AI Takes Center Stage in Vegas as Nvidia Soars to New Heights

I’m fresh off the plane from Las Vegas—and no, I wasn’t hitting the slots, though the city’s Harry Reid International Airport sure hit the jackpot with a record-breaking 57.6 million passengers last year. The airport is on track to service even more people this year, a reflection of the travel boom that’s expected to set new passenger figures this summer.

The reason for my visit was Dell Technologies World 2024, which brought together many of the world’s leading business leaders and experts in technology and artificial intelligence (AI).

As you’re probably aware, AI is driving much of the news and stock market right now. Google Trends data shows that global searches for “AI” recently hit the highest level ever as more and more companies roll out AI products and position themselves for the ongoing AI race.

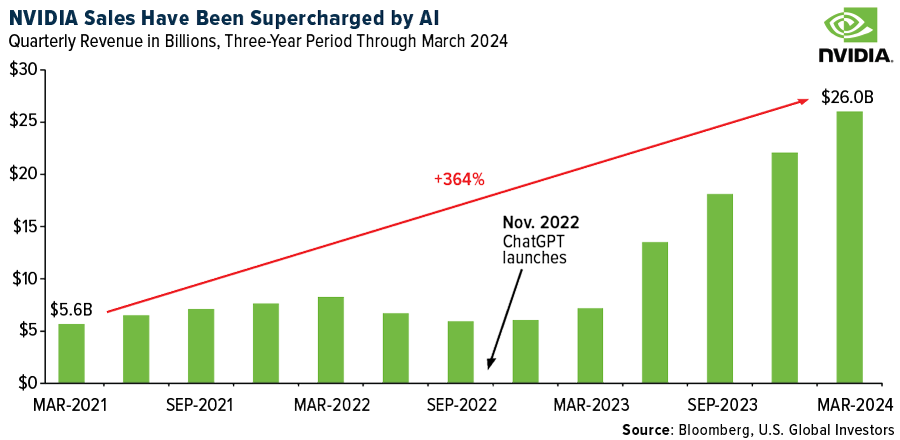

The man of the hour was Jensen Huang, CEO of NVIDIA, which just this week reported phenomenal March-quarter earnings. Revenues topped a record $26 billion, more than triple the amount from the same period a year earlier, while profits were up a staggering sevenfold.

The company expects sales to hit $28 billion in the current quarter as demand for its graphics processing units (GPUs)—ideal for use in AI applications—continues to accelerate.

Rewarding Shareholders After a Blistering Rally

Thanks to the whirlwind market rally, NVIDIA’s market cap now tops a mind-boggling $2.5 trillion, larger than the entire German stock market and making it the world’s third most valuable company after Microsoft and Apple.

With NVIDIA shares trading above $1,000, the company announced a quarterly dividend boost, from $0.04 per share to $0.10, an increase of 150%. It also announced a 10-for-1 stock split to make its stock more attractive to retail investors, following Walmart, which enacted a 3-for-1 split in February. Alphabet, Tesla and Amazon all split shares in 2022. Stock splits don’t change a stock’s fundamentals, but they’ve tended to result in near-term gains as additional investors pile in.

NVIDIA stock now turns up in more retail investors’ portfolios than any other name, according to recent analysis by Vanda Research. The stock represented 9.3% of investors’ portfolios on average, higher than other popular stocks and ETFs such as Apple, Tesla and the Invesco QQQ ETF.

Finally, NVIDIA just ranked number one on the 2024 Axios Harris Poll 100, which ranks the reputations of companies most on Americans’ minds. Tens of thousands of respondents are asked which two companies—in their opinion—stand out as having the best reputation. Rounding out the top five companies were 3M, Fidelity Investments, Sony and Adidas.

The Modern-Day Pickaxes of the Tech Industry

What does this all mean for us, the investors? I believe NVIDIA is just getting started. They already control a huge portion of the market, and they’ve built an entire ecosystem around their AI tools, locking in customers and driving sales. It’s like the gold rush, but instead of pickaxes, they’re slinging GPUs, purchased by everyone from Amazon to Dell to Tesla. During a recent earnings call, Tesla revealed that it had installed 35,000 of Nvidia’s H100 GPUs in its supercomputers.

Some people might compare NVIDIA to Tesla, and sure, there are similarities. Both companies are pushing the boundaries of technology and disrupting their industries.

As Jensen Huang himself pointed out this week, “Tesla is far ahead in self-driving cars, but every single car someday will have to have autonomous capability.” NVIDIA’s GPUs, much like those self-driving features, are poised to become ubiquitous.

Bitcoin’s Scarcity

Let’s not forget the Bitcoin angle. While NVIDIA might not be directly involved in crypto mining, the rise of AI is linked to the growth of blockchain technology. Both are driving demand for powerful computing, and both are shaking up traditional financial systems.

