Boeing Resumes Production as the Airline Industry Prepares for a Record-Breaking 2025

The clouds hanging over Boeing’s operations finally appear to be clearing.

After a turbulent period of setbacks—including crashes, a global pandemic, supply chain snarls and a recent labor strike—Boeing has officially restarted production of the 737 MAX. And while the ramp-up will be gradual, the significance of this for the aviation industry can’t be overstated.

Why? Because the global fleet of commercial airliners has never been older, and carriers are under pressure to modernize.

That should be music to Boeing shareholders’ ears, but it’s also a positive indicator for the entire industry, which looks poised for a record-shattering 2025. With passenger numbers expected to hit record highs and airlines lifting their guidance, the tailwinds are undeniable.

An Aging Fleet Amid Soaring Demand

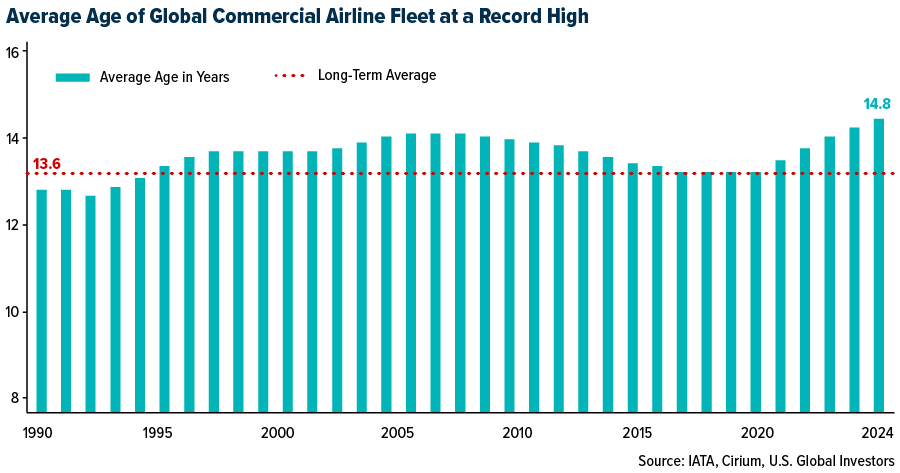

According to the International Air Transport Association (IATA), the average age of the global fleet of commercial aircraft now stands at 14.8 years—the highest on record. Compare that to the average long-term age of 13.6 years, and it’s clear that airlines are flying older planes for longer periods. These aging aircraft require more maintenance, more fuel and more repairs, all of which weigh on airlines’ bottom lines.

The silver lining? This presents a massive opportunity for new aircraft deliveries, and Boeing’s production restart couldn’t come at a better time. The IATA estimates that 1,254 new planes will be delivered this year, potentially followed by 1,802 deliveries in 2025. That would be just shy of the record 1,813 aircraft that were delivered in 2018.

Boeing’s Bumpy Road to Recovery

Boeing’s journey back to full production has had its challenges. The recent strike by workers halted operations for more than 12 weeks, adding to the planemaker’s headaches. According to Reuters, U.S. regulators capped Boeing’s production at 38 jets per month following the midair blowout incident on an Alaska Air flight earlier this year.

But Boeing is resilient. With production resuming, analysts at Jefferies predict the company will average 29 737 MAX deliveries per month in 2025. That’s still below Boeing’s target of 56 per month, but it represents solid progress for the manufacturer.

Airline executives are taking notice. Alaska Air CEO Ben Minicucci recently acknowledged that while Boeing’s comeback is still a work-in-progress, he’s seeing “an improving trend” under the company’s new leadership.

A Billion-Dollar Vote of Confidence

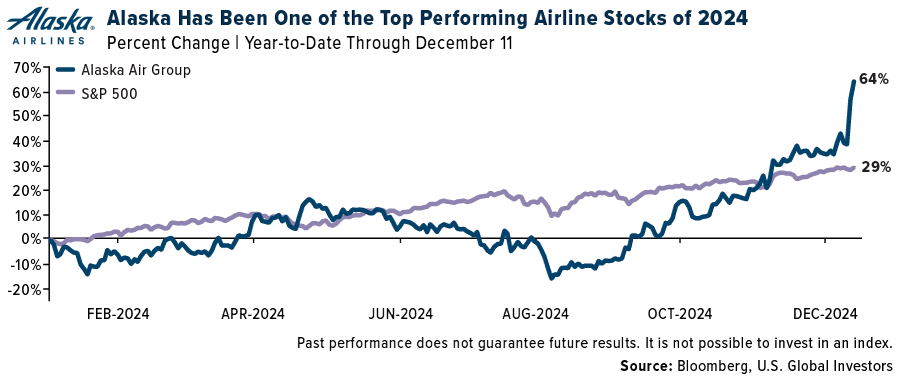

Airlines themselves are brimming with optimism. Alaska, fresh off its acquisition of Hawaiian Airlines, recently announced a $1 billion share buyback program and issued strong financial guidance. The Seattle-based airline—one of the top performers of 2024, gaining 64% year-to-date—expects to post full-year adjusted earnings of at least $5.75 per share in 2025, exceeding Wall Street’s estimates.

Other major carriers are singing a similarly bullish tune. American Airlines raised its profit expectations for the final months of 2024, thanks to robust holiday demand, higher fares and lower fuel costs.

Southwest Airlines also lifted its revenue outlook, citing resilient travel demand and changes to its revenue management practices.

