Airlines to See $30 Billion Profit on Record Passenger Numbers: IATA

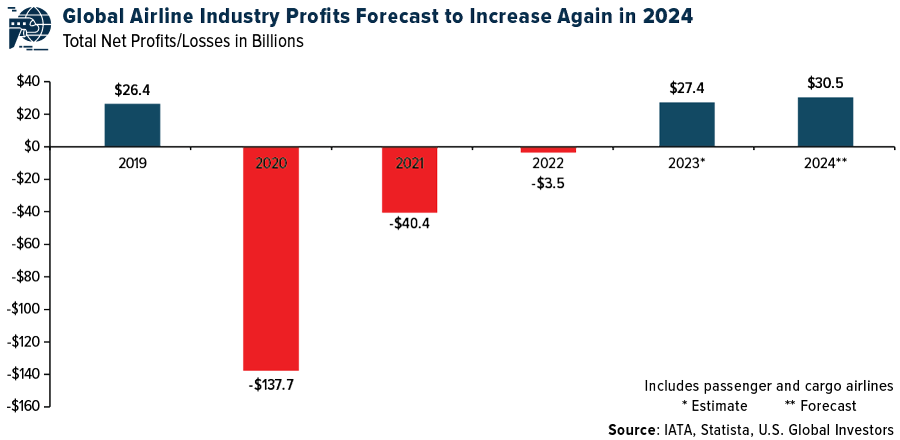

his week, the International Air Transport Association (IATA) significantly upgraded its profitability projections for airlines in 2024. The trade group now expects net profits to reach $30.5 billion, an increase from $27.4 billion in 2023.

This surge in profitability is accompanied by record-high traveler numbers and revenues. A fresh record number of passengers is expected to fly in the U.S. this summer. For the full year, the total global number of travelers is forecasted to reach approximately 5 billion, with revenues projected to soar to $996 billion, a 9.7% increase from 2023.

The recovery in travel has been nothing short of remarkable. Domestic travel bounced back to pre-pandemic levels by the spring of 2023, while international routes have recently surpassed 2019 numbers. The IATA now expects the number of world passengers to grow by an average of 3.8% per year over the next 20 years, resulting in over 4 billion additional passenger journeys by 2043.

“The human need to fly has never been stronger,” said Willie Walsh, IATA’s Director General.

Business Travel Spending Set to Surpass $1.5 Trillion this Year

While leisure travel has been leading the recovery, business travel is steadily gaining momentum, albeit at a slower rate. A Morning Consult survey found that only 10% of U.S. adults had traveled domestically for work in March 2024.

The trend appears to be headed in the right direction, however, with corporations prioritizing domestic trips over long-haul international travel. The Global Business Travel Association (GBTA) predicts global business travel spending will surpass $1.5 trillion in 2024, up from $1.02 trillion in 2022.

Regarding the hotel market, investors are optimistic, but forecasts are being downgraded. Profitability still lags pre-pandemic levels. Earlier this week, STR and Tourism Economics revised down their 2024-2025 U.S. hotel forecast, reflecting lower-than-expected performance in early 2024 and reduced growth projections for the rest of the year.

Domestic Travel Spending in China

Another exciting development is the revival of Chinese outbound travel. The World Travel & Tourism Council (WTTC) predicts that China’s travel and tourism sector will contribute a record-breaking 12.62 trillion yuan ($1.7 trillion) to the country’s economy by the end of this year.

Domestic travel spending in China is also expected to reach new heights, providing a significant boost to the luxury market. As I’ve shared with you before, Chinese shoppers were major luxury-goods spenders before the pandemic. These shoppers are gradually returning, with domestic luxury spending up by 50%, according to Bloomberg Intelligence. The resurgence is encouraging for long-term luxury investments, both in mainland China and Europe.

Services See a Marked Improvement

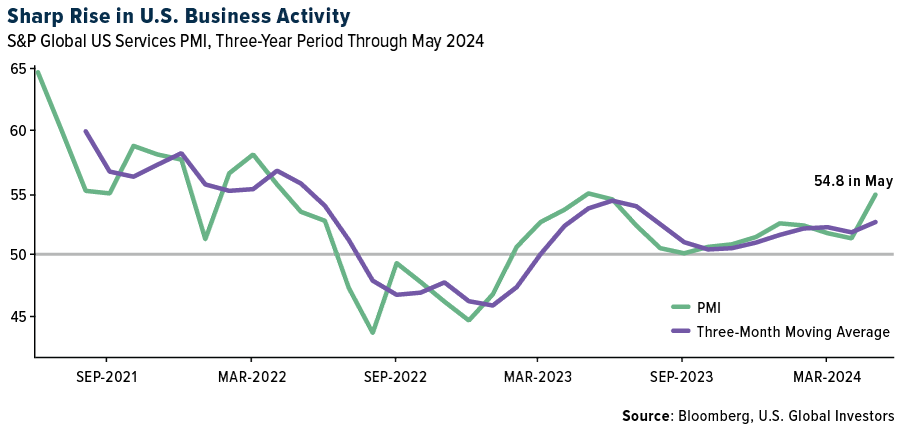

The airline industry’s recovery is part of a broader positive trend in the services sector. The S&P Global US Services PMI, which includes the airline industry, rose to a one-year high of 54.8 in May, accelerating past its three-month moving average. This points to a marked expansion in services activity, reflecting strong consumer demand and business confidence.