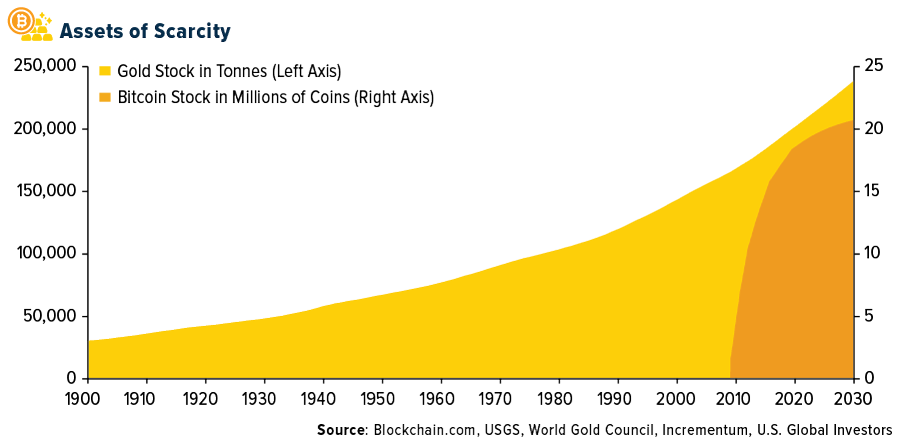

An unusual source for Bitcoin research is Incrementum’s annual In Gold We Trust report, which the Liechtenstein-based firm has been putting out since 2007. Analysts note that, like gold, Bitcoin is sought by investors mainly because it’s deliberately designed to be a scare asset, capped at 21 million coins.

Around 95% of all Bitcoin has been mined; within the next 10 years, this percentage is expected to reach 99%. “The scarcity could further solidify the perception of Bitcoin as a store of value and potentially lead to a reassessment of its value,” the group writes.

Gold Near an All-Time High

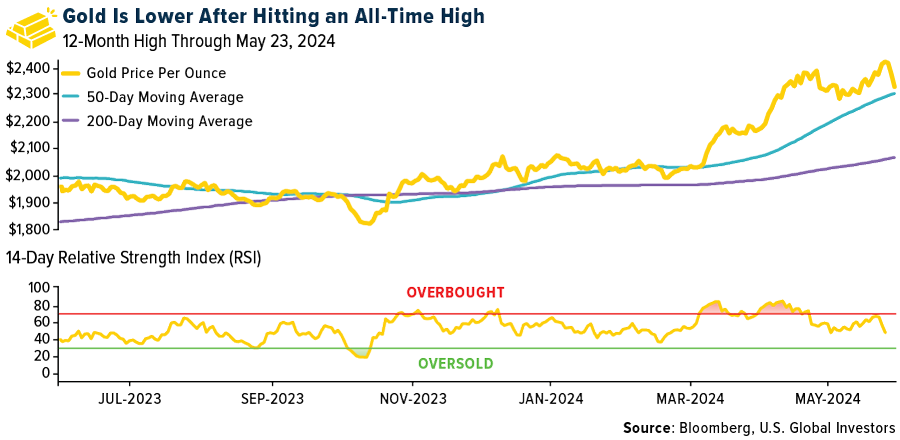

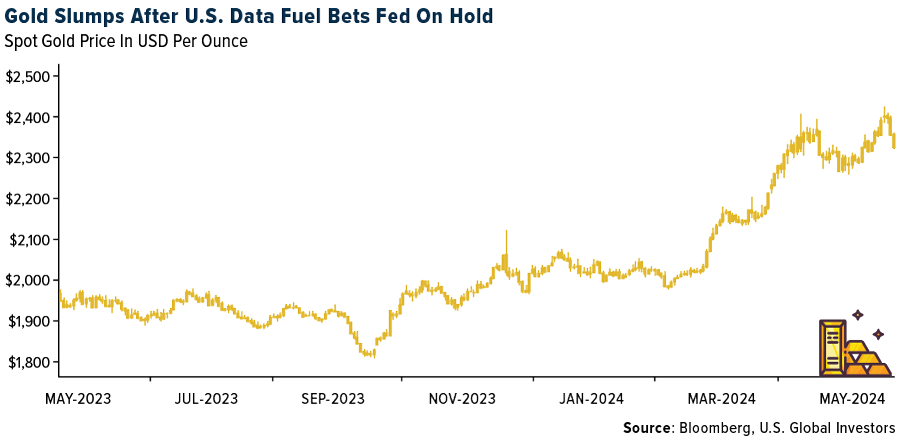

As Bitcoin’s analog cousin, gold has also been turning heads lately. The yellow metal is off its recent high of $2,450 an ounce, touched on Monday in intraday trading, as geopolitical uncertainty mounts and investors look ahead to a rate cut by the Federal Reserve. According to its 14-day relative strength index (RSI), gold looked overbought as recently as last month, but it’s since reverted to the mean.

As always, I recommend a 10% weighting in gold for more conservative investors, with 5% in physical gold (bars, coins, jewelry) and 5% in high-quality gold mining stocks, mutual funds and ETFs.

I also recommend Bitcoin, but since it’s more volatile than gold due to it being a nascent asset, older, more conservative investors may wish to speak to a financial advisor before participating.

Happy investing and stay bullish!

Index Summary

- The major market indices finished mixed this week. The Dow Jones Industrial Average lost 2.33%. The S&P 500 Stock Index was flat at 0.03%, while the Nasdaq Composite climbed 1.41%. The Russell 2000 small capitalization index lost 1.24% this week.

- The Hang Seng Composite lost 3.74% this week; while Taiwan was up 1.44% and the KOSPI fell 1.36%.

- The 10-year Treasury bond yield fell four basis points to 4.47%.

Airlines and Shipping

Strengths

- The best performing airline stock for the week was Bombardier, up 12.0%. Frontier unveiled sweeping changes to its product and customer service offerings. Key components include four different booking bundles, elimination of change fees for all but basic tickets, and an extension (May 17+) of flight credit expiration from three to 12 months, reports Raymond James.

- Oil tanker contracting has materially increased since the first half of 2022, with contracting stabilizing at the highest level since 2015. The order book remains low but is increasing. Bank of America can see an environment where orders remain high given the high vessel earnings, but the rate of order increase has decelerated, implying we may be near the peak.

