AI Agents Are the Next Big Thing, Says NVIDIA’s Jensen Huang

I just returned from NVIDIA’s GTC AI Conference in San Jose, California. This year’s event was completely sold out, with an estimated 20,000 investors, engineers and business leaders in attendance.

CEO Jensen Huang likes to call the annual get-together the “Super Bowl of AI,” and after seeing his keynote, I understand why.

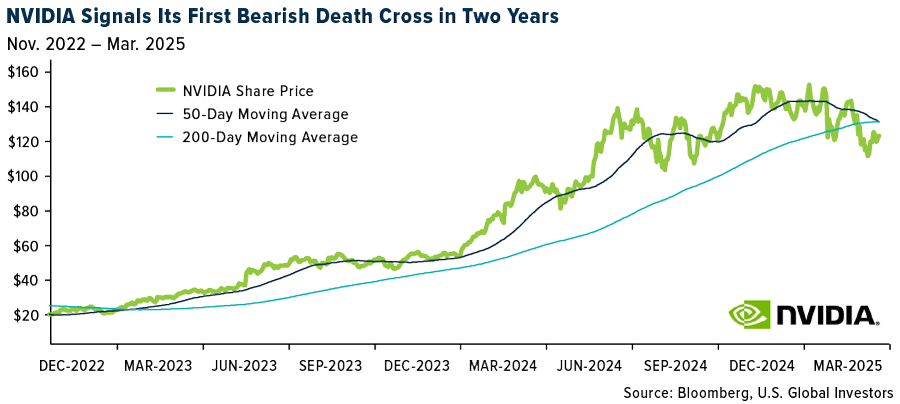

Despite NVIDIA’s stock flashing a bearish “death cross”—its 50-day moving average slipped below the 200-day moving average for the first time since January 2023—the energy at the conference was electrifying. Every major industry was represented, from health care to defense, signaling that artificial intelligence (AI) is expanding at a white-knuckle clip.

During his approximately two-hour presentation (and he didn’t use notes!), Huang described a future where AI agents will transform entire industries, making businesses more efficient, aerospace and defense more advanced and markets more intelligent.

In other words, if you thought ChatGPT was impressive, you haven’t seen anything yet.

AI Agents: The Next Industrial Revolution?

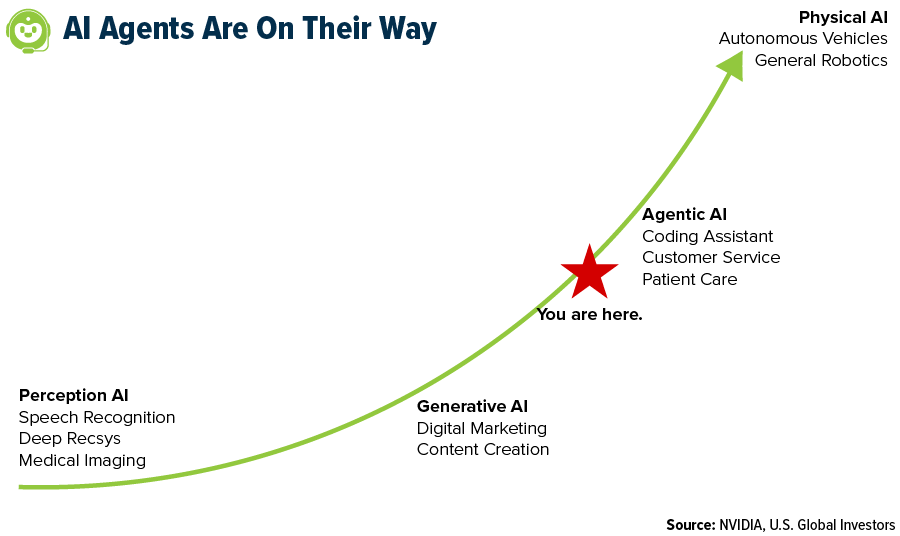

Huang spoke extensively about “agentic AI,” or AI that doesn’t just retrieve data but perceives, reasons and acts on your behalf.

In his example, AI agents “can go to a website, interpret words and videos, maybe even play a video, learn from it, understand it—and then use that new knowledge to complete its task.”

To understand this better, imagine you work on Wall Street. An AI agent could scan earnings reports, build models and execute trades faster than a human could. In health care, AI agents will be able to diagnose diseases, assist in surgeries and manage hospital logistics—all with limited human supervision.

Perhaps the biggest impact will be in aerospace and defense. Huang made a bold prediction: “Everything that moves will be autonomous.”

This suggests a future with AI-powered drones, cybersecurity defense systems, battlefield robots and much more. The U.S. military is already testing AI systems that can independently identify threats and make tactical, split-second decisions in real-time.