The airline industry presents a unique blend of recovery and growth opportunities. I believe the group is well-positioned for sustained growth, with strong profitability projections, an ongoing recovery in both leisure and business travel and positive market dynamics. The rebound in Chinese travel and its impact on the luxury market further supports the sector.

Here are the safest airlines in the world for 2024… watch the video!

Index Summary

- The major market indices finished up this week. The Dow Jones Industrial Average gained 0.29%. The S&P 500 Stock Index rose 1.32%, while the Nasdaq Composite climbed 2.38%. The Russell 2000 small capitalization index lost 2.10% this week.

- The Hang Seng Composite gained 0.62% this week. The KOSPI rose 0.83%.

- The 10-year Treasury bond yield fell 7 basis points to 4.43%.

Airlines and Shipping

Strengths

- The best performing airline stock for the week was Expedia, up 8.8%. In a recent interview, Korean Air Chairman and CEO Cho Won-Tae said that the airline is currently deciding between Boeing’s 787 Dreamliner and additional A350s, with the decision more likely to be the 787, as he notes that Boeing is a strong company, and he believes in its management.

- JPMorgan notes that with the Red Sea crisis continuing, current tanker capacity remains constrained, supporting the recent pickup in the Baltic Clean Tanker Index. In addition, the bank says longer sailing distance (ton-miles) is the primary contribution (75-80%) to tanker demand growth in 2024 with OPEC+’s latest cuts extension until end-2024 to be offset by rising long-haul Atlantic-Asia crude trade.

- JetBlue provided a second quarter 2024 guidance update that noted demand trends were in-line with prior expectations, with implied earnings per share (EPS) moving higher on better operational performance (i.e., higher capacity production/lower non-fuel unit cost) and lower average fuel price.

Weaknesses

- The worst performing airline stock for the week was El AL, down -16.5%. Cirium suggests that Airbus delivered 51 aircraft in May. According to Reuters, the slowdown may be attributed to new production pressures due to parts shortages and labor challenges.

- Media reports suggest Ports of Auckland (POA) is currently consulting with major customers over proposed increases in port charges between CY25 and CY26. The changes, to name a few, include cargo tariff increasing at CPI+1%, peak container access fee up from $95 to $130/$175 in 2025/2026, as well as off-peak container access fee up from $40 to $75/$98 in 2025/2026.

- According to Bank of America, weak demand continued to plague the Chinese aviation industry during the slack season with domestic yields down 14% year-over-year in May. The weak pricing is despite strong industry discipline with airlines cutting seats where demand is weak, shown through improving seat loads.

Opportunities

- According to Terra, at the IATA annual meeting, Azul’s CEO John Rogers said he is expecting the Brazilian government to announce aid packages to airlines within 15 days. The government plan discussed so far was to use public funds as collateral for BNDES loans to companies in the sector.

- According to UBS, the Shanghai Containerized Freight Index (SCFI) is up sequentially 50% over the last five weeks. Several datapoints suggest the current backdrop may be favorable for further sequential rate increases in June. UBS sees K+N as the main beneficiary in an environment of higher ocean rates.

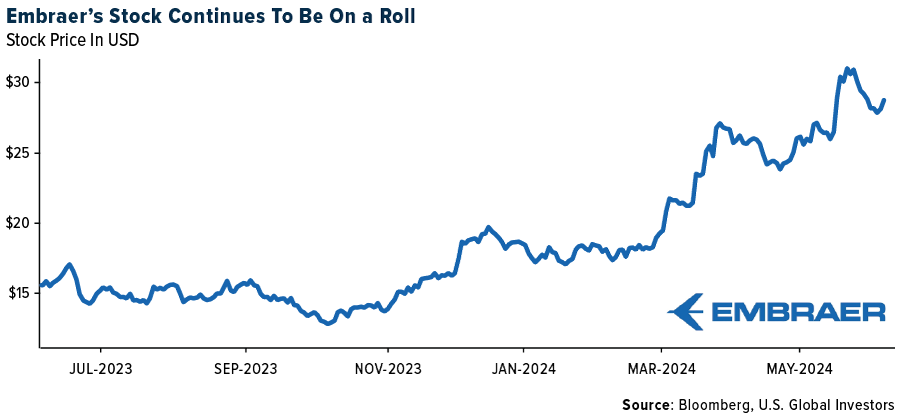

- Embraer announced that Mexico’s state-owned carrier Mexicana has ordered 20 E2 jets; ten E190-E2s and ten E195-E2s. Assuming each aircraft listing price at $75-84mn, this order should add around U$1.6 billion to Embraer’s backlog and make Mexicana the first E2 operator in Mexico, according to JPMorgan.

Threats

- According to the company’s CEO John Rodgerson, Azul has advanced in talks with Abra Group regarding a possible consolidation, however, the next steps should be on hold until the conclusion of GOL’s chapter 11. Any eventual agreement would have to go through the approval of GOL’s creditors and the justice system in the United States, which is involved in restructuring the airline.

