been increasing their exposure to the yellow metal, with assets under management at physically backed ETFs increasing by nearly 6% year-to-date in the Americas, Europe and Asia.

- Goldman Sachs ramped up its gold price forecast to $3,300 an ounce by year-end, citing stronger-than-expected central bank demand and solid inflows into bullion-backed exchange-traded funds. The bank’s increasingly bullish view on the precious metal was evident in the new forecast from analysts Lina Thomas and Daan Struyven, who had just last month upgraded their end-2025 price target to $3,100 an ounce, according to Bloomberg.

Threats

- A senior White House official has hinted at the possibility of the U.S. utilizing its gold reserves to acquire more Bitcoin. Bo Hines, the executive director of the President’s Council of Advisers on Digital Assets, suggested in an interview that the U.S. could capitalize on the gains from its gold holdings to purchase more Bitcoin. This move, according to Hines, could be a budget-neutral way to increase the country’s Bitcoin reserves, according to Benzinga Newswire.

- For 2025, miner production guidance is expected to be 4% lower and cost guidance 4%-5% higher than 2024. Although costs are expected to remain relatively high, Scotia believes the current higher gold price environment, coupled with some relief on input cost pressures and FX, should position companies for further margin improvement.

- The narrowing U.S. trade deficit (driven by strong exports and reduced imports) could temporarily strengthen the dollar, pressuring gold prices as a stronger dollar typically weighs on dollar-denominated commodities, Bloomberg reports.

U.S. Global Investors, Inc. is an investment adviser registered with the Securities and Exchange Commission (“SEC”). This does not mean that we are sponsored, recommended, or approved by the SEC, or that our abilities or qualifications in any respect have been passed upon by the SEC or any officer of the SEC.

This commentary should not be considered a solicitation or offering of any investment product. Certain materials in this commentary may contain dated information. The information provided was current at the time of publication. Some links above may be directed to third-party websites. U.S. Global Investors does not endorse all information supplied by these websites and is not responsible for their content. All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. The following securities mentioned in the article were held by one or more accounts managed by U.S. Global Investors as of (12/31/2024):

Japan Airlines

Bombardier

Textron

Delta Air Lines

United Airlines

Ryanair Holdings

Boeing

Parsons Corporation

Nvidia

TotalEnergies SE

Microsoft Corp.

Alphabet Inc.

Hermes International SCA

LVMH Moet Hennessy Louis Vuitton

Kering SA

Remy Cointreau SA

Tesla Inc.

Harmony Gold Mining Co. Ltd.

Gold Field Ltd.

Sabre Corp.

*The above-mentioned indices are not total returns. These returns reflect simple appreciation only and do not reflect dividend reinvestment.

The Dow Jones Industrial Average is a price-weighted average of 30 blue chip stocks that are generally leaders in their industry. The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies. The Nasdaq Composite Index is a capitalization-weighted index of all Nasdaq National Market and SmallCap stocks. The Russell 2000 Index® is a U.S. equity index measuring the performance of the 2,000 smallest companies in the Russell 3000®, a widely recognized small-cap index.

The Hang Seng Composite Index is a market capitalization-weighted index that comprises the top 200 companies listed on Stock Exchange of Hong Kong, based on average market cap for the 12 months. The Taiwan Stock Exchange Index is a capitalization-weighted index of all listed common shares traded on the Taiwan Stock Exchange. The Korea Stock Price Index is a capitalization-weighted index of all common shares and preferred shares on the Korean Stock Exchanges.

The Philadelphia Stock Exchange Gold and Silver Index (XAU) is a capitalization-weighted index that includes the leading companies involved in the mining of gold and silver. The U.S. Trade Weighted Dollar Index provides a general indication of the international value of the U.S. dollar. The S&P/TSX Canadian Gold Capped Sector Index is a modified capitalization-weighted index, whose equity weights are capped 25 percent and index constituents are derived from a subset stock pool of S&P/TSX Composite Index stocks. The NYSE Arca Gold Miners Index is a modified market capitalization weighted index comprised of publicly traded companies involved primarily in the mining for gold and silver. The S&P/TSX Venture Composite Index is a broad market indicator for the Canadian venture capital market. The index is market capitalization weighted and, at its inception, included 531 companies. A quarterly revision process is used to remove companies that comprise less than 0.05% of the weight of the index, and add companies whose weight, when included, will be greater than 0.05% of the index.

The S&P 500 Energy Index is a capitalization-weighted index that tracks the companies in the energy sector as a subset of the S&P 500. The S&P 500 Materials Index is a capitalization-weighted index that tracks the companies in the material sector as a subset of the S&P 500. The S&P 500 Financials Index is a capitalization-weighted index. The index was developed with a base level of 10 for the 1941-43 base period. The S&P 500 Industrials Index is a Materials Index is a capitalization-weighted index that tracks the companies in the industrial sector as a subset of the S&P 500. The S&P 500 Consumer Discretionary Index is a capitalization-weighted index that tracks the companies in the consumer discretionary sector as a subset of the S&P 500. The S&P 500 Information Technology Index is a capitalization-weighted index that tracks the companies in the information technology sector as a subset of the S&P 500. The S&P 500 Consumer Staples Index is a Materials Index is a capitalization-weighted index that tracks the companies in the consumer staples sector as a subset of the S&P 500. The S&P 500 Utilities Index is a capitalization-weighted index that tracks the companies in the utilities sector as a subset of the S&P 500. The S&P 500 Healthcare Index is a capitalization-weighted index that tracks the companies in the healthcare sector as a subset of the S&P 500. The S&P 500 Telecom Index is a Materials Index is a capitalization-weighted index that tracks the companies in the telecom sector as a subset of the S&P 500.

The Consumer Price Index (CPI) is one of the most widely recognized price measures for tracking the price of a market basket of goods and services purchased by individuals. The weights of components are based on consumer spending patterns. The Purchasing Manager’s Index is an indicator of the economic health of the manufacturing sector. The PMI index is based on five major indicators: new orders, inventory levels, production, supplier deliveries and the employment environment. Gross domestic product (GDP) is the monetary value of all the finished goods and services produced within a country’s borders in a specific time period, though GDP is usually calculated on an annual basis. It includes all private and public consumption, government outlays, investments and exports less imports that occur within a defined territory.

The S&P Global Luxury Index is comprised of 80 of the largest publicly traded companies engaged in the production or distribution of luxury goods or the provision of luxury services that meet specific investibility requirements.

The S&P SmallCap 600 Index is a stock market index that tracks the performance of 600 small-cap companies in the United States. These companies are typically those with a market capitalization between $300 million and $2 billion.

The Conference Board’s Consumer Confidence Index (CCI) is a monthly economic indicator that gauges consumer sentiment about the current and future state of the economy, based on a survey of consumer attitudes and expectations regarding business conditions, employment, and income.

The Solactive Global Copper Miners Index includes international companies active in exploration, mining and/or refining of copper. The index includes a minimum of 20 and a maximum of 40 members.

The STOXX Europe 600 Index is derived from the STOXX Europe Total Market Index (TMI) and is a subset of the STOXX Global 1800 Index. With a fixed number of 600 components, the STOXX Europe 600 Index represents large, mid and small capitalization companies across 17 countries of the European region.