China’s AI Breakthrough Sends NVIDIA Reeling and Sparks National Security Fears

The artificial intelligence (AI) revolution is moving at lightning speed, and one of the biggest stories this past week underscores just how critical the technology has become—not just for Silicon Valley, but for America’s national security and global competitiveness.

Enter DeepSeek, a Chinese AI startup that’s sent shockwaves through the market with the release of a new, highly cost-efficient AI model.

While DeepSeek may not yet be a household name, its impact has been swift. NVIDIA—the dominant player in AI chip design and, as of this morning, the world’s second-largest company by market cap—saw its stock price tumble after DeepSeek’s latest model demonstrated a level of efficiency that many on Wall Street fear could challenge America’s AI supremacy.

NVIDIA’s Wild Ride

To understand why DeepSeek is making headlines, let’s look at NVIDIA’s market swings. On Monday, the tech giant lost an astonishing $590 billion in market value. Tuesday saw a rebound of $260 billion, only to drop again by $130 billion on Wednesday.

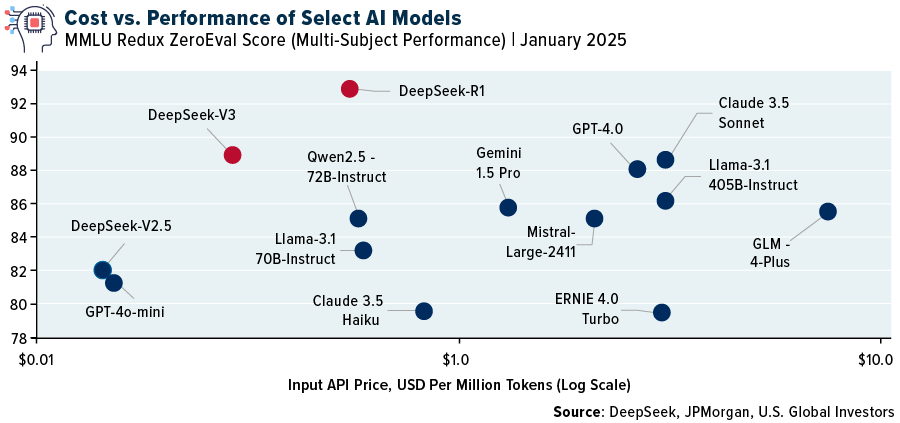

Why the volatility? DeepSeek’s AI model, built at a fraction of the cost of leading U.S. models, signals the potential for a new price war in AI. Unlike OpenAI’s ChatGPT and Meta’s Llama models—trained on expensive high-end semiconductors—DeepSeek has developed an alternative that is allegedly 45 times more efficient than its competitors. Its final training run cost only $5.6 million, compared to the vastly higher sums required for U.S.-made models.

For many investors, this raises questions: Will AI’s profit margins shrink as efficiency increases? Are NVIDIA’s high-priced AI chips at risk of being undercut?

Most importantly, what are the implications for aerospace and defense, where AI is becoming an essential tool in modern warfare and national security?

AI Is Now a Matter of National Security

DeepSeek’s breakthrough isn’t just a financial story—it’s a national security issue. President Donald Trump wasted no time responding, saying DeepSeek should be a “wake-up call” for Silicon Valley.

Supporting AI development, including the data centers that power it, is no longer just about business—it’s a matter of strategic importance.

That may be partly why, in his second week back in office, Trump announced the launch of Stargate, a $500 billion joint AI venture led by SoftBank and OpenAI. Backed by Oracle and MGX, Stargate intends to invest $100 billion immediately into AI infrastructure in the U.S. The goal? To cement America’s leadership in AI and keep its edge in technological warfare and cybersecurity.

But, as some analysts and investors are pointing out, if the Chinese can match American AI’s performance at a fraction of the cost, is $500 billion too high?

In any case, the Stargate development should catch the attention of investors looking at aerospace and defense. AI-driven military applications, from autonomous drones to advanced cyber defense, are not just science fiction anymore. They’re already reshaping global conflict. The ability to train AI models more efficiently could shift the balance of power in how wars are fought, how intelligence is gathered and how cybersecurity threats are handled.

Big Tech’s AI Arms Race Heats Up

Meanwhile, American tech giants are doubling down on AI investments. Mark Zuckerberg posted on Facebook that 2025 will be a “defining year for AI,” with Meta planning to invest $60–$65 billion in AI infrastructure alone. The company expects to double its GPU (graphics processing unit) capacity to 1.3 million chips by the end of next year, significantly ramp up AI hiring and bring 1 gigawatt (GW) of computing power online.

