Betting Against America Has Never Been a Winning Strategy

In his 2022 Berkshire Hathaway shareholder letter, Warren Buffett wrote that in his 80 years of investing, he had “yet to see a time when it made sense to make a long-term bet against America.”

Buffett’s words have rarely been more relevant. With just days remaining before the presidential election, history shows that regardless of who’s in power, the U.S. has consistently outperformed its global peers and rewarded those who stayed the course.

That’s why we made the tough yet necessary decision two years ago to close our Emerging Europe fund. Why? Because, compared to the opportunities here at home, Europe just isn’t competitive.

Sluggish growth and regulatory hurdles weigh heavily on the continent’s economic potential. Outside of its massive luxury market, Europe is a cautionary tale, reminding us of the risks of over-regulation and slow-moving policy.

America Remains the Innovation Leader

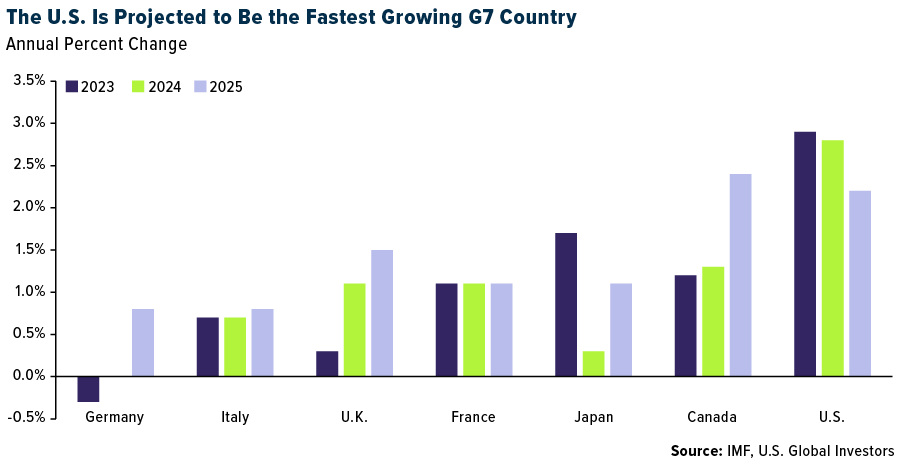

Despite all the predictions of a recession, the U.S. economy is leading the pack. According to the International Monetary Fund (IMF)’s most recent projection, the country is on track for 2.8% growth this year, outpacing every other G7 economy.

Just look at the tech sector: The vast majority of the world’s leading tech companies are based in the U.S., benefitting from robust early- and late-stage financing, an unmatched talent pool and a regulatory environment that—while imperfect—allows businesses to grow and thrive. Over the past few decades, America’s ability to foster true innovation giants—like Apple, Google and Amazon—has only strengthened.

Europe, by contrast, lags behind, shackled by red tape and an over-cautious approach to investing in new technologies. This past summer, in fact, Meta (Facebook) and Apple pulled back from rolling out key products in Europe due to regulatory hurdles. To be clear, Europe has plenty of strong universities and bright minds, but its draconian laws stifle its own growth.

The U.S. Markets: Built to Grow

In the past two decades, the U.S. stock market has been a powerhouse. Just before the 2008 financial crisis, the market cap of the S&P 500 was marginally higher than that of the STOXX Europe 600. Since then, the U.S. market has expanded eightfold while the European market has barely budged.

Companies across the Atlantic are now listing on U.S. exchanges, drawn to our more dynamic financial markets.

When I look at Europe’s economic trajectory, I can see why many people are hesitant to invest there. Again, we closed our Emerging Europe fund because of these same issues. While America innovates, Europe regulates. And as more businesses gravitate toward the NYSE and NASDAQ, the reality is clear: America remains the best place to invest, even in times of political change.

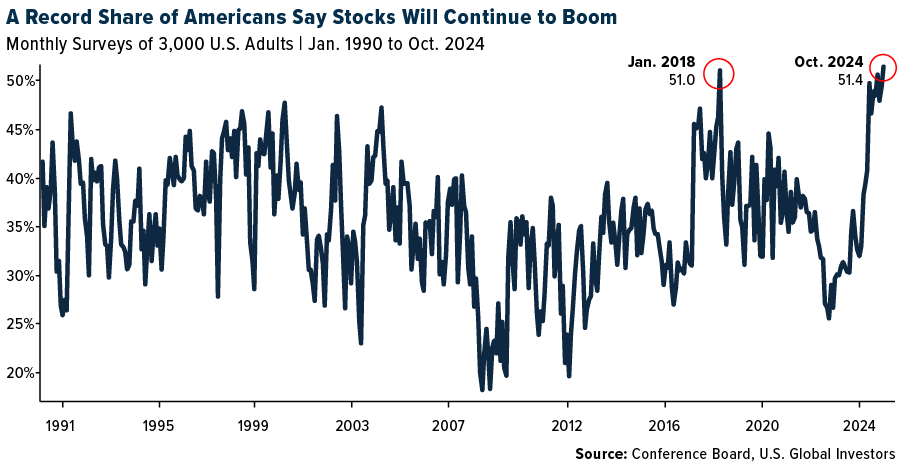

I’m not alone in believing that. According to the Conference Board’s most recent survey of investors, a record 51.4% of respondents said they expected the current stock market rally to continue over the next year.

The Challenges Here Are Real but Manageable

To be fair, the U.S. isn’t without its own set of challenges. National debt has climbed to $35.8 trillion, and consumer credit card debt is at a 20-year high.

