Argentina President Milei’s Bold Economic Reforms Should Be a Model to the Rest of the World

As an advocate of sound fiscal policy and a strong believer in the power of free markets, I find Argentina’s recent economic overhaul under President Javier Milei not just refreshing but essential in today’s world of bloated government spending.

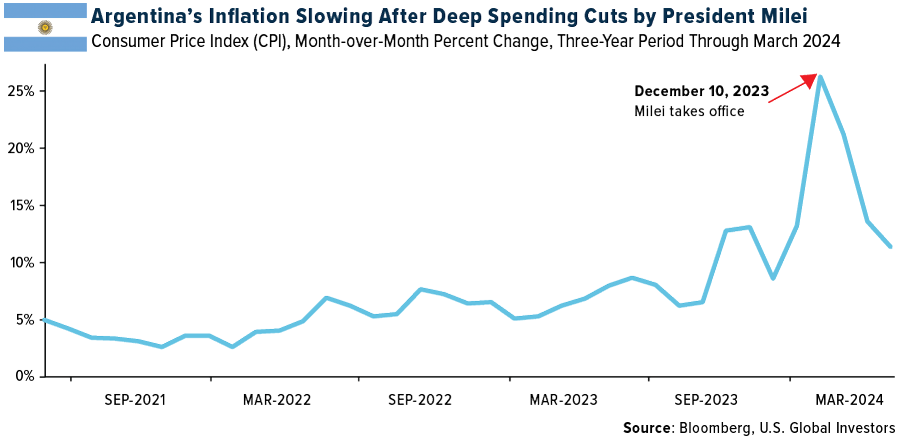

Since taking office in December 2023, the libertarian leader has had to make some hard choices to stabilize Argentina’s economy, which has long been beleaguered by high inflation and overspending. His “shock therapy” approach, deeply rooted in free market principles and fiscal restraint, could serve as a blueprint for other nations grappling with similar economic ailments, including the U.S.

Milei’s strategy hinges on two critical pillars: fiscal reform and monetary stabilization. By addressing the country’s chronic overspending, his administration achieved a noteworthy milestone—a budget surplus in the first quarter, the first since 2008.

Tackling Inflation

On the monetary front, Milei’s government is working tirelessly to restore the balance sheet of Argentina’s central bank. This includes reducing the large peso-denominated liabilities and increasing foreign assets.

In a bold move, Milei halved the number of ministries and eliminated 70,000 public sector jobs. He also suspended new public works contracts and removed various subsidies, further underscoring his commitment to reducing state intervention in the economy.

The early results of these efforts are promising. Argentina has seen a significant drop in the monthly inflation rate, from a staggering 25% in December to 11% in March. Such outcomes not only bolster confidence among citizens and investors alike but also demonstrate the efficacy of disciplined economic policies.

Argentina Tightens While U.S. Continues to Spend Freely

While Argentina shows signs of fiscal tightening, the U.S. paints a contrasting picture with its out-of-control spending. The national debt continues to balloon, with liabilities now representing over 120% of the country’s gross domestic product (GDP). The government now pays over $1 trillion a year just to service the interest on that debt. This bloated bureaucratic machine not only stifles economic freedom but also poses a significant risk to the financial security of future generations.

The consequences of such fiscal irresponsibility are becoming increasingly apparent. The U.S. dollar, while currently strong, faces long-term risks if the nation’s debt trajectory continues unchecked. The average American family is increasingly pessimistic about achieving financial security, with only 35% of Americans believing their finances will improve in the coming year, according to a recent Acorns survey.

Bullish Bets and Cautious Analysis

High-profile endorsements have rolled in five months since Milei took office. Following a meeting with the Argentine president in Los Angeles, Tesla CEO Elon Musk tweeted to his 182 million followers that he recommends investing in Argentina. Similarly, billionaire investor Stanley Druckenmiller, after listening to Milei’s speech at Davos, described the president as the world’s sole free market leader today and disclosed investments in five Argentine companies.

At the same time, caution has been advised by researchers at Alpine Macro, who contend that the recent surge in Argentine stocks and dollar-denominated bonds might be excessive. The S&P MERVAL Index, which measures Buenos Aires-listed stocks, has rallied 40% year-to-date, which is a “one-sigma overshoot above its long-term trend, a level that is hardly sustainable,” Alpine Macro emerging markets strategist Yan Wang writes in an investment brief this week.

Gold’s Timeless Appeal

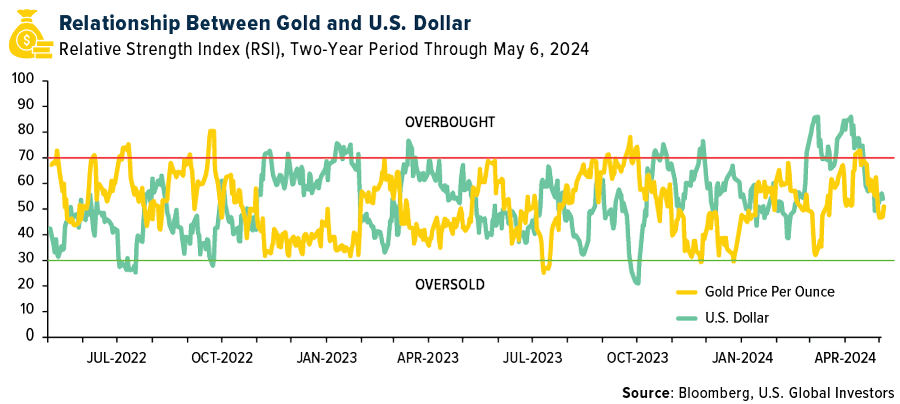

Against this backdrop, gold retains its age-old allure as a safe haven. Historically, gold has served as a reliable store of value and a hedge against currency devaluation and inflation. As the U.S. dollar appreciates due to high interest rates, gold becomes more expensive for investors using other currencies, which can dampen demand and affect prices. Yet, the intrinsic value of gold remains undisputed, particularly as a diversifier.