- Sea Intelligence estimates 5.7% of the global container fleet is absorbed by port congestion versus 14% at the Covid peak and 2-4% historical average. Clarkson’s’ average sailing speed has been decelerating over recent months. High levels of cargo left behind are supportive for capacity utilization over the next weeks. Equipment shortages at several carriers stand in the range of 10-15% of all containers in use.

- Spirit Airlines announced that Brian McMenamy, Vice President and Controller, has been named as Interim CFO, effective June 14. McMenamy succeeds Scott Haralson, EVP and CFO, who is departing to become CFO of a company outside of the airline industry. The company continues to expect cost saving initiatives to benefit 2024 by over $75M with annualized run-rate savings estimated at over $100M.

Luxury Goods and International Markets

Strengths

- Lululemon reported an earnings beat, and the company raised its profit outlook for the full year. First-quarter sales were flat in America, while rising 25% in the international segment. Lululemon shares gained 5% on Thursday after the company released financial results after the close of the prior day.

- Industria de Diseño Textil, a Spanish fashion company best known for its brand Zara, reported an earnings beat as well. The company posted operating income of 1.6 billion Euros in the three months to April 30, up from 1.48 billion Euros, meeting analyst estimates. Sales increased by 7% in the first quarter of the financial year.

- Aston Martin, a car maker, was the best performing S&P Global Luxury stock, gaining 12.9% in the past five days. Shares gained after the new Aston Martin Vantage GT3 recorded its first international triumph just four months after being unveiled to the world at Silverstone, with an outstanding GT300 Class victory in Japan’s most prestigious endurance racing championship – the AUTOBACS SUPER GT Series. The success also marks the British ultra-luxury brand’s first-ever win in the series.

Weaknesses

- Germany, Europe’s largest economy, reported weaker industrial production, which disappointingly dropped 0.1% month-over-month in April, following a 0.4% decline in March. Year-over-year industrial production declined by 3.9%, below the expected correction of only 3%.

- Remy Cointreau shares underperformed in the past year, and the company said it will take another year to return to growth following a sharp downturn in the key U.S. market and China. Remy shares rose as much as 5.8% in early Paris trading after operating income for the year came in slightly above analyst estimates. The stock has lost 40% in the past 12 months.

- RealReal, an online marketplace for resale of luxury goods, was the worst performing S&P Global Luxury stock, losing 16.3% in the past five days. Shares declined after eBay announced increasing its assortments to some luxury items.

Opportunities

- Bloomberg’s luxury analysts predict that the market’s sales growth targets could climb beyond mid-single digits in 2024, supported by Chinese shoppers returning due to a bounce in travel. The most recent Bloomberg Intelligence travel survey confirmed a pickup in Chinese tourists’ long-haul plans from April to June. Overall tourism, which made up 40% of the luxury goods market in 2019 (pre-pandemic), could reach 32% in 2024 after 10% in 2022, Bloomberg reported.

- Bank of America turned more positive on the luxury sector after a recent correction since mid-March. Luxury stocks underperformed U.S. stocks represented by the S&P 1500 Index and European stocks represented by the STOXX 600, and the broker sees it as a buying opportunity. Ashley Wallace sees positive mid- to long-term perspectives, expecting the sector to grow by 9%.

- On Thursday, the ECB did not disappoint the market and cut rates as expected by 25 basis points following the Bank of Canada, which also cut rates by 25 basis points earlier in the week. The Federal Reserve Bank will decide whether to cut rates or not in the United States next week. The FOMC rate decision will be announced on June 12.

Threats

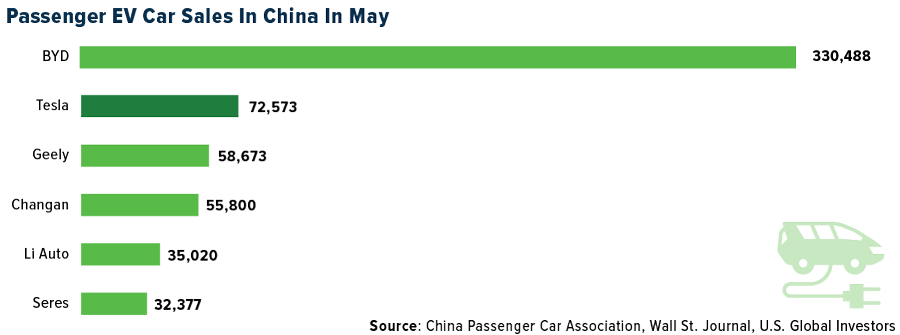

- Tesla’s sales in China rose in the past three months to 72,573 units in May, up 17% from a year earlier. Total sales of EVs are increasing in China; however, BYD sells far more EVs in China than Tesla does. BYD sold 330,488 units in May, marking the third straight month of more than 300,000 in car sales.

