Commodities Halftime Report: Silver, Oil and Gold Were the Top Performers

If you were in charge of feeding everyone this Fourth of July, you probably noticed a hike in prices.

According to the American Farm Bureau Federation, the cost of a typical Independence Day spread for 10 people jumped to $71.22 this year, up 5% from last year and a whopping 30% from five years ago.

That may not seem like much, but this inflation has a compounding effect on commodities. Research from Goldman Sachs shows that a 1 percentage point increase in U.S. inflation has historically led to a real return gain of 7 percentage points for commodities. Meanwhile, the same trigger caused stocks and bonds to decline by 3 and 4 percentage points, respectively.

This data supports the potential of commodities as an inflation hedge. In times of rising prices, having exposure to tangible assets like silver, oil and gold often retain their value better than paper assets.

The reason I mention silver, oil and gold is because they were the top performing commodities in the first half of 2024. Let’s dive into what’s driving these trends and what they might mean for investors.

Silver’s Fourth Year of Market Deficit Could Spell Opportunity

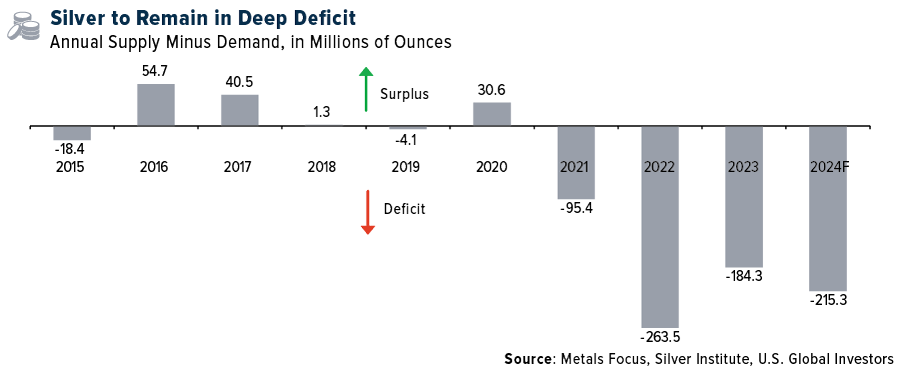

Leading the charge is silver, up close to 22.5% in the first half. The “poor man’s gold” is proving its worth, driven by a global supply deficit and increasing demand. Back in January, the Silver Institute forecasted that global silver demand will reach a near-record 1.2 billion ounces in 2024, up 1% from last year. This growth is primarily fueled by industrial applications, particularly in the booming solar energy sector.

We’re looking at the fourth consecutive year of a structural market deficit in silver. The deficit is expected to widen by 17%, reaching 215.3 million ounces. Loyal readers should be aware of what happens when demand outstrips supply—prices tend to rise.

The Coming Oil Glut?

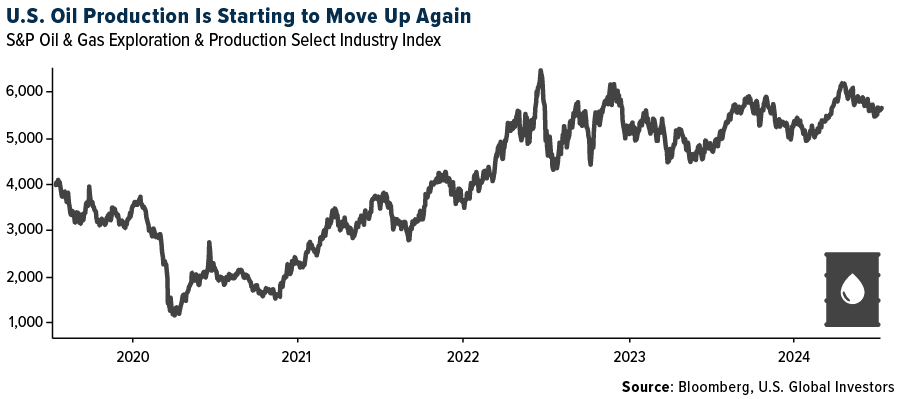

Oil, our second top performer with a gain of 13.8%, continues to demonstrate its staying power in the global economy. Despite the push for electrification, oil demand remains robust.