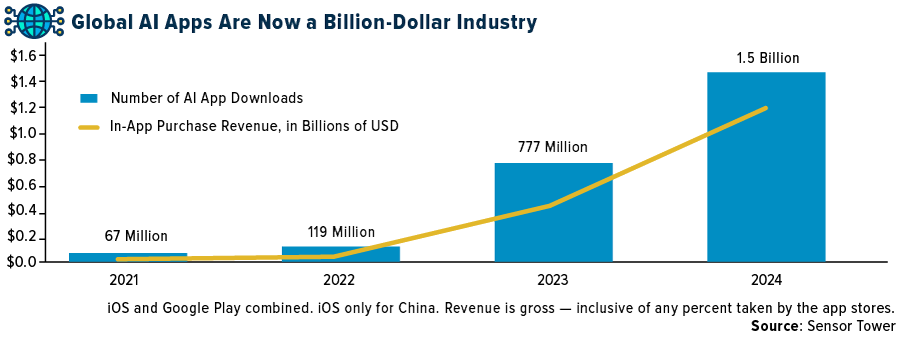

The AI boom is already creating massive economic ripples. According to Sensor Tower, revenues for AI chatbot and AI art generators have skyrocketed from $30 million in 2022—the year ChatGPT was launched—to nearly $1.3 billion in 2024, representing an incredible 4,100% increase. Sensor Tower reports that the U.S. leads the world in AI monetization, accounting for 45% of global revenue, while China lags at just 2%.

DeepSeek’s Security Risks Raise Red Flags

While DeepSeek has proven technically impressive, it’s also raised serious red flags.

For one, Microsoft and OpenAI are investigating whether DeepSeek acquired data from ChatGPT in an unauthorized manner.

And two, cyber intelligence firm KELA has already exposed major security vulnerabilities in DeepSeek’s R1 model, showing that it can be easily manipulated to generate malicious content, including ransomware instructions, fake news fabrication and even details on explosives and toxins.

For this reason, U.S. military service members have been warned not to use DeepSeek AI tools due to potential security risks.

What Investors Should Watch Next

Despite legitimate concerns, I agree with UBS that DeepSeek’s emergence does not derail the overall AI growth story. As its editorial team notes, AI is not a zero-sum game. A more cost-efficient model could actually accelerate adoption across industries, further fueling productivity gains and market expansion.

For investors, this means keeping an eye on how AI is reshaping aerospace and defense. The biggest beneficiaries may not be the AI application companies themselves, but rather the firms building the infrastructure: semiconductor manufacturers, data centers, cloud computing providers, cybersecurity firms and defense contractors integrating AI into next-generation applications.

With the U.S. making AI a national priority, we’re seeing an unprecedented wave of investment into the sector. Whether it’s OpenAI’s partnership with Stargate, Meta’s multi-billion-dollar AI expansion or defense firms using AI for military innovation, the message is clear: AI isn’t just the future of tech—it’s the future of national security.

Read More on Aerospace & Defense and AI:

- Cold War 2.0? Russia, China and the U.S. Clash over Arctic Resources

- Aerospace & Defense Stocks to Watch: The Biggest U.S. Contractors by Revenue

- Data Center Energy Demand Fueled Massive Gains for Utility Stocks in 2024

- Cybersecurity at a Crossroads as Global Threats Hit Record High

Index Summary

- The major market indices finished mixed this week. The Dow Jones Industrial Average gained 0.27%. The S&P 500 Stock Index fell 1.00%, while the Nasdaq Composite fell 1.64%. The Russell 2000 small capitalization index lost 0.87% this week.

- The Hang Seng Composite lost 5.18% this week; while the KOSPI fell 0.77%.

- The 10-year Treasury bond yield fell 7 basis points to 4.544%.

Airlines and Shipping

Strengths

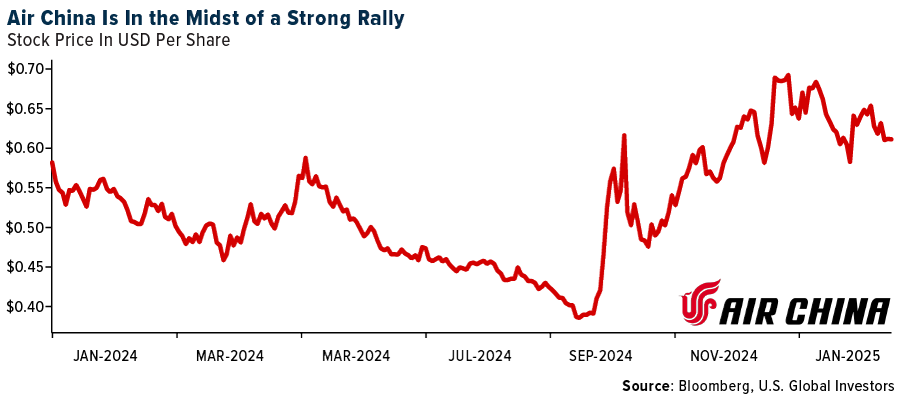

- The best performing airline stock for the week was SkyWest, up 6.0%. According to Goldman, China Eastern significantly narrowed losses in fiscal year 2024 to Rmb3.7-4.7 billion (from a Rmb8.0 billion loss in 2023) with the fastest recovery of international traffic. Air China outperformed peers with a Rmb1.3-2.1 billion loss (from Rmb2.1 billion loss) thanks to Cathay Pacific’s associate income contribution.