- eBay expanded its consignment service on Tuesday to include high-end watches, jewelry, and footwear. Among the brands being accepted by the program are Christian Louboutin, Jimmy Choo, and Louis Vuitton for shoes; Chanel, David Yurman, and Neil Lane for jewelry; and Breguet, Girard-Perregaux, and Jaeger-LeCoultre for timepieces. In recent years, eBay has been focusing its efforts on making high-end, pre-owned items easier to sell and buy on its platform. It has implemented programs like Certified by Brand and Authenticity Guarantee to ensure that users feel confident when buying and selling luxury items on the website. The second-hand market for luxury items is expanding.

- After 30 years with Chanel, including the last five years as artistic director, Virginie Viard will leave the company. Virginie Viard ascended to the role of artistic director in 2019 following the passing of Karl Lagerfeld. Under Viard’s leadership, Chanel experienced substantial financial growth. The company did not reveal her replacement.

Energy and Natural Resources

Strengths

- The best performing commodity for the week was natural gas, rising 13.72%. Europe’s gas prices jumped to the highest level this year following an outage at a gas processing plant in Norway, highlighting the increasingly pivotal nature of Norwegian supplies after the continent largely weaned itself off Russian imports. The price of the European benchmark TTF surged past €38 per megawatt hour on the Intercontinental Exchange, up more than 13%, according to UBS. Further price increases, at least in spot markets, to generate enough power to meet peak demand for electricity, are likely to be passed on to consumers in the Western United States, who are under an intense heat dome that is pushing temperatures up to 30 degrees hotter than normal.

- Compounding the strength of natural gas prices is the fact that drilling activity in the U.S. shale patch has dropped to its lowest level in two and a half years, as reported by Bloomberg. The move comes as operators are making good on their vow to deliver only subdued supply growth this year in the wake of near record low prices earlier this year.

- Consolidation activity amongst energy producers is always a wildcard, but the tidal wave of M&A unfolding in the United States is like a fever that has yet to run its course. U.S. deals appear aimed at achieving quality scale, a lower cost of capital, overhead cost savings—and bolstering resource depth or enhancing portfolio diversification, according to RBC.

Weaknesses

- The worst performing commodity for the week was uranium, as proxied by the Sprott Physical Uranium Trust, dropping 8.95%. On Friday morning, the change in nonfarm payrolls data came in much stronger than expected, dashing hopes of any near-term interest rate cuts by the Federal Reserve. The news was met with an across-the-board drop in copper and precious metal prices. Copper was off as much as 4.40%.

- Base metal futures are traded mainly on three exchanges: CME (Chicago Mercantile Exchange), LME (London Metals Exchange) and SHFE (Shanghai Futures Exchange). These have a key element in common: they all offer paper contracts that are physically settled. When metals inventories in any of these exchanges are low, contracts are at risk of a short squeeze. With copper surpluses unlikely to develop soon, Bank of America sees more frequent and volatile price swings.

- Oil tumbled after OPEC+ unexpectedly rolled out a plan to restore some production to the market this year, adding to the bearish momentum crude has been experiencing for months. Both benchmarks have been at their lowest prices since February. OPEC and its allies over the weekend agreed to start rolling back some production cuts starting in October, earlier than many market watchers had expected, according to Bloomberg. Later, the Saudi Energy Minister noted the hikes in production were condition upon market conditions, such as the current level of pricing.

Opportunities

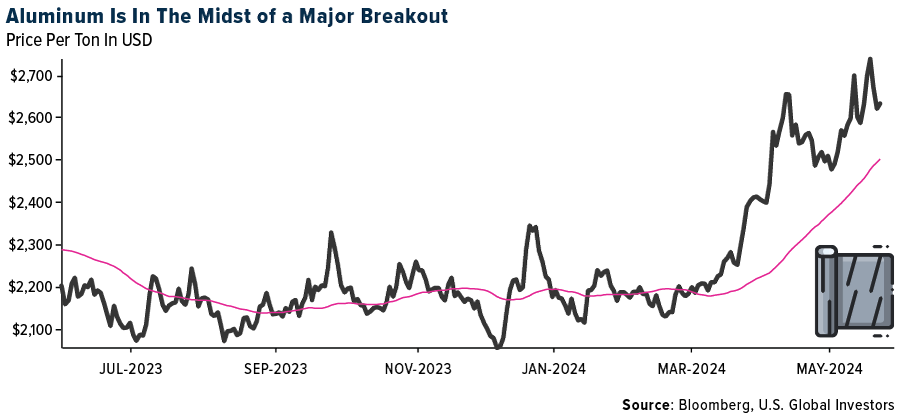

- Over the last two weeks, as copper prices have come under selling pressure from the recent peak of $11,000 per metric ton, JPMorgan has noticed a more significant rotation in investor interest towards aluminum. To some degree they think this shift helps explain aluminum’s outperformance this week despite a sharper pullback in copper amid profit-taking. As of writing, aluminum prices are up by 13% quarter-to-date (QTD), slightly outpacing copper at close to 11%.

- The Peruvian Minister of Energy and Mines, Rómulo Mucho, announced the approval of the technical report related to the $600 million Cerro Verde copper mine expansion project. Cerro Verde, located in the southwestern Arequipa region, is responsible for almost 19% of the copper and 34% of the molybdenum produced in Peru and operates one of the world’s largest concentrating facilities with an average milling rate of more than 400,000 metric tons of ore per day, according to Bank of America.

