AI Frenzy Drove the S&P 500’s Best Two-Year Gains Since the Dot-Com Era

Stocks rallied in 2024, delivering a second consecutive year of gains exceeding 20%, as investors embraced cooling inflation, falling interest rates and the prospect of lower corporate taxes under a second Trump administration. The last time the S&P 500 achieved two or more straight years of +20% growth was during the late 1990s, when the internet boom fueled market optimism.

Much like those high-flying days, 2024 saw tech stocks capture investors’ imaginations. This time, though, it was the promise of artificial intelligence (AI) that drove enthusiasm.

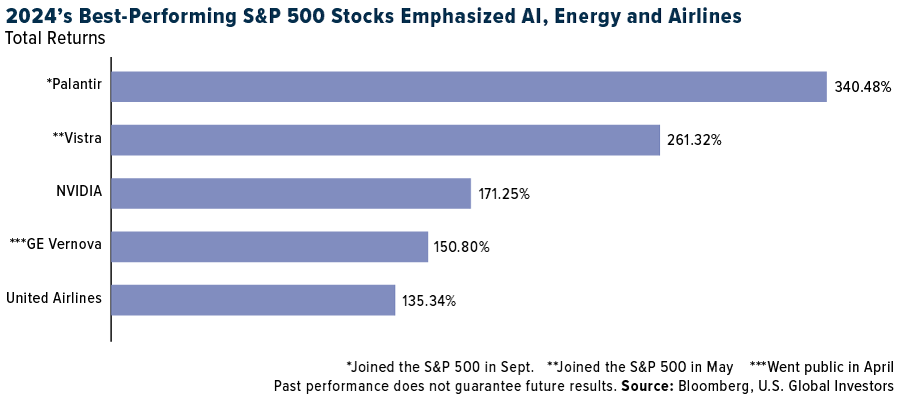

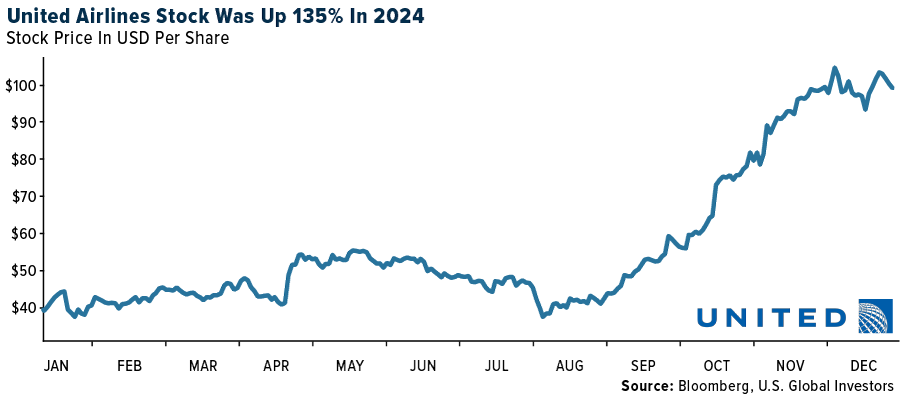

Among the top five best-performing S&P 500 stocks, two (Palantir and NVIDIA) are directly tied to AI, while two others (Vistra and GE Vernova) benefit indirectly through increased energy demand. United Airlines, the fifth-best stock, is reportedly integrating AI to streamline operations like notifications and pilot rebooking, but investor excitement appears largely centered on the recent travel boom and United’s $1.5 billion share buyback program.

Palantir and NVIDIA Ride the AI Wave to Historic Gains

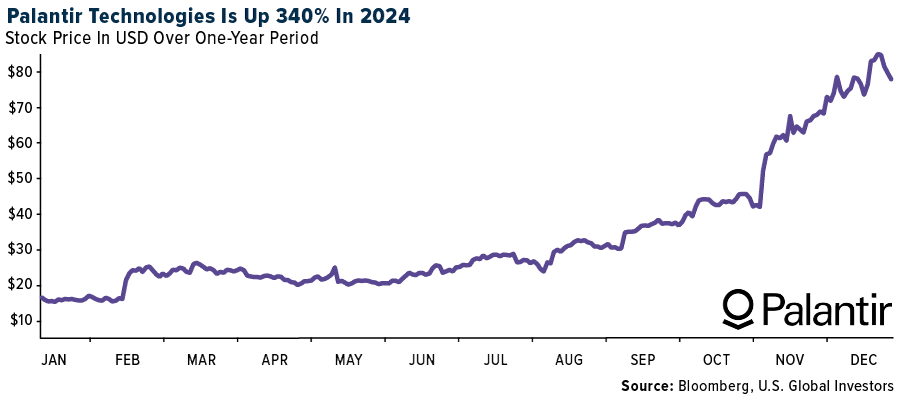

AI dominated headlines and the stock market in 2024, pushing companies like Palantir and NVIDIA to triple-digit growth. Palantir, which specializes in data analytics and AI platforms, saw a massive 340% surge in its stock price, making it the best performing S&P 500 stock of 2024.

Palantir’s work with the Department of Defense has been particularly impactful. Major contracts, such as a $480 million deal for its Maven Smart System and a $401 million follow-on contract for its data-gathering Vantage platform, highlight Palantir’s expanding role in military applications.

Meanwhile, NVIDIA benefited immensely from its position as the dominant supplier of GPUs (graphics processing units). The Santa Clara-based company—whose technology powers data centers around the globe, enabling AI applications and Bitcoin mining—generated a jaw-dropping $35 billion in revenue in the third quarter as demand for its hardware has soared. As of January 3, 2025, NVIDIA is the world’s second-largest company by market cap, valued at $3.5 trillion.

Data Centers Boost Demand for Energy

Utilities, the lowest-performing S&P 500 sector in 2023, rebounded strongly in 2024, reflecting a major shift in electricity consumption as AI, electrification and decarbonization drive demand. The Energy Information Agency (EIA) predicts that global electricity use could rise as much as 75% by 2050.