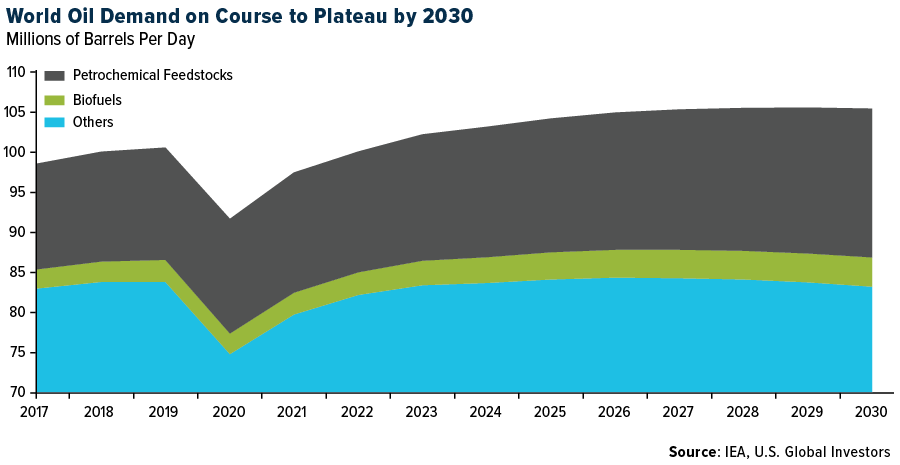

According to a new report by the International Energy Agency (IEA), we’re approaching a significant turning point. Global oil demand, which averaged just over 102 million barrels per day in 2023, is expected to level off near 106 million barrels per day towards the end of this decade. This plateau in demand coincides with a projected surge in global oil production, particularly from non-OPEC+ producers.

The implications of this forecast are profound. We’re looking at a future where oil supplies could reach levels of abundance unseen outside of the pandemic. This potential oversupply situation could exert downward pressure on oil prices.

It’s worth noting that the IEA’s outlook contrasts with some other forecasts. Goldman Sachs Research, for instance, expects oil demand to continue growing until 2034, potentially reaching 110 million barrels a day. They cite increasing demand from emerging Asian markets and the petrochemical industry as key drivers.

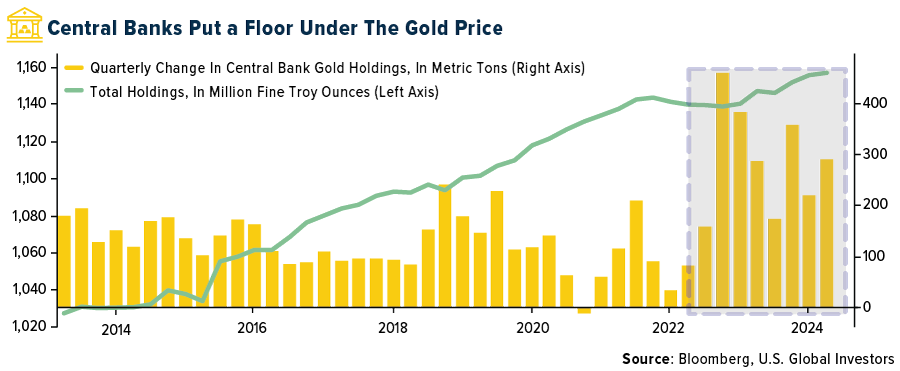

Goldman Sees $2,700 Gold on the Horizon

Last but certainly not least is gold. The yellow metal has shone brightly in 2024, rising 12.8% year-to-date and outperforming many major asset classes. This performance is particularly impressive given the high interest rates and strong U.S. dollar—conditions that ordinarily create a challenging environment for gold.

What’s behind the metal’s resilience? It’s a perfect storm of factors: continued central bank buying, strong Asian investment flows, steady consumer demand and persistent geopolitical uncertainties. In its midyear outlook, the World Gold Council (WGC) estimates that central bank demand alone contributed at least 10% to gold’s performance in 2023 and potentially around 5% so far this year.

Looking ahead, Goldman has set a bullish target of $2,700 per troy ounce for gold by year-end. That’s an increase of about 16% from current levels. They cite solid demand from emerging market central banks and Asian households as key drivers.

Many investors, myself included, appreciate gold’s potential as a hedge against both inflation and geopolitical risks. It could provide a buffer against potential stock market volatility, especially if trade tensions escalate. Additionally, gold might see further upside if concerns about the U.S. debt load increase or if there’s a shift in Federal Reserve policy under a new administration.

As we move into the second half of 2024, the commodities market continues to offer intriguing opportunities. Silver’s industrial demand, particularly in the green energy sector, presents a compelling growth story. Oil remains a critical resource, especially for emerging economies, despite the global push towards renewables. And gold, the eternal safe haven, continues to prove its worth in uncertain times.

Index Summary

- The major market indices finished mixed this week. The Dow Jones Industrial Average gained 0.66%. The S&P 500 Stock Index rose 1.95%, while the Nasdaq Composite climbed 3.50%. The Russell 2000 small capitalization index fell 1.02% this week.

- The Hang Seng Composite gained 6.16% this week; while Taiwan was up 2.28% and the KOSPI rose 2.30%.

- The 10-year Treasury bond yield fell 12 basis points to 4.277%.