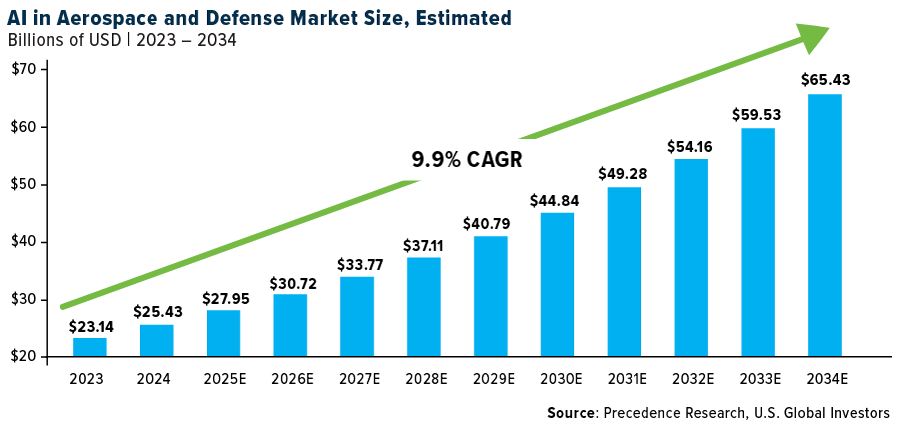

As I shared with you last month, the global AI market in aerospace and defense is projected to surge from approximately $28 billion today to $65 billion by 2034, according to one research firm. That’s a solid 9.91% compound annual growth rate (CAGR). North America alone represents $10.43 billion of this market, and it’s growing even faster at 10.02% annually.

Trump’s Pro-AI Policies and NVIDIA’s Strategic Shift

Under President Trump’s administration, there’s been a concerted effort to boost American leadership in AI. One such initiative is the Stargate Project, a collaborative venture involving OpenAI, SoftBank, Oracle and MGX, which aims to invest up to $500 billion in AI infrastructure across the U.S. by 2029.

Aligning with this vision, NVIDIA has unveiled plans to invest hundreds of billions of dollars in U.S.-based manufacturing over the next four years. The move seeks to reduce reliance on Asian supply chains, particularly in light of tariff uncertainties.

Speaking to the Financial Times this week, Huang remarked that, over the next four years, NVIDIA will buy “probably half a trillion dollars’ worth of electronics in total.” He added that he can see the company “manufacturing several hundred billion of it here in the U.S.”

A Bearish “Death Cross”

Even with all the excitement, NVIDIA’s stock has formed a death cross, a technical pattern that typically signals near-term weakness.

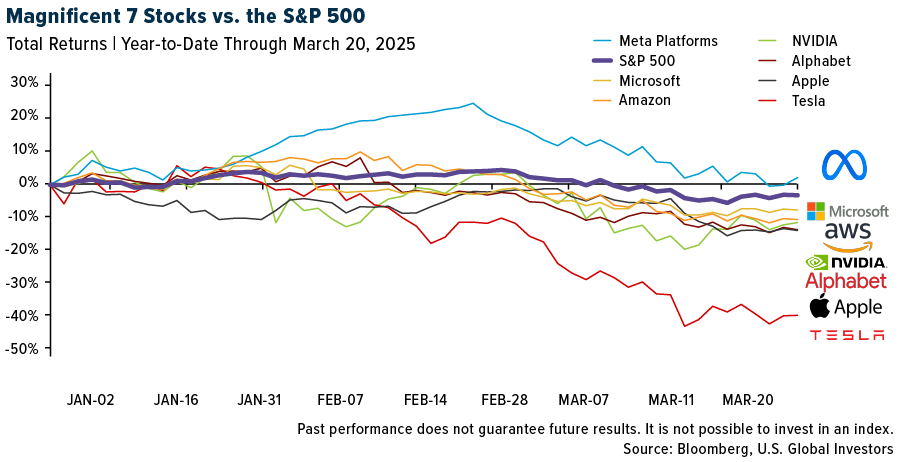

But let’s put things in perspective. After meteoric runs in 2023 (when it was up 238%) and 2024 (up 171%), some consolidation is natural, if history is any guide. Also, every Magnificent 7 stock, except Facebook-parent Meta Platforms, is underperforming the S&P 500 year-to-date.

I believe these dips can present buying opportunities. NVIDIA’s fundamentals remain incredibly strong.

In the fourth quarter of 2024, the company reported record revenue of $39.3 billion and record data center revenue of $35.6 billion. It also reported record full-year revenue of $130.5, more than double the amount generated just a year earlier.

The AI Agent Boom is Just Beginning

Sitting in the audience at NVIDIA’s GTC Conference, I could feel the same energy that surrounded the dot-com boom, the rise of mobile computing and the emergence of cloud technology.

Despite near-term market fluctuations, the investment case for AI remains rock solid. It’s clear to me that companies that build AI, use AI or enable AI infrastructure will shape the global economy in the decades to come.

Index Summary

- The major market indices finished up this week. The Dow Jones Industrial Average gained 1.20%. The S&P 500 Stock Index rose 0.51%, while the Nasdaq Composite climbed 0.17%. The Russell 2000 small capitalization index gained 0.63% this week.

- The Hang Seng Composite lost 1.16% this week; while Taiwan was up 1.10% and the KOSPI rose 2.99%.

- The 10-year Treasury bond yield fell 6 basis points to 4.249%.