This is good news for providers like Vistra and GE Vernova, the number two and number four best performing S&P 500 stocks of 2024.

Vistra, which joined the S&P 500 in May of last year, saw its stock price skyrocket by 261% in 2024. The company’s natural gas and nuclear power plants are well-suited to meet the reliability and scalability needs of data centers. Strategic agreements with cloud computing giants like Amazon and Microsoft to supply power at premium prices further bolstered its financial performance.

GE Vernova, General Electric’s energy spinoff, also saw remarkable growth in 2024, with its stock rising 150% after going public in April. The company’s gas turbines have seen strong demand as providers seek to address the growing energy needs of data centers. The company’s involvement in renewable energy projects—such as the $2.75 billion wind energy agreement in Australia, signed a year ago—further cements its position as a leader in the sector. GE Vernova has projected sales of $45 billion in 2028, up from previous estimates of $43 billion.

United Airlines Soars with Record-Breaking Performance

United Airlines represented a different investment narrative in 2024: the resurgence of post-pandemic air travel. Shares of the Chicago-based airline soared 135% last year, marking the carrier’s best year ever since going public in 2006.

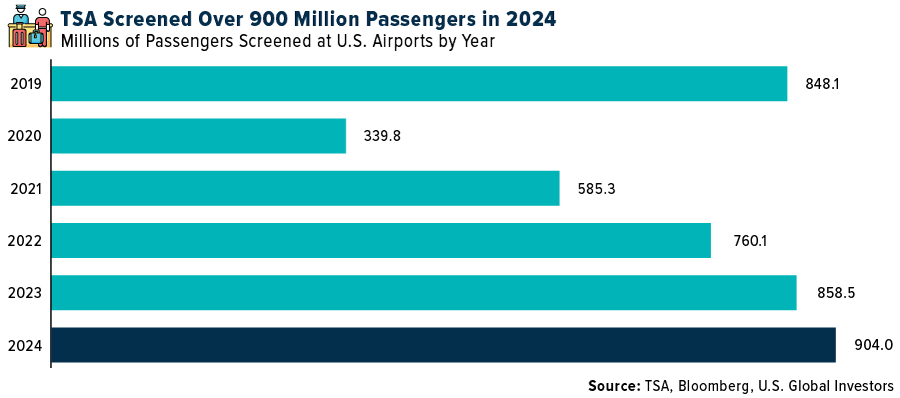

Air travel surged in 2024, with the Transportation Security Administration (TSA) reporting screening a combined 900 million+ passengers at U.S. airports, the most on record. United capitalized on this trend in 2024 by operating its largest-ever domestic schedule and greatly expanding international routes.

Eye-popping passenger volume certainly turned heads, but it was the company’s massive $1.5 billion share buyback program, announced in October, that truly boosted investor sentiment.

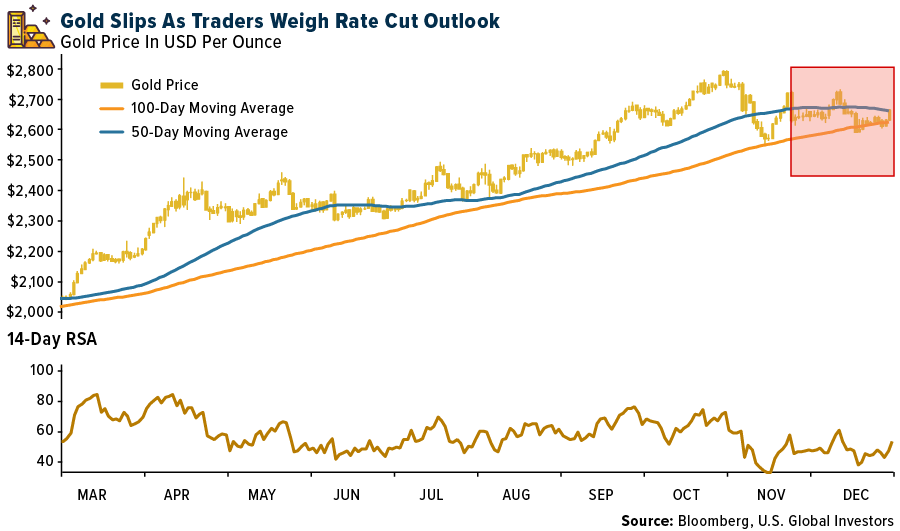

Gold and the S&P 500’s Unusual Correlation in 2024

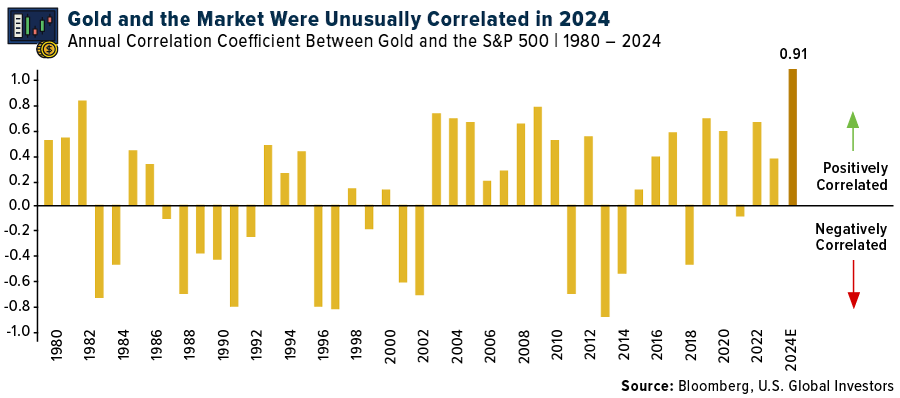

On a slightly different note, the correlation between gold and the S&P 500 reached an unprecedented 0.91 in 2024, meaning that the two assets moved in tandem almost 100% of the time throughout the year.