Record Revenues on the Horizon?

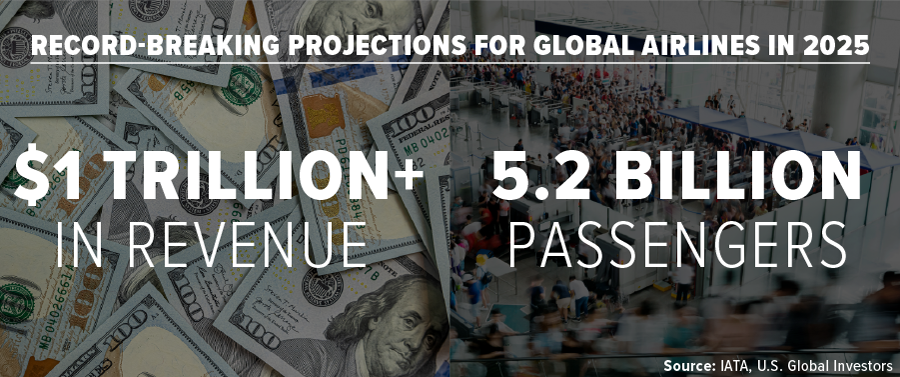

Looking ahead to 2025, the IATA projects total industry revenues to top $1 trillion for the first time in aviation history. Passenger numbers are expected to soar to 5.2 billion, a 6.7% increase from 2024 and another all-time high.

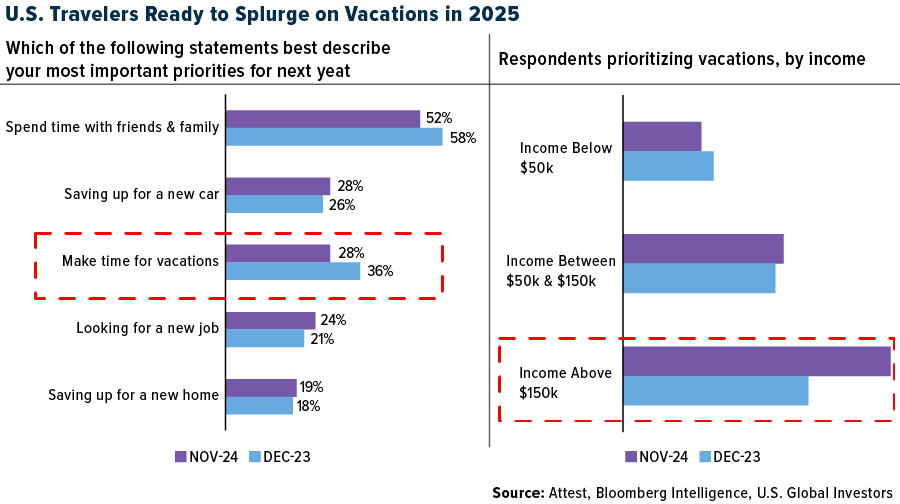

A recent Bloomberg Intelligence survey found that 36% of U.S. travelers plan to take vacations in 2025, up from 28% the previous year. High-income households are leading the charge, with 65% of those earning over $150,000 prioritizing vacations. This is a critical demographic for airlines, as premium travelers generate a disproportionate share of profits.

Wheel’s Up!

Boeing’s production restart is a signal that the industry’s supply-side challenges are being addressed.

Meanwhile, surging demand and record-breaking projections for 2025 suggest that airlines are on the cusp of a new era of profitability.

For investors, travelers and industry stakeholders, we believe the outlook is undeniably bright. The sky’s the limit!

Index Summary

- The major market indices finished mixed this week. The Dow Jones Industrial Average lost 1.82%. The S&P 500 Stock Index fell 0.64%, while the Nasdaq Composite rose 0.34%. The Russell 2000 small capitalization index lost 2.58% this week.

- The Hang Seng Composite lost 4.95% this week; while Taiwan was down 0.75% and the KOSPI rose 2.73%.

- The 10-year Treasury bond yield rose 24 basis points to 4.4%.

Airlines and Shipping

Strengths

- The best performing airline stock for the week was Alaska Air, up 15.2%. Boeing restarted production of its best-selling 737 MAX jetliner, about a month after the end of a seven-week strike by 33,000 factory workers, according to three sources familiar with the matter. Getting the 737 MAX production line moving again is essential to the heavily debt-burdened plane maker’s recovery, and Boeing has about 4,200 orders for the jetliner from airlines eager to meet growing global demand for air travel, according to Reuters.

- Air cargo on the major east-west trade lanes is seeing demand exceed capacity, and this is driving freight rates to 2024 highs on Asian export routes and the transatlantic. The average Shanghai to North Europe spot rate of $5.07/ kg is the highest in almost two years, while the Shanghai-North America rate of $6.61/kg is the highest so far this year, CIBC reports.

- Singapore Air has successfully reinstated its post-pandemic capacity and is now focusing on growth, with a projected 5% increase in Available Seat Kilometers (ASK) in the coming years, according to JP Morgan. The airline’s outbound seats for all regions, excluding Northeast Asia, have surpassed pre-pandemic levels. Management expects strong air travel demand in the second half of fiscal year 2024 and into 2025.

Weaknesses

- The worst performing airline stock for the week was United Air, down 5.2%. JetBlue lowered its system capacity by 140 basis points (bps) in May. The greatest change was driven by Atlantic capacity, lower by 10%, as the airline lowers frequency between New York-JFK and Paris to once-daily, according to Bank of America.