- Bloomberg has been analyzing the fierce impending competition between MSC and Maersk, as the 2M alliance comes to an end. Bookings on the two new networks opened in December, and the route shake-up is already leading to lower prices for customers, according to data from Xeneta.

- According to Goldman, Ryanair’s net income of €149 million was ahead of expectations (company consensus €60 million), fares were up 1% year-over-year on average, following -7% in the prior quarter. Ryanair cited stronger close-in bookings for Christmas and the New Year.

Weaknesses

- The worst performing airline stock for the week was JetBlue, down 18.4%. According to Morgan Stanley, United Airlines has had the highest percentage of cancelations occurring, 5.4% (Spirit Airlines also had an increase in cancelations to 4.5% year-over-year).

- Shipping prices have fallen 19% in total in the past three weeks, reports Morgan Stanley. The group thinks a seasonal correction in demand is likely out of the Chinese New Year, and thus, that container spot rates should continue to trend down for the time being.

- According to Goldman, JetBlue’s March unit revenue (“RASM”) guidance and 2025 cost outlook implies downside risk to consensus loss per share forecasts for both periods. JetBlue’s March quarter RASM forecast of +1.5% at the midpoint implies a 2.5% sequential decline. This is mostly due to weakness in Boston. CASM is 8-10% higher in the first quarter, with three points of this due to higher maintenance costs.

Opportunities

- Goldman is reiterating its positive view for Mexican airports on expectations for passenger traffic year-over-year growth of double digits in 2025E, reflecting seasonality carryover and capacity additions by airlines in Mexico, despite ongoing P&W inspections.

- The “Big Three” West Coast Ports (L.A., Long Beach, and Oakland) reported December 2024 traffic – with combined inbound loaded containers up 24% year-over-year, which is above the pre-pandemic five-year average of positive 3% year-over-year.

- Frontier’s run-rate synergy target from buying Spirit of $600 million represents 7% of combined entity TTM September 2024 sales, explains UBS. Frontier has offered to assume $400 mm in Spirit’s debt and offer 19% of Frontier’s common equity at closing. Notably, this offer is below what Frontier outlined in its discussion with Spirit last year ($580 million in debt assumption and 26.5% equity). The deal would create the fifth largest U.S. airline with combined ASMs representing 9% of the domestic industry.

Threats

- Wizz Air’s guidance for fiscal year 2025 net profit has been reduced to €125m-€175m at current FX rates. The airline is set to deliver materially lower net profit than initially guided in FY25E, with the downgrade relative to consensus expectations driven by worse-than-expected non-cash FX losses. Beyond FX, the downgrade to Wizz Air’s previous FY25E expectations is also driven by ex-fuel CASK pressure, according to RBC.

- Shippers are being wary of Red Sea routes despite the Houthi pledge to end targeting, writes the Wall Street Journal. Some operators signaled that they would resume Red Sea crossings once the second phase of the Gaza cease-fire is completed, said a maritime security executive. Shipping executives say they are now planning for a gradual return to the area in the second quarter.

- According to UBS, the business jet fleet is getting older. Aircraft older than 15 years now make up nearly 50% of the active fleet, versus 35% in 2019. UBS believes this explains some of the strength in aftermarket growth.

Luxury Goods and International Markets

Strength

- Ferrari has already sold out the entire production run of 799 F80 hypercars before the vehicle’s official launch, demonstrating the extraordinary demand for this limited-edition supercar. Only the most loyal Ferrari customers were invited to place orders, with the manufacturer carefully selecting buyers who have previously purchased multiple Ferrari models. The starting price is around $4 million.

- Salvatore Ferragamo’s shares climbed following the Italian luxury brand’s report of impressive double-digit growth in the fourth quarter compared to the same period in 2023. Sales increased worldwide, excluding China.

- Royal Caribbean was the top-performing stock in the S&P Global Luxury sector, rising 14.8% over the past five days. The compnay reported strong quarterly results, driven by robust demand for cruises. The company also announced plans to launch river cruises in 2027, starting with 10 ships and with intentions to expand the fleet in the following years.

Weaknesses

- LVMH reported weaker-than-expected results. Earnings per share were forecasted to be $27.20, but came in at $25.12, with group revenue growing by just 1% in 2024. The Wine & Spirits segment was the weakest, with sales falling by 8%. Regionally, sales in Asia (excluding Japan) also saw a decline of 10%.

- China’s Manufacturing PMI dropped from 50.1 in December to 49.1 in January, signaling a contraction in manufacturing activity. The Non-Manufacturing PMI also weakened, falling from 52.2 to 50.2. A reading below 50 indicates a slowdown in economic activity.