Airlines and Shipping

Strengths

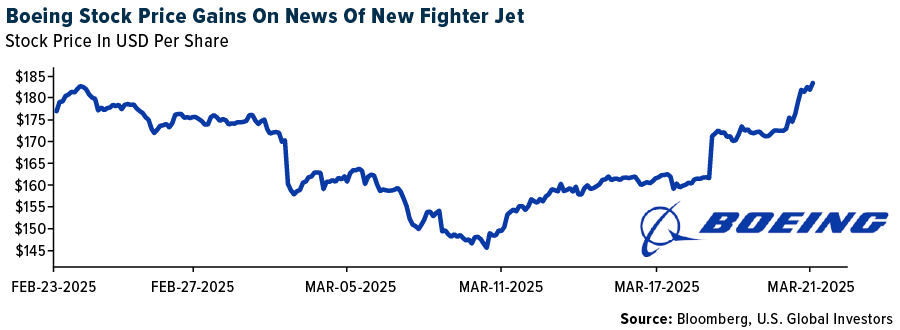

- The best performing airline stock for the week was Boeing, up 10.1%. According to CIBC, 56 business jets have been delivered versus 51 units the year prior, year-to-date. Textron delivered 11 aircraft, followed by Embraer at 10 aircraft, Cirrus at eight aircraft, and Bombardier at seven aircraft.

- Baltic airfreight rates increased 12% year-over-year in mid-March with Hong Kong/Shanghai rates trending up 17%/14% year-over-year. Hong Kong/China to Europe February rates were down 2% month-over-month for the same period, reports Bank of America.

- Both Japan Airlines and ANA Holdings reported solid traffic in February 2025, reports UBS. In its domestic segment, revenue passenger kilometers (RPK) of JAL and ANA was up 7% and 9% year-over-year, respectively, outperforming their respective capacity change of -4% and up 3%, The number of foreign visitors to Japan in February 2025 (estimated) was 3.258mn, up 16.9% year-over-year.

Weaknesses

- The worst performing airline stock for the week was Turkish Air, down 17.8%. According to Morgan Stanley, U.S. government data shows 2.2 million overseas visitors arrived in the U.S. in February, down 2.4% year-over-year. The largest market, Western Europe, was down 1.0%, and the second largest Asia was down 6.9%.

- American ships traveling through the Red Sea will come under fire, the Houthi movement warns, after the U.S. announced that attacks on the Houthis will continue if the group carries out attacks in the waters off Yemen. The escalation comes after the Houthis decided last week to resume armed attacks on all Israeli ships in the Red Sea because Israel is blocking aid from entering Gaza, according to Shipping Watch.

- Allegiant reported February traffic results and lowered first quarter guidance, albeit the reduction in first quarter earnings per share (EPS) guide is better than most peers. Importantly, the 1 ppt cut to first quarter year-over-year revenue was consistent with JetBlue and better than 1.5-5.0 ppts cuts at other airlines, according to Raymond James.

Opportunities

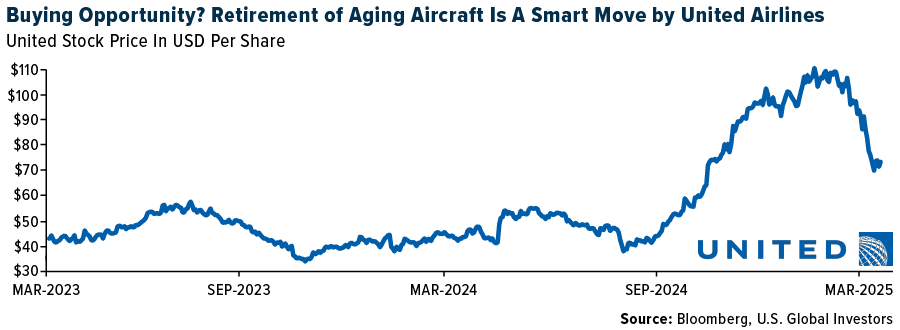

- TD was pleased with United Airlines’ decision to accelerate aircraft retirements. This is likely to be a lever if demand wanes. United and Delta Air Lines each have a significant number of owned aircraft over 24 years old and are among the oldest fleets worldwide.

- U.S. container imports in mid-March remained very strong at more than 20% year-over-year higher on pre-shipping. But container spot rates remain under pressure with a lack of discipline undermining rate hike attempts, according to Bank of America.

- JP Morgan notes significant changes for Indigo, including a shift towards international routes, with international share projected to grow to 40% by FY30, up from 28% in FY25. The airline is expected to expand into mid-haul international routes from FY26 and long-haul international routes from FY28. They anticipate improved spreads in FY26/27, driven by strong ASK growth and lower jet fuel prices.

Threats

- London Heathrow airport will be closed all day today after a fire at a nearby electrical substation left the airport without power. It is not clear when it will fully re-open or when flights will be ready to resume, with over 1,000 inbound/outbound flights scheduled for today alone. IAG will be disproportionately affected, as the dominant airline at Heathrow, with JP Morgan estimating they are 55% of today’s departing flights and with British Airways the biggest share of that.

- According to JP Morgan, the planned US tax on Chinese-built vessels docking at U.S. ports, if implemented, could lead to rerouting via Canadian and Mexican ports, potentially causing congestion at key U.S. ports. Additionally, the Red Sea crisis and geopolitical tensions have influenced shipping routes and port operations, increasing demand for certain ports and highlighting the need for strategic port investments and infrastructure upgrades along the new shipping routes.

- JP Morgan welcomes Azul’s agreement with lessors and bondholders as it addresses the mid-term balance sheet concerns but should still face a significant equity dilution. GOL is still going through its Chapter 11 process, which should imply a significant equity dilution as well.