- Iron ore ocean freight rates for the Australia-China and Brazil-China routes have fallen over 30% since the recent mid-November peak, reports Morgan Stanley, with Brazil-China reaching a 20-month low of $17.50 per ton. This weakness likely reflects the slowing pace of export shipments from Australia and Brazil in recent weeks.

- Canadian airline web traffic was down 6% year-over-year, on average, in October and November, with October coming in up 6% and November down 18%. Non-mainline web traffic was up 1.2% compared to mainline down 7.5%, suggesting a potential trade down to lower-cost carriers, according to RBC.

Opportunities

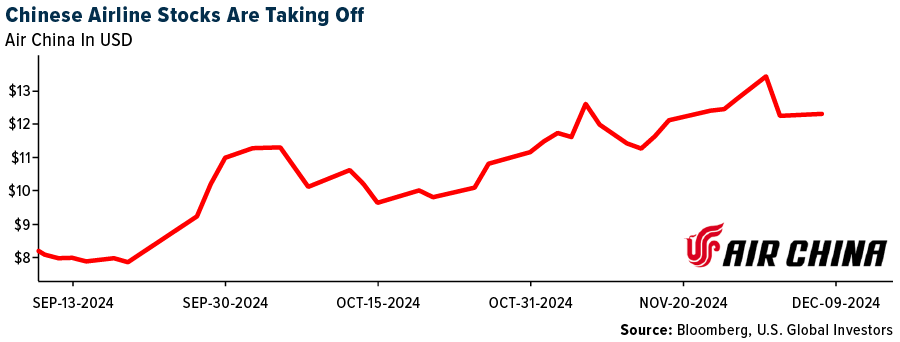

- As reported by Goldman, higher Chinese airline stock prices is driven by a potential under-supply scenario driven by a tighter supply, slower new aircraft delivery, and improvement in demand benefiting from China’s macro policy stimulus. Goldman believes that Air China can benefit most from a potentially improved macro environment given its high exposure to business routes.

- Following weeks of sequential decline, UBS expects more meaningful upward pressure on Far East-U.S. spot rates. On Far East-U.S., following the mid-December rate increase, quotes are settling around $6,000-7,500 per container.

- The board of Alaska Air Group approved a share repurchase program authorizing the company to buy back up to $1 billion of its common stock. The program will begin after the existing repurchase program is complete. Alaska will launch a premium credit card built for the global traveler, including a Global Companion Award Certificate, 3x miles on all eligible foreign and 3x miles on all dining purchases.

Threats

- According to Raymond James, JetBlue believes there is a 5–8-year shortage of MRO capacity. The forecast reflects average aircraft on the ground stepping up from 11 in 2024 to 17/15 in 2025/2026. Based on what Raymond James believes P&W compensation to be, the group estimates at least $0.30-0.35 of missing earnings per share (EPS) in 2025/2026.

- Goldman’s baseline forecast sees moderate downside to oil tanker freight rates, although still well above long-term averages. The bank sees significant downside should the present tanker redirections unwind, as this would reduce the inorganic tanker demand support.

- According to Morgan Stanley, commercial aircraft retirements remain relatively low and have decreased 23% from an average of 584 retirements per year during 2012-2018 to an average of 450 retirements per year during 2020-2024. The average age of total in-service commercial aircraft has increased from 9.9 years old during 2012-2018 to 11.7 years old today.

Luxury Goods and International Markets

Strengths

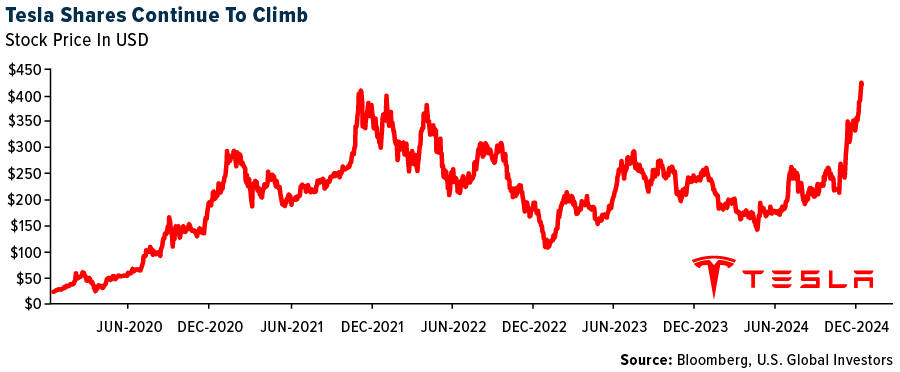

- Tesla shares reached a new all-time high this week, up 70% year-to-date, with most of the gains occurring since mid-October. Tesla CEO Elon Musk has become the first person in history to reach a net worth of $400 billion, surpassing the second richest individual, Jeff Bezos, by approximately $200 billion.

- U.S. household wealth reached a record high in the third quarter, driven by a stock market rally ahead of the presidential election. The Federal Reserve reported on Thursday that household net worth rose by nearly $4.8 trillion, or 2.9%, from the previous quarter, reaching a total of $168.8 trillion. Continued strong household spending may provide ongoing support for discretionary equities.

- Real Real, an online marketplace for the sale of luxury goods in the United States, was the top-performing stock in the S&P Global Luxury sector, gaining 36.26% in the past five days. Wells Fargo said the company’s share could double due to structural changes.

