A Closely Followed Recession Indicator Was Just Triggered. What Happens Now?

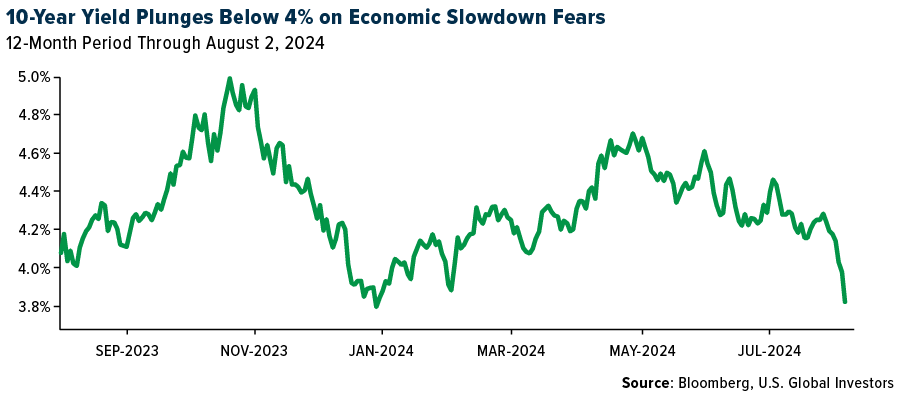

Treasury yields plunged below 4% this week for the first time since January on recession fears as global manufacturing activity contracted and hiring in the U.S. slowed dramatically in July.

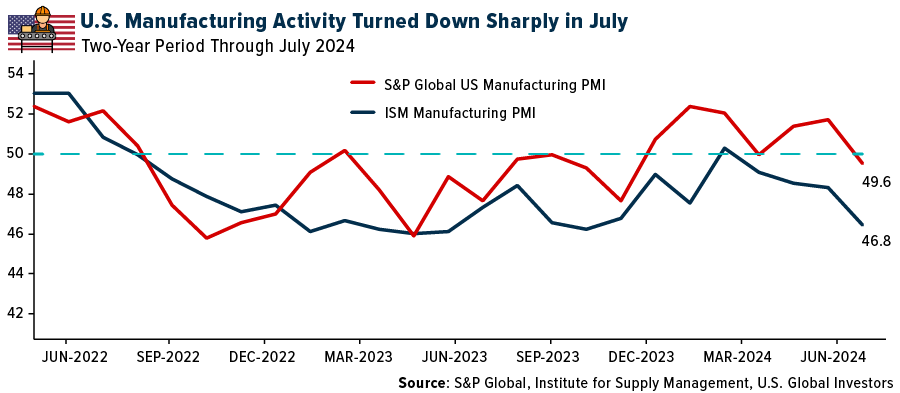

Manufacturers in the U.S. have taken their foot off the accelerator and are applying pressure to the brake. Both major indices that measure the strength of U.S. manufacturing show that the industry contracted last month. Surveyed companies told the Institute of Supply Management (ISM) that demand was subdued “due to current federal monetary policy and other conditions,” while S&P Global found that new business shrank at the fastest pace so far this year.

The JPMorgan Global Manufacturing PMI, meanwhile, also entered contraction territory in July, registering a 49.7 and dipping below its three-month moving average.

Sahm Rule in Effect

But wait, there’s more…

The unemployment rate ticked up to 4.3%, triggering the Sahm Rule, an indicator that—when applied to historical data—has accurately signaled nearly every U.S. recession since the 1950s. Named for Federal Reserve economist Claudia Sahm, the indicator says that a recession is imminent, or we’re already in one, if the unemployment rate’s three-month moving average rises half a percentage point or more (+0.50%) from its low the previous year.

Following today’s weak jobs report, the Sahm Rule hit 0.53%.

Are Recession Indicators Flashing False Positives?

So, what happens now? Would you be surprised if I said nothing?

Only time will tell if we’re barreling toward a recession, but it’s worth pointing out that other closely watched recession indicators have not been very dependable this cycle, including the New York Fed’s recession probability indicator and the Conference Board’s Leading Economic Index.

Remember the inverted yield curve? A year and a half ago, I shared with you that the spread between the 10-year yield and two-year yield was at its most extreme in 40 years. This suggested that a slowdown was “all but guaranteed,” I wrote then.