Historically, gold and the U.S. dollar shared an inverse relationship, though this relationship has weakened in recent weeks, as you can see in the chart below. The 14-day relative strength index (RSI) shows that both assets have reverted to the mean in a rare alignment of price action.

As I shared with you back in January, gold appears to have a new driver besides the U.S. dollar and rates. Namely, emerging economies’ push to diversify away from the U.S. dollar by increasing their gold holdings is now the most important driver of the metal going forward.

As Bloomberg’s Mike McGlone recently put it, “A top reason [gold] has remained resilient is the deepest pockets on the planet—central banks—are accumulating at a breakneck pace.”

Watch our latest video on gold’s Fear Trade by clicking here!

Index Summary

- The major market indices finished up this week. The Dow Jones Industrial Average gained 2.16%. The S&P 500 Stock Index rose 1.85%, while the Nasdaq Composite climbed 1.14%. The Russell 2000 small capitalization index gained 1.18% this week.

- The Hang Seng Composite gained 2.03% this week; while Taiwan was up 1.86% and the KOSPI rose 1.91%.

- The 10-year Treasury bond yield fell 1 basis point to 4.49%.

Airlines and Shipping

Strengths

- The best performing airline stock for the week was Air Transport Services Group, up 13.5%. Qantas announced that it has reached an agreement with the Australian Competition and Consumer Commission to resolve court proceedings in relation to its flight cancellation process. Qantas has agreed to a $100 million civil penalty; $20 million in remediation expenses; and will contribute to ACCC costs. RBC sees this outcome as incrementally positive.

- JPMorgan’s channel checks suggest major container liners are pushing for another round of General Rate Increase (GRI). The bank notes the prior rounds of GRI, effective May 1, have successfully gone through, which led to a 10% rally in the Shanghai Container Freight Index for the week. It is also worth noting another major freight rate index, the Drewry WCI, inflected last week after the prior 13 consecutive weeks of decline.

- Apparently, more Chinese opted to fly out of the Asian nation, with Japan/Thailand standing out as the two most popular destinations, followed by Hong Kong/South Korea/ Malaysia. Overall, the number of Chinese traveling abroad surged over 120% year-over-year during the May holidays, according to JPMorgan.

Weaknesses

- The worst performing airline stock for the week was Tripadvisor, down 29.5%. Raymond James estimates that the Spirit Airline midpoints of second quarter 2024 guidance implies earnings per share (EPS) of $(1.19) or $(0.94), well below its $(0.40). The miss is driven by a much weaker topline with CASM-ex slightly better than expected.

- According to Clarkson Research, April 2024 charter fees for car carriers (6500-unit capacity) were flat year-over-year at $110,000 per day. This level has remained stable since October 2023, but dropped for the first time in 47 months on a month-over-month basis (down 4%). Morgan Stanley is concerned about a deterioration in the supply/demand balance.

- Ryanair shares declined following comments by Michael O’Leary in a press briefing, saying that he now expects summer fares to be up 0-5% year-over-year, below his previous expectation of 5-10%. As per Bank of America’s discussion with the company, the lower summer fare outlook is based on the April performance, which required demand stimulation to drive traffic.

Opportunities

- Spirit Airlines appears to be planning a pivot in its operating model, citing new merchandising efforts and a potential recalibration of ancillary-versus-base fares. JPMorgan expects decisions regarding potential rebranding and reconstitution of its in-flight product to be announced in early August.

- With the Red Sea Crisis likely to be protracted into the second half of 2024, or even into next year, the global liners which have hosted briefings recently have all lifted 2024 freight rate/profit outlook, reports JPMorgan.

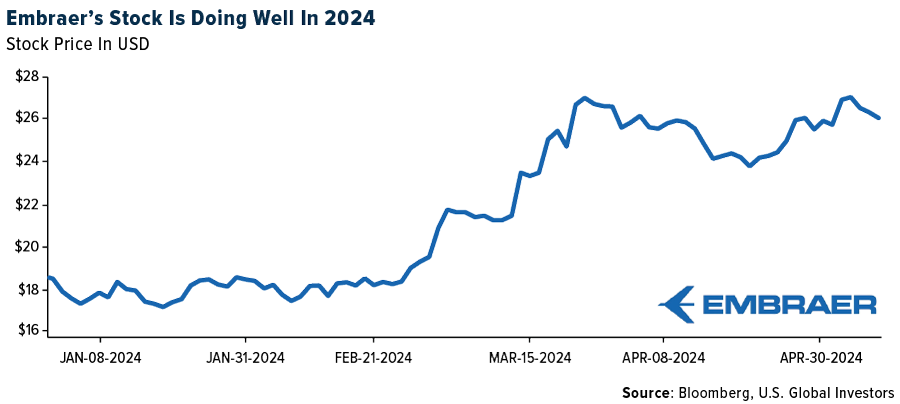

- Embraer may be selected as the OEM to supply up to 84 regional aircraft by 2028 to LOT, given its intention to double its fleet by then, reaching 110 aircraft, says JPMorgan. According to aerospace news sources, LOT is choosing between Embraer’s E2 family and the Airbus A220 for a fleet expansion plan, and they see recent leasing data as a positive indication that Embraer has higher chances to win this bid than Airbus at this point.