Weaknesses

- Inditex (ITX), best known for its Zara brand, reported weaker-than-expected profits after tax. The company posted a record quarterly profit of €1.68 billion on Wednesday, falling short of the expected €1.77 billion, while shares declined this week.

- China reported weaker-than-expected data this week for exports, imports, and money supply. The country is expected to continue its stimulus measures and increase its budget deficit to the highest level in three decades, with the fiscal deficit target potentially reaching 4% of GDP, the largest since 1994.

- Cettire, an Australian online marketplace for the sale of luxury goods to customers worldwide, was the worst-performing stock in the S&P Global Luxury Index, falling 14.5%. Shares declined on little news.

Opportunities

- On Monday, Hong Kong stocks experienced gains following the readout from the Chinese Politburo meeting, which indicated a shift toward a more dovish monetary policy. The key points from the meeting highlighted China’s intention to stimulate consumption, enhance investment efficiency, and expand domestic demand. Furthermore, there was a focus on stabilizing both the stock and property markets. This shift is expected to have positive implications for sectors such as luxury goods, which could see continued growth, especially as China plays a pivotal role in the recovery and turnaround of the luxury market.

- Brunello Cucinelli raised its sales forecast for the year, now expecting growth of 11-12%, up from the previously projected 10%. The company revised its outlook as demand for its 2025 collections continues to drive orders. Its strong high-end branding and appeal to ultra-high-net-worth clients are likely to contribute to this growth.

- LVMH acquired a minority stake in the boutique hotel group Les Domaines de Fontenille, expanding its travel and experiential offerings to capitalize on the rising demand for luxury travel experiences. The luxury giant already owns the Cheval Blanc and Belmond hotel chains, as well as Bulgari Hotels & Resorts.

Threats

- An annual report from Scottish financial advisory firm Noble & Co reveals that the rare and fine whisky market is experiencing a downturn. This decline is attributed to reduced sales volumes, falling prices, and a more cautious consumer outlook. Demand in Asia has significantly weakened, and the market is still adjusting to the post-pandemic period, following a sharp surge in demand during COVID-19.

- As educated young Chinese face shrinking white-collar job opportunities, many are turning to lower-paying gig roles like tour guiding, signaling a shift in discretionary spending power. This trend highlights a potential threat to the luxury market, as reduced earnings among this demographic could curb demand for premium goods and experiences, echoing broader economic concerns in a slowing domestic economy, Bloomberg reports.

- Lucid, a luxury car maker and distributor, faces a significant challenge in securing an additional $4 billion in funding, which is essential for its next phase of growth. Despite a $4.2 billion investment in 2024, demand for its expensive luxury SUVs in the U.S. has been sluggish. Without this funding, the company risks delaying the launch of a more affordable midsize vehicle that is critical for its long-term financial health.

Energy and Natural Resources

Strengths

- The best performing commodity for the week was natural gas, rising 6.53%. Natural gas climbed as speculators continue to pile into instruments that track the commodity benefiting from supply shocks stemming from Russian LNG disconnect and demand from lower winter temperatures. Natural gas prices have become less about real market fundamentals and more about financial players playing with the system, as policymakers side with risk takers within the industry over the end users, Euractiv reports.

- Average U.S. gasoline prices fell below $3 a gallon for the first time in over three years on Monday, extending a run of bargains at the pump for consumers who have faced soaring inflation in recent years. The national average price for regular gasoline fell to $2.97 per gallon, the lowest since May 2021, according GasBuddy.com.

- Global liquefied natural gas supply is set to reach 37.3 million metric tons in December, up 7% from last month, Bloomberg NEF estimates. U.S. exports will expand as two new projects are likely to load their first cargoes. Cheniere Energy’s Corpus Christi Stage 3 in Texas could come online this month, while Venture Global’s Plaquemines in Louisiana could start in the coming weeks.

Weaknesses

- The worst performing commodity for the week was sugar, dropping 5.00%. Sugar has entered oversupply territory as Brazil, the world’s largest exporter of sugar, has extended their production season past typical halt periods (December/ January) to attempt to make up for the loss experienced in the first half of November from torrential rains which paused production.

- According to Bloomberg, forecasts for both 2024 and 2025 have been cut repeatedly by the International Energy Agency and analysts at OPEC. Since the start of the year, the IEA has reduced its 2024 demand growth forecast by 320,000 barrels a day, to just 920,000. OPEC has lowered its forecast by 430,000 barrels a day.

- The world’s largest commodity trading house, Trafigura, took a $1.1 billion loss on employee misconduct in their Mongolian oil business. Their profit dropped 62% on the write-off. Trafigura had flagged in February that they were facing a sizable loss in that business unit. The company – which is entirely owned by its employees – reported net profit of $2.8 billion for its 2024 financial year that ended in September, down 62% from the previous year and the lowest in four years, as reported by Bloomberg.