Well, maybe not. Historically, the average time between an inverted yield curve and a recession is 12 to 24 months. The current inversion was first observed on March 31, 2022, far more than 24 months ago, so either the pullback is delayed or we’re looking at a false positive.

Is the Sahm Rule also flashing a false positive? Again, no one can say for certain, but I believe this week’s economic data suggests that we’ll get a much-needed rate cut when the Federal Open Market Committee (FOMC) meets next month.

Economic uncertainty is one of the top reasons why I’ve always recommended gold as a portfolio diversifier. I prefer to have about 10% of my assets in gold, with half of it in physical bullion (coins, bars and jewelry) and the other half in high-quality gold mining stocks and ETFs.

Gold Analyst Believes China’s Central Bank Continues to Buy Gold

Total gold demand reached its highest second quarter on record this year, according to the most recent report by the World Gold Council (WGC). Global demand for the yellow metal touched 1,258 tonnes in the June quarter, up a marginal 4% from the same period last year but marking the highest second-quarter figure in the WGC’s data going back to 2000.

Gold investment was essentially flat from last year, but record prices weighed heavily on jewelry sales during the quarter. Worldwide consumption of gold jewelry dropped sharply to 391 tonnes, a 19% decrease year-over-year. Sales slumped a significant 35% in China, whose residents have cut back on expensive purchases such as precious metals and luxury goods.

Speaking of gold and China, you may have seen headlines stating that the central bank of the world’s second-largest economy was stepping back from its epic gold-buying spree.

Those headlines may not be entirely accurate, based on new analysis.

In a new report, famed gold analyst Jan Nieuwenheijs says that he believes China has, on the contrary, secretly continued to import bullion. According to his analysis of customs data, Nieuwenheijs concludes that the People’s Bank of China (PBoC) has been buying 400-ounce bars from the U.K., even though it’s been claiming the exact opposite.

If true, this is very bullish for gold demand. I encourage you to check out Nieuwenheijs’s article, which you can find here.

Gold Shines Bright at the Olympics

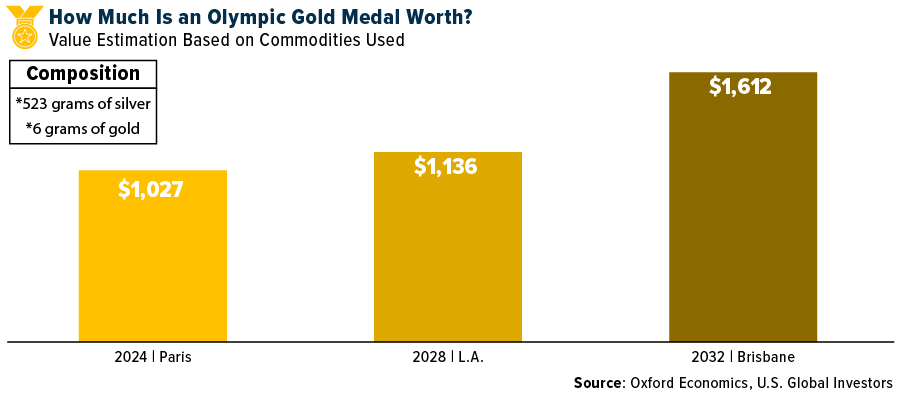

On a final note, many of you watching this year’s Olympics Games may have noticed the unique, hexagon-shaped gold, silver and bronze medals. They are indeed unique, designed by LVMH-owned fashion brand Chaumet, marking the first time in modern Olympic history that a jeweler was put in charge of designing the medals.

It’s for this reason, and the fact that the medals contain an iron piece of the Eiffel Tower, that Oxford Economics says it believes “winning an Olympic medal this year should yield considerable investment value.”

An Olympic gold medal is exceedingly more valuable than the basic materials that went into making it—523 grams of silver, covered in six grams of gold. But if we’re pricing a gold medal based just on today’s commodity prices, it’s valued around $1,027, according to Oxford. Forecasters there say that the same medal could be worth $1,136 in 2028, when the Olympics takes place in Los Angeles, and $1,612 in 2032, just in time for the Brisbane Games.