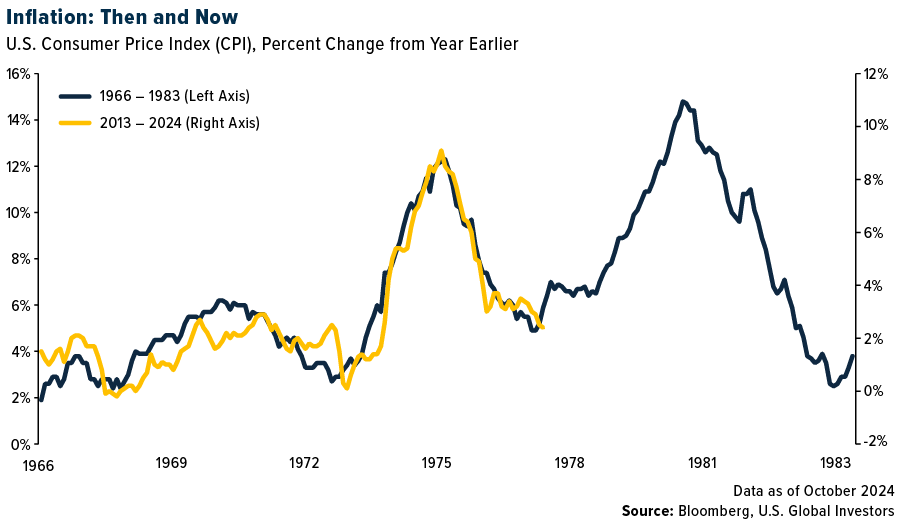

Inflation may be down from its peak, but the risk of a resurgence remains. Many remember the double-digit inflation spikes of the 1970s, fueled by government spending, an oil crisis and a weakening dollar after the collapse of Bretton Woods. Some fear a repeat scenario today as debt continues to climb. But let’s remember that even during the 1970s—one of the most volatile decades for the U.S. economy—investors who stayed the course were ultimately rewarded.

The Case for Staying Invested in America

Many readers may be concerned about the upcoming election and the policy shifts it could bring, but betting against America is not a winning strategy. In boom times as well as bust, the U.S. has outperformed. Our economy is innovative, and our financial systems are built to withstand change.

Political cycles come and go, yet America continues to lead the world in growth and opportunity.

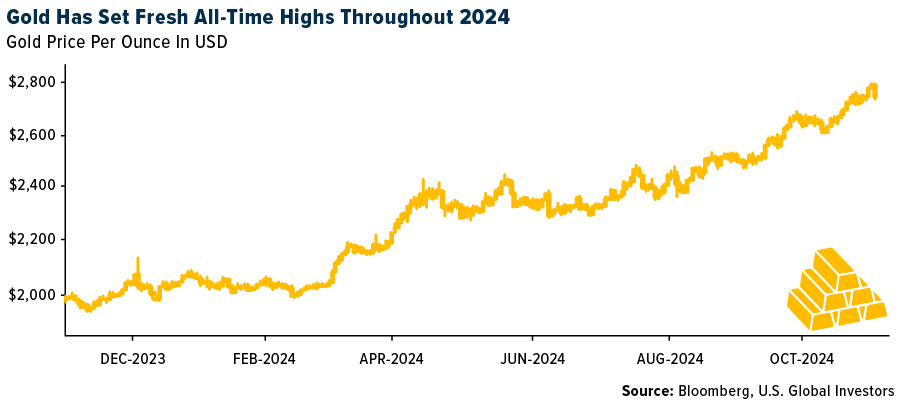

Remember Buffett’s words: Betting on America has historically paid off. And with the right strategies in place—like a healthy allocation to gold—you can continue to build and hold your wealth for generations to come.

Index Summary

- The major market indices finished down this week. The Dow Jones Industrial Average lost 0.15%. The S&P 500 Stock Index fell 1.33%, while the Nasdaq Composite fell 1.50%. The Russell 2000 small capitalization index lost 0.01% this week.

- The Hang Seng Composite lost 7.34% this week; while Taiwan was down 2.43% and the KOSPI fell 1.58%.

- The 10-year Treasury bond yield rose 13 basis points to 4.379%.

Airlines and Shipping

Strengths

- The best performing airline stock for the week was xxxx, up xx.x%. According to TD, Alaska Air reported solid third quarter 2024 results with adjusted earnings per share (EPS) of $2.25, hitting the high end of the guide and beating consensus of $2.22. Revenue beat consensus by 2.2%. Holiday bookings were cited as being strong as well.

- Mitsui O.S.K. Lines announced a share buyback (up to 30 million shares/¥100 billion, 8.28% of shares outstanding, to be repurchased by October 2025), reports JPMorgan. This highlights its undervalued share price versus peers as well as capital efficiency.

- According to BMO, Air Canada’s third quarter 2024 results were ahead of expectations on all key metrics, including RASM and adjusted CASM. 2024 guidance was revised higher. The company announced a buyback program for about 10% of its public float.

Weaknesses

- The worst performing airline stock for the week was xxxx, down xx.x%. IndiGo’s second quarter net loss of Rs-10BN missed consensus, reports Bank of America. Second quarter passenger unit revenues were slightly ahead, but second quarter ex-fuel unit costs were worse than expected on higher grounding mitigation costs and airport fee inflation.