- RBC feels quality energy producers have gone on sale. Corporate consolidation amongst U.S. energy companies is high. And the new model energy producers have embraced global financial resilience with shareholder return optionality. Simply put, energy investing is no longer just about crude oil price volatility.

Threats

- According to JPMorgan, gasoline inventories had a counter-seasonal 2 million barrels per day build last week, driven by refinery throughputs reaching 17.1mm bpd, the highest level of runs for this time of year since 2018. Gasoline inventories now sit at 229mm bbl., 6% above levels from last year at this time and 4% above 2022’s levels.

- While OPEC+ extended all three layers of production cuts (2mb/d of group cuts through 2025, 1.66mb/d of voluntary cuts through 2025, 2.2mb/d of extra voluntary cuts through 2024Q3), Goldman sees the meeting as bearish because eight OPEC+ countries already signaled to gradually phase out the 2.2mb/d of extra voluntary cuts over 2024Q4-2025Q3, despite recent upside surprises to inventories. And as noted above, they believe current prices are too low.

- Fundamentally, stronger-than-expected Chinese aluminum demand year-to-date has been largely offset by higher supply, leaving global balances little changed on net. Moreover, ex-China supply is responding too with capacity restarts in Europe coming quicker than expected. Overall, JPMorgan sees a roughly balanced market this year with a 150kmt global deficit. In 2025, a stronger rebound in ex-Chinese demand is expected to take the reins as Chinese primary aluminum demand slows on the back of stronger growth in recycled metal, keeping global demand growth around 3% year-over-year.

Bitcoin and Digital Assets

Strengths

- Of the cryptocurrencies tracked by CoinMarketCap, the best performer for the week was Notcoin, rising 84.95%.

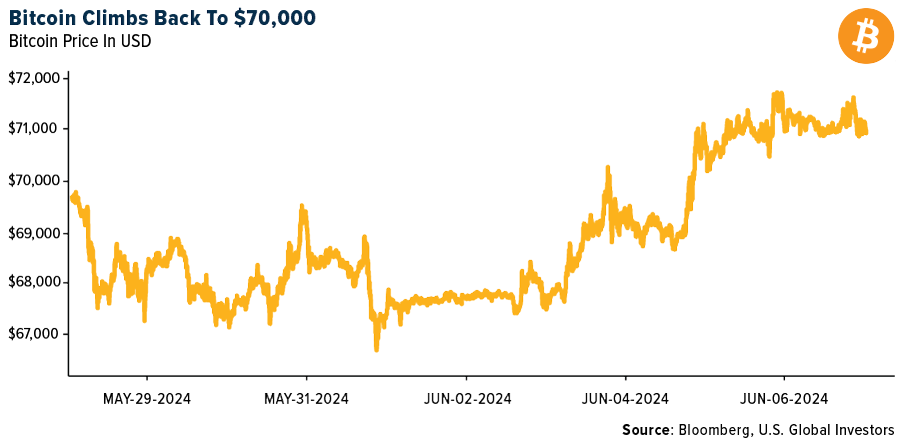

- A more positive U.S. political environment for digital assets will likely help propel Bitcoin to a record amount or even higher by the end of the year, according to Michael Novogratz. “If we take $73,000 in the next couple of weeks or so, we are going to end the year at $100,000 or higher” he commented during a Bloomberg radio interview.

- The U.S. is reclaiming its position as the undisputed top dog of cryptocurrency markets, reports Bloomberg. From a crop of record-shattering Bitcoin ETFs to more accommodating regulators, swelling political donations and a rising presidential contender in crypto backer Donald Trump, signs of a U.S. revival are suddenly everywhere.

Weaknesses

- Of the cryptocurrencies tracked by CoinMarketCap, the worst performer for the week was Beam, down 14.21%.

- A crypto investor known as “Bitcoin Jesus” has been released on bail in Spain, where he faces extradition to the U.S. on tax fraud charges. Roger Ve was allowed to leave jail May 17 after posting $163,000 in bail on the condition that he remains in Spain and hand in his passport, writes Bloomberg.

- MicroStrategy and its co-founder and Chairman Michael Saylor will pay $40 million to resolve a tax fraud lawsuit. The attorney general of Washington, DC, alleged the billionaire failed to pay more than $25 million in income taxes.

Opportunities

- Bitcoin briefly topped $71,000 this week, with crypto investment products seeing inflows for the fourth consecutive week and the latest GameStop frenzy driving memecoin speculation, writes Bloomberg.

- Kraken, one of the oldest cryptocurrency exchanges, is considering raising a final funding round ahead of a possible initial public offering after receiving inquiries from potential investors during the current digital-asset market rally, writes Bloomberg.

- Turkey isn’t planning to tax profits on stocks and cryptocurrency, the country’s Treasury and Finance Minister said. As reported by Bloomberg, the government is considering a “very limited” transaction tax on the assets.

Threats

- Japanese crypto exchange DMM Bitcoin plans to raise 50 billion yen from group companies and plow the funds into buying the largest digital asset to make customers whole after suffering a major hack. The outflow was equivalent to 4,503 Bitcoin or roughly $320 million at around 7:15am London time, writes Bloomberg.

