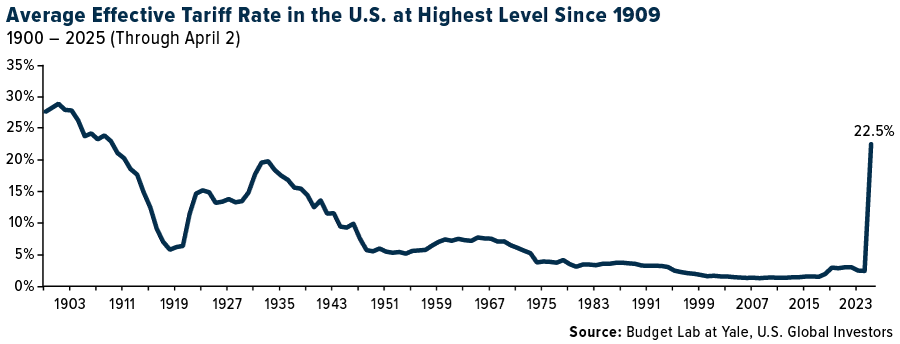

America’s Tariff Rate Hits the Highest Level Since 1909—And That’s Before Retaliation

Ouch.

Global markets are in freefall in response to President Donald Trump’s universal 10% tariff on all goods being imported into the U.S., with as many as 60 countries facing “reciprocal” tariffs on top of that.

When we combine all new tariffs in 2025 so far, including the raft of reciprocal tariffs announced on Wednesday, we’re looking at an average effective rate of 22.5%, according to Yale’s Budget Lab. That’s the highest such rate since 1909—the same year that President Howard Taft proposed the idea of an income tax to Congress.

History Shows Tariffs Often Backfire

As I pointed out to you last month, tariffs are a type of tax paid for by domestic import-export companies, who often pass the additional cost on to consumers. This can turbocharge domestic inflation.

Tariffs can also lead to full-blown trade wars, as we saw in the federal government’s previous attempts to raise revenue through the taxation of imported goods.

The Smoot-Hawley Tariff Act, enacted in 1930, is widely believed to have exacerbated the effects of the Great Depression, as global trade tanked a whopping 65%. A few decades prior, then-Representative William McKinley’s tariff act triggered retaliation from other nations, leading to higher prices for U.S. consumers. (If you need to brush up on your Smoot-Hawley history, I recommend the famous “Anyone? Anyone?” scene in 1986’s Ferris Bueller’s Day Off, which you can watch here.)

As was the case then, we’re already seeing retaliatory tariffs. China announced today that it will impose a 34% duty on all goods imported from the U.S.

Tesla Could Benefit from Its Domestic Supply Chain Advantage

If this weren’t enough, automobile imports face a steep 25% tariff. Trump claims he “couldn’t care less” if foreign manufacturers raise prices for U.S. consumers, and from the looks of it, they may need to—and significantly so, in some cases. Mitsubishi, for instance, will need to increase the price of its vehicles by more than 20% here in the U.S. to offset the new levy, according to estimates by CLSA.

The manufacturer expected to fare the best is Tesla, whose supply chain is well-integrated in the U.S.

More than 62% of the company’s facilities are located domestically, with approximately a quarter of its suppliers also based in the U.S. By comparison, fewer than half of Ford’s facilities worldwide are located in America.

This could be constructive for Tesla, whose stock has fallen by half since its peak in mid-December, making it one of the worst performers of the year so far. Due to political backlash against CEO Elon Musk, Tesla’s quarterly sales fell a significant 13% in the first quarter compared to the same period last year.

Why Falling Yields Could Help Homebuyers

When it comes to new home purchases, bad economic news could be good news. Mortgage rates generally track the yield on the 10-year Treasury, which has sharply dropped below 4% due to trade war fears. Bond yields generally fall when prices rise.

Granted, home prices in the U.S. are still hovering near record highs, but current homeowners may be able to refinance sooner than expected.

Gold Has Historically Shined When Real Yields Turn Negative

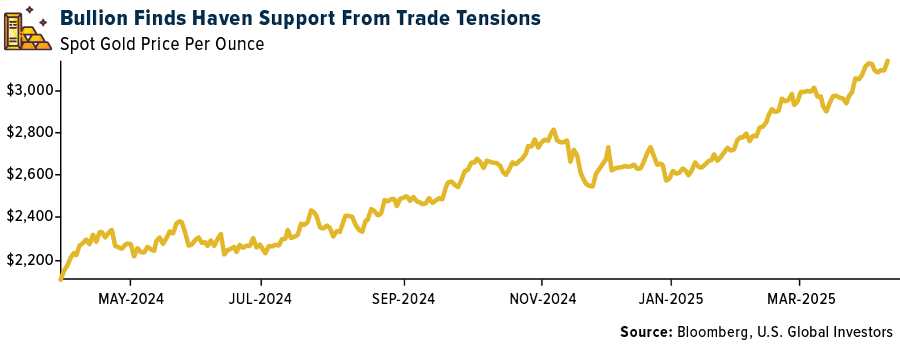

Lower yields are also good for gold. Because it’s a non-interest-bearing asset, gold starts to look more attractive as yields fall, especially when inflation remains historically elevated, as it is now. The 10-year yield is nominally 3.9% right now, but when you factor in the 2.8% headline inflation rate from February, the real yield is closer to 1%.