Luxury Goods and International Markets

Strengths

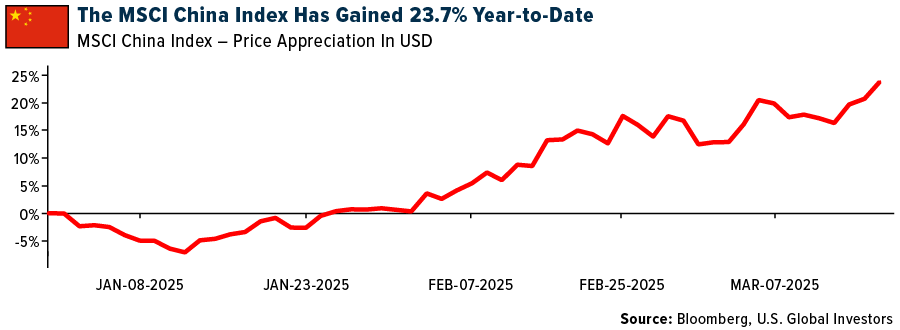

- Germany reached a new all-time high this week, driven by government plans to increase spending. Meanwhile, Chinese equities had a strong start to the year as the government continues to introduce new policies aimed at stimulating growth and restoring domestic consumer confidence.

- Lamborghini reported record-high sales of 10,687 cars and $3.4 billion in revenue in 2024. The company’s success has been driven by the popularity of its Urus SUV and the discontinued Huracan supercar, which will be replaced this year by the new Temerario. Last year the two models accounted for 87% of the brand’s sales.

- Signet Jewelers, a jewelry retailer, was the top-performing stock in the S&P Global Luxury Index, with a 23.0% increase over the past five days. Shares gained after the company projeced stronger-than-expected sales.

Weaknesses

- The FOMC decided to keep interest rates unchanged at its March meeting, as widely anticipated. A notable change in the statement was the addition of the phrase “uncertainty around the economic outlook has increased.”

- Year-to-date, U.S. equities have underperformed compared to major markets such as Europe and China. The latest BofA Global Fund Manager Survey indicates that allocation to U.S. equities is 23% underweight—the lowest level since June 2023 and the largest recorded reduction in exposure. Meanwhile, cash levels have risen to 4.1%, up from 3.5%, following a contrarian sell signal triggered in December.

- Beneteau, a manufacturer of sailboats and motorboats for recreational and racing purposes, was the worst-performing stock in the S&P Global Luxury Index, falling by 10.6%. The company’s forecasted revenue for 2025 missed the average analyst estimate.

Opportunities

- The Chinese government has taken a more proactive approach to boosting consumer confidence. Several measures have been announced, including childbirth subsidies, unemployment benefits, and support for domestic travel and related consumption. Additionally, some banks have begun offering consumer loans at a significantly lower interest rate of 2.58%, compared to rates as high as 10% two years ago.

- Germany’s stock index reached a new record high this week as the German parliament approved a substantial spending increase aimed at stimulating economic growth and strengthening military capabilities. The proposed plan includes a €500 billion infrastructure fund and adjustments to borrowing rules to support higher defense spending. Additionally, a new coalition government is in discussions to allocate an additional €900 billion to €1 trillion in government expenditure over the next decade.

- A Hong Kong real estate company controlled by the billionaire Cheng family, is in talks with Louis Vuitton to open a mega store in one of its signature malls. The proposed store would span approximately 40,000 square feet, making it one of Louis Vuitton’s largest outlets in Asia, boosting Hong Kong’s retail industry.

Threats

- BYD, the Chinese electric vehicle (EV) manufacturer, has introduced an ultra-fast charging system capable of fully charging a car in just five minutes. The company plans to establish over 4,000 charging stations across China, intensifying competition with its U.S. rival, Tesla.

- Morgan Stanley anticipates a weaker quarter for LVMH, despite a strong start to the year. The firm suggests that U.S. consumer spending on luxury goods has softened since the fourth quarter of last year, and Chinese demand is not as robust as initially expected due to ongoing normalization.

- The European Union has announced a 50% tariff on Harley-Davidson motorcycles exported to Europe, effective April 1, as part of the ongoing trade dispute with the United States. The tariff conflict could escalate further following the U.S. trade review scheduled for April 2.

Energy and Natural Resources

Strengths

- The best performing commodity for the week was lumber, rising an additional 12.67%. Sales of existing homes rose in February 2025 compared to January by 4.2%, according to Bloomberg. In addition, housing permits and mortgage applications were down as a result of the rising costs of new home builds. The demand for Canadian SPF (spruce, pine, and fir) lumber in the U.S. market remains strong due to what contractors note as superior qualities for framing, including being lighter, stronger, and less prone to warping compared to southern yellow pine.

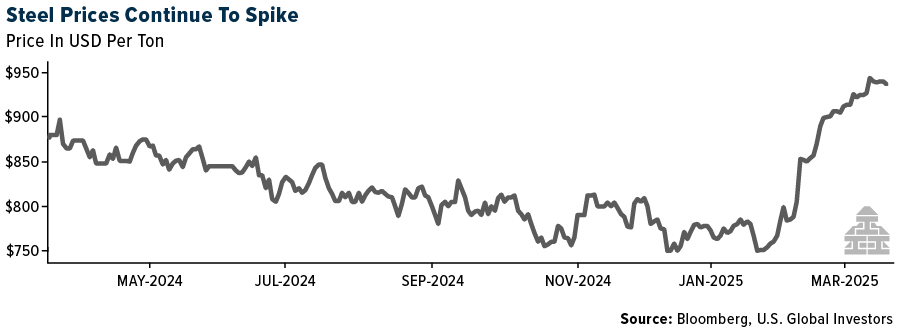

- Spot HRC prices continued to move higher over the past two weeks, albeit at a slower pace, with prices increasing 5.6% to $950 per ton and marking the highest level in a year. The recent increase, in BMO’s opinion, has been driven by a combination of restocking activity and some seasonal improvement in demand as well as limited spot availability.

