Arctic Resource Boom Pits U.S. Against Russia and China in the New “Red Cold War”

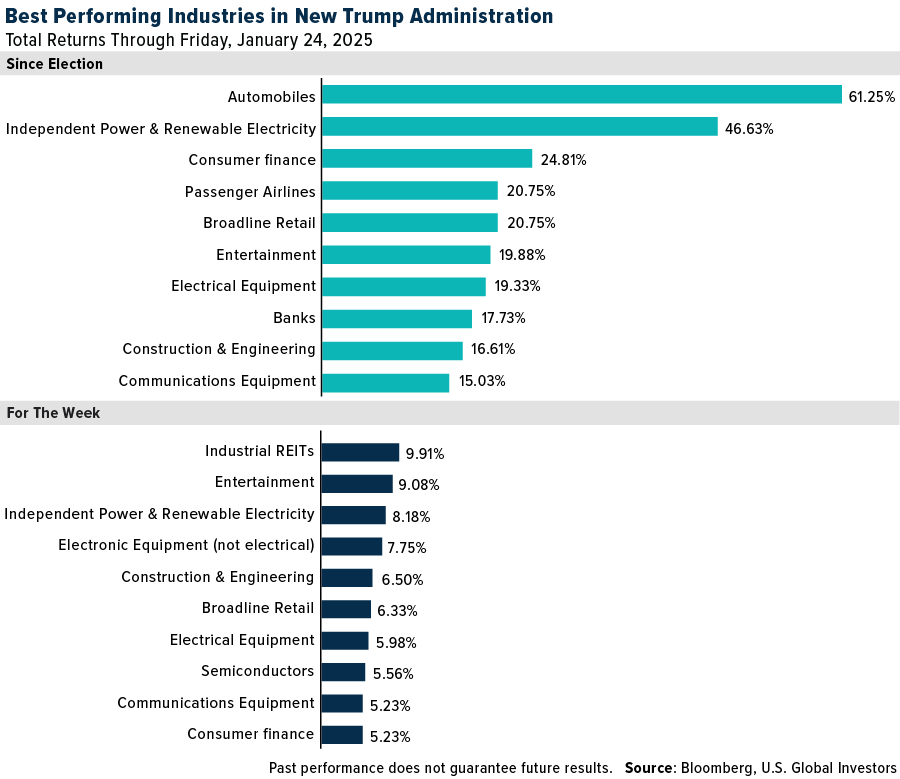

Markets have responded with gusto since November’s presidential election, especially in a few key—and perhaps expected—industries.

The biggest winner so far is the automobile industry, led by Tesla, up an impressive 70% since Election Day. General Motors, while not quite as flashy, is up about 5%. Despite President Donald Trump’s rollback of Biden-era electric vehicle (EV) mandates, Tesla has continued to command investor confidence, possibly due to Elon Musk’s close ties to the president.

Electricity producers also saw a boost, driven by the artificial intelligence (AI) boom. Data centers, which currently consume 1-2% of global power, could grow to 3-4% by the end of the decade, according to Goldman Sachs.

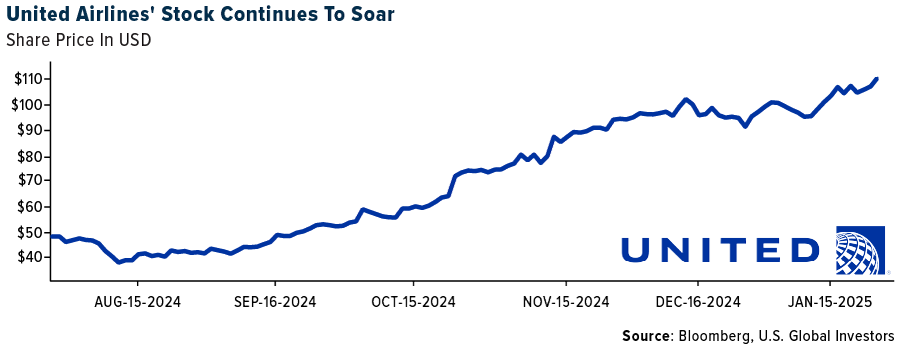

And let’s not forget the airlines industry. United Airlines, up 33%, capitalized on record-breaking TSA screenings in 2024, operating its largest-ever domestic schedule and expanding international routes.

I also want to share the best performing industries for the week, as President Trump has signed an historical number of executive orders (EO) since taking office on Monday. The list includes many of the same areas—power generation, construction & engineering, consumer finance, retail—but there’s an interesting addition: industrial REITs.

The industrial REIT ticker is represented by a single stock, Prologis, the world’s largest industrial property developer. According to the Wall Street Journal, the company has seen its warehouse business explode since the election. It’s also been dipping its toes in the white-hot data center market, selling a facility in the fourth quarter, with more in the pipeline.

Why the Arctic Matters

But let’s pivot to a different story—one unfolding far from Wall Street. I recently spoke with Jonathan Roth, founder of ResourceWars.com and a veteran of capital markets, who highlighted an increasingly urgent issue: the Arctic.

As polar ice caps melt, new opportunities—and risks—are emerging in this increasingly contested region. Nations like the U.S., Russia and China are jockeying for influence, not only to access the Arctic’s vast natural resources but also to secure strategic military and trading advantages.