If yields fall further or if inflation jumps higher due to tariffs, we may end up with negative real yields, which have historically been bullish for gold prices.

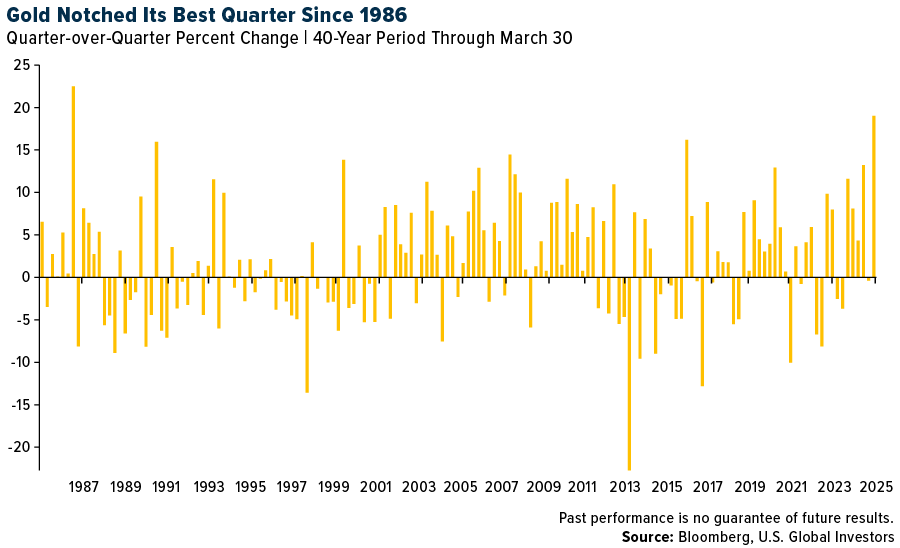

The yellow metal is off its highs today, trading down more than 2% as it’s swept up in the broader selloff. I believe investors should strongly consider buying these dips. Gold just notched its best quarter since 1986, ending the March quarter at $3,123 per ounce, and there could be further upside momentum.

Insights from the Oxford Club’s Investment U Conference

I believe the number one thing investors can do at this moment is to remain calm and not panic.

This week, I attended and spoke at the Oxford Club’s Investment U conference in Florida, where many presenters offered their own advice to those who may be worried right now, especially those nearing retirement age. Dr. Nomi Prins, founder of Prinsights Global, told the audience that now may not be the time to obsess over your 401(k). No need to look at it every minute.

My favorite piece of advice came from my friend Alexander Green, the chief investment strategist of the Oxford Club. Alex reminded the audience of America’s exceptionalism, which is no less true today than it was before markets started crashing. “If we’re no different from other Western democracies,” Alex said, “why were transformative companies like Apple, Alphabet, Facebook, Amazon, Microsoft, Twitter, Netflix, Snapchat, Instagram, Tesla, Uber, Crispr and NVIDIA—to name just a few—all found here?”

Alex is currently working on a book on America’s exceptionalism, which I’ll be sure to pick up once it’s released. You can read my two-part interview with him from 2017 here and here.

Warren Buffett, the perennial optimist, has always urged investors to look beyond the current crisis and to follow the trendlines, not the headlines. In his 2017 letter to Berkshire Hathaway shareholders, he wrote that “major declines” can “offer extraordinary opportunities to those who are not handicapped by debt.” He also paraphrased lines from the British poet Rudyard Kipling’s famous poem “If,” which I’ll end with today:

If you can keep your head when all about you are losing theirs…

If you can wait and not be tired by waiting…

If you can think—and not make thoughts your aim…

If you can trust yourself when all men doubt you…

Yours is the Earth and everything that’s in it.

You can listen to Oscar-winning actor Sir Michael Caine read Kipling’s poem by clicking here.

Index Summary

- The major market indices finished down this week. The Dow Jones Industrial Average lost 0.96%. The S&P 500 Stock Index fell 1.53%, while the Nasdaq Composite fell 2.59%. The Russell 2000 small capitalization index lost 1.64% this week.

- The Hang Seng Composite lost 0.83% this week; while Taiwan was down 2.73% and the KOSPI fell 3.22%.

- The 10-year Treasury bond yield was flat at 4.25%.

Airlines and Shipping

Strengths

- The best performing airline stock for the week was Aena, but down slightly by 0.6%. According to JP Morgan, early fares show pricing growth this summer: Estimated July and August fares show +8%/+1% for EasyJet, +7%/+7% for Ryanair, and -6%/-1% for Wizz. On average, it shows LCC fares +3%/+2% on early bookings for July and August.

- Container shipbuilding activity is slowing as a direct response to geopolitical uncertainties and potential trade policy changes, explains JP Morgan. Shippers are exercising caution in expanding their fleets, focusing instead on optimizing existing assets and enhancing operational efficiencies.