- Shares of Wizz Air were up as the mid-point of fiscal year 2025 net income guidance was 11% above consensus, and management presented an upbeat outlook for summer 2024. With a fiscal year 2024 net income of €366m, Wizz met its guidance thanks to the significant benefit from supplier compensation, explains Bank of America.

Weaknesses

- The worst performing airline stock for the week was was Tongcheng Travel Holdings, down 17.5%. With the 787 model, Boeing just delivered two aircraft month-to-date, which falls short of the four delivered by mid-April, partly due to heat-exchanger issues, and the ongoing 787 investigation. The data also indicates that 787 deliveries will continue at a soft pace, says Bank of America, as the company is not currently performing any pre-delivery flights as of May 16.

- Effects from the Red Sea crisis may persist for the time being. It is unfortunate that annual contracts were signed when spot rates were cheap, but some have not been completed yet. On top of the base rate, contracts also have peak season surcharge (PSS) clauses. Heavy surcharges are needed, according to JPMorgan.

- Turkish Airlines reported US$226m net income in the first quarter, reports JPMorgan, down 3% year-over-year and 9% below company compiled consensus. The carrier continued to benefit from tax gains; otherwise PBT was down 39%, adversely affected from continued normalization in profitability driven by higher unit costs and relatively slower pax revenue build-up (albeit surge in cargo revenues).

Opportunities

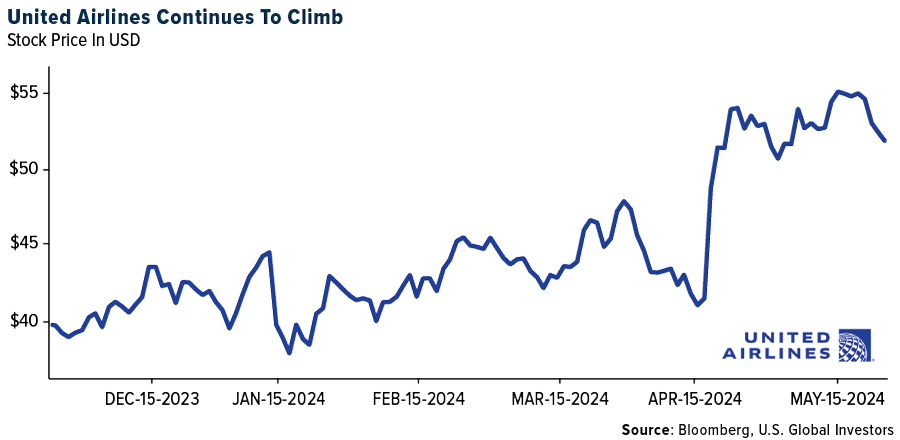

- According to Bloomberg, United Airlines released a statement to its employees that it is allowed to begin the process of adding new planes and routes following the Federal Aviation Administration’s (FAA) reviewal process. However, the lifting of restrictions on route and fleet certifications has not been confirmed, as the FAA released a statement last week reiterating that they are still in the midst of reviewing the carrier’s safety procedures and have not yet approved “any expansion of United Airlines’ routes or fleets.”

- Per ISI’s latest industry report, the group believes the fundamental supply/demand balance for the tanker industry will remain tight through at least next year, with the most likely risk factors seemingly still muted. Despite the massive outperformance of the equities, the vast majority still trade at discounts to NAV, even amid generous dividend policies.

- BITRE has released its most recent Australian aviation data updates for airfares and volumes. Capacity in the domestic market continues to grow, while economy and business airfares were up 7.8% and 11.7%, respectively. On a broader basis, RBC highlights that economy and business airfares have been gradually increasing.

Threats

- Following Frontier’s recent announcement, Spirit Airlines eliminated change fees for all fares. In August 2020, United eliminated domestic change fees (ex-Basic Economy). Shortly after, many peers joined, with applicable routes also expanding over time. Raymond James believes these further chips away at an important differentiator for Southwest Airlines and places greater urgency to introduce assigned seating.

- Air freight rates continued to rise steadily throughout April driven skewed by Asian exports (and eCommerce) while volume growth (and freight rate development) elsewhere remains muted, reports Stifel. Improvement in air freight is very narrow, with downside risk for other areas.

- According to JPMorgan, for Ryanair, the bank now forecasts 5% ex-fuel cost per pax growth in March 2025, estimate. Ryanair is not immune from the cost inflation which continues to impact the industry, and currently, it looks unlikely much of that will be offset by fuel/pricing.

Luxury Goods and International Markets

Strengths

- French luxury brand Chanel said Tuesday that its sales jumped last year to a record just shy of $20 billion, although profits only edged higher. Sales climbed 14.6% to $19.7 billion last year, with double-digit growth across its fashion, fragrance, and jewelry products. However, the company had a cautionary tone in its outlook.

- Carnival Corporation received three prestigious ESG Shipping Awards for 2024, recognizing its sustainability leadership and impactful initiatives in environment, social, and governance. The awards include the Gold Climate Change Leader Award for its Liquefied Natural Gas program, the Gold Technology Leader Award for AIDA Cruises’ lithium-ion battery system, and the Bronze Environment Leader Award for its food waste reduction efforts.

- Deckers Outdoor Corp. was the best-performing S&P Global Luxury stock, gaining 16.24% in the past five days. Deckers Outdoor shares surged to a record high after surpassing fourth-quarter sales expectations, driven by the strong performance of its Hoka and UGG brands, despite a mixed annual profit outlook and ongoing analyst optimism for continued growth.

Weaknesses

- Shares of Li Auto declined sharply this week after the company reported a first-quarter sales miss. Management said that the second-quarter will be the most challenging, but sees improvement later in the year. The company is also delaying the launch of fully electric SUVs, Reuters reports.