- Crypto trading company NovaTechFX and crypto mining company AWS Mining defrauded investors out of more than $1 billion in cryptocurrency, according to a lawsuit filed in New York. A state investigation revealed that investors deposited over $1 billion of crypto to NovaTech from 2019 to 2023 but less than $26 million was actually traded, writes Bloomberg.

- U.S. lawmakers accused Nigeria of taking a Binance Holdings executive “hostage” and urged President Biden to help secure his release. A U.S. citizen, Gambaryan, is head of financial crime compliance at Binance and has been held at a prison in the Nigerian capital since April, writes Bloomberg.

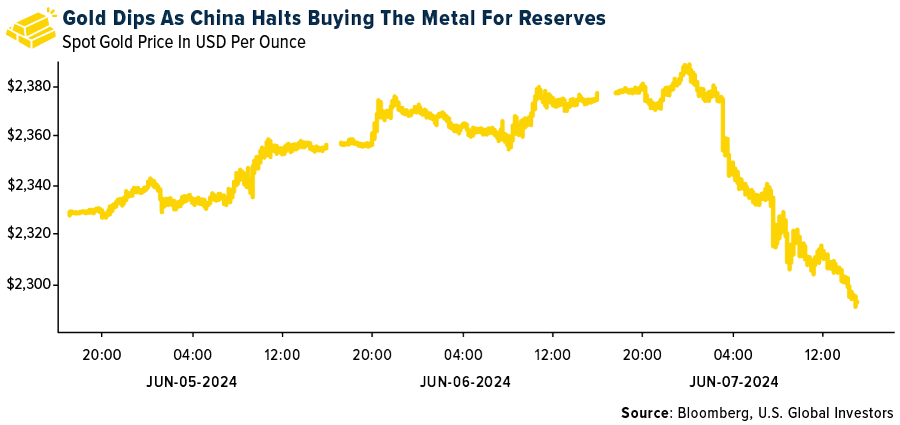

Gold Market

This week gold futures closed the week at $2,305.60, down $40.20 per ounce, or 1.71%. Gold stocks, as measured by the NYSE Arca Gold Miners Index, ended the week lower by 4.05%. The S&P/TSX Venture Index came in off 3.70%. The U.S. Trade-Weighted Dollar rose slightly gaining 0.23%.

Strengths

- The best performing precious metal for the week was palladium, up 0.56%. According to CIBC, Agnico highlighted operational improvements related to the recently commissioned Shaft 4, improvements related to mining methods, and high-grade opportunities in the South Mine Complex Zone. This has improved working conditions and operational efficiencies, which yielded increased production and reduced unit costs.

- Anglo American will list its 79% owned subsidiary Anglo-American Platinum (Amplats) in London to stem capital outflows when the group unbundles its shares. “What we would be looking to do is set up a listing on the UK stock exchange to help manage that potential flowback,” Anglo American CEO Duncan Wanblad told Business Live in an interview.

- According to UBS, gold equities look attractive into 2025 with their coverage trading on average <5x enterprise value-to-EBITDA (EV/EBITDA) and >10% free cash flow (FCF) yield. With 2025 gold consensus (US$2,183/oz) -7% vs spot, they look to earnings upgrades across the sector.

Weaknesses

- The worst performing precious metal for the week was platinum, down 6.76%. Two factors hit the gold and precious metal prices on Friday, first data released by The Peoples Bank of China showed that China’s central bank didn’t buy any gold last month, ending a massive buying spree that ran for 18 months and helped drive the precious metal’s rally as reported by Bloomberg. This took about $40 of the spot gold price overnight.

- Further on Friday morning, the change in nonfarm payrolls data came in much stronger than expected, knocking anther $20 off the gold price and dashing hopes of any near-term interest rate cuts by the Fed. By the close of the day, spot gold had sunk close to $88 or 3.7%

- De Beers will ditch a controversial experiment to sell lab grown diamond jewelry, ending a six-year program that broke one of its oldest taboos. While the company long held the technology to make synthetic gems, it always refused to sell them as jewelry, fearing they would undercut the allure of natural stones, according to Bloomberg.

Opportunities

- Bank of America feels a competing asset class is not necessarily detrimental to gold: the rise of Bitcoin reinforces the investment case for gold, which could lead investors to view a mix of gold and Bitcoin as required in portfolios. The report noted 71% of U.S. financial advisors have little to no allocation in gold (1% or less). From our perspective as a gold fund manager, If the younger generation of Bitcoin investors start buying gold to diversify their investments, they will discover that it is very hard to hack a physical asset, insuring the safety of wealth from electronic threats.

- According to Bank of America, silver, a highly conductive and reflective metal, is an integral component in generating electricity through the photovoltaic effect in solar. The accelerated adoption of PV technology drove a 300% increase in PV related silver demand from 51 million ounces (Moz) in 2013 to 194 Moz in 2023.

- According to BMO, B2Gold announced that it has entered into an agreement to sell a portfolio of 10 precious and base metals royalties to Sandbox Royalties Corp (which has been renamed to Versamet following the transaction). In exchange for the royalty package, B2Gold will receive 153.2M common shares at a price of C$0.80/share.