Greenland, in particular, is shaping up to be a geopolitical hotspot, and it’s no wonder Trump has repeated his interest in acquiring the island.

A Treasure Trove Beneath the Ice

During our conversation, Jonathan emphasized the Arctic’s immense resource wealth. The region is home to some of the world’s largest untapped reserves of natural resources. A 2008 study by the U.S. Geological Survey says that the Arctic holds 1,670 trillion cubic feet of natural gas and other fuels—equivalent to Russia’s entire oil reserves and three times those of the U.S.

Greenland, the world’s largest island that isn’t a continent, is rich in critical minerals essential for modern technologies, including rare earth metals, graphite, niobium and titanium. These materials are vital for everything from smartphones to EVs to military hardware.

Ice loss in the Danish territory has also exposed significant deposits of lithium, hafnium, uranium and gold. A 2023 survey by the Geological Survey of Denmark and Greenland evaluated 38 raw materials on the island, most of which have high or moderate potential.

Russia’s Arctic Ambitions

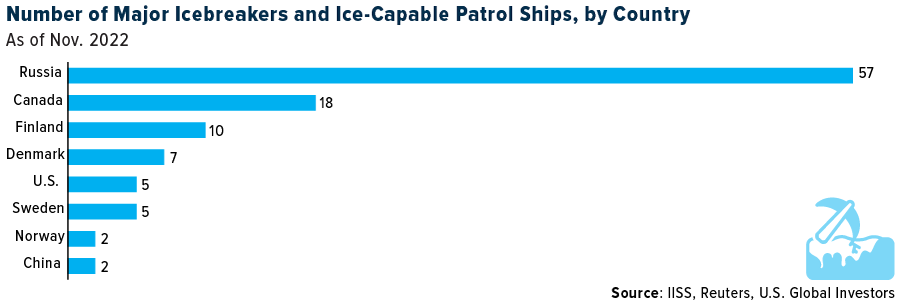

Jonathan also pointed out that Russia has been quietly building its Arctic presence for over a decade. It now has the most significant military presence in the region, with refurbished Soviet-era bases and a fleet of nuclear-powered icebreakers.

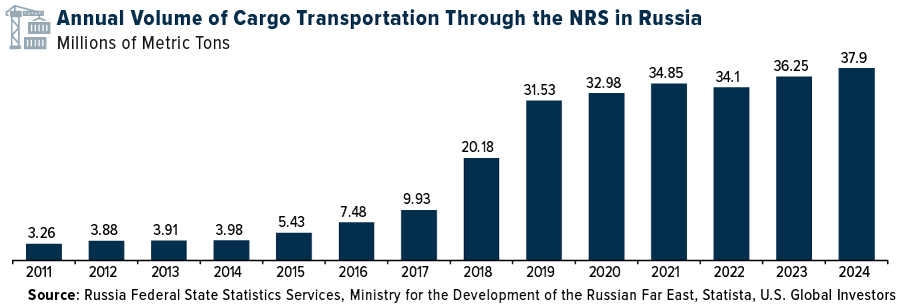

In 2024, some 38 million metric tons of cargo were shipped through Russia’s Northern Sea Route (NSR), a record amount for a single year and a nearly tenfold increase from a decade earlier. The NSR is central to President Vladimir Putin’s vision of a shipping lane that rivals the Suez and Panama Canal, but challenges like shallow, ice-filled waters and foggy conditions mean the route has a long way to go before becoming a global sea lane.

The country’s Arctic ambitions are about more than just trade. The region is a cornerstone of its strategy to secure military and economic power. This poses a significant concern for the U.S. and its allies, especially as climate change accelerates ice melt and opens up new access routes. Russia’s dominance in the Arctic could disrupt global trade, heighten geopolitical tensions and undermine U.S. strategic interests.

The U.S. Lags in Icebreaker Capabilities

While Russia boasts dozens of icebreakers, including nuclear-powered vessels, the U.S. is woefully behind. Jonathan highlighted that the last heavy polar icebreaker built by the U.S., the Polar Star, was commissioned nearly 50 years ago, in 1976. Meanwhile, the newer Polar Security Cutter (PSC) class of icebreakers, intended to bolster U.S. capabilities, has faced years of delays and budget overruns.

Recognizing this, the U.S. has partnered with Canada and Finland under the ICE Pact to develop a new generation of icebreakers. Finland, which designs 80% of the world’s icebreakers, brings valuable expertise to the table.

Greenland: A Strategic Prize

Greenland’s importance extends beyond its resource wealth. Jonathan noted the island occupies a key position along two potential Arctic shipping routes—the Northwest Passage and the Transpolar Sea Route. As sea ice continues to melt, these routes could significantly reduce shipping times and bypass traditional chokepoints like the Suez and Panama Canals.

Greenland is also home to Pituffik Space Base (formerly Thule Air Base), a critical U.S. military installation for missile early warning and space surveillance. The base’s strategic value is compounded by Greenland’s role in the so-called GIUK Gap (Greenland-Iceland-United Kingdom)—a naval chokepoint in the North Atlantic.