- Avanti, which offers entertaimnet facilities in South Korea, was the worst-performing stock in the S&P Global Luxury Index, plummeting 7.1%. Shares declined on light news flow.

Opportunities

- Tesla reported lower than expected earnings per share, but shares bounced on expectations of stronger sales this year and new initiatives to stimulate growth. The company announced plans to introduce more affordable models and launch its robotaxi business, along with the production of its humanoid robot, in 2025. The company also said it hopes to offer completely unsupervised self-driving technology to Tesla later this year.

- The Lunar New Year holiday, which began on January 28 and runs through February 4, presents a significant opportunity for luxury stocks and consumer spending. This important holiday is marked by travel and the exchange of high-end gifts, creating a boost in demand for luxury goods and services. Early indicators suggest that Lunar New Year travel in 2025 is stronger than in previous years, with estimates projecting 9 billion trips—a 7% increase compared to 2024.

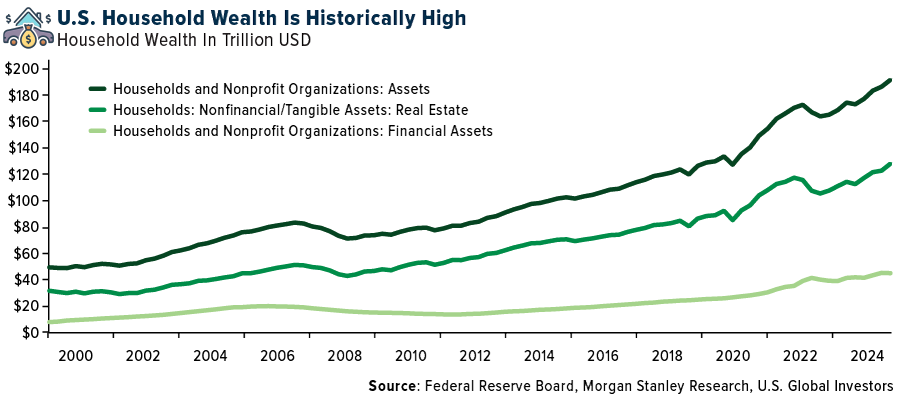

- The Bank of America research team reported a 1% year-over-year increase in U.S. luxury spending for January, signaling a recovery after 10 consecutive quarters of decline. This comes as U.S. household wealth is at a historically high level. The broker is optimistic about the continued growth of luxury spending in the U.S. over the next couple of years, projecting a 7% increase in 2025 and a 6% rise in 2026.

Threats

- Remy Cointreau anticipates a significant decline in full-year sales, driven by reduced U.S. consumer spendiig on luxury spirits and ongoing challenges in the Chinese market. Sales are projected to drop nearly 18%.

- Louis Vuitton reported results that fell short of expectations, underperforming compared to peers such as Richemont and Burberry. While the luxury sector is expected to recover, this rebound may be gradual and take more time to materialize. A key factor in this recovery will likely be the return of Chinese tourists, who have yet to resume significant international travel and spending. The timeline for this recovery remains uncertain.

- The Eurozone economy remained stagnant in the fourth quarter, falling short of expectations for a modest 0.1% expansion. In 2024, the region’s economy grew by 0.9%, below the anticipated 1% growth. On Wednesday, the European Central Bank (ECB) cut interest rates by another 25 basis points and may continue easing monetary policy to revive the sluggish economy.

Energy and Natural Resources

Strengths

- The best performing commodity for the week was coffee, rising 8.72%, and continuing its hot streak as the best performing commodity for 2024. Arabica coffee futures recorded their strongest monthly surge since November as dwindling ICE-monitored stockpiles, combined with Brazilian farmers withholding beans in anticipation of higher prices, stoked supply concerns. These constraints, intensified by poor weather affecting future yields, are expected to support further price increases following the gains seen in 2024, Bloomberg reports.

- According to JP Morgan, U.S. oil well permit activity increased on a sequential monthly basis, with 1,292 approved permits for horizontal wells in December versus 1,047 approved horizontal permits in November. This represented a 24% sequential increase compared to November levels.

- Aluminum rose in London as the European Union readied a proposal to gradually ban imports of the metal from Russia. The plan — which has been circulated among member states as part of a broad sanctions package — would allow European buyers to import 275,000 metric tons of the Russian metal under a quota system for a one-year period, before a full ban comes into effect, people familiar with the matter told Bloomberg.

Weaknesses

- The worst performing commodity for the week was natural gas, dropping 11.48%. U.S. natural gas futures sank as much as 8% as forecasts shifted warmer for February, signaling demand for heating fuel could drop. It is a change from recent trends for the market, which have climbed about 10% since the start of December when the cold weather finally hit, Bloomberg reports.

- A weaker China economy and battered iron ore prices have helped drive down Vale SA’s stock, making investors wary of uncertainties plaguing one of the world’s top suppliers of the steelmaking ingredient. A persistent crisis in China’s property sector and its impacts on iron ore — a metal that accounts for roughly 80% of Vale’s revenue — have led investors to trim allocations in the Brazilian company in the past year, according to Bloomberg.