Threats

- 737 suppliers have emerged from first-quarter earnings remarkably well, with several raising guidance despite a stretched-out production ramp for this platform. The demand signal for most suppliers has not declined or declined only modestly, though some highlighted potential for it to decline in the future, says JPMorgan.

- There are a significant number of new projects coming online, specifically in North America, which should help absorb ship demand. However, the production ramp is gradual, with full production likely until sometime in 2026. There are several other smaller international projects that could also add to capacity, but not in a meaningful amount. As a result, while there should still be some seasonal uplift in shipping rates this fall, Stifel believes it could be much more muted than had been seen the past few years, and this could be a challenging summer.

- According to AeroIn, Azul’s Chief Revenue Officer, Mr. Abhi Shah, stated that despite recent speculation about a possible M&A between Azul and GOL, Azul is not in negotiations to acquire GOL. The executive reiterated that Azul’s strategy currently in place is to focus on the acquisition of new aircraft and the international expansion of the brand.

Luxury Goods and International Markets

Strengths

- Preliminary University of Michigan consumer sentiment for May came in at 67.4, well below the consensus of 76.9, and April’s final figure of 77.2. This marks the lowest headline level since November, with significant drops observed in both current conditions (to 68.8 from 79.0) and expectations components (to 66.5 from 76.0).

- China’s exports and imports returned to growth in April after contracting in the previous month. Shipments from China grew 1.5% year-on-year last month by value, according to customs data released on Thursday, in line with the increase forecast in a Reuters poll of economists. Imports for April increased by 8.4%, surpassing an expected 4.8% rise and reversing a 1.9% fall in March.

- Faraday Future Intelligent was the best performing S&P Global Luxury stock, gaining 12.7% in the past five days. The company’s shares are in danger of being de-listed after losing 99% of its value in a year. This week, Jia Yueting, the Chinese founder of electric vehicle maker Faraday Future, may start livestreaming to save the struggling American company.

Weaknesses

- This week Nikkei Asia reported that luxury sales in China have been sluggish as more consumers, especially Generation Z, turn to secondhand shopping amid uncertainty in the job market.

- Tapestry, best known for its Coach brand, reported an earnings miss, mostly due to weaker sales at smaller brands like Kate Spade and Stuart Weitzman, while Coach sales remained flat. The company also cut its revenue outlook for the remainder of the year following a decline in sales in North America.

- Tesla was the worst performing S&P Global Luxury stock, losing 7.0% in the past five days. Tesla lost most of its gains from the prior week, with shares trading lower on four out of five days. Last week, Tesla shares surged on news of the company receiving preliminary approval for its self-driving system in China; however, this week, Tesla’s shares reversed course. The company has been reporting weaker demand for EV cars, and Elon Musk has been cutting staff, leading to a decline in morale.

Opportunities

- Shares trading in mainland China and Hong Kong continue to climb higher. Despite Morgan Stanley advising investors against chasing the rally, it appears that the government is determined to support its struggling economy. This week, other major cities removed homebuying restrictions, with Xi’an City completely eliminating home purchase restrictions for both new and second-hand homes.

- Global Blue released its tax-free shopping recovery update for April, which indicates improving trends compared to March. Sales have picked up sequentially in Europe and Asia compared to 2019 levels. Mainland China’s tourist spending in Europe reached 68% of 2019 levels. As the Chinese become more willing to travel again post-pandemic, luxury spending is expected to grow.

- Eurozone retail sales experienced their sharpest increase since September 2022, signaling promising signs of economic recovery in household consumption. Data released by Eurostat on Tuesday showed that retail sales in the euro area advanced by 0.8% month-on-month in March. This rebound follows an upwardly revised decline of 0.3% in February and exceeded market expectations of a 0.6% increase, as reported by Euronews.

Threats

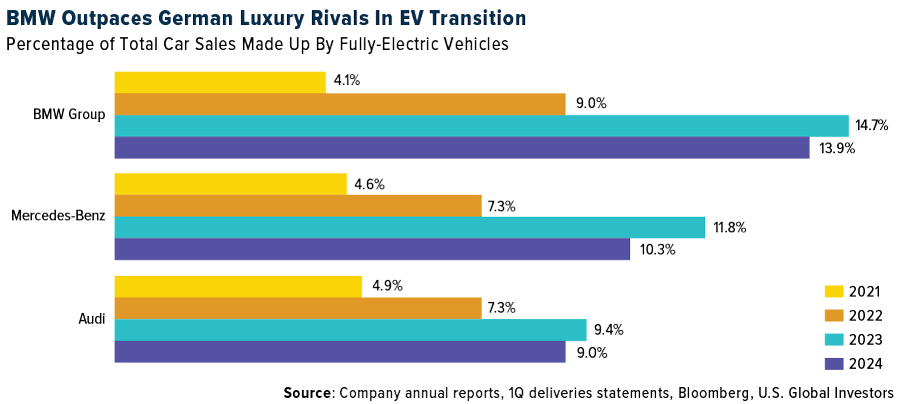

- Car makers across Europe and Asia are warning of a challenging year ahead as rising costs and weak demand for electric cars weigh on profits. BMW reported a 19.4% drop in net profit this week, attributed to an inflation-related increase in manufacturing costs impacting the company’s profitability. Mercedes also announced that it will continue selling its combustion-engine cars longer than initially planned due to weakening demand for EV cars. Many carmakers are feeling the impact of slowing EV sales.