- According to Bank of America, Asia to Europe volumes are solid despite the Golden Week holidays indicating a strong peak season. However, China-USA volumes remain low (-18% year-over-year) due to tighter customs rules and checks since July due to the De Minimis change Executive Order.

- U.S. airlines are now required to give passengers an automatic refund for canceled or significantly delayed flights and for services that were paid for but not provided, such as Wi-Fi or entertainment, reports The Hill. “Passengers deserve to get their money back when an airline owes them—without headaches or haggling. Today, our automatic refund rule goes into full effect. Airlines are required to provide prompt cash refunds without passengers having to ask,” Transportation Secretary Pete Buttigieg wrote Monday.

Opportunities

- China has agreed to allow more flights between Canada and China. Today, Air Canada operates just four weekly flights between Vancouver and Shanghai and Chinese airlines only operate a handful of weekly flights. According to the report, AC will ramp up Vancouver-Shanghai flights to seven per week and will add daily Vancouver to Beijing.

- In the last Trump term, the U.S. reduced the federal corporate tax rate from 39% to 21% and announced tariffs on goods from China in May 2018, which took effect in September. Between May and September of his term, U.S. West and East Cost Ocean freight rates rose 18% year-over-year on average, while imports into the Ports of LA / LB decreased 2%, according to Bank of America. Should President Trump be elected, this could happen again.

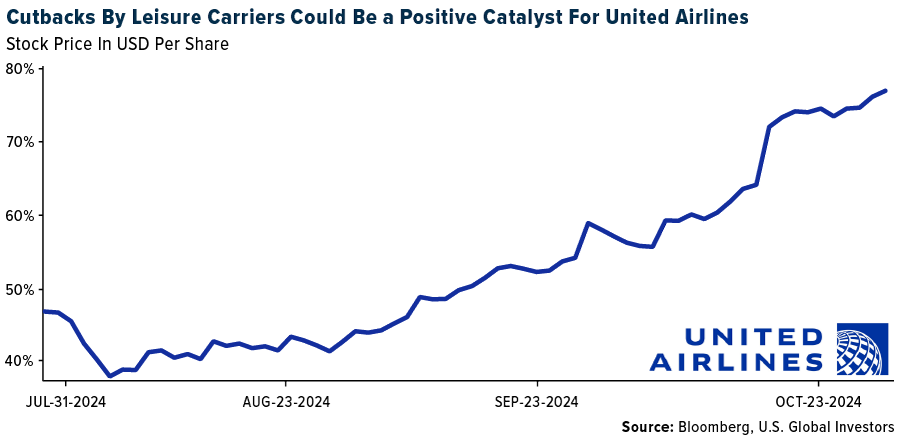

- Spirit cut its first quarter 2025 schedule by 19%, reports TD. Frontier also pulled out 3.6% ASMs from its March quarter schedule. Both airlines will fly with significantly less capacity in Orlando this quarter and next than they did in the year prior. Southwest, the carrier with the largest share of capacity in Orlando, will keep capacity flat yar-over-year in the March quarter. This should create a nice opportunity for an airline like United that has a smaller presence in the Southeast but had a lot of success in Florida in the first quarter of 2024.

Threats

- The U.S. Department of Transportation has launched a public inquiry into the state of competition in the air travel industry, alongside the DOJ, with the comment period to close on December 23.

- According to Bank of America, given longer sailing times to Europe, the bank expects some pull-forward of demand. However, this may be insufficient for liners to successfully maintain higher rates due to continued fleet expansion (1.6% increase by year-end) and no signs of capacity rationalization.

- Spirit Airlines lowered Jan/Feb/Mar system capacity by -19.5%/-21.6%/-16.9% after last week’s announcement of the sale of 23 aircraft, reports Bank of America. This continues the trend of double-digit capacity contraction into 2025 as the fleet reduction compounds engine availability issues with SAVE’s GTF-powered aircraft.

Luxury Goods and International Markets

Strength

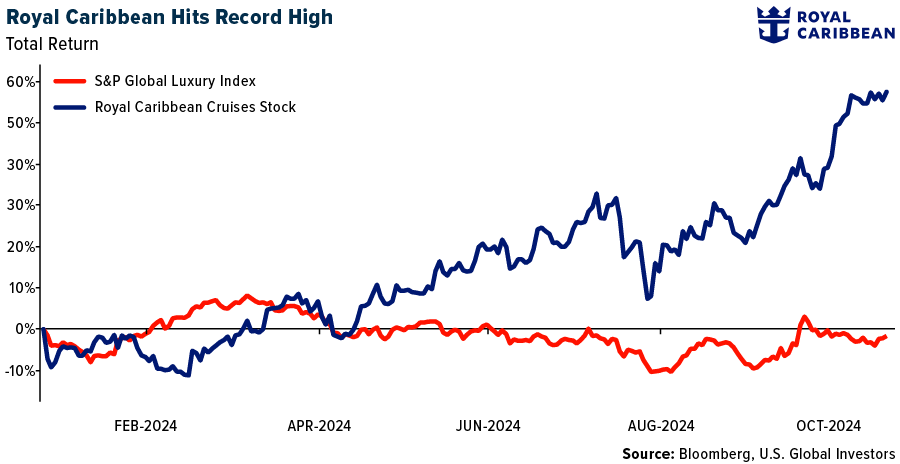

- Royal Caribbean reported strong quarterly results, and the company raised its earnings forecast for a fourth time this year. The company expects the demand for cruises to remain strong. Royal Caribbean is the best performing stock among the members of the S&P Global Luxury Index, gaining more than 60% year-to-date.