Airlines and Shipping

Strengths

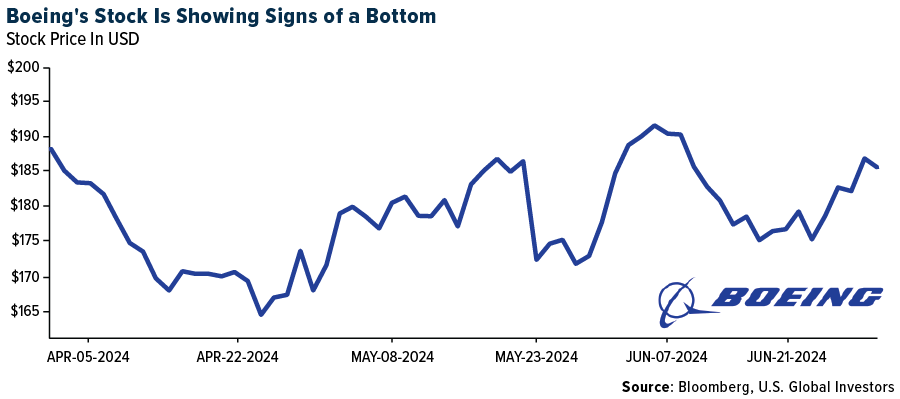

- The best performing airline stock for the week was El Al, up 9.0%. According to Goldman, Boeing is on track to make 43 deliveries for June, including 34 737 MAXs, three 787s and six others. Of the 34 MAX deliveries, 26 were new production deliveries, with eight from inventory. Both the total delivery number and implied underlying rate are improvements versus the trend through the first half of the year.

- The Panama Canal Authority announced further easing of restrictions and now allow 35 ships per day. This is just below typical daily levels of 36-37 but compares to a low of just 22 per day in January, according to Stifel.

- Air Canada announced an agreement with BOC Aviation for the placement of eight Boeing 737-8 aircraft, a positive sign as it highlights RBC’s view that Air Canada has better access into securing aircraft compared to peers.

Weaknesses

- The worst performing airline stock for the week was Norwegian Air Shuttle, down 13.3%. According to ISI, Frontier cut 13 percentage points from August capacity and 4 percentage points from September capacity. Last week, Frontier cut 3 percentage points from July.

- Tanker demand sequentially declined 8% through the second quarter 2024 on Asian refinery maintenance and fading U.S. exports. According to Bank of America, forward curves suggest VLCC rates below breakeven through the third quarter of this year.

- Morgan Stanley says that Air France and Transavia France are currently experiencing pressure on projected unit revenues for the summer season due to the upcoming Olympic Games in Paris, with traffic to and from the French capital lagging behind other major European cities. They have quantified this negative impact on unit revenues in the region of 160-180MM EUR for the period June until August, with no impact on guided capacity at this stage.

Opportunities

- The TSA forecasts a record-setting July 4 holiday and expects to screen over 32 million passengers between Friday, June 28 and Monday, July 8, which is almost a 5.5% year-over-year increase for the holiday, reports CNBC.

- Air cargo demand continues to surprise, tracking at 13.2% year-over-year growth with June demand also tracking double digits higher year-over-year. June saw unseasonally strong demand supported by rising tech shipments and strong eCommerce demand combined with shifts from ocean, given surging ocean freight rates and longer shipping times, according to Bank of America.

- Boeing agreed to acquire Spirit AeroSystems for $37.25 per share, valuing Spirit AeroSystems (SPR) at $4.7B, in an all-stock deal, reports RBC. SPR shareholders will receive a number of shares of Boeing between 0.18 and 0.25 shares for each SPR share, depending on the price of Boeing stock at the time of the acquisition. The total enterprise value of the transaction is $8.3B, considering the SPR debt.

Threats

- Lufthansa is introducing an Environmental Cost Surcharge. The surcharge (ranging from EUR1-EUR72) applies to all for departure in 2025+ and to departures from the 27 EU countries/U.K./Norway/Switzerland, according to Raymond James.

- Car carrier demand growth is tracking at up 5.4%, reports Bank of America, with Chinese seaborne exports hitting record levels in April 2024. But car carrier time charter rates trended lower month-over-month again in June 2024, showing further signs of a peak, while the car carrier orderbook continues to build, hitting 39% in June 2024.

- Southwest Airlines initiated a Rights Plan that will expire in one year. Pursuant to the Rights Plan, the company is issuing one right for each share of common stock. The rights will initially trade with Southwest Airlines common stock and will generally become exercisable only if any person or group acquires 12.5% or more of the company’s outstanding common stock.

Luxury Goods and International Markets

Strengths

- Constellation Brands, an alcoholic beverage company, reported a profit for the quarter that exceeded expectations and affirmed its guidance; however, sales fell slightly short of estimates. Sales increased by 6% to $2.662 billion, compared to estimated sales of $2.669 billion. The company anticipates sales growth of between 6% and 7% in the coming year.