Investment in Pituffik has been inconsistent, however, and its importance has waned since the Cold War. Renewed attention to Greenland could help the U.S. counter Russia’s growing Arctic dominance and China’s ambitions as a “near-Arctic” power.

What’s at Stake

The Arctic’s significance isn’t just about resources or shipping lanes. It’s about power, influence and the ability to shape the future of global trade and security.

For investors, the region offers opportunities in sectors like energy, mining and infrastructure. Companies involved in rare earth mining, icebreaker construction and Arctic logistics could see significant growth as nations ramp up their Arctic investments.

As always, investors should keep a close eye on these developments. The Arctic may be cold, but the race for its riches is heating up.

To watch my full interview with Jonathan Roth, click here!

Index Summary

- The major market indices finished up this week. The Dow Jones Industrial Average gained 2.15%. The S&P 500 Stock Index rose 1.74%, while the Nasdaq Composite climbed 1.65%. The Russell 2000 small capitalization index gained 1.40% this week.

- The Hang Seng Composite lost 2.94% this week; while Taiwan was up 1.63% and the KOSPI rose 0.53%.

- The 10-year Treasury bond yield fell 1 basis point to 4.616%.

Airlines and Shipping

Strengths

- The best performing airline stock for the week was Ryanair, up 10.8%. According to Goldman, United Airlines reported December-quarter adjusted earnings per share (EPS) of $3.26, ahead of FactSet consensus of $2.98 and above the high end of the company’s guidance range of $2.50 to $3.00. The beat versus their forecast was driven by better-than-expected revenue, with unit revenue (“RASM”) up 1.6% versus Goldman’s 0.2%.

- Tanker rates finally saw the bounce that many have been hoping for, reports Stifel, with oil tanker rates up over 130% and all other ship classes up at least a little. The sanctions on many tankers moving Russian crude effectively removes those ships from trade, at least to some extent.

- According to Goldman, Alaska Airlines reported December-quarter adjusted EPS of $0.97, significantly ahead of FactSet’s consensus of $0.45, and nearly double the high end of the company’s recently improved guidance range of $0.40 to $0.50. The beat versus their forecast was driven by better-than-expected revenue and operating costs. This includes about $0.25 of one-time Hawaiian integration benefits.

Weaknesses

- The worst performing airline stock for the week was Expedia, down 8.6%. Air France-KLM CEO Ben Smith tells daily Le Parisien that government plans to raise taxes on plane tickets will cost it as much as €130 million a year. “It’s irresponsible, a new tax was already introduced last year,” Smith is cited as saying in an interview.

- According to Morgan Stanley, the Yemeni Houthi movement, which has been carrying out armed attacks against the international merchant fleet in the Red Sea area since November 2023, will now cease attacks on non-Israeli ships. The attacks will be stopped from Sunday, January 19, according to the movement. The announcement comes considering a new ceasefire agreement between Israel and Hamas, which came into effect on Sunday, January 19.

- As reported by the FAA, business jet departures were down 1% year-over-year in September, with TTM departures down 1.3% year-over-year. By aircraft type, short range aircraft departures are down 4% year-over-year, while medium range aircraft are flat year-over-year, according to UBS.

Opportunities

- Air Europa has hired PJT Partners to raise capital and refinance debt, news website El Confidencial reports, citing unnamed people in the industry. The airline is working to pay off a €475 million loan it got from the Spanish government in 2020 to face the consequences of the pandemic. It is looking for an investor to subscribe to a capital increase of about €240 million.

- U.S. President Donald Trump vowed to take back the Panama Canal waterway in a sign of rising tensions. “China is operating the Panama Canal. And we did not give it to China, we gave it to Panama, and we are taking it back,” said Trump at his inauguration speech. Since Panama’s diplomatic recognition of Beijing, China has invested heavily in strategic infrastructure projects that include ports on both ends of the canal, telecommunications, and road projects worth more than $2.5 billion.

- An Aviation Week/Bank of America survey suggests if Embraer were to independently launch a modern, traditional plane competing with the 737MAX or A320neo families, it would be well received by global airlines. Respondents’ favored plane would look a lot like the core of Airbus’s A320neo family with some interest in shorter- and longer-range variants.

Threats

- American companies United and American Airlines, as well as European companies Air France-KLM, International Airlines Group (IAG, the parent company of Iberia and British Airways), and Lufthansa Group, are currently engaged in discussions with Gol regarding a potential investment in the company, cites Valor. The possibility of a business merger between Gol and Azul has increased interest in the matter, as those left out of this potential group are likely to lose market share in the region.

- The ceasefire in Gaza could be transformative to effective shipping supply, particularly for tankers, containers, and LNG carriers. The Yemeni Houthi’s attacks on ships transiting the Red Sea as a response to the Israeli retaliation to Hamas attacks almost a year and a half ago, dramatically reduced shipping in the region. The resumption of Red Sea trade could add 4-5% to effective supply, particularly for refined products with a lesser impact on crude, which generally does not transit the Suez Canal, according to Stifel.

- American Airlines introduced 2025 EPS guidance of $1.70 to $2.70, with the midpoint beneath consensus of $2.42. American also introduced March quarter earnings guidance of a net loss per share of ($0.20) to ($0.40), worse than consensus of ($0.04).