- The German Economic Institute IW anticipates Germany’s economy to continue facing struggles in 2024, despite some signs of improvement at the beginning of the year. It forecasts that the largest economy in Europe will not return to growth this year, despite experiencing a 0.2% expansion in the first quarter of 2024. While consumption shows some promise, it’s not sufficient to generate a full upswing.

- Paris is expecting to welcome numerous visitors for the upcoming Summer Olympics, though it may not attract as many travelers as hoped. Louis Vuitton is a major sponsor of the upcoming events. According to New York-based luxury travel agency Embark Beyond, Taylor Swift concerts are drawing five times as many Americans as the Paris Olympics. However, Olympic bookings could still pick up, particularly following recent price drops.

Energy and Natural Resources

Strengths

- The best performing commodity for the week was wheat, rising 6.31%, as the U.S. Department of Agriculture estimated world wheat stockpiles came in below market expectations and inventories stand at the lowest level in eight years, as reported by Bloomberg. Iron ore futures in Singapore advanced close to $120 a ton as a government vow to tackle China’s prolonged property crisis injected new optimism into Chinese markets after a public holiday, Bloomberg also reported.

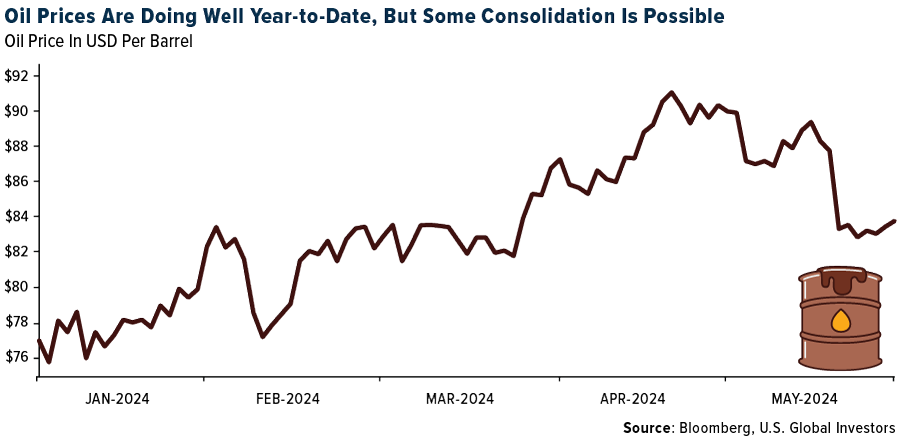

- Oil advanced after a weekly drop as Saudi Arabia’s price hikes for customers in Asia signaled confidence in the outlook, while Israel’s latest moves in the Gaza Strip put the focus back on tensions in the region. Brent climbed toward $84 a barrel after posting the biggest weekly loss since February, reports Bloomberg. WTI ended the week closer to $78, posting a slight gain. Natural gas posted a second weekly gain of close to 5.5% following its 11% gain in the prior week.

- The UK’s decade-long bet on offshore wind is paying off, as rising green power generation starts to push fossil fuels to the margins of the British electric grid. Wind farms in the UK produced twice as much power as gas and coal-fired plants in April, which followed two straight quarters when the UK got more electricity from wind than from fossil fuels, according to National Grid data.

Weaknesses

- The worst performing commodity for the week was nickel, dropping 0.98%. Trade Undersecretary Ceferino Rodolfo of the Philippines told reporters at the sidelines of a conference that the Philippines expects to bring on three more nickel processing plants before the end of 2028, Bloomberg reports. Nickel prices within the past year have declined 50% on cheaper nickel being sourced from the region. BP is alone among its peers in committing to cut oil and gas production, setting a target in 2023 of producing 2 million barrels of oil equivalent by the end of the decade, a 25% reduction from 2019 levels. The target has already been pared back once, from a 40% cut announced in 2020, according to Bank of America.

- European natural gas prices resumed their declines as traders assessed the supply picture with mild weather set to take hold of the continent. While Europe remains vulnerable to supply setbacks after losing most of its Russian pipeline flows in 2022, milder temperatures across the continent should make it easier to direct gas toward storage facilities, says Bloomberg.

- Changes to the EIA’s March data released this week were bearish due to the upward revision to non-OPEC supply. UBS notes that a looser market balance in the second quarter of this year at -0.4M barrels per day given persistently higher production from OPEC+ than the pledges and slower demand, notably from the OECD.

Opportunities

- On prices, copper metal has finally responded to concentrate market tightness, along with signs of a looming deficit with prices up 13% in April. JPMorgan continues to remain positive on the copper outlook given the team’s forecasts of a deficit market in 2024 of 71kt widening to a 244kt deficit in 2025.