- The latest manufacturing PMI data in the Eurozone exceeded expectations, with the index at 47.4 compared to the anticipated 46.1. However, the index remains below the 50 mark, indicating ongoing weakness in the Eurozone. Meanwhile, the service PMI came in slightly below expectations at 53.3, compared to the expected 53.6.

- Li Auto, a Chinese EV maker, was the worst performing S&P Global Luxury stock, losing 9.0% in the past five days. The White House unveiled a slate of tariffs on China-made products from steel to electric vehicles on Tuesday, escalating trade tensions between the world’s two largest economies.

Opportunities

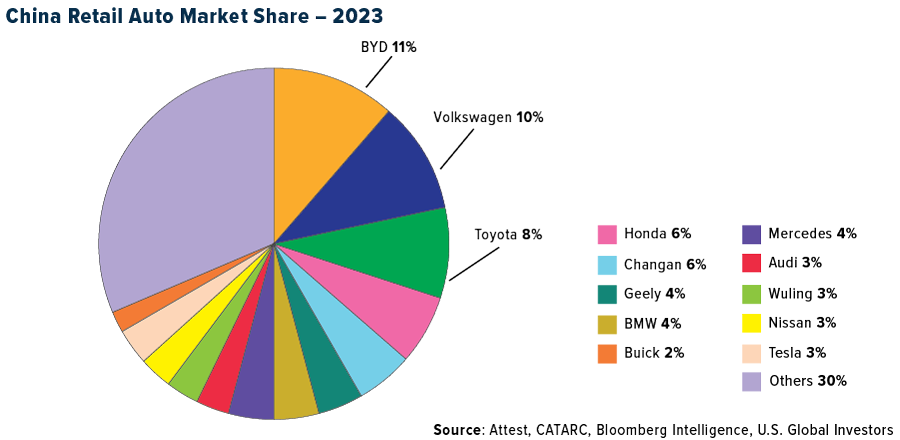

- New energy vehicles (NEVs) are approaching mass adoption in China, with their share in automobile sales set to rise from last year’s 33% as more than half of respondents in a BI survey plan to purchase an NEV for their next car. BYD — which joins Tesla and Mercedes in ranking highly on brand loyalty — should sustain its sales lead, with Toyota and Volkswagen likely to lose market share, Bloomberg reports.

- Japan’s luxury sector is benefiting from Chinese tourists. Bloomberg reported that LVMH, Burberry, Gucci and other foreign luxury fashion houses logged tumbling sales in China in the first three months due to the shifting tastes of Chinese consumers and a rebound in overseas shopping by Chinese tourists. Japan is now the main shopping destination for Chinese buyers of high-end goods, rather than Europe, thanks to the recent depreciation of the Japanese yen.

- Tesla’s 2023 impact report omits its previous goal of selling 20 million cars annually by 2030, reflecting a shift in Elon Musk’s focus toward autonomous vehicles over its core car business. This comes despite the continued aim to displace fossil fuels by selling as many Tesla products as possible.

Threats

- The earnings outlook for the European Union (EU) consumer discretionary sector remains uncertain as sluggish spending in China and Europe, and rising competition, weigh on luxury goods and automobiles. Both segments are exposed to potential trade retaliation from China, should the relationship sour further. Automakers are facing tougher market conditions and most companies reported disappointing sales or earnings in the first quarter, leading to sharp share-price corrections, from a 3% at Porsche to 10% for Stellantis.

- Chanel warned that it is set for more difficult times while analysts say they see growing pressure on profit margins at the exclusive brand. “After three years of exceptional growth for our industry, we are now entering a more challenging environment,” said Philippe Blondiaux, Chanel’s global chief financial officer. Luxury stocks have been volatile this year.

- Bank of America lowered Lululemon’s price target from $530 to $430 while maintaining a “buy” rating, following the departure of Chief Product Officer Sun Choe, and adjusting the fiscal year 2024 sales growth forecast to 9.4%. The bank also noted the stock’s potential, given its global growth opportunities and strong margins despite slowing North American sales.

Energy and Natural Resources

Strengths

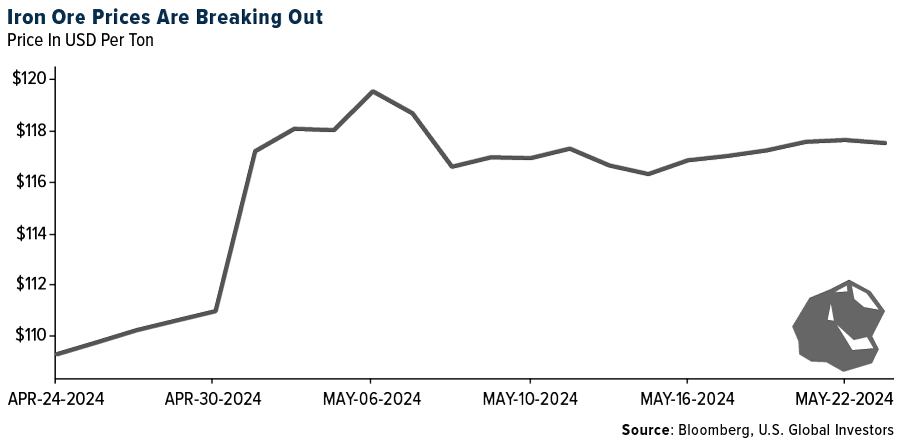

- The best performing commodity for the week was wheat, rising 7.91% on frost and rain concerns in key growing regions what could lower crop yields. As reported by Bloomberg, the new forecast for Russian wheat supplies have dropped by 10% over the past month. Both cotton and coffee futures were strong contenders for the fest weekly gain. Iron ore futures traded over $120 a ton in Singapore. Wei Ying, an analyst with China Industrial Futures, commented that ferrous metals were rising “amid expectations of a demand boost from the latest wave of stimulus.”