Luxury Goods and International Markets

Strengths

- Hermes, a prestigious French luxury goods manufacturer founded in 1837 by Thierry Hermès in Paris, reached a new record high this week. This record high for Hermès comes at a time when the broader luxury market is facing a slowdown, highlighting the company’s ability to navigate challenging market conditions and maintain investor confidence.

- The January headline Eurozone Composite PMI, which reflects the overall economic health of the private sector in the euro area, rose to 50.2, following a positive shift in December. This increase offers some optimism that the Eurozone’s economic recovery may be gaining momentum.

- Burberry was the top-performing stock in the S&P Global Luxury sector, rising 21.4% over the past five days. The company exceeded investor expectations with stronger-than-expected sales. Retail sales dropped by 4%, significantly better than analysts’ forecast of a 13% decline. Sales in the U.S. rose unexpectedly, while the decline in China was less severe than anticipated.

Weaknesses

- New reasearch suggests that the luxury industry is projected to grow between 1% to 3% between 2024 and 2027. This marks a substantial decline from the exceptional growth period of 2019-2023.

- U.S. consumer sentiment declined in January for the first time in six months, according to the University of Michigan’s Sentiment Index. Business activity is expanding at the slowest pace in nine months, S&P Global flash PMIs showed.

- Star Entertainment, the Australian casino and gaming company, was the worst-performing stock in the S&P Global Luxury Index, plummeting 16.4%. The company is facing difficulties raising cash and sustaining its operations.

Opportunities

- Trump’s strong start to his second term has sparked investor optimism, with lower bond yields and a continued focus on AI and tech sectors driving market growth. Wall Street so far has reacted positively to Trump’s approach on tariffs, which appears less harsh than initially feared, leading to significant gains in major indexes, lifting luxury names as well.

- Bank of America forecasts that the majority of growth in the luxury sector will stem from the U.S. this year. With a strong economy, high consumer spending, and increasing demand for premium goods, the American market is expected to be a key driver for luxury brands. This trend is being fueled by a growing number of affluent consumers and a shift toward high-end products across various categories, including fashion, watches, jewelry, and automobiles.

- Larry Fink, the CEO of BlackRock, has suggested that it might be time to reinvest in Europe, citing an overabundance of pessimism about the region. His comments were made during the World Economic Forum’s annual meeting on Friday.

Threats

- Trump’s first week in office initially reassured investors, with minimal focus on tariffs. However, there are concerns that more tariff announcements could be looming in the coming days or weeks. During his campaign, Trump proposed a universal import tax of 10-20% on goods from Europe, Mexico, and Canada, along with a 60% tariff on imports from China. He has since indicated that a 10% tariff on all imports from China remains on the table, potentially taking effect as early as February 1st.

- Chanel, a prestigious brand in the luxury sector, announced it is cutting 70 jobs in the United States as the beauty label cautioned about a tougher economic landscape. The company, known for catering to the wealthiest individuals who can spend $10,000 on a single handbag, is feeling the effects of a broader slowdown in the luxury market post-pandemic, prompting the need for cost-cutting measures.

- The luxury sector has had a strong start to the year, with surprising same-store sales growth from Richmont and Burberry this week. Next week, LVMH, Christian Dior and Tesla will report their quarterly results. Weaker-than-expected results could lead to a market correction after the strong year-to-date rebound we’ve seen so far.

Energy and Natural Resources

Strengths

- The best performing commodity for the week was coffee, rising 5.85%. Coffee producers sold 85% of coffee harvest as of January 21. This compares to an increase of 6% month-over-month and also 74% just one year before.

- BHP has boosted copper production as it races to meet demand for the metal used in key technology ranging from electric vehicles to power grids. The Australian miner produced 10% more copper in the six months to December 31, compared with the previous year, largely driven by strong performance at its Escondida operations in northern Chile, where production rose 22% to a decade high, the company said on Tuesday.

- Oil refiners in India are reaching for all available options in the rush to make up for Russian flows hit by Washington’s latest round of sanctions, turning to the spot market while simultaneously seeking more long-term supplies from Middle Eastern producers. State-owned processors have issued a slew of spot tenders in recent weeks, according to Bloomberg.

Weaknesses

- The worst performing commodity for the week was lumber, dropping 5.58%. Restricting Canadian lumber through trade enforcement could ultimately drive up costs for U.S. builders and homeowners, as domestic mills may not be able to sustain increased demand at lower prices. However, the uncertainty surrounding tariffs on Canadian lumber drove lumber prices down as Trump swore into office this week.

- Russia’s oil shipments via the Baltic Sea fell by roughly 10% in the last four months of 2024, the Finnish Border Guard said, as the impact of EU sanctions against Russian oil and gas exports adopted in June took effect, according to Reuters.

- Iron ore and most base metals fell after President Trump said that he could hit China with 10% tariffs on all imports from as early as next month. Singapore iron ore futures declined as much as 1.3% after the president’s threat, which he said was in response to China sending the drug fentanyl to North America, according to Bloomberg.

Opportunities

- Rio Tinto and Glencore have held early-stage talks about combining their businesses to create a behemoth to rival longstanding industry titan BHP. The discussions took place as recently as late last year but are not currently active, according to people familiar with the matter, according to Bloomberg.

