Bitcoin ETFs and the Path to Mainstream Adoption

It’s not a matter of if, but when.

It’s not a matter of if, but when.

I’m talking, of course, about the long-awaited approval of a U.S.-based spot Bitcoin exchange-traded fund (ETF). Analysts at Bloomberg Intelligence now estimate there’s a 90% chance that the Securities and Exchange Commission (SEC) will give the go-ahead to such an investment product by January 10, 2024.

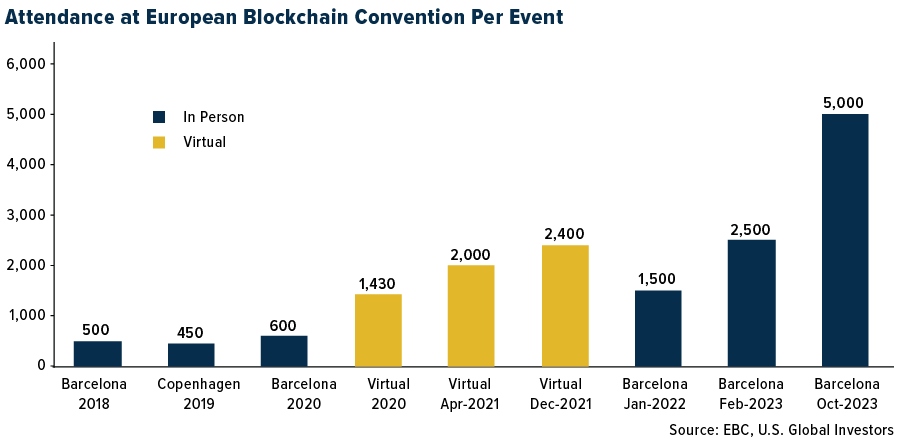

Many presenters at last week’s European Blockchain Convention (EBC) were even more optimistic, saying they believe a Bitcoin ETF will appear on the market by the end of this year.

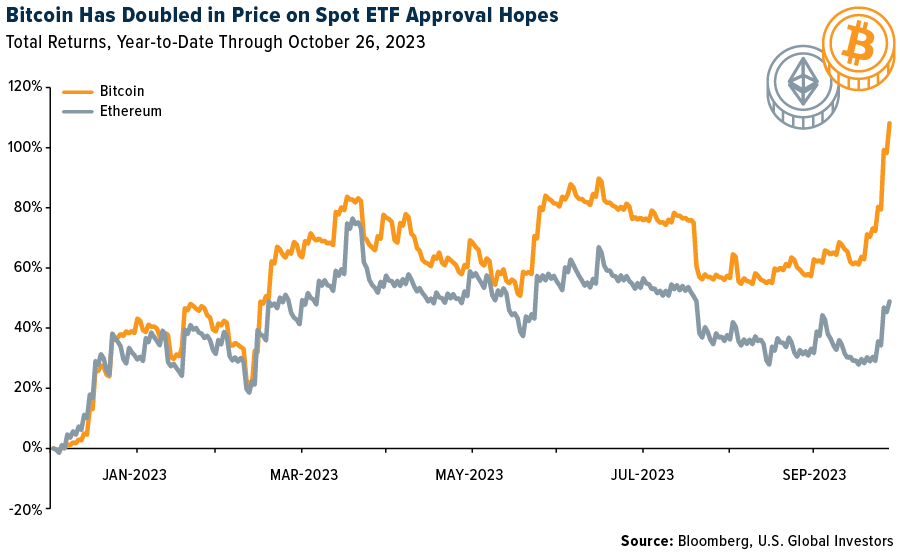

Mr. Market appears to agree. Responding to strong speculation that BlackRock, the world’s largest investment management firm, is preparing to “seed” its iShares Bitcoin ETF this month with an unknown amount of capital in anticipation of its imminent approval, investors bid up the price of the digital asset this week to more than $35,000, a price we haven’t seen in nearly a year and a half. That’s roughly double what Bitcoin started the year at. For comparison’s sake, Ether, the second largest digital token by market cap, is up around 50% year-to-date.