- Bombardier is the most impacted by potential tariffs following the tariff announcement, as the final completion of its aircraft occurs in Canada, and the U.S. accounted for 63% of the company’s revenues in 2023. RBC is therefore very positive about the announcement that exempts goods compliant with the USMCA from tariffs, which includes Bombardier aircraft.

Weaknesses

- The worst performing airline stock for the week was Sabre, down 29.7%. Goldman is lowering Delta Air Lines’ March quarter earnings per share (EPS) estimate to $0.30 (versus FactSet consensus of $0.48) and 2025 EPS to $5.25 (versus consensus of $7.14). Goldman is reducing its 2025-unit revenue (“RASM”) outlook materially, now expecting RASM to decline 1.4% year-over-year versus 2.0% growth previously.

- Air freight rates were down 2% this month in March and up 6% year-over-year. Global air cargo volumes and capacity were flat year-over-year in February, reports the IATA.

- Using Bank of America aggregated credit and debit card data as a proxy, February spend decelerated about 400 basis points (bps) from January while March has stayed at February levels.

Opportunities

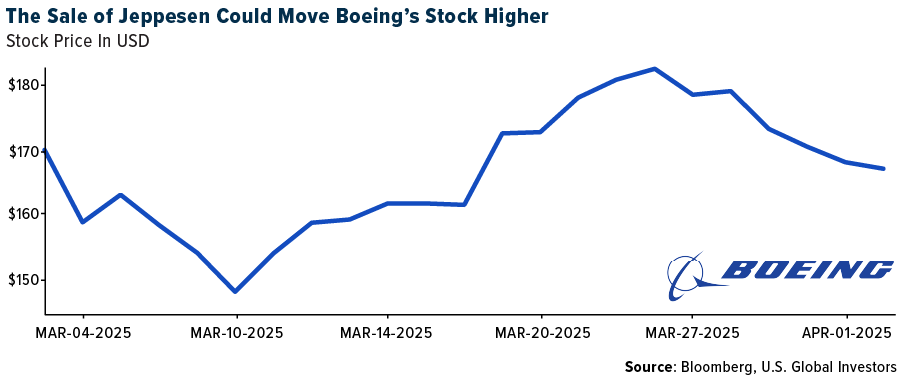

- Boeing will likely narrow the field of potential buyers of its Jeppesen navigation unit in the coming weeks ahead of final bids, Reuters reported, with the divestiture expected to raise $8-9 billion, explains JP Morgan.

- Maersk expects global containerized volume growth at 4% for 2025, higher than the prevailing expectations of 2.5-3% driven by the rising fragmentation of supply chains and the theme of near-shoring, which generates more volumes despite the trade war. Additionally, spot rates started to rebound last week, while contract rate negotiations so far suggest a greater than 10% rise year-over-year for key routes, according to JP Morgan.

- According to TD, American Airlines will see the most growth at LGA (+21%), ORD (+13%), and PHL (+10%), United Airlines at SFO (+10%), Southwest Airlines at BNA (+16%), LAS (+12%), and PHX (+12%). Alaska has the most growth scheduled at PDX (+22%), and JetBlue is increasing capacity at SJU (+20%) and BOS (+16%).

Threats

- China Southern acknowledged that competition remains intense from high-speed rail but hopes to stabilize pricing in 2025 with business demand slowly recovering. Bank of America sees first half of 2025 domestic passenger unit revenue declines of 2% year-over-year consistent with ongoing pricing pressure in the first quarter of this year.

- UBS expects muted air cargo/express demand over the next quarters with the risk skewed to the downside to declining volumes year-over-year. In the same time, the group expects air freight rates to decline year-over-year from May onwards while believing the DHL Express surcharges may not be replicated in full in the 2025 peak season.

- Raymond James’ revised airline estimates reflect the loss of corporate demand momentum and added weakness in off-peak leisure travel that should result in lower average fares for all. However, the group suspects greater mix shift pressure at airlines with greater business travel revenue.

Luxury Goods and International Markets

Strengths

- In March 2025, both the U.S. and China’s manufacturing sectors showed signs of improvement. China’s official manufacturing PMI rose to 50.5, its highest level in a year, driven by strong export orders and domestic demand, while the U.S. manufacturing PMI rebounded to 50.2, signaling a slight expansion after February’s decline. Europe also showed signs of improvement in its manufacturing PMI in March 2025, driven by a rebound in German manufacturing, although it remained below the growth threshold of 50.

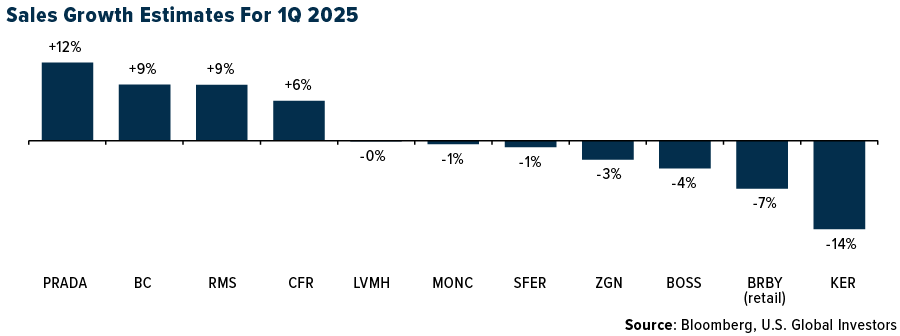

- Prada has recently expanded its presence in Manhattan with the opening of a new men’s boutique on Fifth Avenue. Meanwhile, in Asia, Prada has launched its first standalone restaurant, Mi Shang Prada Rong Zhai, in Shanghai, a culinary venture designed in collaboration with renowned director Wong Kar Wai, blending Italian and Chinese flavors in a culturally rich setting.