- Industrial metals like copper, aluminum, zinc, and nickel extended their weekly declines after President Trump reiterated plans to impose 25% tariffs on key trade partners and potentially on China, Bloomberg writes. These tariffs are expected to be inflationary, prompting tighter monetary policy that could curb metals demand, particularly given the already fragile state of China’s commodity-heavy construction sector, Bloomberg reports.

Opportunities

- Regulations have not been a visible constraint on the U.S. energy industry. In the last 15 years, U.S. hydrocarbon liquids production is up 140% and U.S. gas production up 90%, thanks to the shale revolution, so Stifel sees absolutely no evidence whatsoever that any regulations of any kind have been a constraint on the U.S. energy industry.

- A Canadian lithium firm backed by Bill Gates has raised $35 million to build a refinery outside Vancouver to enhance North America’s battery metal supply chain and counter China’s proposed restrictions over key minerals. Mangrove Lithium closed a funding round with new investments from Mitsubishi Corp., Asahi Kasei Corp., InBC Investment Corp., Orion Industrial Ventures and Export Development Canada, according to Bloomberg.

- Corteva declared a quarterly dividend this week, while being awarded a buy with a heightened price target of $74 by Citigroup. Options data indicate potentially larger-than-usual post-earnings move for Corteva, with an implied 6.6% swing versus its 5% historical average. Combined with the company’s strong outperformance against the S&P 500—up 41% year-over-year—these factors suggest a noteworthy opportunity for investors ahead of the February 5 earnings release.

Threats

- News of Chinese Deep Seek AI unwound the recent uranium “Stargate” rally, the recently announced $500 billion AI infrastructure project. The Deep Seek news came with concerns around whether AI can be performed with relatively lower energy demand, which could mean less uranium demand, according to Bank of America.

- Mark Carney, the former central banker who is running to lead Canada, said the government should be open to curbing electricity exports to the U.S. if it needs to retaliate against tariffs from the Trump administration. “It’s not the first card” to play in a trade war, Carney said during an interview with Radio-Canada, the French-language public broadcaster. But any negotiation with the U.S. will be “very tough,” he said, suggesting the Canadian government needs to keep its options open.

- Oil loadings from two key Libyan ports are being brought to a standstill as protests hinder about a third of the OPEC member’s crude exports, a reminder of global supply risks from ongoing tensions in the North African country, according to Bloomberg.

Bitcoin and Digital Assets

Strengths

- Of the cryptocurrencies tracked by CoinMarketCap, the best performer for the week was Mantra, rising 44.85%.

- Tesla’s Bitcoin gave its latest quarterly results a boost, courtesy of a new accounting rules for digital assets. Its net income got a $600 million mark-to-market benefit from the digital tokens due to the adoption of the accounting approach, according to the CFO and reported by Bloomberg.

- Bitcoin extended its biggest jump in more than a week following the Federal Reserve’s latest monetary policy meeting and comments from Chair Jerome Powell. Bitcoin rose 1.3% to about $105,134 on Thursday, according to a Bloomberg article.

Weaknesses

- Of the cryptocurrencies tracked by CoinMarketCap, the worst performer for the week was Puddy Penguins, down 38.02%.

- The parents of FTX co-founder Sam Bankman-Fried are exploring ways to secure a pardon for the onetime crypto billionaire from President Donald Trump. His parents have been meeting in recent weeks with lawyers and other figures considered to be in Trump’s orbit, according to Bloomberg.

- The Trump administration’s embrace of cryptocurrencies is helping fuel a speculative mania that could cause “havoc” when prices collapse, according to an article published by Bloomberg.

Opportunities

- Thai government is considering a proposal to issue stablecoins backed by state bonds to help boost the nation’s digital asset markets. Stablecoins can be used to pay merchants and will likely receive strong interest from investors since they’ll be backed by government debt, writes Bloomberg.

- The crypto exchange Kraken, which has long-held aspirations of becoming a publicly-traded company, said revenue more than doubled during last year’s record breaking digital asset market rally, according to Bloomberg.

- Cipher Mining shares jumped as much as 26% in premarket trading on Friday after the Bitcoin mining company announced a $50 million PIPE investment from SoftBank that will support the high performance computing business, according to Bloomberg.