Investors Seeking Direct Access to Bitcoin

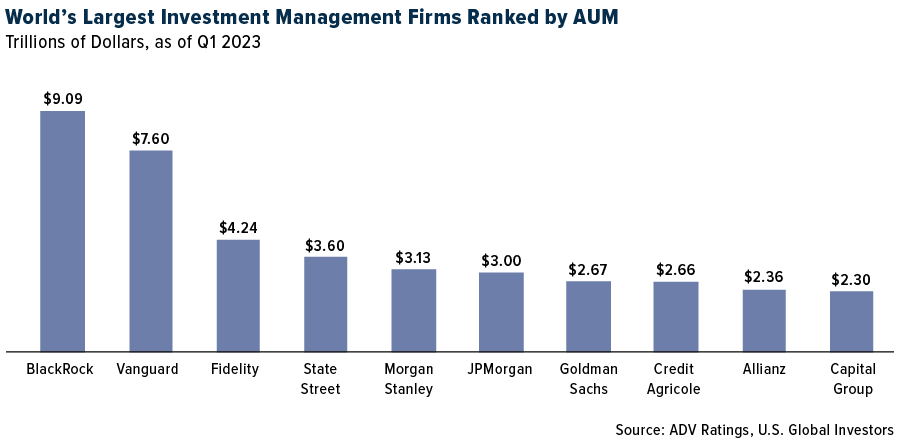

Spot Bitcoin ETFs are already available to certain investors. Canada has had them for years. Europe launched its first one in August. But even when combined, Canada and Europe are dwarfed by the size of the U.S. stock market, which accounts for close to 60% of the total global equity market value. Of the top 10 largest investment management firms, only two—France’s Credit Agricole and Germany’s Allianz—are non-American.

To date, the only way for U.S. investors to get exposure to Bitcoin—besides buying the asset outright—is through futures, options and other derivatives. The largest of these products, the Grayscale Bitcoin Trust (GBTC), has been trading publicly since 2015 and currently has over $21 billion in assets under management (AUM).

But trusts are unwieldy products compared to ETFs, which are traded on exchanges throughout the day and can be highly liquid.

Plus, investors want access to spot Bitcoin prices, just as they have access to spot gold prices with physical gold-backed ETFs.

Grayscale knows all of this, of course, which is why it’s filed to convert GBTC to an ETF. And now, like BlackRock and a number of other firms that have also submitted applications for a Bitcoin ETF—they include Fidelity, Invesco, Franklin Templeton, VanEck and WisdomTree—Grayscale must play the waiting game at a time when many market experts are concerned that the U.S. could be falling behind other jurisdictions when it comes to Bitcoin investment, not to mention regulation.

Some firms are choosing to act now. Cathie Wood’s ARK Invest, which also has a Bitcoin ETF in the pipeline, has begun selling shares of GBTC in anticipation of its successful conversion into an ETF.

Understanding the Impact of a U.S. Spot ETF

So what are the implications?

Assuming for the moment that the SEC is in fact ready to give its blessing to a BlackRock-issued Bitcoin ETF, it’s possible we may never see the token below $30,000 again. In such a scenario, the New York-based investment firm would likely become the world’s largest institutional holder of Bitcoin, creating a potential supply crunch. Remember, Bitcoin production is capped at 21 million, and the “halving”—when the reward for mining Bitcoin is cut in half—is coming up in around six months.

The availability of a Bitcoin ETF would also finally herald the arrival of institutional investors. For many financial advisors, fiduciaries and others, Bitcoin is not an approved wealth management strategy. A spot ETF, on the other hand, would be.

According to estimates made by blockchain and digital asset company Galaxy, a U.S.-based spot Bitcoin ETF would attract $14 billion in investor inflows in the first year alone. This would accelerate to $27 billion in the second year and, at the end of the third year following its launch, nearly $40 billion.

This is only an estimate, and no one can predict the future with absolute certainty. But for speculators, accumulating Bitcoin now—before an ETF hits the U.S. market—may end up being a very profitable decision.

Certainty in an Uncertain World

I’m pleased to report that enthusiasm was very high at the ECB, held in beautiful Barcelona. It was the most well-attended event in the conference’s history, with some 5,000 people in attendance—double the turnout from earlier this year.

Despite it being a blockchain/Web3/DeFi conference, Bitcoin was the $35,000 gorilla in the room. As a number of presenters said, the asset offers certainty in a highly uncertain world. This tracks with my recent comments that Bitcoin represents private property rights and, more broader, human rights.

With a spot ETF looking more and more likely, now could be an unprecedented opportunity to get exposure. Remember, however, to do your own due diligence and keep in mind that volatility is much greater than what you find in traditional investment instruments. For that reason, I recommend a weighting of no more than 2% of your total portfolio.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.