- Ananti, operator of entertainment facilities in South Korea, was the top-performing stock in the S&P Global Luxury sector, with a 13.0% increase over the past five days. South Korea, China, and Japan entered a trade agreement which could benefit companies like Ananti that operate in leisure and recreation sectors.

Weaknesses

- Tesla’s sales in the first quarter of 2025 experienced a significant year-over-year decline. The company delivered 336,681 vehicles globally, marking a 13% drop compared to the 386,810 units sold during the same period in 2024. This represents Tesla’s weakest quarterly sales performance in nearly three years.

- On Friday, China announced it would impose a 34% tariff on all imports from the United States starting April 10, in retaliation to U.S. President Donald Trump’s recent tariff increases on Chinese goods. This escalation in the trade war caused global equities to plunge further, following an already weak performance on Thursday.

- RH, a home furnishings retailer, was the worst-performing stock in the S&P Global Luxury Index, dropping by 38.6%. Its shares were negatively affected by the tariff announcement. The company sources around 70% of its products from Asia, with Vietnam and China—two of the highest-taxed countries—accounting for more than half of that total.

Opportunities

- The major luxury brands, which cater to affluent customers, are likely to cope better with the additional tariffs imposed on global markets this week. They benefit from stronger profit margins, providing them with a larger cushion to absorb higher costs. According to analysts at UBS AG, the difference between the price at which a company purchases and sells goods is approximately 70%.

- Tesla announced that it would deliver the first 1,000 Model 3 and Model Y cars directly to homes in India. These vehicles are being imported as completely built units from Tesla’s German facility, marking a significant milestone in the company’s expansion into one of the world’s largest automotive markets.

- Elon Musk is reportedly preparing to step down from his role as the head of the Department of Government Efficiency (DOGE) in the Trump administration to return to managing Tesla and his other businesses. Sources close to President Donald Trump indicated that Musk’s departure is expected in late May, coinciding with the end of his 130-day term as a special government employee, allowing him to focus more on his business including Tesla, which shares declined 40% year-to-date.

Threats

- American consumers are expected to face higher prices on a wide range of goods due to new tariffs announced by President Trump this week, including a 10% universal tariff and additional reciprocal tariffs targeting 60 trade partners. These measures, which affect imports on a wide spectrum of products will push inflation higher and sour consumer confidence as businesses pass the increased costs onto shoppers.

- President Trump implemented high tariffs on countries where many luxury brands and soft goods retailers produce their products. For instance, Vietnam faced a 46% tariff, impacting the production of many footwear items. As a result, shares of Adidas dropped by 10% on Thursday, and Nike saw a 12% decline. Lululemon was one of the hardest-hit stocks, falling 13%, as Vietnam accounts for 40% of its products. Other key production hubs for retailers, such as Cambodia and Bangladesh, faced tariffs of 49% and 37%, respectively.

- UBS projects weak sales growth for the luxury sector in the first quarter of 2025, estimating a modest 2% increase compared to 4% in the previous quarter. This slowdown highlights a growing disparity between successful and struggling brands within the industry. UBS analysts believe that the luxury sector’s recovery may take longer than initially anticipated, as demand fatigue and economic uncertainties weigh heavily on consumer spending.

Energy and Natural Resources

Strengths

- The best performing commodity for the week was iron ore, rising 1.84%. Iron ore prices strengthened this week, reaching a one-week high above $102 per ton amid robust steel demand in China and expectations of policy support from Beijing. However, the U.S. exclusion of steel and aluminum from reciprocal tariffs eased trade war concerns, though Goldman Sachs maintains a bearish outlook, anticipating prices could drop below $90 by year-end due to potential impacts on Chinese exports.

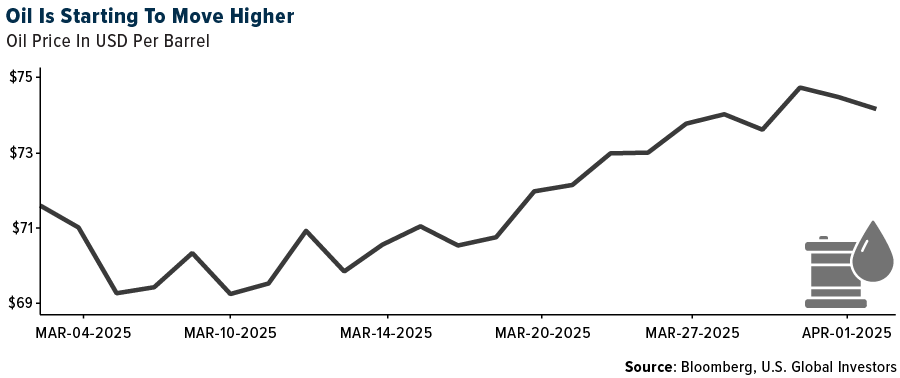

- Oil initially strengthened at the start of the week after President Donald Trump suggested that the U.S. may work to curtail crude shipments from Russia, the world’s third-largest producer and a major exporter. West Texas Intermediate rose almost 2% to top $70 a barrel, the highest in a month, while Brent’s June contract approached $74, reports Bloomberg.