- In the United States, June nonfarm payrolls increased by 206,000 month-over-month, surpassing the consensus estimate of 190,000 and a downwardly revised May figure of 218,000 (previously 272,000). According to FactSet, job gains were most notable in healthcare, construction, and government sectors, while retail and professional/business services experienced declines

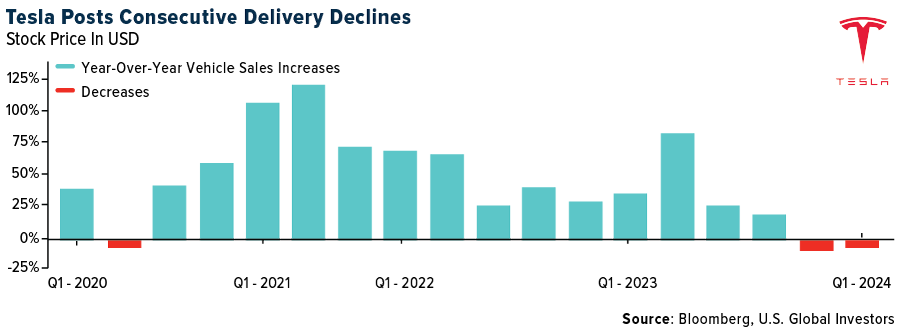

- Electric vehicle maker Tesla was the top-performing S&P Global Luxury stock, rising 27.1% over the past five days. The company’s shares gained after it reported sales data for the latest financial quarter.

Weaknesses

- China’s Manufacturing PMI was reported below 50, indicating contraction rather than expansion. The official index released over the weekend was 49.5. In contrast, the Caixin China Manufacturing PMI, which focuses on smaller privately-owned companies, was reported above the 50-mark at 51.8. The China Manufacturing PMI tracks production among larger, government-owned conglomerates.

- Eurozone inflation slowed as expected from 2.6% to 2.5%. However, core inflation, which excludes volatile items like food and energy, remained unchanged at 2.9%, surpassing expectations of 2.8%

- Faraday Future Intelligence was the worst-performing S&P Global Luxury stock, losing 21.0% in the past five days. This remains a highly volatile stock, after the company’s share price dropped by 99% in a single year.

Opportunities

- Tesla reported weaker year-over-year sales, but the numbers exceeded analysts’ expectations, indicating signs of recovery. The company delivered 443,956 cars in the second quarter, surpassing the expected 439,302. Despite a 4.8% decline from a year ago, Tesla showed sequential improvement from the 386,810 cars delivered in the first quarter of the year.

- UBS’s global equity strategist recommends investing in European consumer stocks over those in the United States. The firm highlights accelerating real wage growth in Europe and the United Kingdom, improving employment trends, increasing consumer confidence, and significantly higher excess savings compared to the U.S. In Europe, excess savings amount to 8% of GDP, while in the UK, it’s 16% of GDP, compared to just 2% in the U.S.

- Uber Technologies is launching luxury yacht and boat rides across European destinations. Users can book exclusive yacht day trips around Ibiza for 1,600 Euros, which includes a personal skipper, a complimentary bottle of champagne, and a snack, with transfer services available across the island. Additionally, Uber will introduce a “limo boat” service in Venice, allowing users to navigate the Venetian Lagoon for 120 Euros per trip through the Uber application.

Threats

- An investigation in Italy into local factories revealed workshops producing handbags and other leather goods for Dior and Armani are using foreign labor to manufacture high-end products at a fraction of their retail price. According to a Bloomberg article, Dior paid a supplier EUR 53 apiece to make a handbag it sells in stores for EUR 2,600. Following the investigation, judges in June placed Manufacturer Dior SLR, a unit of Dior, under court administration.

- According to Bryan Garnier’s research, luxury goods companies are expected to face profit pressure in the first half of the year due to weakness in China. This cautious outlook on the sector led to a downgrade of Swatch from a buy rating to neutral. The research suggests there may be a notable performance difference between soft luxury brands and top picks like Hermes, LVMH and Richemont.

- Americans are projected to spend less on food for Independence Day celebrations this year compared to 2023, according to a survey by the National Retail Federation. The survey indicates that consumers plan to spend $9.4 billion on food and related goods for the holiday, down from $9.5 billion last year. This equates to an expected per-person spending of $90.42 this year, a decrease from over $93 per person last year, as reported by the group.

Energy and Natural Resources

Strengths

- The best performing commodity for the week was copper, rising 6.42%. Copper rose for a fourth session on Friday, extending its rebound from a two-month low, as investors weighed possible stimulus in China and interest-rate cuts in the U.S., according to Bloomberg.

- China is accelerating building of liquid natural gas (LNG) importing facilities, resuming new investment after it was held up by a demand slump two years ago. The China National Offshore Oil Corp. has completed the country’s biggest LNG storage site at its 6 million tons-per-year Binhai terminal, according to Bloomberg.

- U.S. crude production reached a four-month high in April, achieving an output of 13.25 million barrels per day. This is a stronger recovery than estimated by the weekly data, which saw production at 13.1 million barrels/day for April. The recovery in production has been led by shale production in Texas and North Dakota, alongside offshore production from the Gulf of Mexico, according to Morgan Stanley.