- Copper marched past its key threshold of $10,000 a ton after weeks of global trade dislocation triggered by U.S. President Donald Trump’s push for tariffs on the crucial industrial metal. Trump last month ordered his Commerce Department to investigate the nation’s imports of copper as a likely precursor to imposing duties. Since then, U.S. prices have spiked, according to Bloomberg.

Weaknesses

- The worst performing commodity for the week was iron ore, dropping 4.27%. Cleveland-Cliffs announced the pause of an iron ore mine in Virginia while reducing output of another in Minnesota – laying off 630 workers, Bloomberg reports. This is coming off market sentiment in China around construction faltering and failing to increase steel demand, while China is also compensating steelmakers to incentivize closure of older and less efficient factories to relieve the supply glut.

- Lithium prices in China resumed their decline in February following an unexpected rise in January. Prices of lithium carbonate fell 3% month-on-month while those of lithium hydroxide fell 4% over the same period, explains Bloomberg.

- Asian thermal coal prices fell below $100 a ton for the first time in nearly four years as major buyers like China suffer from bloated inventories left after a mild winter. Australia’s Newcastle coal futures for March delivery fell to $98.75 a ton on Monday.

Opportunities

- The nickel market has been oversupplied owing to production increases, especially from Indonesia. Yet, the country is now looking to rein in excess output and market balances could start to shift, so Bank of America reiterates its view that prices will likely average $16,750/ton and $18,000/ton in 2025 and 2026, respectively.

- President Donald Trump has signed an executive order invoking wartime power under the Defense Production Act to boost domestic production of critical minerals, including uranium, copper, potash, gold, and potentially coal, to reduce U.S. reliance on imports, particularly from China. The order aims to enhance national security and energy independence by providing financing and expediting permits for mining projects, while also prioritizing mineral production on federal lands, Bloomberg cites.

- Bismuth prices have surged nearly 500% after China imposed export curbs in response to Trump’s trade offensive. For February, China’s bismuth exports were only 458 tons, half of what last year’s monthly average was. China had been supplying 80% of the world’s refined bismuth demand, while the U.S. hasn’t produced any since 2013, reports Bloomberg. Bismuth is principally recovered as a byproduct from the processing of lead and copper ores.

Threats

- Hedge funds are turning bearish on natural gas ahead of a mild spring that threatens to dent demand for the heating fuel. Short positions across seven natural gas contracts rose by 13,132 contracts to 245,038, according to the Commodity Futures Trading Commission.

- China has not imported liquefied natural gas from the U.S. for 40 days, the longest gap in almost two years, as traders are forced to divert shipments elsewhere to avoid Beijing’s tariffs on the super-chilled fuel. The barren streak is the most extended since June 2023, according to ship-tracking data compiled by Bloomberg.

- China plans to expand its strategic reserves of key industrial metals, including cobalt, copper, nickel, and lithium, to strengthen supply resilience amid growing energy-transition demand and geopolitical tensions. The National Food and Strategic Reserves Administration has initiated price inquiries and bidding processes for these metals, aiming to enhance the country’s ability to meet demand during critical periods and stabilize price, Bloomberg reports.

Bitcoin and Digital Assets

Strengths

- Of the cryptocurrencies tracked by CoinMarketCap, the best performer for the week was Form, rising 80.99%.

- Strategy plans to sell $500 million of dollar-denominated perpetual preferred stock, reports Bloomberg. The enterprise software company intends to use proceeds for general corporate purposes, including the acquisition of Bitcoin and for working capital.

- Hidden Road, a prime brokerage that focuses on cryptocurrencies and FX, is weighing options including a sale or capital raise that could value the company at more than $1 billion. Hidden Road and competitors including FalconX and Coinbase Prime are expected to benefit from a shift in sentiment toward crypto in the U.S., according to Bloomberg.

Weaknesses

- Of the cryptocurrencies tracked by CoinMarketCap, the worst performer for the week was PI, down 28.96%.

- OKX suspended its DEX aggregator service after regulators scrutinized its use by hackers to launder $100 million from a $1.5 billion heist on Bybit last year. OKX claims the service was used for “price discovery,” Bloomberg explains, and that any trading orders were executed on other exchanges.

- U.S. Bitcoin ETFs recorded their longest run of weekly net outflows since listing in January last year as U.S. President Donald Trump’s tariffs drove a wider retreat from riskier assets. Investors pulled $5.5 billion in total from the group of 12 ETFs over the past five weeks, Bloomberg reports.

Opportunities

- Kraken is acquiring NinjaTrader, a retail futures trading platform for $1.5 billion allowing Kraken to offer crypto futures and derivatives in the U.S. for the first time. The acquisition accelerates Kraken’s plans for equities trading and payments, and NinjaTrader will continue to operate as a standalone business, according to Bloomberg.