As many of you are aware, gold has historically shared an inverse, or low, correlation with stocks. That’s precisely why many investors favor gold. Take a look at the period from the mid-80s to early-90s. Gold prices were largely agnostic to what equity prices were doing, making the metal an ideal diversifier.

Granted, we’ve also seen periods of sustained positive correlation (check out the entire 2000s decade), but we’ve never seen such a strong relationship between the two asset classes as we did in 2024.

So, what gives?

First, global central banks have begun a coordinated monetary easing cycle, cutting interest rates to stimulate economic growth. This has created a favorable environment for both stocks (as borrowing costs declined) and gold, which, as a non-yielding asset, has historically thrived when interest rates were low.

Second, geopolitical tensions and economic uncertainty have persisted, driving investor demand for safe-haven assets like gold while also supporting equity markets through increased government spending on defense, cybersecurity and infrastructure.

Third, shifts in asset allocation strategies appear to have played a role. Investors increasingly sought diversified portfolios, blending traditional assets like stocks and bonds with alternative investments such as gold and Bitcoin to hedge against inflation (which, despite falling, remained elevated in 2024). I believe this likely contributed to the tighter correlation between gold and S&P 500 stocks.

Want to learn more about gold’s Fear Trade? Watch the video here!

Index Summary

- The major market indices finished mixed this week. The Dow Jones Industrial Average lost 0.60%. The S&P 500 Stock Index fell 0.48%, while the Nasdaq Composite fell 0.51%. The Russell 2000 small capitalization index gained 1.06% this week.

- The Hang Seng Composite lost 5.67% this week; while Taiwan was down 1.58% and the KOSPI rose 1.54%.

- The 10-year Treasury bond yield fell 2 basis points to 4.599%.

Airlines and Shipping

Strengths

- The best-performing airline stock for the year was TAV Airports Holdings, up 154.88%. International travel demand has remained resilient as the number of U.S. citizen departures to international regions has continued to trend above both 2019 and 2023 levels, with U.S. departures increasing +11% year-over-year and +20% compared to 2019, according to Morgan Stanley.

- According to Stifel, shipping supply is likely to end the year up almost exactly 10%, while the number of container movements is up about 5.5%. This is well below supply growth, with the difference being entirely attributable to ton-mile growth (i.e. the average length of voyage). For last year, that translated into an extra 12% of supply reduction. The ton-mile growth can be entirely attributed to ships avoiding the Red Sea.

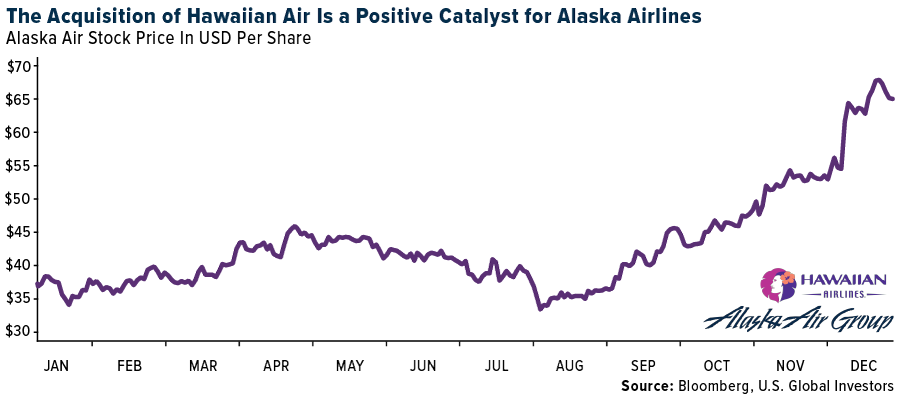

- The Department of Transportation (DOT) approved the Alaska and Hawaiian merger. According to DOT, Alaska and Hawaiian are required to protect the value of rewards, maintain existing service on key Hawaiian routes to the continental U.S. and inter-island, guarantee fee-free family seating, ensure competitive access at the Honolulu hub airport, and the protections will remain in place for six years. Following both DOJ and DOT approval, the merger between Alaska and Hawaiian Airlines is fully complete, with the two companies combining shortly thereafter.

Weaknesses

- The worst performing airline stock for the year was Air France, down 40.23%. According to The Hill, U.S. airlines are now required to give passengers an automatic refund for canceled or significantly delayed flights and for services that were paid for but not provided, such as Wi-Fi or entertainment.

- According to Stifel, June was enormous with 77 ships ordered, marking the second-highest month of ordering in history, followed by a slightly higher-than-average July. August ordering was also elevated.

- Boeing agreed to plead guilty in the 737 MAX criminal case associated with the two MAX crashes in 2018 and 2019, according to a court filing. As part of the plea, Boeing must pay a second criminal fine of $244 million, spend $455 million over the next three years to improve its compliance and safety programs and hire an independent monitor for the duration of the three years to oversee its improvements. The 737’s production may have come to a complete halt following the IAM union strike. While the full impact on deliveries remains uncertain, the pace has slowed significantly recently, with only two 737s delivered, well below normal levels, and 20 per month, according to Bank of America.

Opportunities

- Elliott Investment Management has reportedly built a $2 billion stake in Southwest to push for changes aimed at reversing the airline’s underperformance. It is unclear if a management change is in the cards. Elliott is known for forcing changes that include management shake-ups and outright sales. There are some that believe sufficient change cannot occur without a change in leadership, according to Raymond James.

- According to JP Morgan, spot freight rates have the potential to rebound as major container liners plan to implement a General Rate Increase (GRI) of 20-50%. Additionally, charter rates continue to trend upward. Year-to-date (YTD) demand has been stronger than expected, as confirmed by Hapag-Lloyd during a recent investor meeting. The improved outlook is driven by encouraging re-stocking demand trends following the Lunar New Year.