Weaknesses

- The worst performing commodity for the week was lithium carbonate, dropping 10.96%, as demand remains muted, and inventories have surged 70,000 tonnes since the start of the year in China. JPMorgan’s tracking of global oil demand softened by 80,000 barrels per day for the month of June, still averaging 1.4 million barrels/day year-over-year growth. The pullback in demand was mostly centered in Mexico and Texas, where tropical storm Alberto caused widespread coastal flooding along the Gulf Coast, limiting travel. Oil prices remained firm and posted their fourth weekly gain.

- Anglo American was forced to halt production at its Grosvenor mine Saturday after a methane explosion started a fire. The firm said it may take several months to extinguish the blaze and make the site safe to reenter. That is likely to hamstring any attempt to sell the asset, according to Bloomberg.

- Warmer than normal winters in 2023 and 2024, coupled with surging production, have translated to higher storage levels and generally weaker natural gas prices. Global gas demand remains mixed, with disappointing demand in Europe but stronger than expected demand in China and India. In North America, the gas market remains oversupplied in the near-term, according to BMO.

Opportunities

- Through investment from China’s operators, Indonesia now accounts for almost 60% of global nickel supply, up from less than 10% in 2014. Linked to that, Ceferino S Rodolfo, Filipino under-secretary of the Department of Trade and Industry, said: “There is room now for the Philippines to be a significant player for batteries,” adding that “It’s a race between China and the U.S.,” and the Philippines have “a really strong argument to go for a non-Chinese investor so that we can be the supplier of non-Indonesian, non-Chinese nickel,” according to Bank of America.

- Hedge funds including Anchorage Capital Advisors and Squarepoint Capital have been building positions in cobalt by buying up physical material, as tumbling spot prices and a more liquid futures market create new trading opportunities in the battery metal, according to Bloomberg. China has also purchased cobalt surplus cobalt at cyclically low in prices in recent months.

- Tech companies scouring the country for electricity supplies have zeroed in on a key target: America’s nuclear-power plants. The owners of roughly a third of U.S. nuclear-power plants are in talks with tech companies to provide electricity to new data centers needed to meet the demands of an artificial-intelligence boom, according to the Wall Street Journal. Ironically, the tech companies do not want to invest in building new nuclear facilities, they just want to negotiate long-term baseload contracts to purchase electricity. An interesting tradeoff between builders and users to establish their economic relationship.

Threats

- According to Morgan Stanley, the lithium price could bottom in the $8,000-$10,000 per ton range. Many spodumene players are not profitable at current prices, but they believe they may not see material closures if London Commodity Exchange (LCE) prices do not fall to the $8,000-$10,000 range. Flat prices would imply a long oversupply situation, a rare combination in commodities; the faster prices fall … the earlier there may be a new positive lithium cycle.

- In 2023, the country of Kazakhstan accounted for around 40% of global uranium production. It is with this in mind there are risks to the downside versus market expectations when Kazatomprom, the corporation that operates Kazakhstan’s nuclear fuel assets, provides updated 2025 production plans in August of this year, according to Bank of America.

- The world is on course for an 11% oversupply of LNG by the end of the decade, due to a wave of new projects that will outpace demand growth, according to Bloomberg. The oversupply threat is set to start in 2027, but is contingent on projects coming online according to schedule and Russia’s response to Western sanctions.

Bitcoin and Digital Assets

Strengths

- Of the cryptocurrencies tracked by CoinMarketCap, the best performer for the week was MultiversX, rising 10.70%.

- Indian crypto exchange CoinDCX has acquired Dubai-based BitOasis, a first step in the company’s plans to expand globally. The purchase will give CoinDCX which first invested in BitOasis last year, a “formidable foothold across the MENA region,” the Indian firm’s cofounder Sumit Gupta said. The purchase comes as Dubai vies with the likes of Singapore and Hong Kong to establish itself as a nexus for crypto businesses, writes Bloomberg.

- Asset managers are optimistic that the SEC will greenlight the first U.S. ETFs that invest directly in Ether as soon as mid-July, reports Bloomberg, saying the back and forth with the regulator remains constructive. Despite earlier market speculation that approval would land during the July 4 holiday week, the SEC has told Ether exchange-traded fund applicants that they have until July 8 to submit paperwork.

Weaknesses

- Of the cryptocurrencies tracked by CoinMarketCap, the worst performer for the week was Core, down 31.52%.

- According to data from Cryptoslam, the NFT market experienced a significant decline in monthly volumes during the second quarter (Q2) compared to the first quarter of 2024. Sales volumes in Q2 fell by 45% quarter-over-quarter. In the first quarter of 2024, total sales volumes in the NFT market exceeded $4.1 billion and in the second quarter NFT volumes were approximately $2.28 billion, the lowest since Q3 2023, according to CryptoPotato.