Opportunities

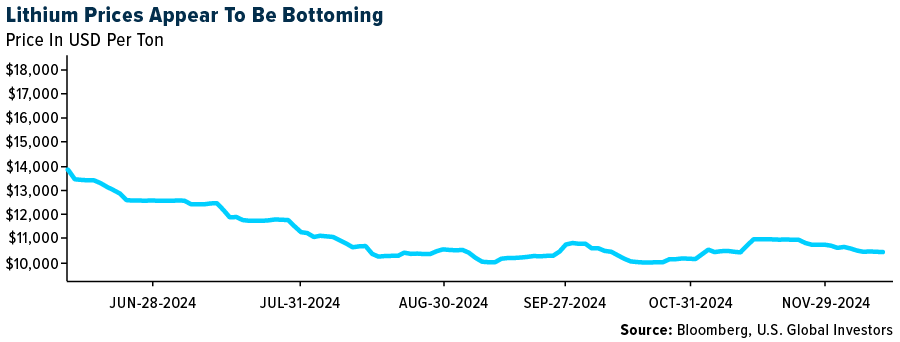

- According to CLSA, global lithium markets are finding their footing, with production cuts equivalent to 5% of global supply. CLSA estimates global supply at 1.4 million tons in 2025, with 15% (210 kt) coming from loss-making operations. As project commissioning is deferred and shutdowns occur, oversupply should moderate over the coming years.

- President-elect Trump’s promise to expedite permits for $1 billion investments in the U.S. could revitalize the energy sector, including nuclear power, by removing bureaucratic barriers and accelerating project timelines. This presents an opportunity for the U.S. to strengthen its energy independence, reduce reliance on fossil fuels, and modernize its energy infrastructure through a renewed focus on nuclear power and other clean energy sources, Bloomberg reports.

- Codelco and Enami, Chile’s two state copper companies, are discussing the possibility of combining their respective efforts to expand smelting capacity into a single project, according to people with knowledge of the matter and Bloomberg.

Threats

- According to Morgan Stanley, China’s November net steel exports pulled back by 17% sequentially, declining toward an annualized run-rate of 106 million tons, potentially sending a sigh of relief across seaborne steel markets. A reversal of year-to-date export trends may underpin a normalization in European HRC margins.

- China’s oil demand may peak in 2025, reports Bloomberg, five years earlier than expected, as the shift away from gasoline and diesel accelerates, according to a report from the nation’s largest energy producer. Earlier this year, an official with the group said overall demand was not expected to peak until 2030.

- Post election political violence in Mozambique is bucking its economy and has forced Syrah Resources to declare force majeure. Syrah, which mines graphite in Mozambique to be processed in the U.S., has been sending samples to Tesla for testing ahead of commercial sales starting in 2025. The revolt is the latest instance of a resurgence of unrest in sub-Saharan Africa, where gaping inequality and perceptions of exclusion have provided fertile ground this year in Kenya, Nigeria and elsewhere, as reported by Bloomberg.

Bitcoin and Digital Assets

Strengths

- Of the cryptocurrencies tracked by CoinMarketCap, the best performer for the week was Bitget, rising 34.28%.

- Michael Saylor’s MicroStrategy checks all the boxes for inclusion in the Nasdaq 100 Index, writes Bloomberg, a development that would trigger purchases of the shares by the $451 billion worth of ETFs around the world that directly track the benchmark.

- The world’s largest asset manager says that Bitcoin does have a place in multi-asset portfolios. According to Blackrock a 1-2% weighting would produce a similar risk profile to the so-called Magnificent 7 stocks in a standard 60/40 portfolio, writes Bloomberg.

Weaknesses

- Of the cryptocurrencies tracked by CoinMarketCap, the worst performer for the week was World Coin, down 22.36%.

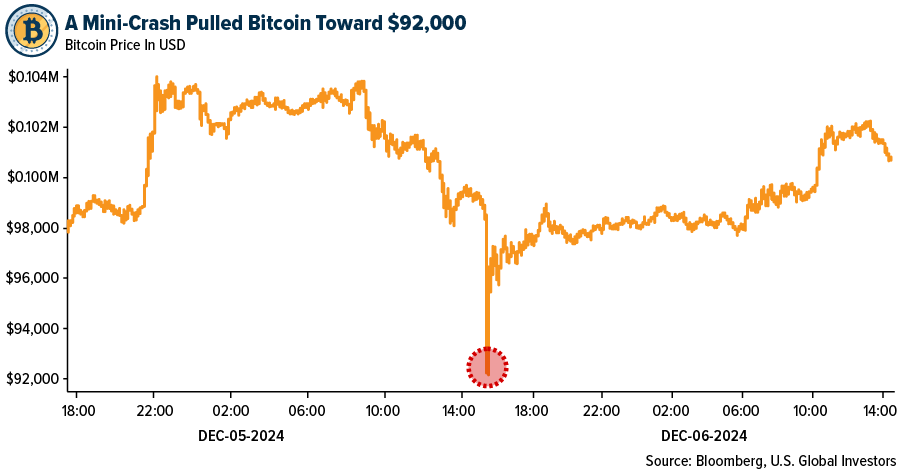

- Bitcoin fell to as low as $92,144 before rebounding to $99,500, as it appears to have been a mini flash crash of the token on December 5. Although it feels like there is still room to run, investors are taking profits, said Josh Gilbert, a market analyst at eToro.

- Thomas Peterffy, the billionaire founder of retail brokerage Interactive Brokers, said investors should own some Bitcoin but not too much. He commented, “For example, we will not allow anyone to invest more than 10% of their assets into Bitcoin because I think that would be very dangerous,” according to a Bloomberg article.

Opportunities

- MicroStrategy purchased an additional $2.1 billion in Bitcoin, financing these acquisitions through a combination of equity and fixed-income securities sales. This marks the fifth consecutive Monday the company has announced Bitcoin purchases. According to Bloomberg, Michael Saylor has accumulated Bitcoin valued at over $41 billion over the past four years.