Have a blessed weekend!

Index Summary

- The major market indices finished down this week. The Dow Jones Industrial Average lost 2.10%. The S&P 500 Stock Index fell 2.06%, while the Nasdaq Composite fell 3.35%. The Russell 2000 small capitalization index lost 6.67% this week.

- The Hang Seng Composite gained 10.99% this week; while Taiwan was down 2.18% and the KOSPI fell 2.04%.

- The 10-year Treasury bond yield fell 40 basis points to 3.786%.

Airlines and Shipping

Strengths

- The best performing airline stock for the week was Airbus, up 1.3%. IAG has published results for the first half of 2024 and delivered a second quarter operating result -0.8% year-over-year to EUR1,241m, supported by unit revenues up 1.8% in the second quarter. IAG announced a gross interim dividend of 3 cents per share, according to RBC.

- WorldACD reports global air freight volumes were up 14% year-over-year and notes that, while Asia-to-U.S. demand is up 8% year-over-year, China-to-U.S. is down 8% year-over-year due to increasing customs inspections for inbound Chinese shipments at Los Angeles, reports Bank of America.

- Recent data indicates five 787 deliveries so far in July by Boeing, an improvement from the three aircraft delivered in June, says Bank of America. Additionally, the company still sees production returning to normal by the end of the year.

Weaknesses

- The worst performing airline stock for the week was Allegiant, down 17.5%. Venezuela has again suspended flights with Panama on perceived political slights. Though timing is unclear, if this lasts through September, Raymond James estimates it could have a $40 million impact on revenue.

- FedEx plans to significantly slash daily flights/number of U.S. cities served by air during the daytime with its air cargo contract with USPS, says Raymond James. This will add 500 pilots to the existing surplus.

- ANA Holdings’ first quarter operating profit of ¥30 billion missed Bank of America’s estimate. Higher maintenance costs were the key disappointment (¥10 billion above plan) which more than offset better first quarter domestic unit revenues (up 7.7% year-over-year).

Opportunities

- U.S. citizen departures to international regions reached a record high since 2019, according to Morgan Stanley, proving international travel remains robust. U.S. departures into international regions came in up 9% year-over-year and up 20% versus 2019 in the month of June, at over 8.2 million departures.

- Scorpio Tankers is generating strong returns as the product market continues to benefit from decent demand but more importantly from long ton-miles because of Red Sea disruptions and continued impact from Russian sanctions. Stifel believes fundamentals should remain supportive of elevated rates and Scorpio is positioned for continued outsized cash flows, translating into significant buybacks which are currently at a significant discount to NAV.

- Alaska Air disclosed that the pre-existing August 5 DOJ merger review deadline has been extended to August 15. Alaska Air and DOJ reached a similar extension in 2016, though the ultimate negotiated solution for the Virgin America merger took an additional month-and-a-half to reach, beyond the adjusted deadline, reports JPMorgan.

Threats

- Delta’s recent outage resulted in 6,500 total flight cancellations (versus >16,700 at Southwest during its December 2022 meltdown). Raymond James estimates the impact to be a $325 million pretax income ($0.31 EPS) drag, with the potential to be as high as $475 million ($0.45 of EPS) if using a similar impact as Southwest.

- Since the beginning of June, the shipping equity peer group is down 11.5% while the S&P is up 3.4%. Stifel expects recent weakness can be linked to increased nervousness around China. Part of that nervousness is likely election-driven as a Trump White House is probably not helpful to global trade.

- The DOT announced that it would launch an investigation into Delta following the recent global IT outage as thousands of Delta’s flights were canceled over several days, according to Skift and other news sources. While most major U.S. airlines were impacted by the software outage, Delta took longer to recover than peers.

Luxury Goods and International Markets

Strengths

- Exclusive Italian car maker Ferrari posted a strong earnings beat this week and raised its full-year outlook. Profits increased in the second quarter, boosted by strong sales of customized and higher-end limited edition cars, such as the $2.2 million Daytona SP3.

- Prada’s net revenue in the first half of the year grew 17%, in line with analysts’ estimates. The company’s Japan retail sales jumped 55% in the first half of the year helped by strong tourism flow, Bloomberg reported. The country has been a favorite destination for Chinese customers taking advantage of a weaker yen.