- In April, daily global aluminum production reached ~197 kilograms per ton per day, up 0.4% month-over-month (MoM) and 4% year-over-year (YoY), according to the IAI. The growth can largely be attributable to an uptick in China, which has grown 0.7% MoM on a day-adjusted basis given the resumption of aluminum capacity in Yunnan.

- Stonge natural gas demand has prompted Japan based Misui OSK Lines Ltd. is expanding its fleet of 97 liquified natural gas (LNG) carriers to 130 and could ultimately climb to fleet of 150 LNG carries. Suppliers of LNG to Japan include Shell and Woodside Energy. Japan sees LNG as critical to replacing coal to produce electricity.

Weaknesses

- The worst performing commodity for the week was copper, dropping 5.74%. Copper surged to its highest-ever level, extending a multi month-long rally driven by financial investors who have piled into the market in anticipation of deepening supply shortages. Futures on the London Metal Exchange (LME) jumped past $11,000 a ton for the first time on Tuesday, according to Bloomberg. However, the euphoria was short lived with the release of the minutes from the latest Federal Reserve meeting which was less optimistic on pace of dropping interest rates.

- According to UBS, both gasoline and diesel cracks are falling putting pressure on refining equities. Nymex diesel cracks, which were over $33/bbl in March, have now dropped to $24.5/bbl, down 25%. Nymex gasoline cracks, which were over $32/bbl in March, have now dropped to $28/bbl, down 14%.

- Oil extended losses after an industry report pointed to rising U.S. crude inventories, adding to bearish signs for the market. Brent traded around $82 a barrel, near its lowest in three months, while West Texas Intermediate (WTI) also edged below $78, according to Bloomberg.

Opportunities

- At face value, observable global oil inventories (crude and products) surged by 63 million barrels, or 1.5 million barrels per day (mbd), in the last six weeks through mid-May. However, over half of this build occurred in Asia, primarily China, as the nation took advantage of lower oil prices. The price-sensitive country has added 33 million barrels (~750 kbd) of crude oil to its strategic and commercial inventories over the past six weeks, the fastest rate in a year, according to JP Morgan.

- The artificial intelligence (AI) boom is focused on technology companies, but you can’t build or train an AI model without access to large amounts of energy to power the queries it will be tasked with. The tech companies know this, and they are now devoting more of their capex to energy infrastructure. The beneficiaries of the capital spent have largely been renewable energy power sources. However, vast amounts of electricity will be needed to power the AI revolution while Western electricity grids have little excess capacity, increasing the risk of bottlenecks. The U.S. grid reached 94% capacity last year. Capacity to deliver electricity will be further constrained by almost a decade of underinvestment in upstream and downstream energy infrastructure in leu of dividends and share buybacks.

- China is preparing to snap up a record volume of cobalt for its state reserves this year, with prices of the battery material languishing near their lowest levels since 2019. The National Food and Strategic Reserves Administration, which oversees the country’s official commodities stockpiles, is preparing to buy around 15,000 tons of refined cobalt, according to Bloomberg.

Threats

- Copper has surged relative to gold of late, but it is unlikely that the ratio can stay as lofty in the months to come. The metals’ price ratio, based on LME copper per ton and spot gold per ounce, has surged past four in recent weeks, a pace of gains that is nearly unsustainable in the face of inputs stemming from China and global geopolitics, according to Bloomberg.

- Mexico’s power grid operator Cenace declared an operational state of alert on Saturday, indicating the system’s available power is lagging below adequate levels. The grid alert is nationwide, according to a statement published on its website. The Electric Reliability Council of Texas (ERCOT) warned Texas that reserve margins would be squeezed with the heat wave.

- Chinese consumers are already under pressure by a downtrodden property market and a lackluster labor market are now getting shocked with a new announced gas price increase of 10% across 125 cities and counties. Rail fairs on China’s most popular high-speed trains are also going to be boosted by 20% in June.

Bitcoin and Digital Assets

Strengths

- Of the cryptocurrencies tracked by CoinMarketCap, the best performer for the week was Pepe, rising 38.75%.

- The UK’s financial regulator approved the first cryptocurrency exchange-traded products (ETPs), a step toward catching up to other financial centers in digital assets. WisdomTree said it received the green light from the Financial Conduct Authority to list a pair of physically-backed crypto ETPs tracking Bitcoin and Ether on the London Stock Exchange (LSE), writes Bloomberg.

- Former President Donald Trump’s presidential campaign on Tuesday began accepting crypto donations, making good on the presumptive Republican nominee’s pledge to become the first major party candidate to embrace Bitcoin, Ether and other digital currencies, according to Bloomberg.

Weaknesses

- Of the cryptocurrencies tracked by CoinMarketCap, the worst performing for the week was Maker, down 13.98%.

- Yuga Labs faced a backlash over a new Punk-themed NFT collection, developed in collaboration with artist Nina Chanel Abney, criticized for “diluting” the original CryptoPunks brand, according to an article published by Bloomberg.

- The number of new Bitcoin wallets dropped to the lowest level since 2018. According to the Block’s data, an average of 275,000 addresses were added to the Bitcoin network each day in the past week, compared to 625,000 six months ago.