- Copper also rose early in the week, before the latest round of tariffs were announced on Thursday, after data showed China’s manufacturing activity improved. Prices for the bellwether industrial metal added as much as 0.9% after Caixin’s manufacturing purchasing managers’ index for March hit 51.2, the strongest reading in four months, according to Bloomberg.

Weaknesses

- The worst performing commodity for the week was silver, dropping 14.82%. Yesterday, ETFs increased their gold holdings by 100,493 troy ounces, while reducing their silver holdings by 833,192 troy ounces, indicating a preference shift towards gold as its price remains elevated. Overall, this year, ETFs have significantly increased their gold holdings by 6.3%, reaching the highest level since September 2023, leaving silver in the dust – Bloomberg reports.

- U.S. crude oil production fell by 305,000 barrels per day (bpd) to 13.15 million bpd in January, the lowest level since February 2024, data from the U.S. Energy Information Administration showed.

- Spot steel prices inched lower over the past two weeks, with prices down 0.5% to $945 per ton. The slight decline has primarily been driven by weakening spot market activity as many service centers have stepped to the sidelines on demand concerns and have only been buying on an as-needed basis, explains BMO.

Opportunities

- Chile’s recovery from the lowest copper output levels in two decades appears to be running out of steam after the top-producing nation registered its worst month in two years. Production last month came in just below 400,000 metric tons, the lowest since February 2023, according to data released Monday by the National Statistics Institute.

- Indian refiners have rushed back to the market to seek crude supply after President Donald Trump’s threat of more penalties against Russia raised concerns over potential disruptions to oil flows. State-owned Bharat Petroleum Corp. and Hindustan Petroleum Corp. are seeking additional supplies for May arrival from regions such as the Middle East, North Sea and Mediterranean, according to Bloomberg.

- The U.S. and Democratic Republic of Congo are developing a minerals and security partnership where the U.S. will invest in Congo’s mining industry in exchange for security assistance against a rebel group. Massad Boulos will visit Rwanda, Kenya, and Uganda to discuss the conflict in eastern Congo and U.S. private sector investment in the region, according to Bloomberg.

Threats

- Korea Zinc accepted a 52% cut in smelting fees from Teck Resources, setting a 50-year low benchmark at $80 per ton for converting mined zinc into refined metal. This significant reduction is expected to pressure global zinc smelters, potentially leading to output cuts or production suspensions with Bloomberg noting producers like Trafigura Group and Glencore Plc are already reviewing assets.

- The North American uranium market is grinding to a halt as U.S. nuclear-power companies spooked by President Donald Trump’s tariff threats slow purchases and delay new contracts. U.S. utility purchases of the nuclear fuel dropped by half as the imposition of Trump’s 10% levy on Canadian energy exports approaches, according to the most recent data from pricing firm TradeTech.

- China has retaliated against the U.S. with commensurate tariffs on all American goods and export controls on rare earths, responding to Trump’s latest tariffs. These measures include a 34% tariff on all US. imports starting April 10, restrictions on exports of seven types of rare earths, and investigations into U.S. companies, reports Reuters.

Bitcoin and Digital Assets

Strengths

- According to CoinMarketCap, the best performing cryptocurrency this week was EOS, up 37.46%.

- Solana’s top DeFi exchange, Jupiter, has acquired digital collectibles platform DRiP Haus in an all-cash deal to expand into NFTs. The goal is to build a “Solana super app” that combines financial trading with digital culture despite the broader NFT market decline.

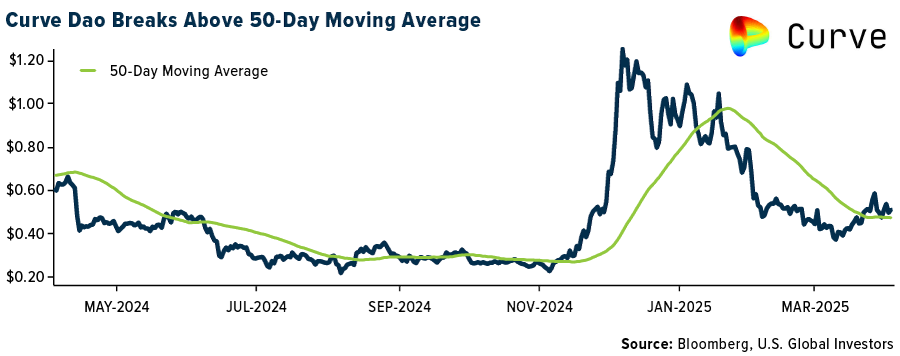

- Curve Dao has broken above its 50-day moving average, during a time which Bitcoin, Ethereum and Solana are all trading below their 50 day moving averages.