- Hugo Boss was the top-performing S&P Global Luxury stock, rising 7.2% over the past five days. The company expects sales growth in a range of 1% to 4% in 2024, increasing focus on cost efficiency to support profitability going forward.

Weaknesses

- JPMorgan’s Global Manufacturing PMI dropped to 49.7 in July from 50.8 the previous month. A reading above 50 indicates expansionary activity, while a reading below 50 signals a slowdown in manufacturing. China’s manufacturing PMI, as well as those for the Eurozone and the United States, all fell into contractionary territory.

- Amazon reported an earnings per share beat after the market closed on Thursday, but shares opened down 8% on Friday. The company’s projection for third-quarter operating income missed Wall Street expectations, and the revenue outlook trailed the average analyst estimate.

- MGM Resorts International was the worst-performing S&P Global Luxury stock, losing 15.2% in the past five days. Shares dropped after the company reported late financial results.

Opportunities

- Dior, a subsidiary of the luxury conglomerate LVMH, created beautiful and expensive outfits for the performers at the opening ceremony of the 2024 Olympic Games, including gowns for Celine Dion and Lady Gaga. All the dresses are currently on display at the Galerie Dior exhibition space in the French house’s historic flagship on Avenue Montaigne in Paris.

- Very wealthy clients that spend more than €20,000 a year on designer goods are a smaller group of around 2.5 million individuals who account for 10% of all luxury sales. Middle-class consumers don’t spend a ton of money on designer goods, but they are still a crucial group for big brands. More than half of global luxury purchases are made by 330 million or so people who spend less than €2,000 a year on expensive handbags, clothing, and jewelry, according to Boston Consulting Group. In the U.S., people who make between $50-125,000 per year are spending more on luxury than those who earn more than $125,000.

KKR, a global investment firm managing investments such as private equity, energy, infrastructure, and real estate, expects deal-making for private equity to continue to improve in the second half of the year. The company reported second-quarter earnings that beat Wall Street estimates, with a key profit measure soaring 49%, as deal-making improved, Bloomberg reported.

Threats

- Softer economic data in the United States put selling pressure on equities this week. There is growing anticipation that the Federal Reserve may have waited too long and could cut rates by 50 basis points in September. U.S. manufacturing activity entered deeper into contraction, unemployment increased, and jobless claims reached their highest level in nearly a year.

- Luxury brands are under pressure due to a slowdown in China. This week, Marriot reported an earnings beat but cut its outlook due to weakness in China and North America. Starbucks, which reported earnings on Tuesday, saw sales in China declining 14% year-on-year in the second quarter. Brands are struggling in the mainland as customers save more and spend on experience over products.

- Shares of Louis Vuitton reached a 52-week low this week, along with many other luxury brands correcting. Since its peak in March, the company has lost 26% of its market value. The outlook for the second half of the year is uncertain due to economic weakness in China and the United States.

Energy and Natural Resources

Strengths

- The best performing commodity for the week was nickel, rising 3.11%, on what was described by SMM as buyers on the “capital side” lifting the price and this was not end-user demand picking up. According to Morgan Stanley, the supply impulse that helped to drive iron ore prices lower over the first half of this year has likely passed, with growth from Australia and Brazil in July the lowest in 15 months, and guidance pointing to a flatter H2 for the Majors.

- China’s copper market is showing a tentative improvement after a months-long slump in demand that stunned bullish investors and dragged prices down from a record high, reports Bloomberg. While there is no major turnaround so far, analysts and traders in China say that buyers in the world’s biggest copper market are starting to dip in again after prices crashed from above $11,000 a ton in May to below $9,000 this week.

- Shell Plc reported strong results with an earnings beat and confirmed another $3.5 billion of share buybacks as the company’s CEO Wael Sawan, stated Shell’s focus it “to make sure that we are able to reward our shareholders consistently, while continuing to modestly deleverage the business.” Shell reduced net debt by over $2 billion over the last quarter, Bloomberg writes.

Weaknesses

- The worst performing commodity for the week was uranium, as proxied by the Sprott Physical Uranium Trust, dropping 5.97%, on news that Kazakhstan’s state-owned miner Kazatomprom increased its 2024 full-year production guidance (which hit the other uranium stocks hard). Cameco Co. lost more than 15% of its share value this week and Denison Mines lost 18%.