- The United States consumer confidence recorded its largest monthly gain in over three and a half years in October. The Conference Board’s consumer confidence index jumped sharply to 108.7 in October, up from a revised 99.2 last month.

- Norwegian Crusie Line Holdings was the top-performing stock in the S&P Global Luxury sector, gaining 7.4% in the past five days. Shares gained after the company reported earnings beat.

Weaknesses

- Moncler faced a setback as shares declined following the company’s third-quarter revenue miss. The Italian maker of high-end puffer jackets is struggling with weaker demand, which is a concern for its overall growth. While the growth in China remained positive during the quarter, it slowed, highlighting potential challenges in maintaining momentum in a key market.

- Estée Lauder shares dropped over 20% on Thursday after the company withdrew its fiscal year guidance, citing uncertainty surrounding a new CEO and weak demand in China, according to Bloomberg. L’Oréal shares also fell following the negative news from its competitor.

- Cettire, an online marketplace for apparel, was the worst-performing stock in the S&P Global Luxury Index, falling 30.8%. The decline followed the release of weak financial results. The company was projected to generate $413.2 million in revenue for the first half of the fiscal year but reported only $155 million in revenue for the three months ending in September.

Opportunities

- In October, China’s manufacturing sector showed signs of recovery, with the official China Purchasing Managers’ Index (PMI) rising to 50.1 from September’s 49.8, surpassing expectations of 49.9. A PMI above 50 indicates expansion, marking the first growth in six months. Similarly, the Caixin PMI increased to 50.3 from 49.3 in September, also indicating expansion. Stronger results may suggest that recent fiscal stimulus measures by Beijing are beginning to positively impact the economy.

- Healthy consumer spending in the United States may continue to help offset weakness in the Chinese market. In the third quarter of 2024, optimism in the U.S. economy grew to its highest level in a year, boosting willingness to spend. According to ConsumerWise report, once again high-income consumers were more optimistic about the economy in the third quarter than middle- and low-income consumers.

- Prada shares surged 8% on Thursday following the company’s stronger-than-expected quarterly results. Group revenue increased by 18%, driven by the impressive performance of its Miu Miu brand, which saw net sales jump 91% year-over-year. In Japan, retail sales grew by 40%, while the American market showed more modest growth at 7.5%.

Threats

- The U.S. presidential election will take place on November 5, but the winner of the very close race between Democrat Kamala Harris and Republican Donald Trump may not be known for days after the polls close. As ballots are counted, one candidate may appear to be leading based on early returns, only for a rival to close the gap as more votes are tallied, Routers explained.

- The European Union announced it will impose duties on electric vehicle (EV) imports from China. Chinese manufacturers will face tariffs of 17% on BYD vehicles, 18.8% on Geely cars, and 35.3% on vehicles exported by state-owned SAIC. Other EV manufacturers operating in China, including Western companies like Volkswagen and BMW, will be subject to a 20.7% duty. Tesla will face a lower, individually calculated rate of 7.8%. China has strongly opposed the EU’s decision and indicated it may implement retaliatory measures in response.

- Mercedes and Porsche are implementing cost reductions in response to significant sales decline in China. Porche’s car deliveries in China have hit a decade low. Mercedes reported its lowest automaking margins in nearly three years after selling fewer expensive models. Volkswagen reported earning miss this week.

Energy and Natural Resources

Strengths

- The best performing commodity for the week was crude palm oil, rising 7.32%. Demand for palm oil has been strong, coupled with supply woes in part due to aging trees in Indonesia and Malaysia which collectively account for more than 80% of global production. This has pushed palm oil up more than 30% so far this year, as reported by Bloomberg.

- Shares of Waaree Energies Ltd. jumped almost 56% in its trading debut after a $514 million initial public offering by India’s largest solar-panel maker, bringing back optimism for the market after the nation’s biggest IPO disappointed investors last week, Bloomberg reports.

- According to RBC, total U.S. scrap steel export volumes in August rose 19% year-over-year. The August print is the strongest for total U.S. exports in calendar year 2024, up 30% month-over-month. Total exports have had positive momentum, with the three-month rolling average up21% year-over-year vs. CYTD up 5%.

Weaknesses

- The worst performing commodity for the week was natural gas, dropping 13.81%, with weekly stockpile injections taking stockpiles above the five-year average. Warmer weather is also in the forecast, which will dampen demand. Oil tumbled more than 6% at the start of the week after Israeli strikes against targets in Iran avoided the OPEC member’s crude facilities, writes Bloomberg, raising the prospect for easing hostilities in the region. Brent fell below $72 a barrel and West Texas Intermediate was near $68.

- Spot steel index prices declined a bit over the past two weeks, with prices down 2.1% to $710 per ton. The recent decline has primarily been attributed to ongoing spot market weakness in part driven by current uncertainty surrounding economic policy in the U.S.

- Per Benchmark, Lithium prices fell this week, now in the $9,500-$11,000 range as prices fell in a lagged response to lower pricing in China, and Hydroxide fell back below the $10,000 mark. Mineral Resources announced this week that it will cut 570 jobs and slow construction at the Mt. Marion lithium project. Management at Mineral Resources is also facing an investor revolt over its deteriorating balance sheet and allegations that management was involved in a tax evasion scheme that is now under investigation.