Threats

- Botswana president Mokgweetsi Masisi wanted a quick separation from Anglo American in terms of the UK group’s plans to sell its 85% stake in the diamond miner. Botswana has a 15% stake in De Beers through a joint venture held with Anglo American which earlier this month outlined plans to sell its long-held diamond investment.

- According to RBC, for Sibanye, the current employment disagreement revolves around the entitlement to the employee share option scheme. Based on the existing agreement, employees would be entitled to this benefit once the Kroondal acquisition is completed. Although an agreement between the parties can likely be reached, this disruption adds another layer of complexity to the investment case amid still lagging PGM prices.

- Calibre Mining reports that a geotechnical incident occurred on the west wall of the Limon Norte open pit in Nicaragua on May 25 that did not impact personnel or equipment, but requires a change to mine sequencing that will negatively impact Q2/24 gold production, according to Scotia.

Defense and Cybersecurity

Strengths

- Israel has confirmed the purchase of 25 F-35 fighter jets from the United States for around $3 billion, with deliveries starting in 2028. The country is enhancing its fleet to 75 and strengthening its strategic alliance amid ongoing regional tensions and international protests.

- Lockheed Martin and Aerostar inaugurated Europe’s first certified HIMARS maintenance center in Bacau, Romania, enhancing readiness and reducing operational costs for HIMARS rocket systems, creating jobs, and expanding Aerostar’s military and aerospace service capabilities.

- The best performing stock in the XAR ETF this week was Boeing, rising 7.11%. After overcoming thruster issues, Boeing’s Starliner successfully docked with the International Space Station, completing a crucial test flight.

Weaknesses

- The U.S. Air Force’s RQ-4B Global Hawk reconnaissance drone went off the radar during a mission over the Black Sea near Crimea, with no additional details provided by RIA Novosti or Flightradar, as of June 4. The incident follows previous drone activities in the region, including a March 2023 incident where a U.S. MQ-9 Reaper drone crashed into the Black Sea after a reported encounter with a Russian Su-27 fighter jet.

- Israeli Prime Minister Benjamin Netanyahu stated that there will be no permanent cease-fire with Hamas until Israel’s conditions, including the destruction of the militant group, are met. Temporary pauses to return hostages may be considered, despite President Biden’s proposal for a permanent truce.

- The worst performing stock in the XAR ETF this week was Astronics Corporation, falling 9.00%, on no headline news.

Opportunities

- Huntington Ingalls Industries has appointed Tim Brown and Terry Nichols to key leadership roles in Australia to advance the goals of the AUKUS trilateral partnership, focusing on nuclear-powered submarines and advanced defense technologies.

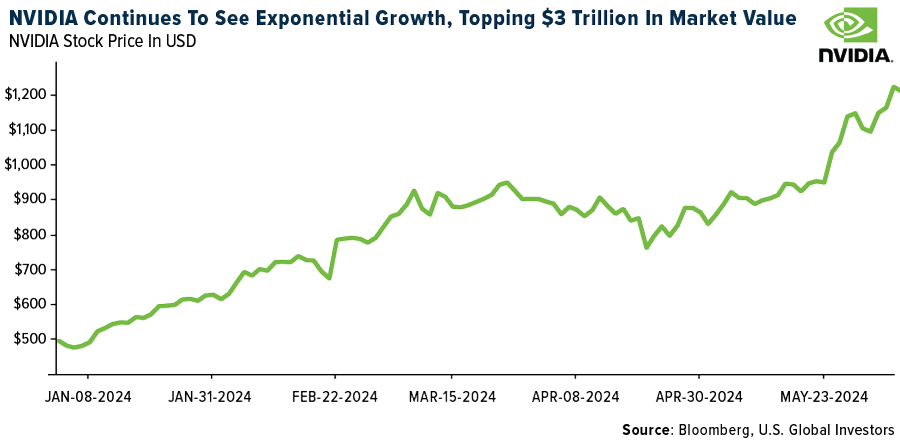

- Nvidia CEO Jensen Huang announced at Computex 2024 that the company will release its next-generation AI chip platform, Rubin, in 2026, featuring new GPUs, CPUs named Versa, and networking chips. It also has plans to launch a new family of AI chips annually, positioning Nvidia to dominate the AI chip market and lead a “robotic” future. In addition, Nvidia passed Apple this week in terms of market cap, briefly making it the world’s most valuable company.

- The global autonomous boats market, valued at nearly $1.2 billion in 2023, is projected to grow at a CAGR of 6.51% to reach $1.7 billion by 2028 and further expand to $2.4 billion by 2033. The growth is driven by increased seaborne trade, defense expenditures, and government support, despite potential cyber-attack threats, with significant growth opportunities in commercial and military segments, hardware and software components, diesel fuel and electric batteries, and various automation levels, (particularly in North America, the Middle East, and Western Europe).

Threats

- The Lebanese armed group Hezbollah recently released a video showing a drone-guided artillery strike on an Israeli Iron Dome air defense battery, raising serious concerns about Israel’s security. If these batteries are destroyed, it will create dangerous conditions for Israel by compromising the effectiveness of its highly touted air defense system and leaving northern regions vulnerable to attacks.