- Crude oil moved to a six-week low as positive Chinese economic data and renewed tension in the Middle East remained overshadowed by doubts over global demand. Brent futures reached nearly $81 a barrel but sold off at the end of week on OPEC+’s plan to raise output at their next meeting, marking a fourth weekly decline, according to Bloomberg.

- China’s apparent oil demand declined significantly in June, down 8% year-over-year as demand slipped below the five-year seasonal average. Persistent weakness in diesel and fuel oil demand as well as a recent slowdown in naphtha and jet fuel demand growth drove the decline. The narrowing year-over-year growth in jet fuel spells trouble for Chinese oil demand, says Morgan Stanley, given it is expected to be the major driver of demand growth in 2024.

Opportunities

- Goldman still sees some room for a cyclical recovery because jet fuel demand remains 1.2mb/d (15%) below its pre-pandemic trend. While global passenger flows have nearly caught up to 2019 levels, they remain well below their steep upward pre-pandemic trend, especially outside the U.S.

- Permian Resources Corp. will buy some of Occidental Petroleum Corp.’s West Texas assets for $817.5 million, it said in a statement. The deal is part of Occidental’s previously announced plan to divest assets to help fund its acquisition of closely held CrownRock LP, according to Bloomberg.

- BHP Group Ltd. — fresh from being rebuffed by Anglo American Plc — swooped to buy Filo Corp., teaming up with Lundin Mining Corp. in a $3 billion deal to gain South American copper assets, Bloomberg reports.

Threats

- Major U.S. shale oil basins hold 85 billion barrels of crude oil reserves in the known formations, or about 17 years of supply at current rate of production. Within this relatively easily accessible inventory, $70 WTI represents a price at which there are sufficient reserves to grow production to a peak of 14.3 mbd, JPMorgan explains, after which it plateaus.

- Copper prices could fall further from the highs reached earlier in the year if Chinese demand continues to falter, the boss of Anglo American has warned. Duncan Wanblad, the miner’s chief executive, described copper as an “emotional metal,” still determined by sentiment toward China, despite the big boost to demand that is expected as the world seeks to decarbonize, according to the Times.

- The management of Koniambo Nickel SAS, which operates a nickel plant in France’s New Caledonia, told 1,200 of its employees on Friday that they will be laid off at the end of August, Les Echos reported. Nickel prices have fallen 25% since the middle of May. If existing nickel operations are closing due to low prices, it’s difficult to expect new marginal projects to attract any new funding.

Bitcoin and Digital Assets

Strengths

- Of the cryptocurrencies tracked by CoinMarketCap, the best performer for the week was Aave, rising 17.58%.

- Coinbase reported second-quarter revenue of $1.45 billion, beating the $1.39 billion estimate. Analysts highlighted the company’s diversified revenue base and strength in subscription and services, which grew to $599 million, a 79% increase year-over-year.

- Japan’s Mitsubishi UFJ Financial Group Inc. is investing $393 million to acquire an 8% stake in Globe Telecom Inc.’s GCash, a leading Philippine fintech company valued at $5 billion. This move comes as part of its strategy to tap into the growing digital payment sector in Asia, which is increasingly integrating with the crypto market.

Weaknesses

- Of the cryptocurrencies tracked by CoinMarketCap, the worst performer for the week was dogwifhat, falling 26.46%.

- Traditional markets from the U.S. to Japan saw declines across major indexes and stocks, reports CoinDesk, with the tremors seeping into the cryptocurrency market. Bitcoin rebounded from lows near $62,500 in Asian morning hours on Friday, amidst a global asset sell-off entering its third day. However, despite the rebound, CoinDesk reports that BTC remained under pressure and trading near its 50-day moving average.

- The Treasury’s proposed updates to anti-money laundering and counterterrorism financing regulations could complicate compliance and increase costs for financial institutions. The proposed updates highlight the challenges for crypto exchanges and other global financial institutions relying on offshore resources.

