Airline Industry Expected to Soar with Record Summer Travel

The airline industry is gearing up for what could be a record-breaking summer travel season, if forecasts turn out to be correct. Despite challenges such as the Boeing 737 MAX 9 grounding and aircraft delivery delays, airlines are reporting strong demand and growth, particularly in international markets. For investors, this could be a unique opportunity to gain exposure to a sector that’s poised for takeoff.

Not every carrier has reported results for the March quarter yet, but what I’ve seen has been encouraging. Delta Air Lines reported record quarterly revenue and expects continued strong momentum, targeting earnings of $6 to $7 per share and free cash flow of $3 to $4 billion for the full year. United Airlines, despite a pre-tax loss that’s largely attributed to the MAX 9 grounding, saw a $92 million improvement over the same quarter last year.

“Demand continued to be strong, and we see a record spring and summer travel season with our 11 highest sales says in our history all occurring this calendar year,” Delta CEO Ed Bastian said during the company’s earnings call.

Passenger Figures Off to a Record Start

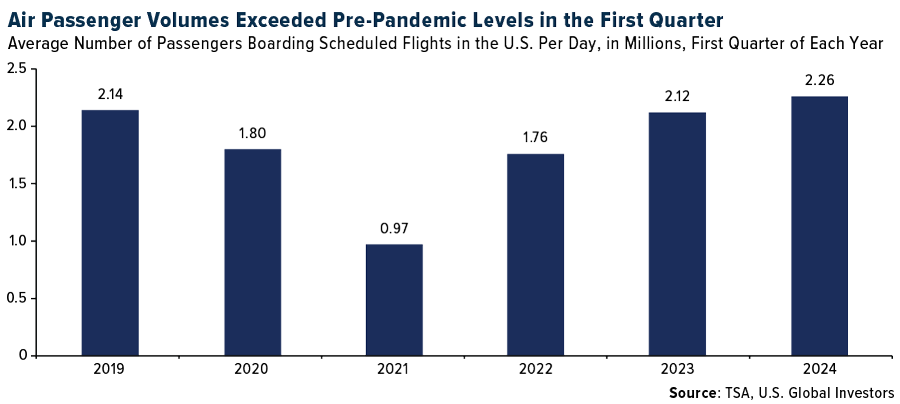

The big takeaway is that the U.S. economy and air travel remain healthy, with airlines experiencing record numbers of travelers. Checkpoint volumes provided by the Transportation Security Administration (TSA) are off to a record start in 2024, with carriers in the U.S. handling an average of 2.26 million passengers each day, a 5.6% increase over the same period in 2019.

This bodes well for the industry, as higher passenger volumes translate to increased revenue and potentially better margins.

International Travel Boom Despite Supply Constraints

International travel is driving the recovery, with U.S.-international air travel rising 15% year-over-year in the first three months of 2024, according to Airlines for America (A4A). This trend is also reflected in the latest data from Airports Council International (ACI), which shows that while domestic airport markets grew over 20% in 2023, international markets drove the recovery with a 36.5% growth rate.

The airline industry is not without its challenges. The global airline industry is facing a summer squeeze as travel demand is expected to surpass pre-pandemic levels while aircraft deliveries drop sharply due to production problems at Boeing and Airbus. Airlines are spending billions on repairs to keep flying older, less fuel-efficient jets and paying a premium to secure aircraft from lessors. This has led to increased costs and could potentially impact margins in the short term.

Why Airline Stocks Could Soar in the Coming Years

Nevertheless, I believe the long-term outlook for the airline industry remains positive. The shift toward hybrid work has created a new segment of travelers who have the time and money to spend on air travel. This trend, coupled with the pent-up demand for leisure travel, should help support the industry’s growth in the coming years.

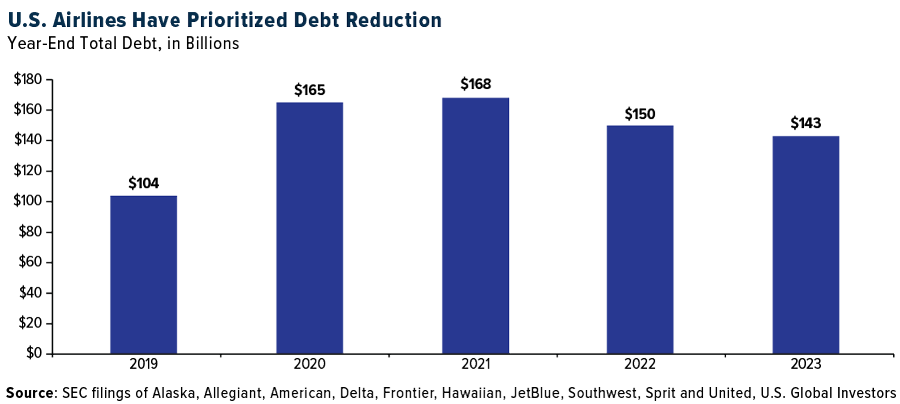

Additionally, airlines have prioritized debt reduction, which should help improve their balance sheets and credit ratings over time. At the end of 2023, the domestic industry reported a collective $143 billion in debt, an approximately 15% decrease from 2021 levels.

As we head into the summer travel season, I believe now may be the time for investors to consider adding exposure to this sector. With a long-term outlook and a diversified approach, investors can potentially benefit from the industry’s recovery and growth in the coming years.

Interested in how to get exposure? Email us at info@usfunds.com with the subject line “Invest in airlines”!

Past performance does not guarantee future results. All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. The following securities mentioned in the article were held by one or more accounts managed by U.S. Global Investors as of (3/30/2023): The Boeing Co., Airbus SE, Delta Air Lines Inc., United Airlines Holdings Inc.,