Weaknesses

- According to CoinMarketCap, the worst performing cryptocurrency this week was Pi, down 36.06%.

- North Korean hackers have stolen over $6 billion in cryptocurrency through increasingly sophisticated cyberattacks—like the $200 million WazirX heist—to fund Kim Jong Un’s regime and nuclear program. This continues to exploit weak cybersecurity, fake job applications, and global crypto infrastructure.

- An investor has filed a proposed class action lawsuit against Bakkt Holdings, alleging the company misled shareholders about the stability and diversity of its crypto services revenue. This was before disclosing the loss of major clients Webull and Bank of America, which together accounted for 73% of its top-line revenue.

Opportunities

- Donald Fintech companies are increasingly seeking bank charters to gain stable access to capital, expand services, and compete more effectively, despite the regulatory challenges and systemic risks this trend may introduce.

- Coinbase Institutional is set to launch regulated XRP futures on April 21, 2025. The launch would offer traders monthly, cash-settled contracts tied to XRP’s price, marking its latest move to expand crypto derivatives amid growing market interest and competition.

- BNY Mellon launched a blockchain-based accounting tool that posts real-time NAV data for tokenized funds, with BlackRock as its first client, marking a major step in linking traditional finance to digital assets amid growing regulatory support.

Threats

- Cloud computing firm Crusoe has exited Bitcoin mining by selling its crypto operations to NYDIG and is now pivoting fully to AI, focusing on building AI-optimized data centers to scale infrastructure and accelerate AI adoption.

- After resigning as New York governor, Andrew Cuomo advised offshore crypto exchange OKX on handling a U.S. federal investigation—promoting his ally Linda Lacewell to its board. The company later pleaded guilty to operating illegally in the U.S. and paid over $500 million in fines.

- Crypto exchange OKX has been fined €1.1 million by Malta’s financial watchdog for serious anti-money laundering violations, marking yet another regulatory setback following penalties in the U.S., Thailand, and previous Maltese actions.

Defense and Cybersecurity

Strengths

- Cognyte Software Ltd. reported a significant improvement in financial performance with an 11.9% increase in revenue to $350.6 million and a reduction in operating loss from $18.1 million to $5.1 million, indicating a positive impact on valuation and projections.

- General Dynamics Corporation achieved record-high revenue of $47.7 billion in 2024, with strong performance across all segments despite challenges. In addition, the company returned $3 billion to shareholders through share repurchases and dividends.

- The best performing stock in the XAR ETF this week was Loar Holdings, rising 5.26%, after reporting record fourth quarter and full-year 2024 results with strong organic growth, improved profitability, and an upward revision of its 2025 guidance.

Weaknesses

- Tech stocks—especially in networking, cybersecurity, and fiber optics—tumbled after President Trump’s new “reciprocal” tariffs sparked fears of widespread disruption to global supply chains, forcing companies to consider relocating manufacturing and prompting analysts to warn of declining demand across the software and services sectors.

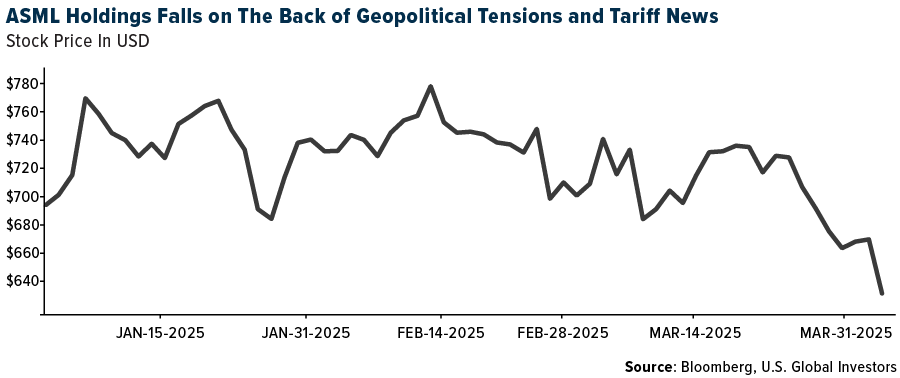

- ASML shares dropped to a one-year low after new U.S. tariffs on EU goods raised concerns about supply chain disruption and geopolitical risks. The company’s CEO warned that rising export controls could undermine global semiconductor collaboration despite ASML’s critical role in chip manufacturing.

- The worst performing stock in the XAR ETF this week was Boeing, falling 21.19%, after China retaliated against President Trump’s unexpectedly high tariffs, escalating trade tensions that jeopardized Boeing’s critical access to the Chinese aviation market and raised costs throughout its global supply chain.

Opportunities

- Lockheed Martin has partnered with Google to integrate advanced generative AI technologies into its AI Factory ecosystem, enhancing capabilities in national security and aerospace sectors.