- Hong Kong has pledged to speed up the licensing process for crypto trading platforms, reports Bloomberg, as the region continues its drive to become a cryptocurrency hub. Joseph Chan, acting secretary for financial services and the Treasury, said at the parliament today that the SEC will facilitate a “swift licensing process” and establish a consultative panel that’s expected to commence early next year for licensed trading platforms.

- Coincheck, the second-largest cryptocurrency exchange in Japan, is listing on Nasdaq this Wednesday, reports Bloomberg. The firm is merging with Thunder Bridge Capital to become the second crypto exchange to go public in the U.S. Coincheck reportedly began working on its public listing in 2022 through a de-spac merger deal that valued the exchange at $1.25 billion.

Threats

- Australian operator of the Kraken crypto exchange, Bit Trade, has been ordered to pay A$8 million for unlawfully issuing a credit facility to more than 1,100 Australian customers, according to the Australian Securities & Investments commission.

- Crypto liquidations broke past $1.5 billion within the past 24 hours, Bloomberg writes, as the price of bitcoin retreated from the $100,000 level. Nearly 514,400 traders experienced liquidations, among them $1.38 billion were long positions with $137.7 million in short positions liquidated.

- An Austin, Texas, man received a two-year sentence for falsely under reporting capital gains earned from selling $3.7 million in bitcoin, marking the first criminal tax evasion prosecution centered entirely on cryptocurrency, according to Bloomberg.

Defense and Cybersecurity

Strengths

- BAE Systems has signed $2.5 billion contracts with Sweden and Denmark for the delivery of new CV90 combat vehicles, including 115 units for Denmark, 50 for Sweden, and additional vehicles for Ukraine funded jointly by both nations. The contracts cover spares, logistics, training and the latest CV90 version, which incorporates advanced features and lessons from previous deployments.

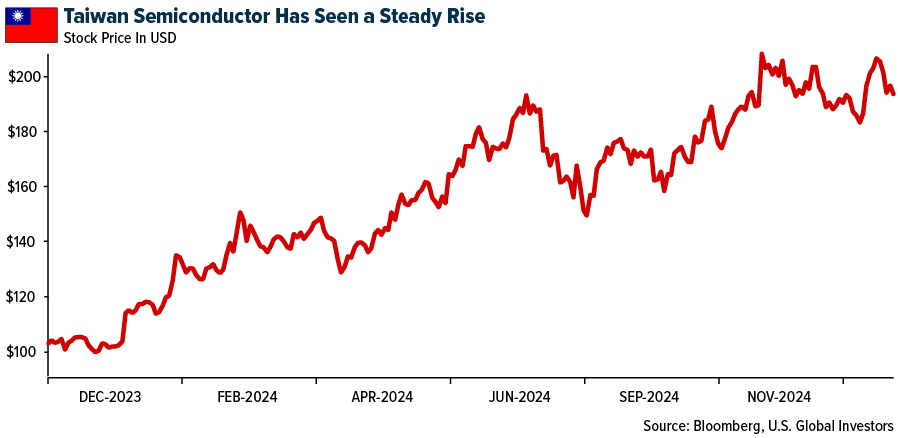

- Taiwan Semiconductor Manufacturing reported November net revenue of $8.49 billion, a 34% year-over-year increase. The report comes despite a 12.2% decline from October, with January-November revenue up 31.8% compared to 2023.

- The best performing stock in the XAR ETF this week was Boeing, rising 10.21%, after investing $1 billion to expand its South Carolina 787 Dreamliner plant, creating 500 jobs and upgrading infrastructure to boost production after a challenging year.

Weaknesses

- Russia’s military has circumvented Western sanctions to acquire American semiconductors. This includes Texas Instruments components, via shadowy distributors, shell companies and intermediaries in Hong Kong, fueling its war efforts despite U.S. restrictions and monitoring challenges.

- Russia is close to securing an agreement with Syria’s new leadership to maintain its military bases at Tartus and Khmeimim, ensuring its strategic presence in the Middle East despite the overthrow of Bashar al-Assad.

- The worst performing stock in the XAR ETF this week was Loar Holdings, falling 13.98%. The company announced the launch of a public offering of 4,750,000 shares of its common stock, with proceeds intended for debt repayment and general corporate purposes, subject to market conditions.

Opportunities

- Ayar Labs, a San Jose-based semiconductor startup, raised $155 million in funding, boosting its valuation to over $1 billion, to advance its optical I/O technology aimed at improving AI infrastructure with faster data transfer, lower power consumption, and reduced costs.

- Apple Inc., in collaboration with Broadcom Inc., is developing a custom AI server chip, code-named Baltra, slated for mass production by 2026. The goal is to expand its silicon capabilities and reduce reliance on Nvidia processors.

- Palantir Technologies and Anduril Industries are partnering to accelerate the integration of AI in U.S. military operations, utilizing Anduril’s Lattice software and Palantir’s secure data platform, while inviting other companies to join their effort.

Threats

- Russian forces have advanced within six kilometers of the strategic city of Pokrovsk in Donetsk, escalating their costly offensive against outnumbered Ukrainian defenders who are fiercely resisting.

- The fall of Bashar al-Assad’s regime in Syria after rebel advances has created a power vacuum, raising fears of chaos and competition among factions as regional and global powers navigate the uncertain transition.