- President Trump rehashed the crypto-supportive actions taken by his administration since he returned to the U.S. presidency and reiterated support for stablecoin legislation, saying it will help expand the dollar’s dominance. Last week the Senate Banking Committee advanced landmark stablecoin legislation in a major victory for the cryptocurrency, according to Bloomberg.

- Akshay Naheta, a former SoftBank Group executive, has joined Bakkt Holdings as co-CEO to help revitalize the struggling U.S. crypto trading and custody platform. Naheta will collaborate with current CEO Any Main and also serve on the company’s board.

Threats

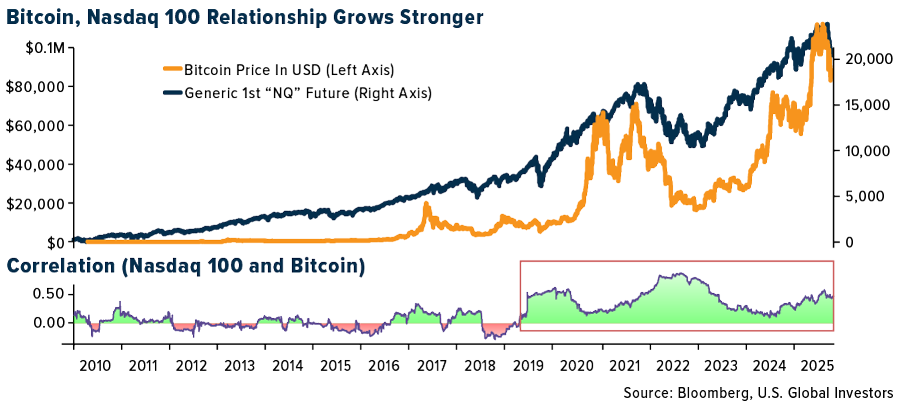

- Bitcoin was initially marketed as digital gold, a hedge against inflation and fiat devaluation. However, in practice, it has acted more like a speculative tech asset. Unlike gold, which is influenced by central bank purchases and safe-haven demand, Bitcoin primarily trades based on sentiment and momentum—factors closely linked to the performance of the Nasdaq.

- Carl Rinsch, director of the 2013 Keanu Reeves film “47 Ronin,” was arrested and indicted on wire fraud and money laundering charges for allegedly spending nearly $11 million meant for a television project on cryptocurrency and luxury cars, among other personal purchases, writes Bloomberg.

- Bitcoin futures are rolling into the April contract with the spread compressing with March futures, which is a negative signal. The actual price for the longer duration is higher than for March, but it looks as though more traders are taking advantage of the premium to establish fresh shorts, reports Bloomberg.

Defense and Cybersecurity

Strengths

- V2X was awarded a position on the U.S. Navy’s WEXMAC 2.0 contract, which aims to enhance global logistics capabilities and streamline procurement processes for joint forces and federal agencies, covering 22 regions with a five-year period and a ceiling value of $1.2 billion, with an option to extend up to 10 years.

- Elbit Systems and Rafael Advanced Defense Systems secured a contract to supply naval decoy control and launch systems for NATO European countries’ frigates, to be executed over four years for five vessels.

- The best performing stock in the XAR ETF this week was Archer Aviation Inc., rising 10.38%, after hiring former Aptiv CTO and Apple veteran Benjamin Lyon as its new president of engineering, signaling a strategic boost to its air taxi development efforts.

Weaknesses

- The Trump administration canceled over $580 million in Pentagon contracts, targeting wasteful spending and hitting firms like Booz Allen, Gartner, and McKinsey. The cuts sparked a sell-off in government contractor stocks, creating uncertainty around future consulting work.

- Israeli airstrikes across Gaza killed over 400 Palestinians, including women and children, shattering a ceasefire with Hamas, as Prime Minister Netanyahu vowed intensified military action, triggering political shifts and international concern over the fate of hostages and further escalation.

- The worst performing stock in the XAR ETF this week was Cadre Holdings Inc., falling 7.56%, after CEO Warren B. Kanders reported insider stock transactions, including the sale of 150,000 shares and withholding of shares for tax purposes related to vested restricted stock units.

Opportunities

- At a campaign rally in Ohio, President Trump unveiled plans for a new F-47 fighter jet, calling it a symbol of renewed American military dominance. Trump announced Friday that Boeing will build the Air Force’s future fighter jet, which the Pentagon says will have stealth and penetration capabilities that far exceed those of its current fleet and is essential in a potential conflict with China, Reuters reports.

- Turkey has expressed its willingness to contribute troops to a potential peacekeeping mission in Ukraine. Discussions between Turkish President Recep Tayyip Erdoğan, Ukrainian President Volodymyr Zelensky, and Russian Foreign Minister Sergey Lavrov have taken place regarding this possibility. However, any deployment would be contingent upon a ceasefire agreement and broader international consensus.

- Microsoft is making significant strides in sustainability and AI, with an $80 billion investment in emission-free data centers in the Nordic region and a 475-megawatt solar power investment to support AI data centers in the U.S., while IBM is undergoing a major restructuring, cutting thousands of jobs in its Cloud Classic unit.

Threats

- Turkey’s main opposition party, CHP, called for nationwide protests after the detention of Istanbul Mayor Ekrem Imamoglu, sparking mass demonstrations, market turmoil, and rising political tensions ahead of his expected nomination as presidential candidate.