Opportunities

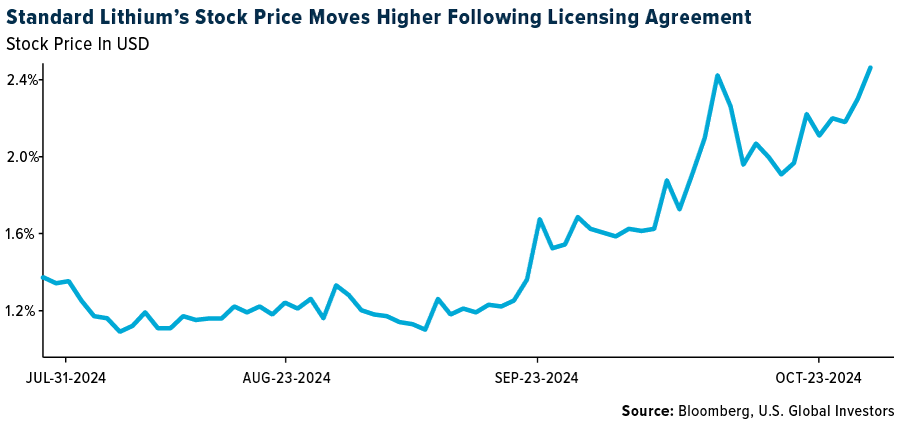

- Koch, Inc. signed a deal with a U.S. lithium venture to provide technology that includes an industry-first guarantee of recovering at least 95% of the metal from salty water using its new extraction methods. The company’s Koch Technology Solutions unit agreed to license its so-called direct lithium extraction process to a joint venture of Standard Lithium Ltd. and Equinor ASA for use in a planned commercial plant in southwest Arkansas, the firms said Monday in a statement.

- Fortescue Ltd. said the iron ore market may have misjudged fundamentals for the key steelmaking ingredient due to the hurdles involved in ramping up overall supplies, as output from existing mines wanes. “There are some supply challenges,” Fortescue’s metals chief Dino Otranto said in an interview at the International Mining and Resources Conference in Sydney on Tuesday. “People are under-appreciating that mines do run out and these huge iron ore deposits that we saw 50, 60 years ago just don’t exist anymore.”

- TerraPower LLC, the nuclear energy company backed by billionaire Bill Gates, agreed to invest in construction of a uranium enrichment facility in South Africa to support its own U.S. reactor project. The company also agreed to buy enriched uranium from the facility being built by ASP Isotopes Inc. to help fuel its future reactor in Wyoming.

Threats

- China’s copper demand will peak around the end of this decade, according to a state-backed government researcher, offering a potential counterpoint to bullish views on the metal’s prospects. China’s demand growth in the five years up to 2030 will average 1.1%, reports Bloomberg, down from 3.9% in the five years to 2025. The copper intensity of renewables investment is falling as industries bid to reduce usage or find alternative materials.

- China’s largest oil and gas companies continue to heed Beijing’s call for more supply. Now, they need the government to ensure there’s sufficient demand for their products. The authorities are belatedly getting to grips with a post- pandemic slowdown that has hobbled profits across Chinese industry. Oil and gas businesses, particularly the operations that refine crude into fuels and make chemicals for items like plastics, are among the worst casualties, according to Bloomberg.

- BP Plc raised the possibility that its share buybacks could slow next year from the $1.75 billion quarterly pace seen in 2024, as weaker oil prices push its debt higher. The British oil major’s net debt increased in the third quarter by $1.7 billion to $24.27 billion, reports Bloomberg, the highest since the start of 2022. While that helped the company maintain its buyback for now, BP suggested the level could change in February, when it will review its strategy and financial guidance

Bitcoin and Digital Assets

Strengths

- Of the cryptocurrencies tracked by CoinMarketCap, the best performer for the week was Dogecoin, rising 18.45%.

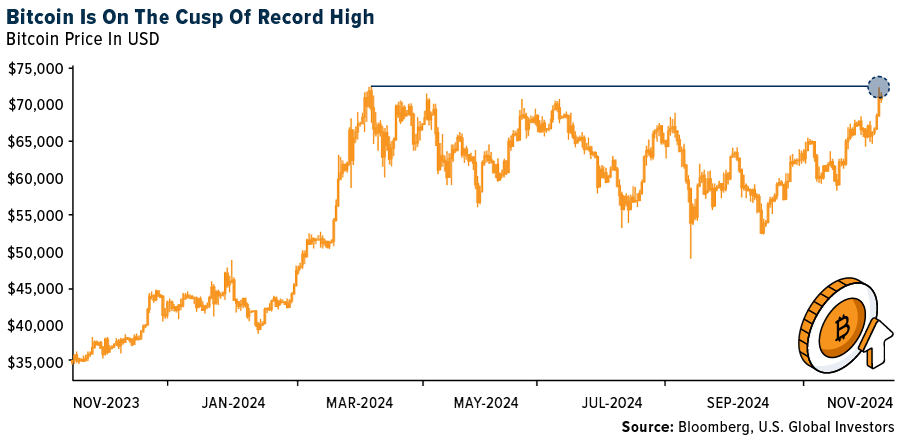

- U.S. exchange-traded funds (ETFs) investing in Bitcoin saw an $870 million net inflow, their third-highest daily haul, as the digital asset flirts with a record high amid speculation about potential outcomes of the U.S. election. Some analysts cite Republican nominee Donald Trump’s elevated odds in election betting markets for the growing demand for Bitcoin exposure, writes Bloomberg.