- Saudi Aramco is interested in getting LNG supply contracts and using those to build a trading portfolio as part of plans for M&A in the LNG business, CFO Ziad Al-Murshed said on a conference call with analysts.

- Floating terminals to import natural gas allowed Europe to overcome the worst of the energy crisis. Their next task could be to help the continent’s sluggish hydrogen markets take off. Hoegh LNG Holdings Ltd., a provider of floating storage and regasification units for liquefied natural gas, is working on a hybrid ship that can deliver gas and hydrogen in parallel, according to Bloomberg.

Threats

- Nitrogen and phosphate prices continue to extend recent declines into the mid-year seasonal lull, with RBC estimating 10-15% potential downside until support from marginal cost and better affordability show up. Investor feedback has been generally bearish following the past week’s earnings results, with some raising concerns the earlier Spring season and peak may result in a drawn-out summer lull, however they do think this has been largely priced-in.

- China’s copper exports are set to hit their highest in two years, as beleaguered smelters ship out metal to benefit from a powerful rally in global prices. Four major producers plan to deliver a total of between 40,000 tons and 50,000 tons of refined copper to London Metal Exchange warehouses in Asia, according to people with knowledge of the sales, who asked not to be identified because the plans are private, Bloomberg reports.

- European natural gas prices declined on signs that demand will remain tepid over the summer after a mild winter left inventories much fuller than normal. Benchmark hovered near €30 per megawatt-hour. That is close to the level Goldman Sachs Group Inc. expects prices to stay for the remainder of the summer.

Bitcoin and Digital Assets

Strengths

- Of the cryptocurrencies tracked by CoinMarketCap, the best performer for the week was Akash Network, rising 39.80%.

- Though the price of Bitcoin has pulled back modestly in recent weeks, analysts at Bernstein believe the leading cryptocurrency “is far from done,” reports Bloomberg. They have reiterated their prediction that Bitcoin will reach $150,000 this cycle, expected by the end of 2025.

- Wintermute is providing liquidity to OSL and HashKey, Hong Kong’s licensed digital asset exchanges, to ensure Bitcoin and Ether can be bought, sold, and delivered to create and redeem ETF shares, writes Bloomberg.

Weaknesses

- Of the cryptocurrencies tracked by CoinMarketCap, the worst performer for the week was Core, down 18.49%.

- Former New England Patriots and Tampa Bay Buccaneers tight end Rob Gronkowski will pay $1.9 million to settle claims brought against him by former customers of Voyager Digital, writes Bloomberg.

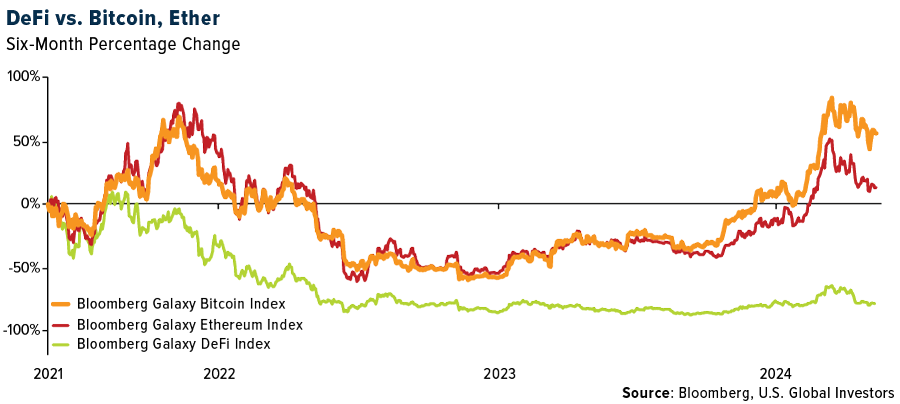

- The Bloomberg Galaxy DeFi Index of digital coins involved in decentralized finance was little changed this week from the week prior. The Bloomberg Galaxy Bitcoin Index declined 3% during the same period while the Ethereum Index dropped 2.2%, reports Bloomberg.

Opportunities

- QCP Capital, one of the largest options trading desks for digital assets, won initial approval to operate in Abu Dhabi, says Bloomberg, becoming the latest crypto firm to expand in the Middel East.

- Mastercard is joining with some of the largest U.S. banks, writes Bloomberg, to test shared-ledger technology. This will allow the common settlement of tokenized assets, such as commercial bank money, as well as Treasury and investment grade debt securities.

- The EigenLayer crypto project is set to hand out a new token that has become the most hyped digital-asset launch of the year, reports Bloomberg, as well as one of the most controversial because of exclusions imposed on users in the U.S., China and elsewhere. The project has raised about $165 million from backers.

Threats

- Binance Holdings said it was asked for a large payment in Nigeria to make problems there “go away,” and repeated calls for the release of its employee who’s been jailed in the West African nation, writes Bloomberg.

- Trading volume in major crypto exchanges fell in April for the time in seven months, reports Bloomberg, while Bitcoin retreated from a record high. Spot trading volume on so-called centralized exchanges such as Coinbase, Binance, and Kraken tumbled to 32.6% last month.