- On March 20, 2025, Russia accused Ukraine of attacking the Sudzha gas metering station near the border, causing a major fire, while Ukraine denied involvement, calling it a provocation, amid rising tensions and halted gas transit to Europe. During this time Russia launched its largest drone strike on Odesa to date—causing massive fires and damage to civilian infrastructure—while also hitting Kyiv and Kremenchuk, underscoring the collapse of ceasefire talks despite U.S.-backed peace efforts.

- Check Point Software Technologies reported a significant 44% increase in global cyber-attacks in 2024, primarily driven by nation-state-backed hackers using AI, with healthcare and education sectors being heavily targeted.

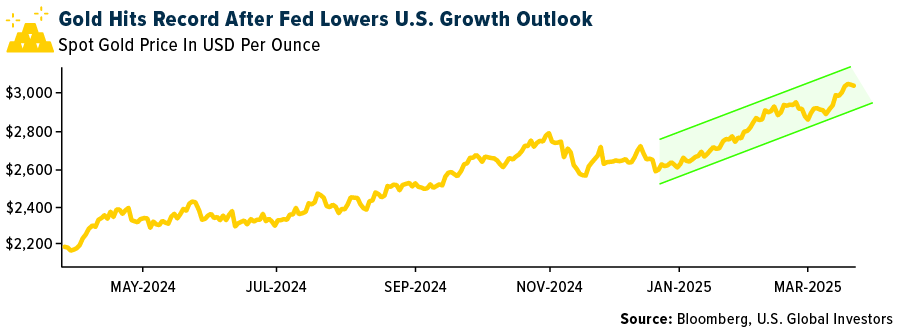

Gold Market

This week gold futures closed at $3,015.00, up $13.90 per ounce, or 0.46%. Gold stocks, as measured by the NYSE Arca Gold Miners Index, ended the week higher by 1.74%. The S&P/TSX Venture Index came in up 2.42%. The U.S. Trade-Weighted Dollar rose 0.27%.

Strengths

- The best-performing precious metal for the week was gold, up 0.46%. Prices rose for the third consecutive week amid continued trade war tensions and broader market uncertainty. Bullion hit a fresh high of $3,065, reinforcing its role as a safe-haven asset, with investors rallying behind its strength. Gold is now up just over 14% year-to-date, while the S&P 500 is down a little over 4%.

- Catalyst Metals, benefiting from record-high gold prices, has sold its Henty Gold Operation in Tasmania to junior miner Kaiser Reef for $30 million, split between cash and shares. Catalyst gains a 19.99% stake in Kaiser and a board seat. The acquisition underscores strength in the junior mining space, as Kaiser Reef paid a premium for Henty’s established infrastructure and high-grade resources, positioning itself for growth from the mine’s 25,000-ounce annual production and more than 10 years of mine life, according to Bloomberg.

- Bank of America, Citigroup and Macquarie Group have all reaffirmed bullish stances on gold as it hit record highs above $3,000 an ounce, Bloomberg reports. Amid rising concerns about the global economy, analysts cite persistent central bank buying and strong Chinese demand as key drivers. Since late 2022, gold has nearly doubled in price, supported by a global search for stability.

Weaknesses

- The worst-performing precious metal this week was platinum, down 3.39%. ETFs were net buyers of gold, silver and palladium, but net sellers of platinum—offloading over 11,000 ounces on March 20 alone. According to Bloomberg, this contributed to platinum’s underperformance.

- Galiano Gold reported fourth-quarter earnings per share (EPS) of $0.02, missing consensus estimates of $0.04, on previously reported production of 28.5K ounces. The miss was attributed to lower-than-expected gold sales (13% below Scotia’s forecast) and elevated all-in sustaining costs (AISC) of $2,638/oz, which were 3% above expectations.

- Calibre Mining’s top shareholder has opposed Equinox Gold’s $1.8 billion takeover bid, casting doubt on the year’s largest proposed bullion deal. Van Eck’s Imaru Casanova, portfolio manager of the International Investors Gold Fund, expressed disapproval in a note, citing dilution of quality and lack of operational synergies. “We do not see any synergies between any of the companies’ operations,” she said. “Both operate in the Americas, but in vastly different locations.”

Opportunities

- According to Bank of America, Kinross, SSR Mining and New Gold show the greatest downside risk if gold prices fall by $100/oz or 10%. Conversely, KGC, B2Gold and SSRM show the most upside if gold gains $100/oz.

- UBS has raised its gold price forecast to $3,200/oz over the next four quarters, up from its long-standing estimate of $3,000. UBS analysts, including Wayne Gordon and Giovanni Staunovo, cited the increasing likelihood of a prolonged global trade conflict as a key factor for their bullish revision, underscoring gold’s role as a store of value.

- Noru Al Ali of Bloomberg points out that despite gold trading above $3,000, gold miners remain over 25% below their 2010 peak. The disconnect, driven by central bank buying and geopolitical concerns, favors the metal over miners—for now. However, if gold holds above $3,000, miners’ margins may expand significantly, attracting new investor interest.

Threats

- India’s sovereign gold bond program, launched in 2015 to reduce physical gold demand, is now seen as a $13 billion naked short position for the government. With gold prices soaring, the program has become a costly liability, requiring payouts to bondholders far beyond original expectations—ultimately at taxpayer expense, Bloomberg reports.