- Chile, the world’s No. 1 copper producer, will boost its output of the red metal to 5.54 million metric tons in 2034, representing a 5.6% increase from 2023, state-run copper commission Cochilco said on Wednesday. The Latin American nation produced 23.6% of the world’s copper in 2024, Cochilco said. That amount is expected to increase, with Chile’s hold over the industry representing a 27.3% share by 2034, it added. Cochilco said it expected Chile to reach a peak production level in 2027, mining 6.07 million tons of copper that year, according to Reuters.

- Copper reached a two-month high above $9,300 per ton as President Trump’s softer stance on tariffs toward China eased trade concerns, boosting demand for metals. The resulting dollar selloff and strengthening yuan further supported copper prices, highlighting the metal’s role as an economic bellwether amid improved market sentiment.

Threats

- In RBC’s view, President Trump’s pledge to impose a sweeping 25% tariff on all imported goods from Mexico and Canada—including crude oil and natural gas—is not a zero-probability event and is one that Canada’s policymakers and producers alike should take seriously. In 2023, the U.S. imported 6.5 million barrels per day of crude oil, of which Canada accounted for 60%.

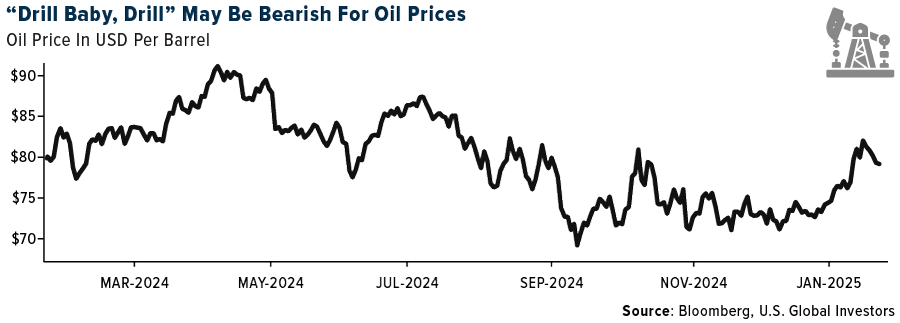

- Oil and industrial metals declined after Trump reignited trade-war fears with his tariff threats against Mexico and Canada. The prospect of a renewed global trade conflict has bearish implications for commodities, given the risks to consumption and growth, according to Bloomberg.

- Alcoa said that, currently, “the U.S. imports two-thirds of its primary aluminum from Canada. A 25% tariff on current Canadian export volume to the U.S. could represent $1.5 billion to $2 billion of additional annual cost for U.S. customers. Trade flows would likely be impacted such that U.S. aluminum imports would increase from countries and regions that have a lower import duty level, like the Middle East and India, while Canadian metal could reroute to Europe and other countries.”

Bitcoin and Digital Assets

Strengths

- Of the cryptocurrencies tracked by CoinMarketCap, the best performer for the week was Official TRUMP, rising 402.61%.

- World Liberty Financial, the DeFi project associated with U.S. President Donald Trump, acquired roughly $112.8 million worth of cryptocurrencies on Trump’s first day in office. The crypto project supported by Trump’s family further diversified its treasury holdings by purchasing six kinds of tokens including $47 million worth of ether and $47 million worth of wrapped bitcoin, writes Bloomberg.

- President Donald Trump is planning to release an executive order elevating crypto as a policy priority and giving industry insiders a voice within his administration, Bloomberg explains. The order is expected to name crypto as a national imperative or priority intended to guide government agencies to work with the industry.

Weaknesses

- Of the cryptocurrencies tracked by CoinMarketCap, the worst performer for the week was ai16z, down 29.46%.

- Kenya will require providers of virtual assets to set up local offices as authorities in the East African nation seek a firmer grip on the fast-growing industry. The proposed policy excluded assets that can’t be transferred, exchanged or traded outside a close ecosystem, writes Bloomberg.

- Riot Platforms say it’s halting the development of a previously announced 600 MW Phase Bitcoin mining expansion at its Corsicana facility in connection with an evaluation of AI/HPC opportunities, Bloomberg report. Riot now sees 2025 ending with a total hash rate capacity of 38.4 EH/s.

Opportunities

- Billionaire Alex Gerko’s quantitative-trading firm XTX Markets is investing more than 1 billion euros building five data centers in Finland to underpin its growing use of machine learning. The London-based market maker, which uses complex trading algorithms to trade over $250 billion worth of assets a day, will build the hub in central Finland, according to Bloomberg.

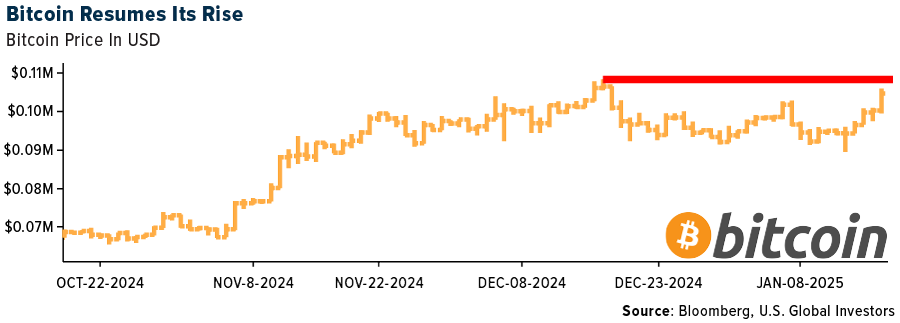

- Bitcoin appears to be back on track toward record highs with the second inauguration of pro-crypto President Donald Trump. The largest cryptocurrency by market value has climbed as much as 13% since Sunday putting it on pace for the biggest weekly gain since election week in November, writes Bloomberg.