- MicroStrategy Inc. has hired banks to help it raise $42 billion through the sale of new shares and fixed income to buy more Bitcoin after a flurry of deals over the past year. The company hired a handful of banks to sell stock through a so-called at the market offering that could net it $21 billion, reports Bloomberg, while lining up potential sales of fixed-income securities that could bring in the same amount.

Weaknesses

- Of the cryptocurrencies tracked by CoinMarketCap, the worst performer for the week was IMX, down 20.07%.

- Shares of Coinbase Global fell the most in more than two years after the largest U.S. crypto exchange posted results late Wednesday that were below Wall Street expectations. Total revenue increased to $1.21 billion, writes Bloomberg, less than analysts’ forecast of $1.25 billion.

- The U.S.-based cryptocurrency exchange Kraken is laying off workers as part of organizational changes following the appointment of a new co-chief executive. Kraken wants to become leaner and faster while streamlining operations.

Opportunities

- Visa customers with eligible debit cards will be able to deposit funds into their Coinbase Global accounts via a partnership announced by the payments giant and crypto exchange. Coinbase already has millions of connections to customers’ debit cards, but this new development allows for the real-time flow of funds for customers, writes Bloomberg.

- The crypto prime brokerage market is booming, and new firms are popping up to get a share of the growth. Growing institutional interest from hedge funds, family offices, and sovereign wealth funds is pushing the valuation of crypto prime brokerages higher, and the bull market is helping the cause, writes Bloomberg.

- Superscrypt, a blockchain venture capital company backed by Temasek Holdings, plans to raise up to $100 million for its second investment fund, according to people familiar with the matter. Singapore’s state-owned investment company Temasek has been lined up as an anchor investor in the new fund alongside the New York-based fintech firm Republic, writes Bloomberg.

Threats

- Consensys, a software provider for the Ethereum network being sued by the SEC, blamed regulatory uncertainty caused by the agency in part for its decision to eliminate 162 positions or 20% of its workforce, Bloomberg reports. Consensys operates the popular crypto wallet MetaMask as well as provides a slew of blockchain tools and products.

- A cryptocurrency investment scam using the same acronym as the New York Stock Exchange defrauded victims after luring them in with online dating apps. Trading platform NYSE.LPQV.Live solicits inexperienced investors through apps like Tinder, and then directs them to open legitimate cryptocurrency accounts to fund the investments in NYSE, according to Bloomberg.

- Citadel securities lawsuit accusing Portofino Technologies AG of trade-secrets thefts can largely move forward against the high-frequency crypto trading startup but not a seed investor in the firm. Citadel securities claimed two former London-based employees secured funding from investors to launch Portofino in Switzerland with trade secrets stolen from the market-making firm, writes Bloomberg.

Defense and Cybersecurity

Strengths

- Huntington Ingalls Industries (HII) has secured a $3 billion contract with the U.S. Department of Defense to support the LOGIX initiative. This is part of the DoD’s Joint All-Domain Command and Control strategy aimed at enhancing national security through advanced technological solutions.

- The United States has approved a $2 billion arms sale to Taiwan, including advanced air defense missile systems that have been battle tested in Ukraine. The goal is to enhance Taiwan’s defense against growing Chinese military pressure. Despite China’s objections, the U.S. is committed by law to support Taiwan’s defense, aiming to maintain regional stability and security.

- The best performing stock in the XAR ETF this week was Leonardo DRS Inc., rising 8.74%, after being awarded a $235 million contract by the U.S. Navy to produce AN/SPQ-9B ship protection radars. This will enhance air and surface target detection capabilities.

Weaknesses

- The Columbia-class nuclear submarines, set to replace the aging Ohio-class and crucial for U.S. naval deterrence, face significant delays and contractor setbacks, escalating lifecycle costs to $348 billion and risking extended service for older submarines. This has prompted concerns from lawmakers and military leaders about reliability and strategic capability.

- Oshkosh has lowered its fiscal year 2024 adjusted earnings per share (EPS) forecast to $11.35 from $11.75, citing a softening access equipment market in North America. Expected net sales have been reduced to $10.6 billion from $10.7 billion.

- The worst performing stock in the XAR ETF this week was Huntington Ingalls, falling 25.45%, after the company cut its cash-flow forecast and faced delays in securing a Navy submarine contract, alongside supply chain issues and workforce challenges.

Opportunities

- Poland is set to begin negotiations for purchasing over 100 HIMARS rocket launchers from Lockheed Martin as part of a broader arms deal. This comes amidst ongoing debates over military procurement policies and a strong defense budget commitment, while also planning for domestic production and concurrent contracts with South Korea for similar systems.

- Broadcom shares rose 4% after a report that OpenAI is collaborating with the company and Taiwan Semiconductor Manufacturing to develop a new AI chip to meet its growing computing needs.

- The LITENING targeting pod, equipped with advanced electro-optical and infrared sensors, has proven itself a game-changing tool for the U.S. Navy’s F/A-18 E/F Super Hornet. It enhances situational awareness and mission effectiveness during combat by enabling precise target identification and rapid response, as demonstrated during initial flight tests and real-world operations.