- Bitcoin fell for a fourth consecutive trading session, reports Bloomberg, reaching its lowest since February, on concerns about potential selling by governments, creditors of failed exchanges, and beleaguered crypto miners. Bitcoin fell as much as 8% before paring the declines and is down about 25% from its March record.

Opportunities

- Sentient Labs, a month-old artificial intelligence startup co-founded by an executive behind the Polygon blockchain, raised $85 million from investors including billionaire Peter Thiel’s Founders Fund. Crypto venture capital funds Pantera Capital and Framework Ventures co-led the seed funding round alongside Founders Fund, writes Bloomberg.

- Robinhood Markets is considering offering cryptocurrency futures in the U.S. and Europe in the coming months. Once its $200 million acquisition of Bitstamp closes next year, Robinhood is hoping to use the crypto exchange’s licenses to offer perpetual futures for Bitcoin and other tokens in Europe, writes Bloomberg.

- Global Banking Standard Setter has approved a framework for crypto exposures, reports Bloomberg. The basel committee on Banking supervision approved a disclosure framework for banks’ exposure to crypto that must be implemented by the start of 2026.

Threats

- Silvergate Bank, one of the banks that collapsed due to the FTX fraud, has been fined $63 million by two regulators for allegedly failing to monitor transactions, Bloomberg reports. The Federal Reserve announced penalties against the bank owned by Silvergate Capital Corp.

- Swiss bank regulators are seeking more regulation of stablecoin issuers. In a Bloomberg interview, the head of Switzerland’s financial regulator said stablecoin issuers should be supervised more closely, calling the crypto tokens a “loophole” in the existing regulatory framework, writes Bloomberg.

- The amount of cryptocurrency stolen through hacks and network exploits more than doubled to $1.38 billion in the first six months of the year. Five large attacks accounted for 70% of all the crypto that was stolen, writes Bloomberg.

Defense and Cybersecurity

Strengths

- The U.S. Army has awarded Lockheed Martin a multi-year, $4.5 billion contract to procure 870 Patriot Advanced Capability-3 MSE missiles and associated hardware.

- Lockheed Martin Aeronautics has secured a $520.4 million contract modification from the U.S. Air Force to produce the F-16 Viper Shield electronic warfare suite. Work is expected to be complete by June 2028 and will involve foreign military sales to several countries.

- The best performing stock in the XAR ETF this week was Archer Aviation Inc., rising 25.00% after Ark Investment Management, led by Cathie Wood, disclosed buying 191,383 shares. This follows a $55 million investment from Stellantis and the achievement of a significant flight test milestone earlier in the week.

Weaknesses

- The Justice Department has accused Boeing of fraud and urged the company to plead guilty or face trial, complicating its government contracts. This comes due to alleged violations of a 2021 settlement related to the fatal 737 Max crashes, prompting Boeing to consider buying Spirit AeroSystems amid ongoing safety concerns and fluctuating stock prices.

- A Russian jet fired a glide bomb at Kharkiv’s Nova Poshta mail hub, killing one civilian, injuring at least 10 others, and leaving nine unaccounted for, as the city continues to face frequent aerial strikes. President Zelenskiy is calling for weapons to counter these attacks amidst reports of over 800 such bombs dropped in the past week and additional drone strikes on Russian industrial facilities.

- The worst performing stock in the XAR ETF this week was AeroVironment, falling 7.28%, after the company reported better-than-expected fourth-quarter earnings and sales, but issued guidance below estimates. This comes despite record revenue and significant growth in its Loitering Munitions Systems segment.

Opportunities

- The Pentagon and defense-related activities would receive $833.1 billion in discretionary funding for fiscal 2025 under H.R. 8774, which is $8.6 billion more than fiscal 2024 and aligns with spending limits set by the June 2023 debt-limit deal. The measure includes provisions such as a 19.5% pay increase for junior enlisted service members, restricts remote work funding, and excludes the Ukraine Security Assistance Initiative, while also imposing various policy prohibitions and adjustments to military programs and procurement.

- Leonardo and Rheinmetall have signed a Memorandum of Understanding to create a 50:50 joint venture focused on developing and commercializing advanced land defense systems. This would include the new Main Battle Tank and Lynx Platform for the Armoured Infantry Combat System, primarily for the Italian Army and other European markets.

- The U.S. Navy has approved L3Harris’ design plans for the next-generation electronic warfare system for F/A-18 Hornet and Super Hornet aircraft. This marks a significant milestone in an $80 million contract to enhance the jets’ countermeasures against sophisticated threats, with prototype testing set for this summer.

Threats

- Russian submarines conducted two unprecedented missions in the Irish Sea after Putin’s invasion of Ukraine, leading UK forces to protect British and Irish waters. The operations involved Kilo-class submarines capable of firing Kalibr cruise missiles, which UK officials had not seen before, raising concerns over potential threats to regional security.

- The European Commission is concerned that chipmakers like NXP, Infineon, and Renesas could lose market share in China due to Beijing’s investment in domestic semiconductor production, aiming for self-sufficiency and reducing reliance on Western imports.