- Cryptocurrency-wallet provider Phantom Technologies has raised $150 million in a funding round led by Sequoia Capital and Paradigm that value the startup at $3 billion more than double its previous valuation.

Threats

- A co-founder of French crypto wallet startup Ledger SAS and his partner were released after being kidnapped in central France, the Paris prosecutor’s office said on Thursday. David Balland was taken from his home in the early hours of Tuesday and freed on Wednesday night after a police operation in Chateauroux, writes Bloomberg.

- A United Arab Emirates cryptocurrency firm caught in an FBI “wash trading” sting operation won’t operate in the U.S. market anymore and will pay more than $428,000 to settle Securities and Exchange Commission claims. CLS Global will plead guilty to one count of conspiracy to commit market manipulation and wire fraud, writes Bloomberg.

- Recently hot meme coin Fartcoin is down 17% in the last 24 hours amid news that Andy Ayrey, the creator of the popular AI bot Truth Terminal that inspires the token, helped facilitate the sale of a majority of its Fartcoin holdings in an over-the-counter trade, according to Bloomberg.

Defense and Cybersecurity

Strengths

- Rolls-Royce signed a £9 billion contract to design, build, and support nuclear reactors for the UK’s submarine fleet, including the new Dreadnought-class submarines, over the next eight years. The deal is part of the government’s commitment to maintaining a continuous at-sea nuclear deterrent and includes £400 million in savings through streamlined contracts.

- Leidos won an eight-year, $2.6 billion contract from the TSA to maintain 12,000 security units across over 430 airports in the U.S. and territories.

- The best performing stock in the XAR ETF this week was Rocket Lab, rising 26.50%, after successfully supporting Firefly Aerospace’s Blue Ghost Mission 1 to the Moon by providing software, solar solutions, and managing orbit and altitude control as part of NASA’s Commercial Lunar Payload Services program.

Weaknesses

- Government-services stocks fell this week due to investor concerns over CACI International’s quarterly bookings, which dropped 45% year-over-year, and broader uncertainty around contract renewals and potential spending cuts from Trump’s Department of Government Efficiency (DOGE) initiative.

- Boeing’s fourth quarter loss widened to $5.46 per share with revenue falling to $15.2 billion, down from $22.02 billion last year, due to a union work stoppage, defense program charges, and lower deliveries, while shares dropped 1.7% pre-market to $175.56.

- The worst performing stock in the XAR ETF this week was MOOG Inc., declining 6.65%, after reaffirming its fiscal year 2025 adjusted EPS guidance at $8.20 (vs. $8.26 estimate), operating margin at 12.9% (down from 13%), and sales at $3.70 billion (vs. $3.71 billion estimate). This comes while reporting first quarter adjusted EPS of $1.78 (vs. $1.70 estimate), net sales of $910 million (up 6.2% year-over-year, vs. $873 million estimate), operating margin of 11.1% (vs. 11% year-over-year), and maintaining a 12-month backlog of $2.5 billion.

Opportunities

- Parsons got a one-year contract extension for a confidential program in January 2025, which the company mentioned was pending during its third quarter 2024 earnings call.

- U.S. private security contractors will soon begin operating a crucial Gaza checkpoint as part of a multinational force, marking a significant shift in U.S. involvement in the region.

- Thales and Leonardo SpA’s joint venture will integrate a satellite for a mission to measure Earth’s emissions using NASA’s SBG-TIR satellite and the Italian Space Agency’s VIS-NIR camera.

Threats

- Cisco CEO Chuck Robbins believes that growing geopolitical tensions are driving a global trend towards data sovereignty. This means countries are increasingly demanding that data be stored and processed within their own borders, making it more complex for businesses like Cisco to operate internationally.

- Western intelligence reports that two Iranian cargo ships are expected to transport a crucial chemical for missile propellant from China to Iran in the coming weeks.

- Government-services stocks fell due to investor concerns over CACI International’s quarterly bookings, which dropped 45% year-over-year, and broader uncertainty around contract renewals and potential spending cuts from Trump’s Department of Government Efficiency (DOGE) initiative.