- Bitcoin is grinding lower as part of a $500 billion slide in digital assets, stoking questions about whether the crypto rebound has peaked. The token is flirting with five straight days of declines which would be the longest such losing run since October last year, writes Bloomberg.

Defense and Cybersecurity

Strengths

- Northrop Grumman has been awarded a $169.7 million contract by the U.S. Navy to provide comprehensive support for the MQ-4C Triton drones, including engineering, logistics, and training, with work scheduled across multiple global locations through May 2028.

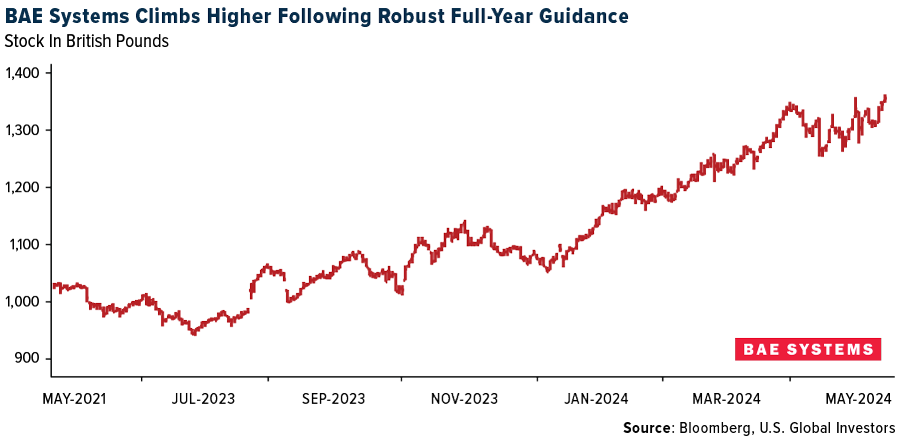

- The U.S. Navy has awarded $1.86 billion in contracts to eight companies, including BAE Systems and Peraton, to extend professional management and technical services for cyberspace operations through May 2026. BAE Systems said it was on track to meet guidance for higher earnings and forecast “further positive momentum” from this contract and commitment from the UK government on defense spending.

- The best performing stock in the XAR ETF this week was AeroVironment Inc., rising 10.49%. The Pentagon has launched the Replicator initiative, a $1 billion program to rapidly expand U.S. military capabilities with thousands of drones, starting with AeroVironment Inc.’s Switchblade-600, known for its use by Ukraine against Russian forces.

Weaknesses

- The U.S. delayed a bomb shipment to Israel due to concerns about a potential offensive in the densely populated Gazan city of Rafah. This reflects growing tensions between U.S. President Biden and Israeli Prime Minister Netanyahu over civilian protection and humanitarian issues amid ongoing conflict with Hamas.

- Armin Papperger, CEO of Rheinmetall, warned at an event in Düsseldorf that Germany’s military modernization could collapse by 2026 due to a €30 billion annual shortfall once the special Bundeswehr fund dries up. This emphasizes the necessity for new funding to meet NATO’s 2% GDP defense spending target and to sustain transformation efforts amidst increased geopolitical tensions and a new focus on munitions production in response to the Ukraine conflict.

- The worst performing stock in the XAR ETF this week was Cadre Holdings, falling 8.42%. The company reported weaker-than-expected on GAAP earnings per share (EPS) by $0.06.

Opportunities

- The U.S. Department of Defense has selected AeroVironment’s Switchblade 600 for its new Replicator initiative, which aims to rapidly deploy affordable, expendable autonomous systems across all military domains to enhance combat readiness and address the rapid military expansion of global powers.

- Israeli cybersecurity startup Wiz has raised $1 billion, raising a total of about $2 billion and valuing it at $12 billion. This is the largest investment raise in the history of Israeli startups. American technology giant Akamai announced the purchase of Israeli cyber startup Noname for $450 million. In recent weeks, U.S. chip giant NVIDIA has acquired two Israeli artificial intelligence companies Run:ai and Deci for a total of $1 billion. The past month has shown unprecedented excitement around Israeli cybersecurity and AI startups.

- CrowdStrike and Amazon Web Services have broadened their partnership to accelerate cybersecurity consolidation and cloud transformation. The two are integrating AWS services with CrowdStrike’s Falcon platform for enhanced protection and innovation in cloud security.

Threats

- Russian troops have launched an offensive along the entire border of the Kharkov region. Fierce fighting is underway, and the declared offensive of Russian troops began on Friday, May 10.

- Boeing’s first crewed Starliner space mission, scheduled with astronauts Suni Williams and Butch Wilmore to the International Space Station, has been delayed until at least May 17 due to a technical issue with a valve. The news comes amidst ongoing challenges and significant company developments.

- Russia has issued arrest warrants for key Ukrainian politicians and ministers, including the current president and the former president, thereby increasing the risk of rejecting future peace negotiations regarding the ongoing war.

Gold Market

This week gold futures closed the week at $2,370.10, up $61.50 per ounce, or 2.66%. Gold stocks, as measured by the NYSE Arca Gold Miners Index, ended the week higher by 5.53%. The S&P/TSX Venture Index came in up 2.69%. The U.S. Trade-Weighted Dollar rose 0.27%.

Strengths

- The best performing precious metal for the week was silver, up 6.56%, which can be an indicator of speculative interest being revived in the precious metal trade. Gold consolidated early in the week between $2,340 to nearly $2,310, but the weaker than expected initial jobless claims came in higher than expectations, which launched gold higher, and the momentum continued Friday with the weaker than expected preliminary survey of consumer sentiment by the University of Michigan.