- United Airlines has adjusted its aircraft delivery schedule due to delays in Boeing deliveries and certifications. The airline now expects to receive only 61 narrowbody aircraft this year, down from the 101 previously anticipated. Consequently, United has reduced its 2024 capital expenditure (capex) forecast to $6.5 billion, compared to the earlier estimate of $9 billion. Capex for 2025-2027 is projected to range between $7 billion and $9 billion annually. According to Bank of America, United could generate over $1 billion in free cash flow over the next three years.

Threats

- According to Cowen, maintenance costs are up 20%+ and out of control. There is limited available capacity in maintenance shops which are having to raise pay to hire and retain skilled labor. Aircraft that were delivered within the last decade are at the point where they need to go through their first major maintenance cycle.

- According to Morgan Stanley, since its peak in 2021, the container shipping industry has added 19% capacity. By their estimates, another 10% capacity will be added by the end of 2025. By contrast, they note that global trade is growing by 3-4% p.a.

- Southwest Airlines has implemented a Rights Plan, issuing one right for each share of common stock. These rights will initially trade alongside Southwest’s common stock and will generally only become exercisable if any individual or group acquires 12.5% or more of the company’s outstanding shares.

Luxury Goods and International Markets

Strengths

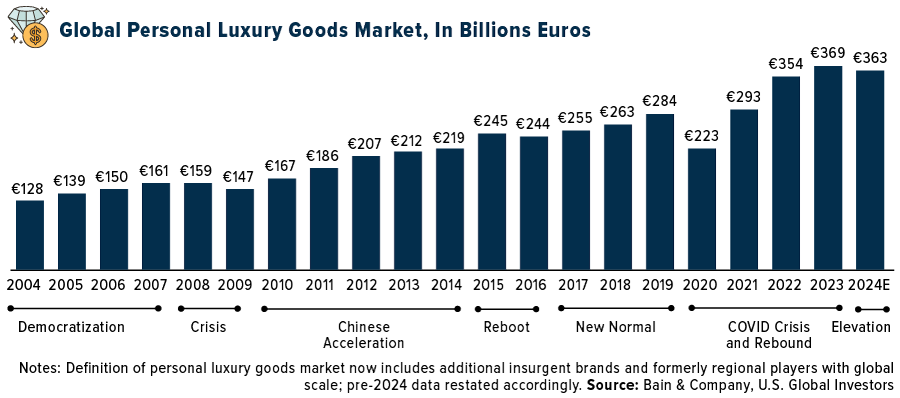

- The global personal luxury goods market has seen steady growth over the past 20 years. In 2004, it was valued at €128 billion and according to Bain & Company’s Luxury Study, the market is expected to reach €363 billion in 2024, normalizing its growth after a sharp post-Covid recovery.

- U.S. equities outperformed other developed markets in 2024, driven by a strong economy and the outcome of the U.S. presidential elections. The S&P 500 Index rose by 25%, led by strong gains in communication services, information technology, and consumer discretionary sectors. In China, the CSI 300 Index gained 15%, with most of the growth occurring in the second half of the year after the government announced economic support. Meanwhile, the STOXX 600 Index, which tracks European equities, increased by only 2.5% in 2024.

- In 2024, The RealReal, an online marketplace for luxury goods in the U.S., was the top-performing stock in the S&P Global Luxury sector, rising by 443.8%. Under new leadership, the company moved away from low-margin direct sales and positioned itself to generate free cash flow by 2025. The RealReal reported strong third-quarter results, exceeding earnings expectations and raising its forecasts. In December, Wells Fargo upgraded the company to an “overweight” rating and raised its price target from $4 to $15.

Weaknesses

- At the start of the year, brokers predicted that the luxury sector would see improvement in the second half of the year. However, as 2024 ended, it is clear that the sector has remained flat or slightly declined. Companies with significant exposure to China underperformed the most, with Kering’s shares dropping 42% and Estée Lauder’s shares falling 47.6%.

- In 2024, the French CAC 40 Index, which includes many luxury companies, dropped by 8.5%. In contrast, the STOXX 600 Index, which covers large, mid, and small companies from 17 European countries, rose by 2.5%. Meanwhile, the S&P 500 Index in the U.S. saw a strong increase of 25%. The decline in the French market was mainly due to poor performance from luxury stocks. Shares of Kering, known for the Gucci brand, fell by 42%. L’Oréal saw a 28% drop, and LVMH lost 18% of its market value.

- In 2024, Star Entertainment Group, an Australian casino and hospitality company, was the worst-performing stock in the S&P Global Luxury Index, falling 66.6%. Shares fell after the company reported a massive loss for the period ending June 2024. The company delayed the release of its fiscal year 2024 financial results for about one month due to findings in an inquiry by the New South Wales Independent Casino Commission (NICC). The commission found the company unfit to hold a casino license in Sydney. Also, the cost associated with the launch of Queen’s Wharf Brisbane nearly collapsed the company.

Opportunities

- According to the LUXONOMY Report, the global luxury market wil continue to grow around 5-6% annually unitl 2030. Asia-Pacific, driven mainly by China and India, will be the region with the greatest expansion, projected to account for 55% of the global luxury market by 2030. Europe and North America will remain important markets, although with more moderate growth.

- Within the luxury industry, experiential luxury—which includes tourism, wellness, and fine dining—is expected to grow faster than luxury goods, as consumers prioritize experiences over material purchases. By the end of the decade, it is estimated to account for 35% of the market. According to Grand View Research, the global luxury travel market was valued at $1.38 trillion in 2023 and is projected to grow at an annual rate of 7.9% from 2024 to 2030.