- North Korea launched two suspected ballistic missiles on Monday, days after testing a new multiple warhead system for nuclear strikes. One missile flew about 600 kilometers and the other broke apart mid-flight, highlighting rising tensions following Kim Jong Un’s meeting with Vladimir Putin and their mutual defense agreement.

Gold Market

This week gold futures closed the week at $2,397.60, up $58.00 per ounce, or 2.48%. Gold stocks, as measured by the NYSE Arca Gold Miners Index, ended the week higher by 6.27%. The S&P/TSX Venture Index came in up 2.80%. The U.S. Trade-Weighted Dollar fell 0.95%.

Strengths

- The best performing precious metal for the week was silver, up 6.60%. Montage Gold announced their 2024 short-term incentive plan which highlights the aligned interests of the management and the shareholders to drive forward the Koné project’s construction and development. Compensation is dependent on rapidly achieving stated milestones to put Koné into construction in the first quarter of 2025, according to Stifel.

- West African Resources seeks to raise A$120 million via a single tranche placement at A$1.37 per share, according to the Australian Financial Review (AFR). Citing a term sheet, the AFR reports that funds raised will go towards funding construction of the Kiaka gold project, mining pre-production capital, exploration programs and working capital. Total proceeds of A$150 were secured as the placement was heavily oversubscribed.

- Central banks, led by Turkey, China and India, put a floor under the gold price in the face of outflows from exchange-traded funds (ETFs) in the recent past. The sector uses gold as a dollar-diversification play, making it popular in nations with large U.S. currency holdings. China bought the metal for 18 months straight before pausing in May, according to data from the International Monetary Fund (IMF). China’s pause in purchases may just be from buying their gold from international markets. Fred Hickely of the High-Tech Strategist newsletter noted that China did indeed buy gold, but it was sourced from domestic production.

Weaknesses

- The worst performing precious metal for the week was gold, but still up 2.48%. Costco reported their first delivery of 100-gram gold bars this week, but they sold out in less than a day. The gold bars fetched $7,599.99 each. Calidus Resources has collapsed with its main financier, Macquarie, calling in receiver Korda Mentha. It remains unclear why Macquarie called time on the company, which runs the Warrawoona gold mine near Marble Bar, according to Canaccord.

- Endeavour Mining says it is studying the damage from the leak of poisonous liquid at its second-biggest mine located in southern Ivory Coast. Early reports show that a broken valve leaked 3,000 liters of mud containing cyanide into a canal within the perimeter of the mine, according to Bloomberg.

- According to BMO, Ascot Resources has faced commissioning challenges throughout its processing plant, particularly in the areas of the elution circuit boiler, carbon management, thickener flocculation and metallurgical sampling and estimation. These issues have slowed production and sales below expectations. Additionally, global supply chain challenges and limited vendor support have caused some delays. There is likely a capital shortfall that will need to be addressed in the near term.

Opportunities

- Excessive government spending in the U.S. and geopolitical uncertainty are underpinning calls from some investor heavyweights to buy gold as a hedge against sovereign debt risks. Schroder Investment Management and UBS Global Wealth Management are bracing for a rocky second half, and gold has emerged as a preferred trade to navigate the volatility, according to Bloomberg.

- Citigroup expects rising investment demand to absorb almost all gold mine supply over the next 12-18 months, it said in a report. That underpins the bank’s base case for a price of $2,700-$3,000 an ounce during next year.

- Canaccord views the Red 5-Silver Lake merger as logical with clear benefits for both companies, namely absolving Silver Lake’s relatively short mine life overhang, and rectifying Red 5’s single asset exposure and net debt position. Red 5’s large reserve base and Silver Lake’s strong balance sheet marry neatly, giving the enlarged entity the opportunity to aggressively pursue internal optimization initiatives as well as potential inorganic opportunities.

Threats

- According to Mining.com, the Ivory Coast is planning to revise its mining code to increase state profits, the country’s mines minister Mamadou Sangafowa Coulibaly said on Monday. The country is seeking to develop its long-neglected mining sector to diversify its income sources. The west African country’s mining code was last revised in 2014.

- According to BMO, Ascot Resources’ cash balance at the end of the second quarter was C$12 million, representing a decrease of C$35 million since the first quarter. Additionally, Ascot reported that it has received a waiver for non-compliance with the covenants set forth in its financing package, which is due to expire on July 31, 2024.

- Bloomberg reports that Vale Base Metals has chosen Sean Usmar as its CEO. Sean Usmar founded Triple Flag Precious Metals in 2016 and currently serves as the company’s CEO and director. Sources within the article note that the selection is not yet confirmed and “it’s possible things could change.” As of the end of the week, there appears to be no confirmation on the rumor.