Opportunities

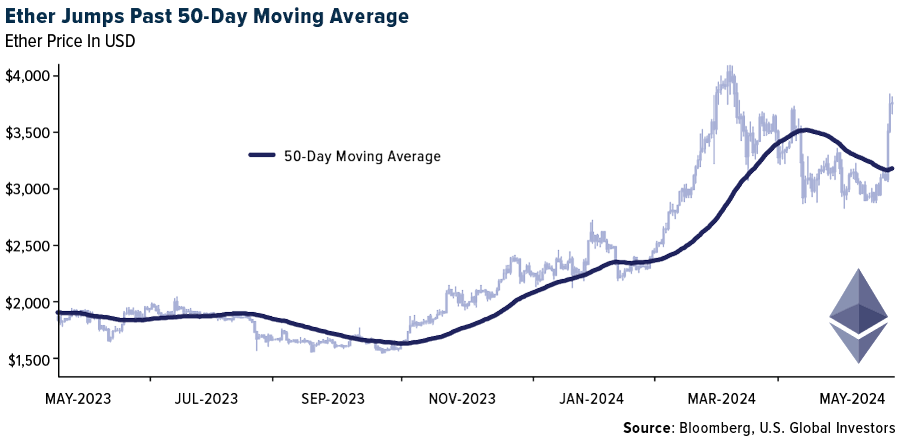

- Crypto markets are increasingly optimistic about regulatory approval for U.S. ETFs investing directly in Ether amid a flurry of activity at potential issuers, exchanges and the securities regulator. The token has surged about 23% this week and was trading at approximately $3,780 and broke its 50-day moving average, according to Bloomberg.

- The House approved a major win for the cryptocurrency industry Wednesday, voting by a large bipartisan margin to establish the Commodity Futures Trading Commission (CFTC) rather than the SEC as the primary overseer for digital assets, according to Bloomberg.

- The developer of Farcaster, a web3 social media startup, announced that it raised $150 million fundraising led by Paradigm at a $1 billion valuation after the funding, writes Bloomberg.

Threats

- The LSE Group has lost half of its four-person team overseeing ETFs, just as it prepares to list its first products tied to cryptocurrencies. Michael Stanley, LSE’s head of ETP, and business development head Hetal Patel have departed, according to Bloomberg.

- The trial of exiled Chinese billionaire Guo Wengui began this week in New York, where he’s accused of swindling more than $1 billion from investors in a complex fraud scheme that netted him luxuries, including a $26 million New Jersey mansion and a $37 million yacht, according to Bloomberg.

- Former FTX executive Ryan Salame should serve five to seven years in prison for criminal charges stemming from the multibillion-dollar collapse. In a sentencing memo federal prosecutors said the 30-year-old pleaded guilty to “serious crimes,” writes Bloomberg.

Defense and Cybersecurity

Strengths

- Lockheed Martin successfully intercepted a cruise missile target in flight for the first time by firing a PAC-3 Missile Segment Enhancement (MSE) interceptor from the USS Thomas Hudner using the Virtualized Aegis Weapon System.

- RTX has been awarded a $196.64 million contract by the Defense Logistics Agency for tactical airborne navigation systems spare parts, with a completion date of May 19, 2029.

- The best performing stock this week was Cadre Holdings, rising 9.00%, on little news, after weeks of poor performance.

Weaknesses

- The decision by the U.S. Air Force to award a $30 billion contract for drone prototypes to privately held General Atomics and Anduril instead of major defense contractors Boeing, Lockheed Martin and Northrop Grumman represents a significant loss for the latter three companies and marks a shift in defense contracting dynamics.

- Slovak Prime Minister Robert Fico was the target of an assassination attempt on May 15, driven by political motives related to his policies, including efforts to scrap a special prosecutor’s office, halt military aid to Ukraine, and overhaul public media. The assailant, a 71-year-old pensioner identified as Juraj C., fired at Fico during a public appearance and has been charged with attempted premeditated murder.

- The worst performing stock was Virgin Galactic, falling 15.19%, on little news.

Opportunities

- CyberArk Software announced it will acquire Venafi from Thoma Bravo for $1.54 billion in cash and stock, aiming to boost annual recurring revenue by $150 million and expand its market reach to $60 billion.

- Aerojet Rocketdyne’s Arkansas facility, employing around 1,100 people and producing over 100,000 solid rocket motors (SRMs) annually, is undergoing extensive modernization and expansion through a $215.6 million Department of Defense (DoD) agreement to enhance production efficiency and capacity. This supports critical defense systems like THAAD and Patriot Missiles, with recent upgrades including a new Engineering, Manufacturing & Development facility and a consolidated production site for the Guided Multiple Launch Rocket System (GMLRS).

- Kratos Defense & Security Solutions’ OpenSpace virtualized SATCOM ground system was used in BlueHalo’s demonstration for the U.S. Space Force’s SCAR program, showcasing dynamic satellite ground operations and backend mission services at the 2024 Space Symposium.

Threats

- The chief prosecutor of the International Criminal Court (ICC) is seeking arrest warrants for Israeli Prime Minister Benjamin Netanyahu and Hamas leader Yahya Sinwar on war crimes charges, including crimes against humanity related to Netanyahu. This move has been condemned by Israeli officials and opposed by the U.S., which argues that the ICC lacks jurisdiction.

- Iranian President Ebrahim Raisi and Foreign Minister Hossein Amirabdollahian died in a helicopter crash in a mountainous region of northwestern Iran, amidst heightened regional tensions due to the ongoing Gaza war. Raisi’s death, confirmed by state media, raises questions about succession as he was a potential candidate to become the next supreme leader.