- In the third quarter of 2024, U.S. household wealth reached a record high, driven by a stock market rally ahead of the presidential election. Household net worth increased to $168.8 trillion, with the value of Americans’ equity holdings rising by $3.89 trillion, while real estate values declined by nearly $200 billion. This wealth growth is expected to further boost economic growth and consumer spending.

Threats

- UBS predicts global growth will slow over the next two years, dropping from 3.2% to 2.6%, driven by a slowdown in the United States and the impact of new tariffs on an already struggling China. According to UBS economists, a 60% tariff could initially reduce China’s GDP growth by 2.5%. Countries like Mexico, Korea, and Taiwan are expected to be hit harder than Europe. For Europe, additional taxes on luxury goods, spirits, and high-end autos may be imposed by Trump, further affecting the region.

- In the luxury sector, China’s role is expected to be pivotal, largely influenced by the government’s ability to implement the announced stimulus measures effectively and introduce additional policies if needed. The country’s property sector faces significant challenges, which could impact consumer spending and confidence. Furthermore, while domestic tourism has shown a strong recovery, international travel has yet to return to pre-pandemic levels, limiting the overall rebound in tourism-related luxury spending. The effectiveness of China’s economic strategies will be crucial in shaping the growth trajectory of the global luxury market.

- There are high expectations for the incoming administration in the United States, particularly regarding its ability to address global geopolitical tensions. Key questions remain unanswered: How will the war in Europe conclude, and when? Will peace be achieved in the Middle East? Could China take steps toward a potential conflict over Taiwan? Furthermore, many wonder if Trump will fulfill his campaign promises to end the ongoing war in Europe. The administration’s actions during its initial months in office will be critical in shaping the global political landscape for years to come.

Energy and Natural Resources

Strengths

- The best performing commodity for the year was coffee, rising 68.29%. Coffee’s record performance broke a nearly 50-year high set back in 1977 for price. The major catalysts behind this heightened performance were droughts in key growing regions – Brazil and Vietnam which accosted the supply chain for coffee, as well as heightened demand, with the entire globe having a net increase of 5% coffee servings.

- The second-best performing commodity for 2024 was palm oil, which rose 22.50%, pushing above two-year highs fueled by tightening supply and robust global demand. Severe weather in Malaysia, which halted supply, coupled with Indonesia and India’s push to increase biodiesel production, added to the flame of performance in palm oil.

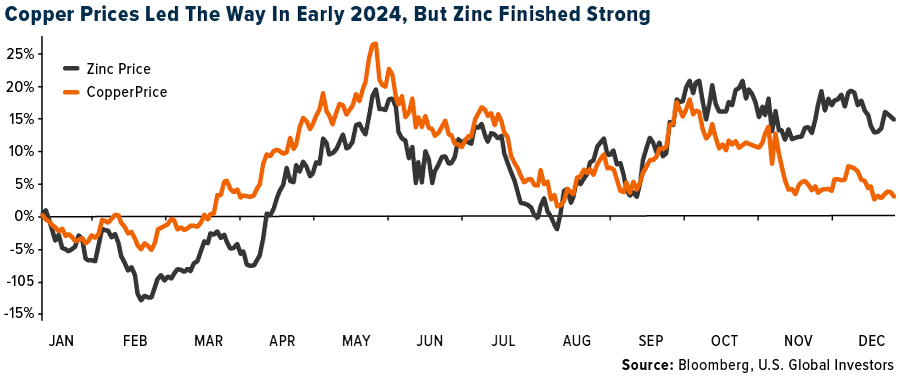

- Zinc rounded out the top-performing commodities in 2024, with a gain of 11.89%, propelled by production issues at key mines in Australia and China, which led to tight global supplies and a widening market deficit. Zinc’s performance captured headlines and triggered a proxy battle for control of Korea Zinc Co. which gained 79.19% for the year. Quite a contrast to copper’s performance, which was up just 1.76%. Consequently, Freeport-McMoRan Inc., a major U.S. copper producer, saw its share price slide 10.07% in 2024.

Weaknesses

- The worst performing commodity for the year was lithium carbonate, dropping 48.31%. Lithium carbonate faced a steep decline in 2024, with prices plunging due to oversupply and stalling electric vehicle (EV) sales, particularly in China. Overproduction and expanded capacity, including Argentina’s aggressive production growth, compounded the supply glut, driving prices to multi-year lows.

- Iron ore was the second-worst performing commodity, down 25.31%. Iron ore plunged nearly a third as China’s property crisis and economic slowdown weighed heavily on demand. High port inventories, reaching near-record levels, further exacerbated the oversupply, while weak steel demand from struggling real estate and manufacturing sectors deepened the downturn.

- Despite the positive sentiment surrounding a nuclear renaissance in the United States, particularly in the development of new power plants, there are concerns about meeting the anticipated surge in electricity demand in the future, which will be needed to power everything from electric vehicles to AI systems. Physical uranium markets struggled in 2024, with prices facing pressure from production guidance from Kazatomprom, the world’s largest producer, that was 12% higher than 2023. Uranium prices were at a 17-year high in January and the Kazatomprom news didn’t help market sentiment, despite some near-term production issues, it can ramp up production of uranium.

Opportunities

- Tin is at risk of a short squeeze after a price spike. Tin on the London Metal Exchange has surged, and its advance in 2024 puts it well ahead of more closely- watched commodities like copper or crude oil. Disruptions have hit tin supply in major producers Indonesia, Mynamar and Democratic Republic of Congo, according to Bloomberg. Tin exports from Indonesia posted their weakest quarter since at least 2007, even after rising in March.

- China took measures to stimulate its economy, and the effects will be felt across all materials. China announced that the PBOC will reduce the banks’ required reserve ratio (RRR) by 50bps and indicated it could cut by a further 25-50bps by the end of the year. Besides reducing funding costs, there were some targeted measures aimed at supporting the housing market and boosting consumption, according to UBS.