- NASA’s Artemis moon missions have been delayed to 2026 and 2027 due to technical issues, cost overruns, and shifting priorities, with potential program changes under the new Trump administration

Gold Market

This week gold futures closed at $2,666.90, up $7.90 per ounce, or 0.27%. Gold stocks, as measured by the NYSE Arca Gold Miners Index, ended the week lower by 0.17%. The S&P/TSX Venture Index came in off 0.39%. The U.S. Trade-Weighted Dollar rose 0.88%.

Strengths

- The best performing precious metal for the week was gold, up 0.27%. According to Bank of America, central bank gold inflows totaled 2,575 tons over the past five years, with the largest buyers being China (+412 tons, a 22% increase in holdings), Türkiye (+359 tons or +141%), Poland (+299 tons, or +232%), India (+280 tons, or +47%) and Russia (+223 tons, or +11%).

- Gold rose after China’s central bank added bullion to its reserves for the first time in seven months. That was the first addition since April, which was the end of an 18-month run of purchases that had helped underpin prices, according to Bloomberg.

- Premiums for gold and silver futures in New York swelled as traders weighed the possibility of precious metals being included in sweeping tariff measures proposed by President-elect Donald Trump. The price moves have been fueled by short covering by banks and funds who are buying Comex futures and selling contracts in London, said Nicky Shiels, head of metals strategy at MKS Pamp SA.

Weaknesses

- The worst performing precious metal for the week was silver, down 2.05% with its higher beta to gold’s volatility. According to Morgan Stanley, the November month-over-month (MoM) import value of lab-grown diamonds fell by-30% MoM/28% year-over-year (YoY), while export value fell by a steeper 54% MoM/42% YoY. This also points to some inventory build-up. The trend of market-share gains vs. natural stones appears to have paused in November as both markets declined sequentially by a similar order of magnitude.

- Torex Gold Resources announced it has received a notification from the Director General of Mines under the Federal Ministry of Economy that all activities within its Morelos Property are to be suspended to support their inspection associated with the fatal incident at the ELG Underground on December 5, according to Scotia.

- Lundin Gold shares fell Tuesday after the company reported higher costs projections from its operations as part of its guidance. The Canadian gold miner said late Monday that it expects to produce about 475,000 to 525,000 ounces of gold from its operations in 2025, according to Dow Jones.

Opportunities

- Gold may get a modest setback from the Federal Reserve this month, but options traders are optimistic this will just be a blip in the road higher. More broadly, gold found a new lease on life this year, with investors moving away from swaying to the tune of real rates and, instead, finding inspiration from market pricing for the Fed funds rate, according to Bloomberg.

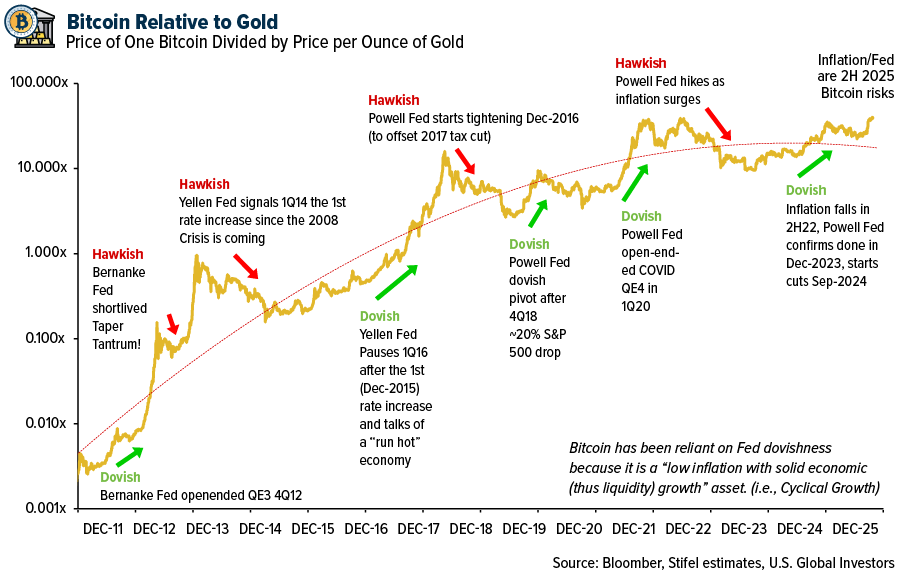

- Fed Chair Jerome Powell recently commented that Bitcoin was like “digital gold,” and he did not see it as a threat to the dominance of the U.S. dollar. However, some might interpret that Powell just said that Bitcoin is just as good as gold, or in fact it has been better than gold in price appreciation under current economic conditions! Stifel Equity Strategy team led by Barry Bannister presented the argument that makes gold and Bitcoin look like polar opposites when you consider the conditions what drives their respective asset values. Barry contends that Bitcoin needs a dovish Fed coupled with low inflation and sold economic growth as it primary price driver. Gold is more defensive and tends to perform better in an inflationary environment. Tariffs could be the first disruption to reset core inflation closer to 3% by the second half of 2025, trigger higher interest rates and risk an economic slowdown.

- Gold prices can break through the $3,000 barrier by the end of next year—even if the dollar stays high, Goldman Sachs said, pushing back on recent commentary. The team advises investors to watch the Federal Reserve’s actions, not the dollar, to determine how high gold prices can go in 2025.

Threats

- On a recent episode of MSNBC’s All In, host Chris Hayes said that a Senate bill could potentially result in a $100 billion transfer from taxpayers to Bitcoin owners. The bill, proposed by Sen. Cynthia Lummis, calls for the U.S. Treasury to acquire 1 million Bitcoins over a span of five years, with a holding period of at least 20 years.