Threats

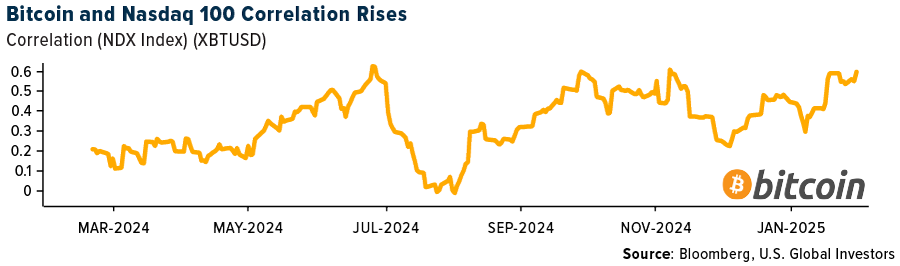

- Crypto prices have fallen in recent days as Chinese artificial intelligence startup DeepSeek triggered volatility in broader markets. Bitcoin has been moving more in tandem with stock markets recently, writes Bloomberg.

- A proposed class action lawsuit has been filed against cryptocurrency platform pump.fun alleging it put investors at high financial risk by marketing and issuing unregistered and volatile memecoins. The lawsuit claims pump.fun’s operators used aggressive marketing tactics and didn’t register with the SEC, according to Bloomberg.

- Democratic Senator Elizabeth Warren is pressing Commerce secretary nominee Howard Lutnick on connections he and his firm Cantor Fitzgerald LP have with a company that’s the go-to cryptocurrency of the criminal world, raising questions about potential conflicts of interest ahead of his confirmation hearing on Wednesday, according to Bloomberg.

Defense and Cybersecurity

Strengths

- U.S. arms exports hit a record $318.7 billion in 2024, driven by increased demand from countries replenishing stocks sent to Ukraine and preparing for potential conflicts, benefiting defense manufacturers like Northrop Grumman.

- General Dynamics reported Q4 earnings per share (EPS) of $4.15 (beating consensus of $4.05) and revenue of $13.3 billion (above $12.82 billion expected), with 13% revenue growth for the year and a one-to-one book-to-bill ratio. Gulfstream delivered 47 aircraft in Q4 (42 large-cabin) and 136 for the year (118 large-cabin), positioning the company for continued growth.

- The best performing stock this week was Axon Enterprise, rising 6.86%. That’s the most in 11 weeks, with increasing volume.

Weaknesses

- DeepSeek, a Chinese artificial intelligence (AI) startup backed by the hedge fund High-Flyer and led by CEO Liang Wenfeng, launched cost-efficient AI models that disrupted the global tech market, causing a massive selloff and wiping out over $1 trillion in value. Nvidia, Microsoft and Alphabet were hit hard, with Nvidia experiencing a historic stock price drop, raising concerns about reduced demand for high-end chips and the future of U.S. tech dominance in AI.

- The U.S. Department of Justice is blocking Hewlett Packard Enterprise’s $14 billion acquisition of Juniper Networks due to antitrust concerns, and a new Mirai-based botnet variant is exploiting vulnerabilities in Mitel SIP phones, impacting Akamai Technologies.

- The worst performing stock this week was BWX Technologies. The stock decline 11.53% after certain sectors like semiconductors, AI, data centers and energy companies overreacted negatively on a new Chinese AI model called DeepSeek.

Opportunities

- BAE Systems signed a £285 million contract to upgrade and maintain the Royal Navy’s combat systems and warship networks, making sure they stay modern and ready for future threats. This eight-year RECODE program will keep 20 ships up to date, improve collaboration with the Navy, and support 200+ skilled jobs while ensuring the fleet can rapidly adapt to evolving military challenges.

- Lockheed Martin was awarded a $502 million contract by the U.S. Navy for the development and support of the AN/SQQ-89A(V)15 anti-submarine warfare systems, with work expected to continue through January 2029 and potentially extend to January 2033.

- KBR, Inc. secured a significant $187 million contract with the U.S. Department of State for medical support services in Iraq.

Threats

- China is building a huge laser fusion research center. The new facility in the southwestern city of Mianyang is reported to help develop nuclear weapons and generate electricity.

- The European Union (EU) needs to double its defense spending by at least €100 billion immediately, as Poland, Lithuania, Latvia and Estonia warn that Russia is ramping up its military, and they push for joint borrowing, seizing Russian assets, and deeper cooperation with NATO.

- The recent suspension of new defense contracts by Defense Secretary Pete Hegseth, though brief, underscores potential vulnerabilities in the defense procurement process, highlighting risks of miscommunication and operational disruptions within the Department of Defense.

Gold Market

This week gold futures closed at $2,830.30, up $23.40 per ounce, or 0.84%. Gold stocks, as measured by the NYSE Arca Gold Miners Index, ended the week higher by 2.40%. The S&P/TSX Venture Index came in up 0.40%. The U.S. Trade-Weighted Dollar rose 0.90%.

Strengths

- The best performing precious metal for the week was platinum, up 9.00%, and breaking through $1,000 per ounce. Gold exports to the U.S. from Europe’s main refining hub in Switzerland jumped to the highest since Russia’s invasion of Ukraine, as traders scrambled to bring bullion ashore ahead of potential tariffs. Switzerland shipped 64.2 tons of gold to the U.S. in December, the most since March 2022, according to Bloomberg. Traders are considering that a tariff on gold could lift domestic gold prices. In other news, gold reached a new all-time high this week, due to a weaker dollar and haven demand.