- In addition, China recently approved the construction of the of the world’s biggest renewable power plant on the Tibetan plateau to harness hydropower from the Yarlung Tsangpo River. Should construction progress, this could lead to a real boost in commodity demand by China and would tighten up global markets which have left investors scant returns.

Threats

- According to Bloomberg, the copper pipeline for the period 2024–2033 includes 51 projects, of which 11 are new, according to data released by Chilean copper agency Cochilco. The updated investment estimate is 27% higher than a previous projection for 2023-2032, according to a presentation at the mining ministry in Santiago.

- Chinese miners and refiners are driving a surge in African lithium output, shrugging off concerns over a glut to lock in future supplies of the critical battery metal. The continent is projected to account for almost 11% of global supply this year, compared with close to zero at the start of the decade, according to S&P Global Commodity Insights.

- China’s floundering solar sector will continue to face tough times in the short-term, major manufacturer Longi Green Energy Technology Co. said, as an oversupplied market keeps profits suppressed. The nation’s world-leading solar industry is grappling with a deepening glut after production outstripped demand in recent years, according to Bloomberg.

Bitcoin and Digital Assets

Strengths

- Of the cryptocurrencies tracked by CoinMarketCap, the best performer for the year was Moonwell, rising 724.03%. Bitcoin also had an exceptional run in 2024.

- Bitcoin entered 2024 prices around $40,000 and by March had surged past $70,000 for the rest of the year. However, after the U.S. presidential election results in November, bitcoin took off. Donald Trump’s decisive victory took the digital currency to $100,000 for the first time, marking a 120% increase since January, according to an article published by Bitcoin Tax.

- Bitcoin futures ETFs have been around for a while, both in the U.S. and other countries, but getting a spot Bitcoin ETF felt almost impossible until January 2024. After years of rejections, the SEC finally approved 11 spot Bitcoin ETFs this year, marking a huge milestone for the industry. Just a few months later the SEC approved 8 spot Ethereum ETFs.

Weaknesses

- Of the cryptocurrencies tracked by CoinMarketCap, the worst performer for the year was UwU Lend, down 96.24%.

- While complete data for 2024 is still coming in, it’s clear that crypto scams have risen compared to 2023. By September 2024, crypto hacks caused $2.11 billion in losses, a 72% jump from the same period in 2023, according to Bitcoin Tax.

- The altcoin market faced significant challenges in 2024, with widespread downturns and shifting priorities among investors. Analysts predict this trend may persist into early 2025, writes CCN.com, with established cryptocurrencies gaining more favor.

Opportunities

- The 2024 Bitcoin halving makes it more likely that the digital asset’s value will rise. This is a huge contrast to fiat currencies, which typically decline in value over time via inflation. The halving event is one of the ways Bitcoin’s protocol maintains scarcity, and scarcity is one of the reasons why Bitcoin is sought after by millions of people, explains a Coinbase article.

- President-elect Donald Trump has plans to create a U.S. bitcoin strategic reserve, stoking the enthusiasm of the crypto bulls. Trump could create the reserve via an executive order directing the U.S. Treasury Exchange Stabilization Fund. The reserve has the potential to include bitcoin that the government has seized from criminal actors, reports Reuters, which is about 200,000 tokens worth $21 billion.

- Institutional adoption accelerated in 2024 as corporations and institutional investors are turning to Bitcoin as an investment. In fact, the world’s largest money manager, BlackRock, has recommended a weight of 2% of your portfolio to bitcoin, according to a report by Nasdaq.

Threats

- Starting January 1, 2025, the IRS is changing how you track the cost basis for cryptocurrency. Instead of grouping all your wallets and exchanges together, you will need to track each one separately rather than in one big bucket, explains Bitcoin Tax.

- Exchanges play a critical role in the crypto ecosystem, but 2024 tested their credibility. Legal challenges and operational issues left many users questioning the reliability of these platforms, writes CCN.com. High profile cases exposed weakness in compliance and operations and loss of trust pushed traders toward decentralized options.

- There were a handful of high-stakes legal battles and arrests this year in the crypto ecosystem, starting with Sam Bankman-Fried’s sentencing of 25 years in prison in March of 2024. CZ pleaded guilty to AML laws and was sentenced to four months in prison along with a $4.3 billion fine. French authorities arrested Pavel Durov, the CEO of Telegram, in August of 2024 accusing him of enabling criminal activities through the messaging platform. Montenegrin authorities approved extraditing Do Kwon in February 2024 to face charges for the collapse of the Terra Luna cryptocurrency.

Defense and Cybersecurity

Strengths

- Donald Trump has won the 2024 U.S. presidential election, returning to the White House as the 47th president this month. Trump aims to strengthen U.S. military capabilities, reassess alliances like NATO, confront threats from nations such as China and Iran, and prioritize stricter immigration policies and border protection.

- The battle drone market underwent transformative changes in 2024, driven by advancements in AI, data centers, and satellite integration, enabling drones to operate autonomously with real-time decision-making and enhanced precision. These technologies have redefined warfare by minimizing human involvement, increasing operational efficiency, and altering traditional combat strategies through faster and more adaptive responses.

- The best performing stock in the XAR ETF in 2024 was Intuitive Machines, rising 610.76%. The positive move was driven by major NASA contracts, successful lunar missions, and strong financial growth.

Weaknesses

- Ukraine endured significant losses in 2024, as the situation worsened with intensified and accelerated Russian offensives. While Ukraine’s counteroffensive near Kursk achieved some success and temporarily bolstered its position, the potential reduction in Western military aid and an emerging demographic crisis have placed the nation in an extremely challenging situation.

- In 2024, U.S.-China tensions escalated with a major Chinese cyberattack on the U.S. Treasury, compromising sensitive data, and intensifying trade wars as the U.S. imposed tariffs and China restricted critical mineral exports. These developments highlight the growing conflict, with significant implications for global security and economic stability.