Threats

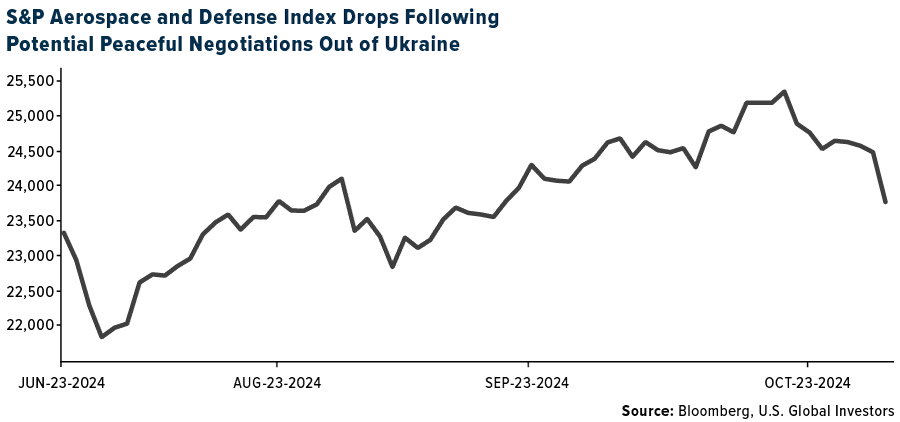

- European defense stocks have declined, with companies like Rheinmetall and Saab seeing drops after Ukraine indicated that it might consider incorporating peace initiatives from countries such as China, Brazil and South Africa into its own peace proposal.

- Iranian officials vowed to retaliate against recent Israeli attacks, escalating tensions that risk further conflict in the region.

- Kremlin spokesman Dmitry Peskov confirmed that a new Rheinmetall military factory in Ukraine, opened in late October, could become a legitimate target for Russian attacks. Rheinmetall continues its plans to establish multiple defense plants in Ukraine despite previous threats from Moscow.

Gold Market

This week gold futures closed at $2,754.60, down $10.50 per ounce, or 0.38%. Gold stocks, as measured by the NYSE Arca Gold Miners Index, ended the week lower by 4.12%. The S&P/TSX Venture Index came in off 2.57%. The U.S. Trade-Weighted Dollar rose 0.05%.

Strengths

- The best performing precious metal for the week was gold, but still down 0.38%. According to Bloomberg, bullion retains a clear upward bias. With wider markets bracing for the potential prospect of Trump 2.0, a poll showed most investors reckoned such an outcome would be bullion positive. A second Trump presidency could bring greater policy disruption, trade tariffs and enhanced geopolitical risks. The Federal Reserve, meanwhile, will likely deliver another rate cut next week, which also aids gold’s cause.

- Global gold demand swelled about 5% in the third quarter, setting a record for the period and lifting consumption above $100 billion for the first time, according to the World Gold Council. The increase — which saw volumes climb to 1,313 tons — was underpinned by stronger investment flows from the West, including more high-net-worth individuals, that helped offset waning appetite from Asia, the industry-funded group said in a report on Wednesday.

- Agnico Eagle Mines reported adjusted earnings per share for the third quarter that beat the average analyst estimate, according to Bloomberg. Adjusted EPS was $1.14 versus $1.01 consensus. Revenue from mining operations $2.16 billion (estimate $2.11 billion).

Weaknesses

- The worst performing precious metal for the week was palladium, down 7.87% following last week’s surge on western proposal to stop buying certain Russian sourced metals. Gold demand in China — the world’s biggest consumer — plunged by more than a fifth in the third quarter as record prices and a sluggish economy dented consumption, especially for jewelry. Total demand fell by 22% to 218 tons in the three months to September, according to Bloomberg calculations based on data from the China Gold Council on Monday.

- Gold retreated as some investors booked profit after the metal’s rally to a fresh record. Bullion fell by as much as 2% after earlier reaching a fresh record of $2,790.10. The drop followed the release of strong economic data, which boosts the chance of a cautious approach to interest-rate cuts in the months ahead. Lower borrowing costs tend to benefit the precious metal, as it does not pay interest, according to Bloomberg.

- Eldorado Gold Corp. reported on Friday that its share price dropped as much as 6% after the company adjusted its production guidance for the year. The revised guidance places production at the lower end of previous estimates, while cash costs are expected to be at the higher end.

Opportunities

- According to Canaccord, gold valuations remain attractive with the senior producers trading at 0.69x NAV, up from a recent low of 0.57x but below the historical average of 0.81x and at the lower end of the 0.65-1.0x range.

- According to RBC, junior gold valuations have started to move higher along with metal prices, but remain depressed versus historical levels and prior peaks. They continue to see significant value in the group at spot metal prices and strong potential for re-rating versus producers on increased appetite for new projects with better economics at higher prices. Costs have capped upside as well as a weak M&A market.

- According to Bank of America, silver net non-commercial long positions on the CME have risen but are still below all-time highs. Investor interest has also been inconsistent across other segments, with a gap emerging between silver prices and risk reversals. Inflows into physically backed ETFs remain relatively low. However, with strong demand for silver from the EV sector and the potential for accelerated industrial production in the coming quarters, there is room for silver prices to rally further.

Threats

- According to RBC, Gold Road Resources’ Q3 gold production fell 9% below estimates, while all-in sustaining costs (AISC) rose by 17%, increasing the risk of meeting the revised guidance for calendar year 2024. The guidance remains unchanged at 290-305K ounces, but a strong Q4 performance will be essential to achieve this target.

- According to RBC, Ramelius Resources had a weak Q1, with gold production down 15%, all-in sustaining costs (AISC) up 11%, and tax-adjusted cash flow down by A$32 million—all below estimates. The production shortfall was primarily driven by the Mt Magnet site, raising concerns that these issues may persist throughout the year.