- Bitcoin has soared more than 50% since Nov. 4, topping $100,000 in part on hopes that crypto advocate—having donated some $135 million to Trump and dozens of successful congressional campaigns—will persuade Trump to make the crypto reserve a reality, according to Bloomberg.

- Zimbabwe is planning to hold 26% of new mining projects on a free carry basis and will also negotiate with existing operators to acquire a similar stake. “We need to move to a level where we reach 26% shareholding in most of the big projects,” Zimbabwe’s Secretary for Mines Pfungwa Kunaka told Bloomberg in an interview.

U.S. Global Investors, Inc. is an investment adviser registered with the Securities and Exchange Commission (“SEC”). This does not mean that we are sponsored, recommended, or approved by the SEC, or that our abilities or qualifications in any respect have been passed upon by the SEC or any officer of the SEC.

This commentary should not be considered a solicitation or offering of any investment product. Certain materials in this commentary may contain dated information. The information provided was current at the time of publication. Some links above may be directed to third-party websites. U.S. Global Investors does not endorse all information supplied by these websites and is not responsible for their content. All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. The following securities mentioned in the article were held by one or more accounts managed by U.S. Global Investors as of (09/30/2024):

Boeing

Singapore Air

JetBlue

Alaska Air Group

Tesla

Hugo Boss

Inditex

Brunello Cucinelli

LVMH

Cheniere Energy

Tesla

Torex Gold Resources Inc.

Lundin Gold Inc.

*The above-mentioned indices are not total returns. These returns reflect simple appreciation only and do not reflect dividend reinvestment.

The Dow Jones Industrial Average is a price-weighted average of 30 blue chip stocks that are generally leaders in their industry. The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies. The Nasdaq Composite Index is a capitalization-weighted index of all Nasdaq National Market and SmallCap stocks. The Russell 2000 Index® is a U.S. equity index measuring the performance of the 2,000 smallest companies in the Russell 3000®, a widely recognized small-cap index.

The Hang Seng Composite Index is a market capitalization-weighted index that comprises the top 200 companies listed on Stock Exchange of Hong Kong, based on average market cap for the 12 months. The Taiwan Stock Exchange Index is a capitalization-weighted index of all listed common shares traded on the Taiwan Stock Exchange. The Korea Stock Price Index is a capitalization-weighted index of all common shares and preferred shares on the Korean Stock Exchanges.

The Philadelphia Stock Exchange Gold and Silver Index (XAU) is a capitalization-weighted index that includes the leading companies involved in the mining of gold and silver. The U.S. Trade Weighted Dollar Index provides a general indication of the international value of the U.S. dollar. The S&P/TSX Canadian Gold Capped Sector Index is a modified capitalization-weighted index, whose equity weights are capped 25 percent and index constituents are derived from a subset stock pool of S&P/TSX Composite Index stocks. The NYSE Arca Gold Miners Index is a modified market capitalization weighted index comprised of publicly traded companies involved primarily in the mining for gold and silver. The S&P/TSX Venture Composite Index is a broad market indicator for the Canadian venture capital market. The index is market capitalization weighted and, at its inception, included 531 companies. A quarterly revision process is used to remove companies that comprise less than 0.05% of the weight of the index, and add companies whose weight, when included, will be greater than 0.05% of the index.

The S&P 500 Energy Index is a capitalization-weighted index that tracks the companies in the energy sector as a subset of the S&P 500. The S&P 500 Materials Index is a capitalization-weighted index that tracks the companies in the material sector as a subset of the S&P 500. The S&P 500 Financials Index is a capitalization-weighted index. The index was developed with a base level of 10 for the 1941-43 base period. The S&P 500 Industrials Index is a Materials Index is a capitalization-weighted index that tracks the companies in the industrial sector as a subset of the S&P 500. The S&P 500 Consumer Discretionary Index is a capitalization-weighted index that tracks the companies in the consumer discretionary sector as a subset of the S&P 500. The S&P 500 Information Technology Index is a capitalization-weighted index that tracks the companies in the information technology sector as a subset of the S&P 500. The S&P 500 Consumer Staples Index is a Materials Index is a capitalization-weighted index that tracks the companies in the consumer staples sector as a subset of the S&P 500. The S&P 500 Utilities Index is a capitalization-weighted index that tracks the companies in the utilities sector as a subset of the S&P 500. The S&P 500 Healthcare Index is a capitalization-weighted index that tracks the companies in the healthcare sector as a subset of the S&P 500. The S&P 500 Telecom Index is a Materials Index is a capitalization-weighted index that tracks the companies in the telecom sector as a subset of the S&P 500.

The Consumer Price Index (CPI) is one of the most widely recognized price measures for tracking the price of a market basket of goods and services purchased by individuals. The weights of components are based on consumer spending patterns. The Purchasing Manager’s Index is an indicator of the economic health of the manufacturing sector. The PMI index is based on five major indicators: new orders, inventory levels, production, supplier deliveries and the employment environment. Gross domestic product (GDP) is the monetary value of all the finished goods and services produced within a country’s borders in a specific time period, though GDP is usually calculated on an annual basis. It includes all private and public consumption, government outlays, investments and exports less imports that occur within a defined territory.

The S&P Global Luxury Index is comprised of 80 of the largest publicly traded companies engaged in the production or distribution of luxury goods or the provision of luxury services that meet specific investibility requirements.