- Silver open interest dropped by 13% in the last week of February amid renewed U.S. tariff threats and trade friction with Canada and Mexico. Meanwhile, platinum and palladium open interest have declined by 13% and 6%, respectively, year-to-date, according to Bank of America.

- After a surge in gold investment in China, the China Securities Journal cautioned investors to manage expectations and risk appropriately. “Many factors affect gold price volatility,” the Journal wrote, urging investors to allocate their gold exposure based on individual risk tolerance.

U.S. Global Investors, Inc. is an investment adviser registered with the Securities and Exchange Commission (“SEC”). This does not mean that we are sponsored, recommended, or approved by the SEC, or that our abilities or qualifications in any respect have been passed upon by the SEC or any officer of the SEC.

This commentary should not be considered a solicitation or offering of any investment product. Certain materials in this commentary may contain dated information. The information provided was current at the time of publication. Some links above may be directed to third-party websites. U.S. Global Investors does not endorse all information supplied by these websites and is not responsible for their content. All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. The following securities mentioned in the article were held by one or more accounts managed by U.S. Global Investors as of (12/31/2024):

Embraer

Bombardier

Textron

Japan Airlines

ANA Holdings

Allegiant

JetBlue

United Airlines

Delta Air Lines

Tesla

Louis Vuitton

Booz Allen Hamilton

NVIDIA Corp.

Microsoft Corp.

Alphabet Inc.

Tesla Inc.

Catalyst Metals Ltd.

Kinross Gold Corp.

New Gold Inc.

*The above-mentioned indices are not total returns. These returns reflect simple appreciation only and do not reflect dividend reinvestment.

The Dow Jones Industrial Average is a price-weighted average of 30 blue chip stocks that are generally leaders in their industry. The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies. The Nasdaq Composite Index is a capitalization-weighted index of all Nasdaq National Market and SmallCap stocks. The Russell 2000 Index® is a U.S. equity index measuring the performance of the 2,000 smallest companies in the Russell 3000®, a widely recognized small-cap index.

The Hang Seng Composite Index is a market capitalization-weighted index that comprises the top 200 companies listed on Stock Exchange of Hong Kong, based on average market cap for the 12 months. The Taiwan Stock Exchange Index is a capitalization-weighted index of all listed common shares traded on the Taiwan Stock Exchange. The Korea Stock Price Index is a capitalization-weighted index of all common shares and preferred shares on the Korean Stock Exchanges.

The Philadelphia Stock Exchange Gold and Silver Index (XAU) is a capitalization-weighted index that includes the leading companies involved in the mining of gold and silver. The U.S. Trade Weighted Dollar Index provides a general indication of the international value of the U.S. dollar. The S&P/TSX Canadian Gold Capped Sector Index is a modified capitalization-weighted index, whose equity weights are capped 25 percent and index constituents are derived from a subset stock pool of S&P/TSX Composite Index stocks. The NYSE Arca Gold Miners Index is a modified market capitalization weighted index comprised of publicly traded companies involved primarily in the mining for gold and silver. The S&P/TSX Venture Composite Index is a broad market indicator for the Canadian venture capital market. The index is market capitalization weighted and, at its inception, included 531 companies. A quarterly revision process is used to remove companies that comprise less than 0.05% of the weight of the index, and add companies whose weight, when included, will be greater than 0.05% of the index.

The S&P 500 Energy Index is a capitalization-weighted index that tracks the companies in the energy sector as a subset of the S&P 500. The S&P 500 Materials Index is a capitalization-weighted index that tracks the companies in the material sector as a subset of the S&P 500. The S&P 500 Financials Index is a capitalization-weighted index. The index was developed with a base level of 10 for the 1941-43 base period. The S&P 500 Industrials Index is a Materials Index is a capitalization-weighted index that tracks the companies in the industrial sector as a subset of the S&P 500. The S&P 500 Consumer Discretionary Index is a capitalization-weighted index that tracks the companies in the consumer discretionary sector as a subset of the S&P 500. The S&P 500 Information Technology Index is a capitalization-weighted index that tracks the companies in the information technology sector as a subset of the S&P 500. The S&P 500 Consumer Staples Index is a Materials Index is a capitalization-weighted index that tracks the companies in the consumer staples sector as a subset of the S&P 500. The S&P 500 Utilities Index is a capitalization-weighted index that tracks the companies in the utilities sector as a subset of the S&P 500. The S&P 500 Healthcare Index is a capitalization-weighted index that tracks the companies in the healthcare sector as a subset of the S&P 500. The S&P 500 Telecom Index is a Materials Index is a capitalization-weighted index that tracks the companies in the telecom sector as a subset of the S&P 500.

The Consumer Price Index (CPI) is one of the most widely recognized price measures for tracking the price of a market basket of goods and services purchased by individuals. The weights of components are based on consumer spending patterns. The Purchasing Manager’s Index is an indicator of the economic health of the manufacturing sector. The PMI index is based on five major indicators: new orders, inventory levels, production, supplier deliveries and the employment environment. Gross domestic product (GDP) is the monetary value of all the finished goods and services produced within a country’s borders in a specific time period, though GDP is usually calculated on an annual basis. It includes all private and public consumption, government outlays, investments and exports less imports that occur within a defined territory.

The S&P Global Luxury Index is comprised of 80 of the largest publicly traded companies engaged in the production or distribution of luxury goods or the provision of luxury services that meet specific investibility requirements.