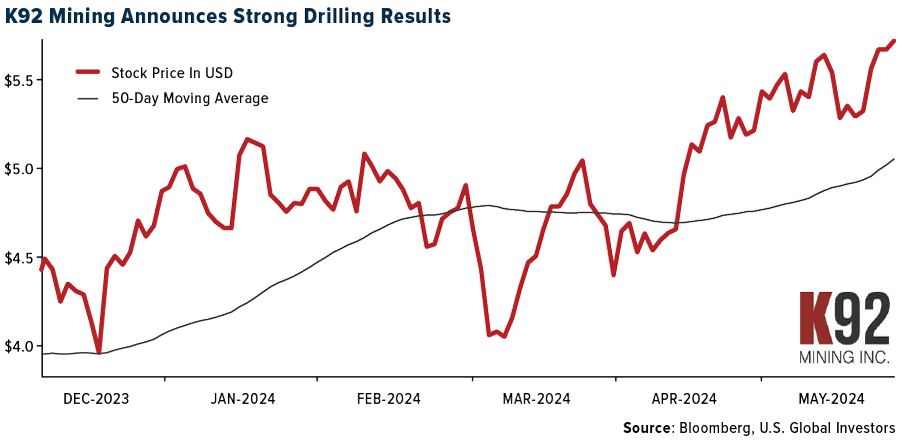

- K92 Mining reported drilling results from the Kainantu gold mine in Papua New Guinea that extended multiple high-grade zones and included a new dilatant zone discovery. At the Kora South deposit, a new dilatant zone was discovered with intercepts of 78.50 meters at 27.03 grams per ton gold equivalent and 34 meters at 8.14 grams per ton gold equivalent.

- Kinross reported operating results that surpassed RBC and consensus expectations with 4% higher production and 5% lower costs. This supported higher adjusted earnings per share (EPS) ($0.10 versus RBC $0.09). KGC reiterated annual guidance—in their view 1Q positions the company favorably to achieve annual targets.

Weaknesses

- The worst performing precious metal for the week was gold, but still up 2.66%. Gold Fields reported its Q1/24 operational results. While BMO had incorporated the softer quarter, costs came in significantly higher than expected. However, with backend-weighted production in H2/24, the company has kept overall guidance unchanged.

- Following a strong start to 2024, SA PGM exports for the month of March declined 13% year-over-year (YoY) and 12% month-over-month (MoM) to 504,000 ounces to the lowest levels since 2020. However, SA PGM exports year-to-date are still up 12% YoY and UBS continues to see increased exports for these metals to the West.

- Gatos’ Q1 EPS of $0.04 compared with BMO’s $0.06 estimate, which included revenue of $72 million versus their $79 million. Notably, the JV continued to make strong capital distributions increasing Gatos’ cash balance to $85.4M. All-in sustaining costs (AISC) of $14.36/ounce silver was at the low end of guidance and below their estimate.

Opportunities

- Data dating back to 2010 shows that in times of buoyant gold prices, exploration spend has typically followed. However, since 2019, exploration spend and the gold price have decoupled, Canaccord thinks driven by M&A. Over the last 10 years, periods of sustained exploration spend have typically been followed by several world-class discoveries.

- China’s central bank topped up its gold reserves for an 18th straight month in April, although the pace of buying slowed in the face of record prices. The People’s Bank of China has long been one of the market’s largest buyers, steadily growing its bullion holdings since 2022. However, the precious metal’s record-breaking rally since mid-February — with successive all-time-highs reached last month — seems to have dented demand, according to Bloomberg.

- A booming solar-power industry is driving a surge in the demand for silver, which is needed in large quantities to make photovoltaic panels. Silver is integral to the production of solar photovoltaic — or solar PV — panels because of its high electrical conductivity, thermal efficiency and optical reflectivity, as reported by the Wall Street Journal.

Threats

- JPMorgan summarized rainfall data for the April month for a selection of Australian projects, utilizing Bureau of Meteorology data. Rainfall 25%+ above the monthly mean was recorded at 11 sites, with East Coast assets in New South Wales and Queensland bearing the brunt coming out of the wet season.

- Gold’s 12% rally this year has put major bond and stock markets in the shade, but it does look to be losing momentum. That happens to coincide with a slowdown in the Chinese central bank’s purchases of the precious metal, according to Bloomberg.

- The Pan American Silver Escobal mine in Guatemala remains on care and maintenance as the ILO 169 consultations continue with the Xinka indigenous representatives and as a new government gains familiarity with the project. Management notes that the ILO 169 consultation process has experienced delays since the new government in Guatemala took office in January 2024, according to Canaccord.

U.S. Global Investors, Inc. is an investment adviser registered with the Securities and Exchange Commission (“SEC”). This does not mean that we are sponsored, recommended, or approved by the SEC, or that our abilities or qualifications in any respect have been passed upon by the SEC or any officer of the SEC.

This commentary should not be considered a solicitation or offering of any investment product. Certain materials in this commentary may contain dated information. The information provided was current at the time of publication. Some links above may be directed to third-party websites. U.S. Global Investors does not endorse all information supplied by these websites and is not responsible for their content. All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. The following securities mentioned in the article were held by one or more accounts managed by U.S. Global Investors as of (03/31/2024):

Qantas

Airbus SE

Ryanair Holdings PLC

Azul SA

Tesla Inc.