- The worst performing stock in the XAR ETF in 2024 was Boeing, as the stock declined 32.1%. This drop was driven by manufacturing flaws, labor disputes, financial losses, and reputational damage from ongoing safety and production issues.

Opportunities

- Bashar Assad’s departure from Syria and the transition of power mark a significant shift, creating opportunities for rebalancing alliances and reshaping geopolitical dynamics in the region. This change offers a chance for regional stability but also introduces new uncertainties in the broader Middle East landscape.

- Mario Draghi has emphasized the importance of NATO defense spending, committing Italy to increase its defense budget to 2% of GDP by 2028, while also highlighting that a significant portion of EU defense spending is directed to non-EU suppliers, particularly the United States, and advocating for greater investment in European defense industries to strengthen strategic autonomy.

- In 2024, innovative companies like Palantir Technologies, SpaceX, Anduril Industries, OpenAI, Saronic, and Scale AI formed collaborations to leverage advanced AI, autonomous systems, and space technologies, challenging traditional defense giants like Lockheed Martin for U.S. Department of Defense contracts.

Threats

- The 2024 Middle East conflict saw Iran’s attack on Israeli military infrastructure escalate into a wider regional crisis, drawing responses from Israel, Hezbollah, the U.S., and other global powers. Despite international mediation efforts leading to a temporary ceasefire, the region remained on the brink of renewed violence.

- Russia’s new Oreshnik missile, an advanced intermediate-range ballistic missile capable of traveling at speeds exceeding Mach 10 and carrying multiple warheads, poses a significant challenge to U.S. missile defense systems and underscores the escalating arms race between major powers.

- North Korea has intervened in the war between Ukraine and Russia by exporting ammunition and missiles and deploying troops who took part in battles in the Kursk region. This significantly alters the dynamics of the conflict, expanding its scope, and escalating threats to global security.

Gold Market

Gold futures closed the week at $2,651.40, up $19.50 per ounce, or 0.74%. Gold stocks, as measured by the NYSE Arca Gold Miners Index, ended the week higher by 2.14%. The S&P/TSX Venture Index came in up 4.25%. The U.S. Trade-Weighted Dollar rose 0.86%.

Strengths

- The best performing precious metal for the year was gold, dazzling the world with 21.41% premium afforded in 2024. Central banks, led by a gold-hungry China and joined by India and Turkey, unleashed a buying spree, adding over 1,000 tonnes to their reserves—a historic move to shield against inflation, currency risks and global turmoil. India’s cultural reverence for gold, paired with booming GDP growth, turbocharged demand, while investors flocked to gold amid Federal Reserve rate cuts and escalating geopolitical tensions.

- According to Bank of America, central bank gold inflows totaled 2,575 tons over the past five years, with the largest buyers being China (+412 tons, a 22% increase in holdings), Türkiye (+359 tons or +141%), Poland (+299 tons, or +232%), India (+280 tons, or +47%) and Russia (+223 tons, or +11%).

- Silver is living up to its promise as the Fed interest rate-cutting narrative gains greater traction. The cheaper precious metal is outperforming gold by a comfortable margin. Right now, it is on pace to close out another quarterly climb in what would be the longest winning run since 2011, according to Bloomberg.

Weaknesses

- The worst performing precious metal for the year was palladium, decreasing 20.8%. Palladium endured a crushing 2024, with prices plunging below $1,000 an ounce as weakened demand collided with a Russian supply glut. The rise of electric vehicles, which don’t require palladium for catalytic converters, and automakers substituting platinum, further eroded its once-dominant role. With oversupply persisting and job losses hitting mining companies like Sibanye-Stillwater, palladium’s decline cemented its status as the worst-performing precious metal of the year.

- According to Bank of America, production widely disappointed with nine of 12 gold companies reporting guidance below Bloomberg consensus expectations. On unit costs, similarly, nine companies of 12 reported guidance that was higher versus Bloomberg consensus expectations. Total capex was better, with only four of 12 companies reporting higher capex than consensus. On conference calls, cost inflation remained very topical with most companies noting that they are still seeing cost inflationary pressures in certain areas (such as labor) while easing fuel costs have provided some offset.

- According to Bloomberg, shares of Victoria Gold Corp. plunged the most on record after suspending operations at its flagship mine in Canada’s Yukon, following a heap leach failure. Its stock fell as much as 87% to $1 a share, its lowest since December 2002, in Toronto, after the Canadian bullion producer disclosed the incident at its Eagle Gold Mine.

Opportunities

- Silver has caught up and outperformed gold by 10% since mid-February, yet still at a gold/silver ratio over 80:1 and above the 10-year average. The 2020 ratio peak at 65:1 would equate to a silver price of over $37/ounce today, implying silver has room to move higher versus gold at current levels, according to RBC.

- For two years, J.P. Morgan strategists have urged investors to buy gold, and for two years they have been right. The bank predicted a triple crown, saying gold is once again the top commodity to buy. “Gold still looks well situated to hedge the elevated levels of uncertainty around the macro landscape heading into the initial stages of the Trump administration in 2025,” wrote a team led by Natasha Kaneva, head of JPM global commodities strategy. Gold’s extended rally is reminiscent of the late 1970s, another period when inflation was a persistent problem.

- According to Canaccord, gold valuations remain attractive in their view with the senior producers trading at 0.69x NAV, up from a recent low of 0.57x but below the historical average of 0.81x and at the lower end of the 0.65-1.0x range. According to RBC, junior gold valuations have started to move higher along with metal prices, but they remain depressed versus historical levels and prior peaks. They continue to see significant value in the group at spot metal prices and strong potential for re-rating versus producers on increased appetite for new projects with better economics at higher prices. Costs have capped upside as well as a weak merger and acquisition (M&A) market.