- The Pentagon reported that Russia launched the Cosmos 2553 anti-satellite weapon into the same orbit as a U.S. satellite, escalating tensions over space weapons amid ongoing UN disputes and mutual accusations.

Gold Market

This week gold futures closed the week at $2,357.70, down $82.70 per ounce, or 3.39%. Gold stocks, as measured by the NYSE Arca Gold Miners Index, ended the week lower by 3.73%. The S&P/TSX Venture Index came in off 1.17%. The U.S. Trade-Weighted Dollar rose 0.28%.

Strengths

- The best performing precious metal for the week was silver, but still lower by 2.32%. Scotia views the Ontario Teachers Power Plan deal as positive for New Gold shares—not only is the deal structure financially accretive by their estimates, but it increases exposure to a known asset (New Afton) with a long operating history in a stable jurisdiction. They see this removing a potential overhang on NGD shares and allows the focus to shift to value creation through exploration and optimization.

- Silver’s rally is making waves in China as precious metals including gold surge. Futures for the cheaper commodity in Shanghai touched the highest in more than a decade as investors bet on rising demand, according to Bloomberg.

- Equinox Gold announced that it has poured first gold at the Greenstone mine. This is in line with the May timeline that management had been guiding for. All equipment is operating as expected, and the operation will now ramp up towards commercial production expected in Q3, according to BMO.

Weaknesses

- The worst performing precious metal for the week was platinum, down 4.89%. Gold fell for a third straight day after U.S. economic data showed an expansion in business activity amid a pickup in inflation, which may delay the Fed from lowering borrowing costs, according to Bloomberg.

- China’s bullion imports slowed last month as demand in the world’s biggest consumer begins to buckle in the face of record prices. Overseas purchases of physical gold fell to 136 tons in April, a 30% decline from the previous month and the lowest total for the year, according to the latest customs data.

- Anglo American says the value of rough-diamond sales from global sight holder sales and auctions in De Beers’ fourth sales cycle fell to $380 million compared with $446 million in the third cycle, according to Bloomberg.

Opportunities

- Citigroup Global Research Global Head Max Layton says gold is on track to reach $3,000 in the coming 12 months. He also comments on what he calls “off the charts” demand for gold coming from China, where the market is seeing a “big shift” from property spending into gold retail. Elsewhere in Asia, South Korea’s National Pension Service has begun to explore ways to invest in gold, commodities and private REITs, Seoul Economic Daily reports, without citing anyone.

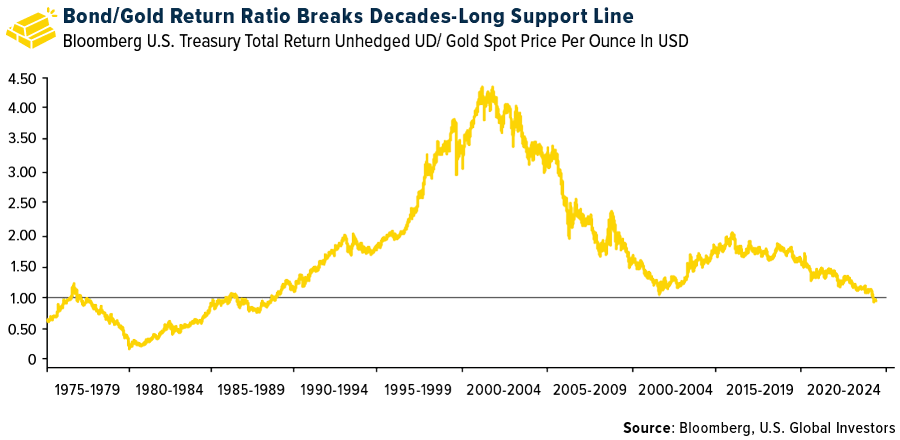

- Idanna Appio spent 15 years at the Federal Reserve Bank of New York analyzing the history of sovereign debt crises. Now, as a fund manager at the $138 billion First Eagle Investments, she’s reached a conclusion: U.S. Treasury bonds are too risky to hold, as reported on Bloomberg. Rather than buying what’s deemed the world’s safest asset to balance out her equity and credit holdings, Appio is adding gold to her portfolio. Alice Atkins and Sujata Rao, the authors of the reported story “The Investment Implications of a World That’s Fast Getting Older” penned an interesting report on the changing demographics, particularly with falling birth rates, labor supply, and inflation. The shift of assets away from U.S. debt for a pension is leaning more into equity, commodity markets, and investing in infrastructure projects with revenues linked to future inflation.

- For much of the past half century, U.S. Treasuries have handily outpaced gold as a buy-and-hold investment. Now, bonds’ status as the ultimate haven is facing one of its biggest challenges yet. Investors traditionally flocked to US debt as a super-safe investment paying steady income and backed by the world’s economic powerhouse. This relationship has been shifting lately, as echoed in the bullet point above, with recent trends moving in gold’s favor, according to Bloomberg.

Threats

- Without new mining concessions, Mexico’s mining production will likely decline over time. There are risks of potentially lower global supplies of silver (Mexico is the world’s top producer, contributing 24.6% of total production in 2023), according to Scotia. This likely will be supportive of the silver price but projects in Mexico may face additional delays.

- Despite event-driven uncertainty surrounding the potential de-merger of Amplats, and in the absence of clarity around the pace and structure of an Amplats de-merger JP Morgan thinks Amplats’ rally ahead of both the peer group and the basket price could underpin volatility, with immediate risk skewed to the downside.