U.S. Global Investors, Inc. is an investment adviser registered with the Securities and Exchange Commission (“SEC”). This does not mean that we are sponsored, recommended, or approved by the SEC, or that our abilities or qualifications in any respect have been passed upon by the SEC or any officer of the SEC.

This commentary should not be considered a solicitation or offering of any investment product. Certain materials in this commentary may contain dated information. The information provided was current at the time of publication. Some links above may be directed to third-party websites. U.S. Global Investors does not endorse all information supplied by these websites and is not responsible for their content. All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. The following securities mentioned in the article were held by one or more accounts managed by U.S. Global Investors as of (06/30/2024):

Boeing

Air Canada

Frontier Holdings

Air France-KLM

Deutsche Lufthansa

Southwest Airlines

Anglo American

Dior

Hermes

LVMH

Richemont

Constellation Brands

Montage Gold

West African Resources

Endeavor Mining

Silver Lake Resources

Triple Flag Precious Metals

*The above-mentioned indices are not total returns. These returns reflect simple appreciation only and do not reflect dividend reinvestment.

The Dow Jones Industrial Average is a price-weighted average of 30 blue chip stocks that are generally leaders in their industry. The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies. The Nasdaq Composite Index is a capitalization-weighted index of all Nasdaq National Market and SmallCap stocks. The Russell 2000 Index® is a U.S. equity index measuring the performance of the 2,000 smallest companies in the Russell 3000®, a widely recognized small-cap index.

The Hang Seng Composite Index is a market capitalization-weighted index that comprises the top 200 companies listed on Stock Exchange of Hong Kong, based on average market cap for the 12 months. The Taiwan Stock Exchange Index is a capitalization-weighted index of all listed common shares traded on the Taiwan Stock Exchange. The Korea Stock Price Index is a capitalization-weighted index of all common shares and preferred shares on the Korean Stock Exchanges.

The Philadelphia Stock Exchange Gold and Silver Index (XAU) is a capitalization-weighted index that includes the leading companies involved in the mining of gold and silver. The U.S. Trade Weighted Dollar Index provides a general indication of the international value of the U.S. dollar. The S&P/TSX Canadian Gold Capped Sector Index is a modified capitalization-weighted index, whose equity weights are capped 25 percent and index constituents are derived from a subset stock pool of S&P/TSX Composite Index stocks. The NYSE Arca Gold Miners Index is a modified market capitalization weighted index comprised of publicly traded companies involved primarily in the mining for gold and silver. The S&P/TSX Venture Composite Index is a broad market indicator for the Canadian venture capital market. The index is market capitalization weighted and, at its inception, included 531 companies. A quarterly revision process is used to remove companies that comprise less than 0.05% of the weight of the index, and add companies whose weight, when included, will be greater than 0.05% of the index.

The S&P 500 Energy Index is a capitalization-weighted index that tracks the companies in the energy sector as a subset of the S&P 500. The S&P 500 Materials Index is a capitalization-weighted index that tracks the companies in the material sector as a subset of the S&P 500. The S&P 500 Financials Index is a capitalization-weighted index. The index was developed with a base level of 10 for the 1941-43 base period. The S&P 500 Industrials Index is a Materials Index is a capitalization-weighted index that tracks the companies in the industrial sector as a subset of the S&P 500. The S&P 500 Consumer Discretionary Index is a capitalization-weighted index that tracks the companies in the consumer discretionary sector as a subset of the S&P 500. The S&P 500 Information Technology Index is a capitalization-weighted index that tracks the companies in the information technology sector as a subset of the S&P 500. The S&P 500 Consumer Staples Index is a Materials Index is a capitalization-weighted index that tracks the companies in the consumer staples sector as a subset of the S&P 500. The S&P 500 Utilities Index is a capitalization-weighted index that tracks the companies in the utilities sector as a subset of the S&P 500. The S&P 500 Healthcare Index is a capitalization-weighted index that tracks the companies in the healthcare sector as a subset of the S&P 500. The S&P 500 Telecom Index is a Materials Index is a capitalization-weighted index that tracks the companies in the telecom sector as a subset of the S&P 500.

The Consumer Price Index (CPI) is one of the most widely recognized price measures for tracking the price of a market basket of goods and services purchased by individuals. The weights of components are based on consumer spending patterns. The Purchasing Manager’s Index is an indicator of the economic health of the manufacturing sector. The PMI index is based on five major indicators: new orders, inventory levels, production, supplier deliveries and the employment environment. Gross domestic product (GDP) is the monetary value of all the finished goods and services produced within a country’s borders in a specific time period, though GDP is usually calculated on an annual basis. It includes all private and public consumption, government outlays, investments and exports less imports that occur within a defined territory.

The S&P Global Luxury Index is comprised of 80 of the largest publicly traded companies engaged in the production or distribution of luxury goods or the provision of luxury services that meet specific investibility requirements.

The S&P Oil & Gas Exploration & Production Select Industry Index represents the oil and gas exploration and production segment of the S&P Total Market Index.