- Kongsberg Gruppen has signed a 15-year agreement with the Norwegian Defence Materiel Agency to establish a national F-35 maintenance and upgrade facility at Rygge. This should enhance Norway’s defense capabilities, operational readiness, and local industry expertise.

- Chemring Group has secured a £251 million ($324 million) six-year U.K. missile defense contract, with its Roke unit leading research, development, and coordination of industry partners across ballistic and hypersonic missile capabilities.

Threats

- Israel has launched a new large-scale military operation in Gaza to seize extensive areas and dismantle Hamas infrastructure, ending a ceasefire and intensifying its offensive following Hamas’s October 2023 attack.

- Russia said the talks with the U.S. about the Ukraine war are going nowhere. They don’t agree with the current ceasefire proposal, and the Trump administration is clearly not happy about it.

- Trade wars pose a significant threat by increasing costs, disrupting global supply chains, and reducing access to key international markets, which can undermine competitiveness and long-term growth.

Gold Market

This week gold futures closed at $3,057.00, down $57.30 per ounce, or 1.84%. Gold stocks, as measured by the NYSE Arca Gold Miners Index, ended the week lower by 7.58%. The S&P/TSX Venture Index came in off 9.14%. The U.S. Trade-Weighted Dollar fell 1.06%.

Strengths

- The best performing precious metal for the week was gold, off 1.84%. Despite a temporary dip from record highs due to market pessimism over new tariffs, gold’s safe-haven status remains strong amid an increasingly uncertain global economic environment. With robust demand and central bank support, gold is poised to benefit from trade volatility, macroeconomic concerns, and geopolitical tensions, continuing its impressive performance this year.

- Gold hit a record at the start of the new quarter as a major escalation in U.S. President Donald Trump’s trade tariffs due this week heightened concerns about the global economy and fanned haven demand. Bullion neared $3,150 an ounce, on pace for a fourth day of gains. Gold initially plunged over 2% due to a risk-asset rout but has since pared back losses, as analysts believe its long-term outlook remains bullish, especially in a stagflation scenario. The recent tariffs are expected to heighten recession and inflation risks, which historically benefit gold.

- Gold traded at another record high early on Wednesday as the dollar and Treasury yields fell ahead of the implementation of fresh U.S. tariffs that threaten to slow the country’s economy, boosting safe-haven demand. Gold for June delivery was last seen up $14.60 to $3,160.60 per ounce, topping Monday’s previous record high of $3,150.30, reports Bloomberg.

Weaknesses

- The worst performing precious metal for the week was silver, down 14.82%. Yesterday, ETFs increased their gold holdings by 100,493 troy ounces, while reducing their silver holdings by 833,192 troy ounces, indicating a preference shift toward gold as its price remains elevated. Overall, this year, ETFs have significantly increased their gold holdings by 6.3%, reaching the highest level since September 2023, leaving silver in the dust – Bloomberg reports.

- SSR Mining production and cost guidance for 2025 was weaker than expected versus RBC forecasts and consensus estimates, with some impact from the timing of the close of the Cripple Creek & Victor transaction and ongoing cleanup, care and maintenance costs at Copler.

- Equinox announced it is indefinitely suspending operations at its Los Filos mine in Guerrero, Mexico, following the expiry of its land access agreement with the community of Carrizalillo on March 31, 2025, according to Canaccord.

Opportunities

- For the end of the month and quarter, we have seen a +A$718 per ounce move in the gold price in the last three months and this should translate into significant free cash flow (FCF) prints in April for the gold names that are able to deliver operationally, reports Canaccord.

- In a weakening market, the presence of eight precious metals names on IBD’s 50 highlights opportunity amidst uncertainty. Specifically, royalty companies like Wheaton Precious and Osisko are gaining favor for their limited capex and stable cash flows, awarding them a position in Investor Business Daily’s top 50 stocks.

- Endeavour Silver announced that it has entered into a definitive share purchase agreement to acquire all the outstanding shares of Compañia Minera Kolpa S.A. and its main producing asset located in Peru, the Huachocolpa Uno Mine, for a total consideration of $145 million, consisting of $80 million payable in cash and $65 million in EDR shares, according to CIBC.

Threats

- According to Raymond James, for Centerra in 2025, they continue to expect lower gold production and sales, as Oksut benefited from the sale of in-process inventory in 2024. They also expect gold production in the first quarter to be one of the weaker production quarters for the year at both Mt. Milligan and Oksut.

- Precious metals refiner Heraeus notes that “the tariffs that were confirmed last week on U.S. automotive imports are likely to crimp new vehicle production and sales and negatively impact U.S. automotive palladium demand this year.” In 2024, the U.S. imported more than 8 million new light vehicles.

- A massive arbitrage trade that has drawn tens of billions of dollars’ worth of gold and silver to the U.S. came to an abrupt halt with Wednesday’s announcement that precious metals would be exempt from Donald Trump’s sweeping tariffs. For several months, prices in New York have traded at large and unusual premiums to global benchmarks as traders weighed the risk that precious metals could be caught up in tariffs. The differential created an incentive for banks and traders to load planes and ships with so much bullion that it distorted U.S. trade data in the process, Bloomberg reports.