- After Newmont reported disappointing earnings on October 23, its stock price has fallen lower in price each day for the past eight days, posting its longest losing streak in five years. Generalist investors who may have played Newmont as their liquid gold stock exposure were negatively rewarded for stepping back into gold.

U.S. Global Investors, Inc. is an investment adviser registered with the Securities and Exchange Commission (“SEC”). This does not mean that we are sponsored, recommended, or approved by the SEC, or that our abilities or qualifications in any respect have been passed upon by the SEC or any officer of the SEC.

This commentary should not be considered a solicitation or offering of any investment product. Certain materials in this commentary may contain dated information. The information provided was current at the time of publication. Some links above may be directed to third-party websites. U.S. Global Investors does not endorse all information supplied by these websites and is not responsible for their content. All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. The following securities mentioned in the article were held by one or more accounts managed by U.S. Global Investors as of (09/30/2024):

Alaska Air

Mitsui OSK Lines

Air Canada

Frontier Group Holdings

Spirit Airlines

Royal Caribbean Cruises Ltd.

Moncler SpA

The Estee Lauder Cos. Inc.

L’Oreal SA

Prada SpA

Bayerische Motoren Werke AG

Tesla Inc.

Mercedes-Benz Group AG

Porsche Automobil Holding SE

Volkswagen AG

Agnico Eagle Mines Ltd.

Eldorado Gold Corp.

Ramelius Resources Ltd.

Newmont Corp.

BP Plc

*The above-mentioned indices are not total returns. These returns reflect simple appreciation only and do not reflect dividend reinvestment.

The Dow Jones Industrial Average is a price-weighted average of 30 blue chip stocks that are generally leaders in their industry. The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies. The Nasdaq Composite Index is a capitalization-weighted index of all Nasdaq National Market and SmallCap stocks. The Russell 2000 Index® is a U.S. equity index measuring the performance of the 2,000 smallest companies in the Russell 3000®, a widely recognized small-cap index.

The Hang Seng Composite Index is a market capitalization-weighted index that comprises the top 200 companies listed on Stock Exchange of Hong Kong, based on average market cap for the 12 months. The Taiwan Stock Exchange Index is a capitalization-weighted index of all listed common shares traded on the Taiwan Stock Exchange. The Korea Stock Price Index is a capitalization-weighted index of all common shares and preferred shares on the Korean Stock Exchanges.

The Philadelphia Stock Exchange Gold and Silver Index (XAU) is a capitalization-weighted index that includes the leading companies involved in the mining of gold and silver. The U.S. Trade Weighted Dollar Index provides a general indication of the international value of the U.S. dollar. The S&P/TSX Canadian Gold Capped Sector Index is a modified capitalization-weighted index, whose equity weights are capped 25 percent and index constituents are derived from a subset stock pool of S&P/TSX Composite Index stocks. The NYSE Arca Gold Miners Index is a modified market capitalization weighted index comprised of publicly traded companies involved primarily in the mining for gold and silver. The S&P/TSX Venture Composite Index is a broad market indicator for the Canadian venture capital market. The index is market capitalization weighted and, at its inception, included 531 companies. A quarterly revision process is used to remove companies that comprise less than 0.05% of the weight of the index, and add companies whose weight, when included, will be greater than 0.05% of the index.

The S&P 500 Energy Index is a capitalization-weighted index that tracks the companies in the energy sector as a subset of the S&P 500. The S&P 500 Materials Index is a capitalization-weighted index that tracks the companies in the material sector as a subset of the S&P 500. The S&P 500 Financials Index is a capitalization-weighted index. The index was developed with a base level of 10 for the 1941-43 base period. The S&P 500 Industrials Index is a Materials Index is a capitalization-weighted index that tracks the companies in the industrial sector as a subset of the S&P 500. The S&P 500 Consumer Discretionary Index is a capitalization-weighted index that tracks the companies in the consumer discretionary sector as a subset of the S&P 500. The S&P 500 Information Technology Index is a capitalization-weighted index that tracks the companies in the information technology sector as a subset of the S&P 500. The S&P 500 Consumer Staples Index is a Materials Index is a capitalization-weighted index that tracks the companies in the consumer staples sector as a subset of the S&P 500. The S&P 500 Utilities Index is a capitalization-weighted index that tracks the companies in the utilities sector as a subset of the S&P 500. The S&P 500 Healthcare Index is a capitalization-weighted index that tracks the companies in the healthcare sector as a subset of the S&P 500. The S&P 500 Telecom Index is a Materials Index is a capitalization-weighted index that tracks the companies in the telecom sector as a subset of the S&P 500.

The Consumer Price Index (CPI) is one of the most widely recognized price measures for tracking the price of a market basket of goods and services purchased by individuals. The weights of components are based on consumer spending patterns. The Purchasing Manager’s Index is an indicator of the economic health of the manufacturing sector. The PMI index is based on five major indicators: new orders, inventory levels, production, supplier deliveries and the employment environment. Gross domestic product (GDP) is the monetary value of all the finished goods and services produced within a country’s borders in a specific time period, though GDP is usually calculated on an annual basis. It includes all private and public consumption, government outlays, investments and exports less imports that occur within a defined territory.

The S&P Global Luxury Index is comprised of 80 of the largest publicly traded companies engaged in the production or distribution of luxury goods or the provision of luxury services that meet specific investibility requirements.