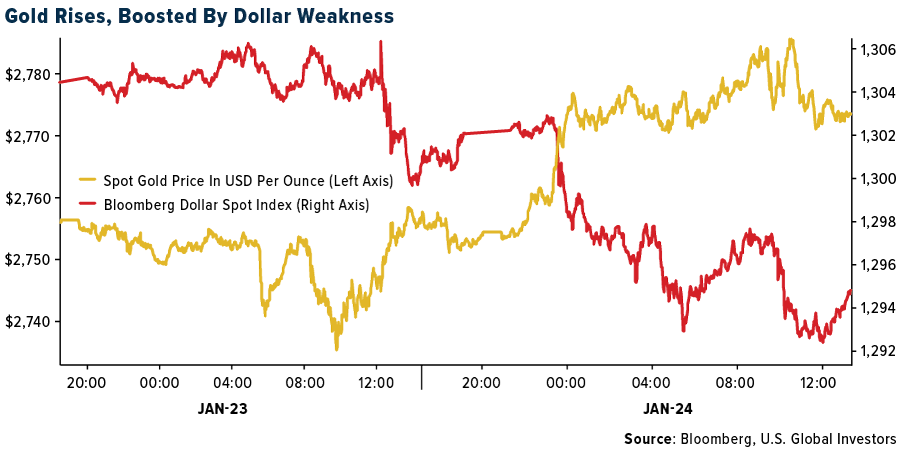

Gold Market

This week gold futures closed the week at $2,805.40, up $30.40 per ounce, or 1.10%. Gold stocks, as measured by the NYSE Arca Gold Miners Index, ended the week higher by 3.26%. The S&P/TSX Venture Index came in up 0.80%. The U.S. Trade-Weighted Dollar tumbled 1.74%.

Strengths

- The best performing precious metal for the week was palladium, up 4.18%, which may have outperformed on certain incentives for EV growth being removed from with the incoming administration. Precious metals refiner Heraeus noted that “tariff concerns have in the precious metals markets, as gold, silver, and platinum have all been affected.” On Friday, President Trump softened his stance on China tariffs—perhaps as a negotiation tactic. Nevertheless, the dollar weakened, and gold prices rose.

- K92’s production in 2025 is expected to be 160,000 to 185,000 ounces gold equivalent, increasing from the 2024 production of 149,515 ounces. Additionally, all-in sustaining costs (AISC) of $1,460-$1,560 per ounce gold are expected for 2025, according to Bloomberg.

- G Mining Ventures projects a strong 2025 performance, with the Tocantinzinho Gold Mine targeting annual production of 175,000 to 200,000 ounces of gold at competitive costs, supported by efficient operations and advanced technologies. Their strategic investments in exploration and development at Oko West and Gurupi position the company for long-term growth

Weaknesses

- The worst performing precious metal for the week was silver, down 0.16%. Tax issues continue to dog certain jurisdictions—Mali being a recent example. Meanwhile, Rio Tinto has offered $295 million to the Mongolian government to settle a long-running tax dispute over the Oyu Tolgoi copper mine. This move could potentially clear the way for a merger with Glencore, as reported by Bloomberg.

- Hochschild Mining shares plunged 21% for the week. The mining company said the cost of producing gold and silver this year will be higher than previously guided, according to analysts and Bloomberg.

- B2Gold missed on earnings and followed up with a convertible senior unsecured note offering due 2030 in an aggregate principal amount of US$350 million. The Company intends to use the net proceeds from the offering to fund working capital requirements and for general corporate purposes. Additional capital had been expected and with the Mali shadow following the stock, it still has a negative return for the year versus some peers like Alamos Gold, with double digit gains.

Opportunities

- BMO Capital analyst Kevin O’Halloran has initiated coverage on Vizsla Silver with an outperform rating. Vizsla owns the Panuco property in Sinaloa, Mexico, which boasts an expected production profile of 15.2 million ounces per year of AgEq (silver equivalent), positioning it as one of the largest underground silver mines globally. The mine benefits from a relatively high average silver-equivalent grade of 350 grams per ton, with a front-loaded grade profile that supports a rapid expected payback period and boosts silver-equivalent production to 20.2 million ounces per year in the initial production years.

- Morgan Stanley strategists believe there are more investors looking to sell the dollar than expected and forecast a weaker U.S. currency by the end of the first quarter, despite the dollar’s current dominance. Potential catalysts for a dollar decline, including inflation data, Federal Reserve rate cuts, and trade policy developments.

- Saudi Arabia has already made some mining deals, including a 10% holding in Vale SA’s base metals unit and a pending deal for a stake in a copper and gold mining project in Pakistan and may even have an interest in Barrick Gold’s share of its 50% stake in Chile’s Zaldivar copper mine. Interestingly, foreign investors are more interested in accessing Saudi Arabia’s cash than investing in it. Despite touting $100 billion in local investment opportunities and $2.5 trillion in mineral resources, few major miners have committed to investing in Saudi Arabia, as reported by Bloomberg.

Threats

- Peru’s public safety crisis is worsening, eclipsing previous episodes, with the country’s Interior Minister and President blaming transnational criminal organizations for the chaos and violence. Peru is a major producer and exporting country of precious and base metals to world markets, and this could threaten supply chains. The government’s warning comes after months of protests and warnings from workers about a rise in extortion rackets, as reported by Bloomberg.

- Soaring precious metal prices are driving a gold rush in Brazil. Unfortunately, that surge in mining is being driven by illegal mining which is now dominated by drug gangs which usually use the cheapest gold extraction process available, being mercury. Brazil has tried to crack down on this activity, but the Amazon rainforest is so vast, such that operations continue.