- The gold market has launched a digital database to track bullion and keep precious metals from illicit sources out of the market. The Gold Bar Integrity Database, developed by the London Bullion Market Association, will trace precious metals to prevent supply from criminal gangs or conflict zones ending up in bank vaults. It will also seek to stop counterfeit bars stamped with the logos of major refineries from entering the market, as occurred in previous years, according to Bloomberg.

- Allied Gold has demonstrated strong operational performance in the fourth quarter of 2024, achieving record quarterly production of 99,632 ounces of gold, with significant contributions from the Sadiola mine’s Korali oxide ore. Despite a slight increase in AISC to US$1,780/oz, the company maintains a robust financial position with pro-form cash balances exceeding $340 million after year-end gold sales. Allied Gold continues to progress on its growth projects, including the Kurmuk development and Sadiola expansion, which are on time and budget, positioning the company for substantial production increases in the coming years.

Weaknesses

- The worst performing precious metal for the week was gold, but still up 0.84%. With the palladium market comfortably supplied, there have been concerns that Norilsk Nickel, the lowest cost supplier, might maximize production, squeezing its peers especially in South Africa. That said, updating its guidance, the company noted:“The palladium production forecast assumes a slight decline in output in 2025, averaging just over 1%, to 2.704-2.756 million ounces, compared to 2.762 million ounces produced the previous year.”

- Eldorado ELD released a technical report for the Lamaque Complex that was slightly negative to BMO’s valuation. This technical report saw the Lamaque complex having a shorter mine life, lower production, and increased costs compared with their prior estimates

- Gold declined as traders sold the precious metal to cover losses in equities amid a global rout in technology stocks. The stock markets from New York to London to Tokyo got hammered on concern that a cheaper artificial intelligence-model from Chinese startup Deep Seek could threaten the dominance of U.S. technology, according to Bloomberg.

Opportunities

- Newmont Corporation announced that it has agreed to sell its Porcupine operation in Ontario, Canada to Discovery Silver Corp. for up to $425 million in total consideration. The transaction is expected to close in the first half of 2025, subject to certain conditions being satisfied. Franco Nevada announced a $450 million financing package with Discovery Silver for the takeover. Franco will be providing Discovery funding through a $300 million royalty, a $100 million senior secured loan, and $49 million in equity for the operator’s acquisition.

- Gold has shown strong performance recently, rising 6.2% in U.S. dollar terms, 10.8% in AUD, and 9.4% in CAD over the past two months, while gold producers tracked by indices have fallen in the same period. This divergence between the commodity and producer performance presents an opportunity for gold companies, especially those operating in CAD and AUD and selling in USD, to potentially improve their profitability. As the gold price continues to rise faster than production costs, these companies are poised to benefit from expanding margins, which could lead to improved financial performance and potentially bridge the gap between the commodity’s appreciation and the current underperformance of gold producers.

- Raphael Lamm and Mark Landau, founders of Melbourne hedge fund L1 Capital, told investors that Trump could spur gold prices higher, despite a bull run in the precious metal outpacing all other major asset classes last year. “If we look at the fundamental drivers for gold – and there’s a long laundry list of them – the key one in our mind is the U.S. debt position,” Paragon CIO John Deniz told investors on a call this month, as reported by Bloomberg.

Threats

- Rwanda has been urged to withdraw its advancing troops from the outskirts of Goma, a mineral-rich city in the Democratic Republic of Congo (DRC). The Rwanda-backed M23 rebels have made rapid advances through the lucrative but conflict-ravaged eastern borderlands, killing at least 13 peacekeepers, forcing thousands of civilians to flee and grounding flights, according to the Telegraph.

- Botswana’s president Duma Boko, who swept to power in October elections, said his government has reached a diamond extraction and sales agreement with De Beers that will bring certainty to the gem-dependent economy. Terms were finalized by midnight on Jan. 24 and will be announced soon, Boko said in an interview on Tuesday. Revenue from diamond sales from Botswana have dropped 46% year-over-year and is at threat of disappearing with cheaper lab grown diamonds.

- A surge in gold shipments to the U.S. has led to a shortage of bullion in London, as traders amass an $82 billion stockpile in New York over fears of Trump administration tariffs. The wait to withdraw bullion stored in the Bank of England’s vaults has risen from a few days to between four and eight weeks, according to people familiar with the process, as the central bank struggles to keep up with demand. “People can’t get their hands on gold because so much has been shipped to New York, and the rest is stuck in the queue,” said one industry executive.

U.S. Global Investors, Inc. is an investment adviser registered with the Securities and Exchange Commission (“SEC”). This does not mean that we are sponsored, recommended, or approved by the SEC, or that our abilities or qualifications in any respect have been passed upon by the SEC or any officer of the SEC.