Threats

- Gold’s year-end outlook faces risks from a resurgent dollar, challenging the seasonal tailwinds that typically support the metal this time of the year. The precious metal typically sees its highest returns in December and January, with average gains of 2.4% and 3.5%, respectively, over the past 10 years.

- There has been a sharp decline in new gold deposit discoveries over the past few decades. Between 1990-1999, gold discoveries averaged 18 annually. This number fell in the 2000s to 12 discoveries annually, and then further declined to just four in the 2010s. Between 2020 and 2023, there have only been five major discoveries despite an increase in exploration spend, according to Bank of America.

- According to Scotia, return on invested capital (ROIC) for the mining sector is 7%, on the lower end of most industries. ROIC varies among sectors, from the technology sector at the higher end (15%) to metals & mining (7%) towards the lower end. Overall, gold companies are generally in line with the ROIC seen in the mining sector.

U.S. Global Investors, Inc. is an investment adviser registered with the Securities and Exchange Commission (“SEC”). This does not mean that we are sponsored, recommended, or approved by the SEC, or that our abilities or qualifications in any respect have been passed upon by the SEC or any officer of the SEC.

This commentary should not be considered a solicitation or offering of any investment product. Certain materials in this commentary may contain dated information. The information provided was current at the time of publication. Some links above may be directed to third-party websites. U.S. Global Investors does not endorse all information supplied by these websites and is not responsible for their content. All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. The following securities mentioned in the article were held by one or more accounts managed by U.S. Global Investors as of (09/30/2024):

Estee Lauder

Kering

L’Oreal

LVMH Moet Hennessy

Boeing Co./The

TAV Havalimanlari Holdings AS

Air France-KLM

Alaska Air Group Inc.

Southwest Airlines Co.

United Airlines Holdings Inc.

*The above-mentioned indices are not total returns. These returns reflect simple appreciation only and do not reflect dividend reinvestment.

The Dow Jones Industrial Average is a price-weighted average of 30 blue chip stocks that are generally leaders in their industry. The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies. The Nasdaq Composite Index is a capitalization-weighted index of all Nasdaq National Market and SmallCap stocks. The Russell 2000 Index® is a U.S. equity index measuring the performance of the 2,000 smallest companies in the Russell 3000®, a widely recognized small-cap index.

The Hang Seng Composite Index is a market capitalization-weighted index that comprises the top 200 companies listed on Stock Exchange of Hong Kong, based on average market cap for the 12 months. The Taiwan Stock Exchange Index is a capitalization-weighted index of all listed common shares traded on the Taiwan Stock Exchange. The Korea Stock Price Index is a capitalization-weighted index of all common shares and preferred shares on the Korean Stock Exchanges.

The Philadelphia Stock Exchange Gold and Silver Index (XAU) is a capitalization-weighted index that includes the leading companies involved in the mining of gold and silver. The U.S. Trade Weighted Dollar Index provides a general indication of the international value of the U.S. dollar. The S&P/TSX Canadian Gold Capped Sector Index is a modified capitalization-weighted index, whose equity weights are capped 25 percent and index constituents are derived from a subset stock pool of S&P/TSX Composite Index stocks. The NYSE Arca Gold Miners Index is a modified market capitalization weighted index comprised of publicly traded companies involved primarily in the mining for gold and silver. The S&P/TSX Venture Composite Index is a broad market indicator for the Canadian venture capital market. The index is market capitalization weighted and, at its inception, included 531 companies. A quarterly revision process is used to remove companies that comprise less than 0.05% of the weight of the index, and add companies whose weight, when included, will be greater than 0.05% of the index.

The S&P 500 Energy Index is a capitalization-weighted index that tracks the companies in the energy sector as a subset of the S&P 500. The S&P 500 Materials Index is a capitalization-weighted index that tracks the companies in the material sector as a subset of the S&P 500. The S&P 500 Financials Index is a capitalization-weighted index. The index was developed with a base level of 10 for the 1941-43 base period. The S&P 500 Industrials Index is a Materials Index is a capitalization-weighted index that tracks the companies in the industrial sector as a subset of the S&P 500. The S&P 500 Consumer Discretionary Index is a capitalization-weighted index that tracks the companies in the consumer discretionary sector as a subset of the S&P 500. The S&P 500 Information Technology Index is a capitalization-weighted index that tracks the companies in the information technology sector as a subset of the S&P 500. The S&P 500 Consumer Staples Index is a Materials Index is a capitalization-weighted index that tracks the companies in the consumer staples sector as a subset of the S&P 500. The S&P 500 Utilities Index is a capitalization-weighted index that tracks the companies in the utilities sector as a subset of the S&P 500. The S&P 500 Healthcare Index is a capitalization-weighted index that tracks the companies in the healthcare sector as a subset of the S&P 500. The S&P 500 Telecom Index is a Materials Index is a capitalization-weighted index that tracks the companies in the telecom sector as a subset of the S&P 500.

The Consumer Price Index (CPI) is one of the most widely recognized price measures for tracking the price of a market basket of goods and services purchased by individuals. The weights of components are based on consumer spending patterns. The Purchasing Manager’s Index is an indicator of the economic health of the manufacturing sector. The PMI index is based on five major indicators: new orders, inventory levels, production, supplier deliveries and the employment environment. Gross domestic product (GDP) is the monetary value of all the finished goods and services produced within a country’s borders in a specific time period, though GDP is usually calculated on an annual basis. It includes all private and public consumption, government outlays, investments and exports less imports that occur within a defined territory.

The S&P Global Luxury Index is comprised of 80 of the largest publicly traded companies engaged in the production or distribution of luxury goods or the provision of luxury services that meet specific investibility requirements.

The CSI 300 is a capitalization-weighted stock market index designed to replicate the performance of the top 300 stocks traded on the Shanghai Stock Exchange and the Shenzhen Stock Exchange.

The STOXX Europe 600, also called STOXX 600, SXXP, is a stock index of European stocks designed by STOXX Ltd.