- Bloomberg reported that Americans are now rolling over a larger share of their credit card debts despite high interest rates. Revolving card balances have accelerated to the highest level since 2012 and delinquency rates have risen, with 3.5% of card balances past due by 30 or more days. Pairing this data of an overstretched consumer with the recently released index of US consumer sentiment for January declined for the first time in 6-months, citing unemployment and potential tariffs’ impact on inflation.

U.S. Global Investors, Inc. is an investment adviser registered with the Securities and Exchange Commission (“SEC”). This does not mean that we are sponsored, recommended, or approved by the SEC, or that our abilities or qualifications in any respect have been passed upon by the SEC or any officer of the SEC.

This commentary should not be considered a solicitation or offering of any investment product. Certain materials in this commentary may contain dated information. The information provided was current at the time of publication. Some links above may be directed to third-party websites. U.S. Global Investors does not endorse all information supplied by these websites and is not responsible for their content. All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. The following securities mentioned in the article were held by one or more accounts managed by U.S. Global Investors as of (12/31/2024):

Tesla Inc.

United Airlines Holdings Inc.

K92 Mining Inc.

G Mining Ventures Corp.

Glencore PLC

Alamos Gold Inc.

Vizsla Silver Corp.

Barrick Gold Corp.

BHP Group Ltd.

Alcoa Corp.

United Airlines

Alaska Airlines

Airbus

American Airlines

Azul

Lufthansa

Boeing

LVMH

Richmont

Tesla

Christian Dior

Hermes

*The above-mentioned indices are not total returns. These returns reflect simple appreciation only and do not reflect dividend reinvestment.

The Dow Jones Industrial Average is a price-weighted average of 30 blue chip stocks that are generally leaders in their industry. The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies. The Nasdaq Composite Index is a capitalization-weighted index of all Nasdaq National Market and SmallCap stocks. The Russell 2000 Index® is a U.S. equity index measuring the performance of the 2,000 smallest companies in the Russell 3000®, a widely recognized small-cap index.

The Hang Seng Composite Index is a market capitalization-weighted index that comprises the top 200 companies listed on Stock Exchange of Hong Kong, based on average market cap for the 12 months. The Taiwan Stock Exchange Index is a capitalization-weighted index of all listed common shares traded on the Taiwan Stock Exchange. The Korea Stock Price Index is a capitalization-weighted index of all common shares and preferred shares on the Korean Stock Exchanges.

The Philadelphia Stock Exchange Gold and Silver Index (XAU) is a capitalization-weighted index that includes the leading companies involved in the mining of gold and silver. The U.S. Trade Weighted Dollar Index provides a general indication of the international value of the U.S. dollar. The S&P/TSX Canadian Gold Capped Sector Index is a modified capitalization-weighted index, whose equity weights are capped 25 percent and index constituents are derived from a subset stock pool of S&P/TSX Composite Index stocks. The NYSE Arca Gold Miners Index is a modified market capitalization weighted index comprised of publicly traded companies involved primarily in the mining for gold and silver. The S&P/TSX Venture Composite Index is a broad market indicator for the Canadian venture capital market. The index is market capitalization weighted and, at its inception, included 531 companies. A quarterly revision process is used to remove companies that comprise less than 0.05% of the weight of the index, and add companies whose weight, when included, will be greater than 0.05% of the index.

The S&P 500 Energy Index is a capitalization-weighted index that tracks the companies in the energy sector as a subset of the S&P 500. The S&P 500 Materials Index is a capitalization-weighted index that tracks the companies in the material sector as a subset of the S&P 500. The S&P 500 Financials Index is a capitalization-weighted index. The index was developed with a base level of 10 for the 1941-43 base period. The S&P 500 Industrials Index is a Materials Index is a capitalization-weighted index that tracks the companies in the industrial sector as a subset of the S&P 500. The S&P 500 Consumer Discretionary Index is a capitalization-weighted index that tracks the companies in the consumer discretionary sector as a subset of the S&P 500. The S&P 500 Information Technology Index is a capitalization-weighted index that tracks the companies in the information technology sector as a subset of the S&P 500. The S&P 500 Consumer Staples Index is a Materials Index is a capitalization-weighted index that tracks the companies in the consumer staples sector as a subset of the S&P 500. The S&P 500 Utilities Index is a capitalization-weighted index that tracks the companies in the utilities sector as a subset of the S&P 500. The S&P 500 Healthcare Index is a capitalization-weighted index that tracks the companies in the healthcare sector as a subset of the S&P 500. The S&P 500 Telecom Index is a Materials Index is a capitalization-weighted index that tracks the companies in the telecom sector as a subset of the S&P 500.

The Consumer Price Index (CPI) is one of the most widely recognized price measures for tracking the price of a market basket of goods and services purchased by individuals. The weights of components are based on consumer spending patterns. The Purchasing Manager’s Index is an indicator of the economic health of the manufacturing sector. The PMI index is based on five major indicators: new orders, inventory levels, production, supplier deliveries and the employment environment. Gross domestic product (GDP) is the monetary value of all the finished goods and services produced within a country’s borders in a specific time period, though GDP is usually calculated on an annual basis. It includes all private and public consumption, government outlays, investments and exports less imports that occur within a defined territory.

The S&P Global Luxury Index is comprised of 80 of the largest publicly traded companies engaged in the production or distribution of luxury goods or the provision of luxury services that meet specific investibility requirements.