This commentary should not be considered a solicitation or offering of any investment product. Certain materials in this commentary may contain dated information. The information provided was current at the time of publication. Some links above may be directed to third-party websites. U.S. Global Investors does not endorse all information supplied by these websites and is not responsible for their content. All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. The following securities mentioned in the article were held by one or more accounts managed by U.S. Global Investors as of (12/31/2024):

Air China

AP Moeller Maersk

Ryanair

JetBlue

Frontier Airlines

NVIDIA Corp.

General Dynamics Corp.

Microsoft Corp.

Alphabet Inc.

Hewlett Packard Enterprise Co.

Tesla Inc.

Ferrari NV

LVMH Moet Hennessy Louis Vuitton

Remy Cointreau SA

Cie Financiere Richemont SA

Royal Caribbean Cruises Ltd.

Franco Nevada Corp

Newmont

DeBeers

*The above-mentioned indices are not total returns. These returns reflect simple appreciation only and do not reflect dividend reinvestment.

The Dow Jones Industrial Average is a price-weighted average of 30 blue chip stocks that are generally leaders in their industry. The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies. The Nasdaq Composite Index is a capitalization-weighted index of all Nasdaq National Market and SmallCap stocks. The Russell 2000 Index® is a U.S. equity index measuring the performance of the 2,000 smallest companies in the Russell 3000®, a widely recognized small-cap index.

The Hang Seng Composite Index is a market capitalization-weighted index that comprises the top 200 companies listed on Stock Exchange of Hong Kong, based on average market cap for the 12 months. The Taiwan Stock Exchange Index is a capitalization-weighted index of all listed common shares traded on the Taiwan Stock Exchange. The Korea Stock Price Index is a capitalization-weighted index of all common shares and preferred shares on the Korean Stock Exchanges.

The Philadelphia Stock Exchange Gold and Silver Index (XAU) is a capitalization-weighted index that includes the leading companies involved in the mining of gold and silver. The U.S. Trade Weighted Dollar Index provides a general indication of the international value of the U.S. dollar. The S&P/TSX Canadian Gold Capped Sector Index is a modified capitalization-weighted index, whose equity weights are capped 25 percent and index constituents are derived from a subset stock pool of S&P/TSX Composite Index stocks. The NYSE Arca Gold Miners Index is a modified market capitalization weighted index comprised of publicly traded companies involved primarily in the mining for gold and silver. The S&P/TSX Venture Composite Index is a broad market indicator for the Canadian venture capital market. The index is market capitalization weighted and, at its inception, included 531 companies. A quarterly revision process is used to remove companies that comprise less than 0.05% of the weight of the index, and add companies whose weight, when included, will be greater than 0.05% of the index.

The S&P 500 Energy Index is a capitalization-weighted index that tracks the companies in the energy sector as a subset of the S&P 500. The S&P 500 Materials Index is a capitalization-weighted index that tracks the companies in the material sector as a subset of the S&P 500. The S&P 500 Financials Index is a capitalization-weighted index. The index was developed with a base level of 10 for the 1941-43 base period. The S&P 500 Industrials Index is a Materials Index is a capitalization-weighted index that tracks the companies in the industrial sector as a subset of the S&P 500. The S&P 500 Consumer Discretionary Index is a capitalization-weighted index that tracks the companies in the consumer discretionary sector as a subset of the S&P 500. The S&P 500 Information Technology Index is a capitalization-weighted index that tracks the companies in the information technology sector as a subset of the S&P 500. The S&P 500 Consumer Staples Index is a Materials Index is a capitalization-weighted index that tracks the companies in the consumer staples sector as a subset of the S&P 500. The S&P 500 Utilities Index is a capitalization-weighted index that tracks the companies in the utilities sector as a subset of the S&P 500. The S&P 500 Healthcare Index is a capitalization-weighted index that tracks the companies in the healthcare sector as a subset of the S&P 500. The S&P 500 Telecom Index is a Materials Index is a capitalization-weighted index that tracks the companies in the telecom sector as a subset of the S&P 500.

The Consumer Price Index (CPI) is one of the most widely recognized price measures for tracking the price of a market basket of goods and services purchased by individuals. The weights of components are based on consumer spending patterns. The Purchasing Manager’s Index is an indicator of the economic health of the manufacturing sector. The PMI index is based on five major indicators: new orders, inventory levels, production, supplier deliveries and the employment environment. Gross domestic product (GDP) is the monetary value of all the finished goods and services produced within a country’s borders in a specific time period, though GDP is usually calculated on an annual basis. It includes all private and public consumption, government outlays, investments and exports less imports that occur within a defined territory.

The S&P Global Luxury Index is comprised of 80 of the largest publicly traded companies engaged in the production or distribution of luxury goods or the provision of luxury services that meet specific investibility requirements.

The book-to-bill ratio is a financial metric that compares the number of orders a company receives to the number of orders it fills.

A basis point is one hundredth of one percent.