U.S. Global Investors, Inc. is an investment adviser registered with the Securities and Exchange Commission (“SEC”). This does not mean that we are sponsored, recommended, or approved by the SEC, or that our abilities or qualifications in any respect have been passed upon by the SEC or any officer of the SEC.

This commentary should not be considered a solicitation or offering of any investment product. Certain materials in this commentary may contain dated information. The information provided was current at the time of publication. Some links above may be directed to third-party websites. U.S. Global Investors does not endorse all information supplied by these websites and is not responsible for their content. All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. The following securities mentioned in the article were held by one or more accounts managed by U.S. Global Investors as of (03/31/2025):

EasyJet

Ryanair Holdings

Bombardier

Delta Air Lines

Boeing

Maersk

Alaska Airlines

American Airlines

United Airlines

Southwest Airlines

JetBlue

Teck Resources

Glencore Plc

Wheaton Precious Metals

Osisko Gold Royalties

Endeavour Silver

Centerra

Tesla Inc.

Mercedes-Benz Group AG

Volkswagen AG

Alphabet Inc.

Microsoft Corp.

NVIDIA Corp.

Adidas

Tesla

Lululemon

Prada

Cognyte Software

General Dynamics

Kongsberg

Chemring Group

*The above-mentioned indices are not total returns. These returns reflect simple appreciation only and do not reflect dividend reinvestment.

The Dow Jones Industrial Average is a price-weighted average of 30 blue chip stocks that are generally leaders in their industry. The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies. The Nasdaq Composite Index is a capitalization-weighted index of all Nasdaq National Market and SmallCap stocks. The Russell 2000 Index® is a U.S. equity index measuring the performance of the 2,000 smallest companies in the Russell 3000®, a widely recognized small-cap index.

The Hang Seng Composite Index is a market capitalization-weighted index that comprises the top 200 companies listed on Stock Exchange of Hong Kong, based on average market cap for the 12 months. The Taiwan Stock Exchange Index is a capitalization-weighted index of all listed common shares traded on the Taiwan Stock Exchange. The Korea Stock Price Index is a capitalization-weighted index of all common shares and preferred shares on the Korean Stock Exchanges.

The Philadelphia Stock Exchange Gold and Silver Index (XAU) is a capitalization-weighted index that includes the leading companies involved in the mining of gold and silver. The U.S. Trade Weighted Dollar Index provides a general indication of the international value of the U.S. dollar. The S&P/TSX Canadian Gold Capped Sector Index is a modified capitalization-weighted index, whose equity weights are capped 25 percent and index constituents are derived from a subset stock pool of S&P/TSX Composite Index stocks. The NYSE Arca Gold Miners Index is a modified market capitalization weighted index comprised of publicly traded companies involved primarily in the mining for gold and silver. The S&P/TSX Venture Composite Index is a broad market indicator for the Canadian venture capital market. The index is market capitalization weighted and, at its inception, included 531 companies. A quarterly revision process is used to remove companies that comprise less than 0.05% of the weight of the index, and add companies whose weight, when included, will be greater than 0.05% of the index.

The S&P 500 Energy Index is a capitalization-weighted index that tracks the companies in the energy sector as a subset of the S&P 500. The S&P 500 Materials Index is a capitalization-weighted index that tracks the companies in the material sector as a subset of the S&P 500. The S&P 500 Financials Index is a capitalization-weighted index. The index was developed with a base level of 10 for the 1941-43 base period. The S&P 500 Industrials Index is a Materials Index is a capitalization-weighted index that tracks the companies in the industrial sector as a subset of the S&P 500. The S&P 500 Consumer Discretionary Index is a capitalization-weighted index that tracks the companies in the consumer discretionary sector as a subset of the S&P 500. The S&P 500 Information Technology Index is a capitalization-weighted index that tracks the companies in the information technology sector as a subset of the S&P 500. The S&P 500 Consumer Staples Index is a Materials Index is a capitalization-weighted index that tracks the companies in the consumer staples sector as a subset of the S&P 500. The S&P 500 Utilities Index is a capitalization-weighted index that tracks the companies in the utilities sector as a subset of the S&P 500. The S&P 500 Healthcare Index is a capitalization-weighted index that tracks the companies in the healthcare sector as a subset of the S&P 500. The S&P 500 Telecom Index is a Materials Index is a capitalization-weighted index that tracks the companies in the telecom sector as a subset of the S&P 500.

The Consumer Price Index (CPI) is one of the most widely recognized price measures for tracking the price of a market basket of goods and services purchased by individuals. The weights of components are based on consumer spending patterns. The Purchasing Manager’s Index is an indicator of the economic health of the manufacturing sector. The PMI index is based on five major indicators: new orders, inventory levels, production, supplier deliveries and the employment environment. Gross domestic product (GDP) is the monetary value of all the finished goods and services produced within a country’s borders in a specific time period, though GDP is usually calculated on an annual basis. It includes all private and public consumption, government outlays, investments and exports less imports that occur within a defined territory.

The S&P Global Luxury Index is comprised of 80 of the largest publicly traded companies engaged in the production or distribution of luxury goods or the provision of luxury services that meet specific investibility requirements.