- IAMGOLD announced a $300 million equity-bought deal financing, which takes advantage of the strong share performance, and from a position of strength, boosts cash balance to enable IMG to accelerate the plan to repurchase its 9.7% interest in the Côté Gold Mine from Sumitomo (returning to an effective 70%-interest in the operation). There is the risk of dilution from this transaction, according to Bloomberg.

U.S. Global Investors, Inc. is an investment adviser registered with the Securities and Exchange Commission (“SEC”). This does not mean that we are sponsored, recommended, or approved by the SEC, or that our abilities or qualifications in any respect have been passed upon by the SEC or any officer of the SEC.

This commentary should not be considered a solicitation or offering of any investment product. Certain materials in this commentary may contain dated information. The information provided was current at the time of publication. Some links above may be directed to third-party websites. U.S. Global Investors does not endorse all information supplied by these websites and is not responsible for their content. All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. The following securities mentioned in the article were held by one or more accounts managed by U.S. Global Investors as of (03/31/2024):

Frontier Group Holdings

Wizz Air Holdings

Boeing

United Airlines

Ryanair Holdings

Southwest Airlines

Carnival Corporation

Mercedes

Volkswagen

LVMH

Burberry

Lululemon

Apple Inc.

Tesla Inc.

Amazon.com Inc.

Misui OSK Lines Ltd.

Deckers Outdoor Corp.

Mercedes-Benz Group AG

Bayerische Motoren Werke AG

Porsche Automobil Holding SE

New Gold Inc.

Equinox Gold Corp.

IAMGOLD Corp.

*The above-mentioned indices are not total returns. These returns reflect simple appreciation only and do not reflect dividend reinvestment.

The Dow Jones Industrial Average is a price-weighted average of 30 blue chip stocks that are generally leaders in their industry. The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies. The Nasdaq Composite Index is a capitalization-weighted index of all Nasdaq National Market and SmallCap stocks. The Russell 2000 Index® is a U.S. equity index measuring the performance of the 2,000 smallest companies in the Russell 3000®, a widely recognized small-cap index.

The Hang Seng Composite Index is a market capitalization-weighted index that comprises the top 200 companies listed on Stock Exchange of Hong Kong, based on average market cap for the 12 months. The Taiwan Stock Exchange Index is a capitalization-weighted index of all listed common shares traded on the Taiwan Stock Exchange. The Korea Stock Price Index is a capitalization-weighted index of all common shares and preferred shares on the Korean Stock Exchanges.

The Philadelphia Stock Exchange Gold and Silver Index (XAU) is a capitalization-weighted index that includes the leading companies involved in the mining of gold and silver. The U.S. Trade Weighted Dollar Index provides a general indication of the international value of the U.S. dollar. The S&P/TSX Canadian Gold Capped Sector Index is a modified capitalization-weighted index, whose equity weights are capped 25 percent and index constituents are derived from a subset stock pool of S&P/TSX Composite Index stocks. The NYSE Arca Gold Miners Index is a modified market capitalization weighted index comprised of publicly traded companies involved primarily in the mining for gold and silver. The S&P/TSX Venture Composite Index is a broad market indicator for the Canadian venture capital market. The index is market capitalization weighted and, at its inception, included 531 companies. A quarterly revision process is used to remove companies that comprise less than 0.05% of the weight of the index, and add companies whose weight, when included, will be greater than 0.05% of the index.

The S&P 500 Energy Index is a capitalization-weighted index that tracks the companies in the energy sector as a subset of the S&P 500. The S&P 500 Materials Index is a capitalization-weighted index that tracks the companies in the material sector as a subset of the S&P 500. The S&P 500 Financials Index is a capitalization-weighted index. The index was developed with a base level of 10 for the 1941-43 base period. The S&P 500 Industrials Index is a Materials Index is a capitalization-weighted index that tracks the companies in the industrial sector as a subset of the S&P 500. The S&P 500 Consumer Discretionary Index is a capitalization-weighted index that tracks the companies in the consumer discretionary sector as a subset of the S&P 500. The S&P 500 Information Technology Index is a capitalization-weighted index that tracks the companies in the information technology sector as a subset of the S&P 500. The S&P 500 Consumer Staples Index is a Materials Index is a capitalization-weighted index that tracks the companies in the consumer staples sector as a subset of the S&P 500. The S&P 500 Utilities Index is a capitalization-weighted index that tracks the companies in the utilities sector as a subset of the S&P 500. The S&P 500 Healthcare Index is a capitalization-weighted index that tracks the companies in the healthcare sector as a subset of the S&P 500. The S&P 500 Telecom Index is a Materials Index is a capitalization-weighted index that tracks the companies in the telecom sector as a subset of the S&P 500.

The Consumer Price Index (CPI) is one of the most widely recognized price measures for tracking the price of a market basket of goods and services purchased by individuals. The weights of components are based on consumer spending patterns. The Purchasing Manager’s Index is an indicator of the economic health of the manufacturing sector. The PMI index is based on five major indicators: new orders, inventory levels, production, supplier deliveries and the employment environment. Gross domestic product (GDP) is the monetary value of all the finished goods and services produced within a country’s borders in a specific time period, though GDP is usually calculated on an annual basis. It includes all private and public consumption, government outlays, investments and exports less imports that occur within a defined territory.

The S&P Global Luxury Index is comprised of 80 of the largest publicly traded companies engaged in the production or distribution of luxury goods or the provision of luxury services that meet specific investibility requirements.

The Relative Strength Index (RSI) is a technical indicator that measures the speed and magnitude of price changes to determine if an investment is overbought or oversold.

Mean reversion is a financial theory that suggests asset prices will eventually return to their long-term average or mean.