- Norway’s Chief of Defense, Eirik Kristoffersen, says NATO has a two-to-three-year window to bolster defenses before Russia can potentially launch a conventional attack, emphasizing the urgency to rebuild forces and stocks while supporting Ukraine.

- In response to NATO allowing Ukraine to use Western weapons against Russia, Vladimir Putin has threatened to deploy missiles within range of Britain and other Western allies, echoing the Cuban Missile Crisis.

U.S. Global Investors, Inc. is an investment adviser registered with the Securities and Exchange Commission (“SEC”). This does not mean that we are sponsored, recommended, or approved by the SEC, or that our abilities or qualifications in any respect have been passed upon by the SEC or any officer of the SEC.

This commentary should not be considered a solicitation or offering of any investment product. Certain materials in this commentary may contain dated information. The information provided was current at the time of publication. Some links above may be directed to third-party websites. U.S. Global Investors does not endorse all information supplied by these websites and is not responsible for their content. All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. The following securities mentioned in the article were held by one or more accounts managed by U.S. Global Investors as of (03/31/2024):

*The above-mentioned indices are not total returns. These returns reflect simple appreciation only and do not reflect dividend reinvestment.

The Dow Jones Industrial Average is a price-weighted average of 30 blue chip stocks that are generally leaders in their industry. The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies. The Nasdaq Composite Index is a capitalization-weighted index of all Nasdaq National Market and SmallCap stocks. The Russell 2000 Index® is a U.S. equity index measuring the performance of the 2,000 smallest companies in the Russell 3000®, a widely recognized small-cap index.

The Hang Seng Composite Index is a market capitalization-weighted index that comprises the top 200 companies listed on Stock Exchange of Hong Kong, based on average market cap for the 12 months. The Taiwan Stock Exchange Index is a capitalization-weighted index of all listed common shares traded on the Taiwan Stock Exchange. The Korea Stock Price Index is a capitalization-weighted index of all common shares and preferred shares on the Korean Stock Exchanges.

The Philadelphia Stock Exchange Gold and Silver Index (XAU) is a capitalization-weighted index that includes the leading companies involved in the mining of gold and silver. The U.S. Trade Weighted Dollar Index provides a general indication of the international value of the U.S. dollar. The S&P/TSX Canadian Gold Capped Sector Index is a modified capitalization-weighted index, whose equity weights are capped 25 percent and index constituents are derived from a subset stock pool of S&P/TSX Composite Index stocks. The NYSE Arca Gold Miners Index is a modified market capitalization weighted index comprised of publicly traded companies involved primarily in the mining for gold and silver. The S&P/TSX Venture Composite Index is a broad market indicator for the Canadian venture capital market. The index is market capitalization weighted and, at its inception, included 531 companies. A quarterly revision process is used to remove companies that comprise less than 0.05% of the weight of the index, and add companies whose weight, when included, will be greater than 0.05% of the index.

The S&P 500 Energy Index is a capitalization-weighted index that tracks the companies in the energy sector as a subset of the S&P 500. The S&P 500 Materials Index is a capitalization-weighted index that tracks the companies in the material sector as a subset of the S&P 500. The S&P 500 Financials Index is a capitalization-weighted index. The index was developed with a base level of 10 for the 1941-43 base period. The S&P 500 Industrials Index is a Materials Index is a capitalization-weighted index that tracks the companies in the industrial sector as a subset of the S&P 500. The S&P 500 Consumer Discretionary Index is a capitalization-weighted index that tracks the companies in the consumer discretionary sector as a subset of the S&P 500. The S&P 500 Information Technology Index is a capitalization-weighted index that tracks the companies in the information technology sector as a subset of the S&P 500. The S&P 500 Consumer Staples Index is a Materials Index is a capitalization-weighted index that tracks the companies in the consumer staples sector as a subset of the S&P 500. The S&P 500 Utilities Index is a capitalization-weighted index that tracks the companies in the utilities sector as a subset of the S&P 500. The S&P 500 Healthcare Index is a capitalization-weighted index that tracks the companies in the healthcare sector as a subset of the S&P 500. The S&P 500 Telecom Index is a Materials Index is a capitalization-weighted index that tracks the companies in the telecom sector as a subset of the S&P 500.

The Consumer Price Index (CPI) is one of the most widely recognized price measures for tracking the price of a market basket of goods and services purchased by individuals. The weights of components are based on consumer spending patterns. The Purchasing Manager’s Index is an indicator of the economic health of the manufacturing sector. The PMI index is based on five major indicators: new orders, inventory levels, production, supplier deliveries and the employment environment. Gross domestic product (GDP) is the monetary value of all the finished goods and services produced within a country’s borders in a specific time period, though GDP is usually calculated on an annual basis. It includes all private and public consumption, government outlays, investments and exports less imports that occur within a defined territory.

The S&P Global Luxury Index is comprised of 80 of the largest publicly traded companies engaged in the production or distribution of luxury goods or the provision of luxury services that meet specific investibility requirements.