Bayerische Motoren Werke AG

Mercedes-Benz Group AG

Volkswagen AG

LVMH Moet Hennessy Louis Vuitton SA

K92 Mining Inc.

Kinross Gold Corp.

*The above-mentioned indices are not total returns. These returns reflect simple appreciation only and do not reflect dividend reinvestment.

The Dow Jones Industrial Average is a price-weighted average of 30 blue chip stocks that are generally leaders in their industry. The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies. The Nasdaq Composite Index is a capitalization-weighted index of all Nasdaq National Market and SmallCap stocks. The Russell 2000 Index® is a U.S. equity index measuring the performance of the 2,000 smallest companies in the Russell 3000®, a widely recognized small-cap index.

The Hang Seng Composite Index is a market capitalization-weighted index that comprises the top 200 companies listed on Stock Exchange of Hong Kong, based on average market cap for the 12 months. The Taiwan Stock Exchange Index is a capitalization-weighted index of all listed common shares traded on the Taiwan Stock Exchange. The Korea Stock Price Index is a capitalization-weighted index of all common shares and preferred shares on the Korean Stock Exchanges.

The Philadelphia Stock Exchange Gold and Silver Index (XAU) is a capitalization-weighted index that includes the leading companies involved in the mining of gold and silver. The U.S. Trade Weighted Dollar Index provides a general indication of the international value of the U.S. dollar. The S&P/TSX Canadian Gold Capped Sector Index is a modified capitalization-weighted index, whose equity weights are capped 25 percent and index constituents are derived from a subset stock pool of S&P/TSX Composite Index stocks. The NYSE Arca Gold Miners Index is a modified market capitalization weighted index comprised of publicly traded companies involved primarily in the mining for gold and silver. The S&P/TSX Venture Composite Index is a broad market indicator for the Canadian venture capital market. The index is market capitalization weighted and, at its inception, included 531 companies. A quarterly revision process is used to remove companies that comprise less than 0.05% of the weight of the index, and add companies whose weight, when included, will be greater than 0.05% of the index.

The S&P 500 Energy Index is a capitalization-weighted index that tracks the companies in the energy sector as a subset of the S&P 500. The S&P 500 Materials Index is a capitalization-weighted index that tracks the companies in the material sector as a subset of the S&P 500. The S&P 500 Financials Index is a capitalization-weighted index. The index was developed with a base level of 10 for the 1941-43 base period. The S&P 500 Industrials Index is a Materials Index is a capitalization-weighted index that tracks the companies in the industrial sector as a subset of the S&P 500. The S&P 500 Consumer Discretionary Index is a capitalization-weighted index that tracks the companies in the consumer discretionary sector as a subset of the S&P 500. The S&P 500 Information Technology Index is a capitalization-weighted index that tracks the companies in the information technology sector as a subset of the S&P 500. The S&P 500 Consumer Staples Index is a Materials Index is a capitalization-weighted index that tracks the companies in the consumer staples sector as a subset of the S&P 500. The S&P 500 Utilities Index is a capitalization-weighted index that tracks the companies in the utilities sector as a subset of the S&P 500. The S&P 500 Healthcare Index is a capitalization-weighted index that tracks the companies in the healthcare sector as a subset of the S&P 500. The S&P 500 Telecom Index is a Materials Index is a capitalization-weighted index that tracks the companies in the telecom sector as a subset of the S&P 500.

The Consumer Price Index (CPI) is one of the most widely recognized price measures for tracking the price of a market basket of goods and services purchased by individuals. The weights of components are based on consumer spending patterns. The Purchasing Manager’s Index is an indicator of the economic health of the manufacturing sector. The PMI index is based on five major indicators: new orders, inventory levels, production, supplier deliveries and the employment environment. Gross domestic product (GDP) is the monetary value of all the finished goods and services produced within a country’s borders in a specific time period, though GDP is usually calculated on an annual basis. It includes all private and public consumption, government outlays, investments and exports less imports that occur within a defined territory.

The S&P Global Luxury Index is comprised of 80 of the largest publicly traded companies engaged in the production or distribution of luxury goods or the provision of luxury services that meet specific investibility requirements.

The Shanghai Container Freight Index (SCFI) is a weekly index that tracks the spot market freight rates for shipping containers departing from Shanghai, China, to various destinations around the world.

The Bloomberg Galaxy Defi Index (DEFI) is a capped market capitalization-weighted index targeting the rapidly expanding universe of decentralized finance.

The S&P MERVAL Index (MERV) is Argentina’s main stock market index and measures the performance of the most liquid and largest domestic stocks traded on the Buenos Aires Stock Exchange (BYMA).

The Relative Strength Index (RSI) is a technical indicator that measures the speed and magnitude of price movements in financial markets. It’s a momentum oscillator that oscillates between 0 and 100, and is used to track an asset’s overbought and oversold levels.

In finance, sigma can refer to an accumulated sum, which is a measure of investment return, or standard deviation, which is a measure of risk.

The University of Michigan Consumer Sentiment Index (MCSI) is an economic indicator that measures how optimistic consumers feel about the economy and their personal finances.