Opportunities

- After four days of consecutive outflows, spot ether ETFs finally saw positive inflows on Tuesday, July 30, with the nine newly approved ETFs pulling in a net total of $33.7 million, according to Farside Investors data. Leading the pack, BlackRock’s ETHA attracted $118 million, followed by Fidelity’s FETH with $16.4 million, and Grayscale’s mini ether ETF, ETH, with $12.4 million. Franklin Templeton’s EZET and Bitwise’s ETHW also saw inflows of $3.7 million and $3.5 million, respectively. These gains helped offset the $120.3 million outflows from Grayscale’s larger fund, suggesting a potential stabilization in the market.

- At last week’s Bitcoin Conference in Nashville, former U.S. President Donald Trump announced his intention to establish a U.S. strategic Bitcoin reserve. This initiative includes a proposed bill to hold 1 million bitcoins in reserves, aiming to strengthen the nation’s financial position and support the burgeoning cryptocurrency market.

- Solana saw a significant uptick in investor interest due to its rapidly growing ecosystem and the successful launch of new technological advancements like its high-speed blockchain platform. CoinMarketCap suggests this has positioned Solana as a strong competitor in the Layer 1 blockchain space, driving its market cap and transaction volumes to new heights.

Threats

- Cryptocurrencies are sliding amid potential geopolitical instability, reports Bloomberg. On Wednesday, Bitcoin tumbled 2.85% and Ethereum dropped 1.43% after Iran’s attacks in Israel as investors’ concerns rise. If these global geopolitical tensions cease to ease, the digital assets could continue in a downtrend.

- Coinbase is concerned about “ongoing regulation through enforcement” in Australia, ahead of expected draft legislation by the end of 2024, reports CoinDesk. The exchange’s Asia-Pacific Managing Director, John O’Loghlen, emphasized that such enforcement is not beneficial to the industry, particularly given recent positive interactions with regulators. Australia’s Treasury plans to introduce draft legislation covering licensing and custody rules for crypto asset providers.

- Vice President Kamala Harris is triggering a crypto tug-of-war between Democrats, writes Politico. Senators are divided over cryptocurrency regulation, with Senator Elizabeth Warren and others pushing for stricter controls, while figures like Chuck Schumer support easing restrictions. This conflict emerges as the House debates federal crypto legislation that could redefine regulatory authority, the article explains, as the split highlights the growing influence of the crypto industry in politics.

Defense and Cybersecurity

Strengths

- Huntington Ingalls Industries reported second quarter 2024 earnings with a GAAP earnings per share (EPS) of $4.38, beating estimates, and revenue of $3.0 billion, up 6.8% year-over-year. This comes alongside significant increases in operating income and net earnings, though free cash flow was negative at $99 million, with new contract awards totaling $3.1 billion.

- The AUKUS partnership, formed in 2021 between the U.S., the UK, and Australia, aims to enhance Indo-Pacific defense against China, with Australia acquiring nuclear submarines and BWX contributing to the SSN-AUKUS design. The U.S. and Australia will also invest in the U.S. submarine industry to improve production rates, while Australia boosts military spending to develop its submarine capabilities.

- The best performing stock in the XAR ETF this week was Howmet Aerospace, rising 9.05%, after Howmet Aerospace raised its forecasts and reported second-quarter results that exceeded estimates, with adjusted EPS at 67 cents, revenue at $1.88 billion, adjusted net income at $276 million, and adjusted EBITDA at $483 million.Truist analyst Michael Ciarmoli called the results “stellar” amidst ongoing aerospace production rate uncertainty.

Weaknesses

- Hamas leader Ismail Haniyeh was assassinated in Tehran, according to Iran’s Revolutionary Guard, with suspicion immediately falling on Israel. This comes amid heightened tensions following Hamas’ October 7 attack on Israel, and as U.S. and international efforts continue to seek a cease-fire.

- Iran raised the red flag and is preparing to retaliate for the strike on Tehran. Iran has announced that it will launch a direct strike on Israel and is also preparing for a full-scale special operation.

The worst performing stock in the XAR ETF this week was Virgin Galactic Holdings, falling 19.33%, after an unusual increase in reader interest, with trading volume 21% above the 20-day average and still falling in a long bearish streak.

Opportunities

- United Launch Alliance launched a classified U.S. military payload to orbit with its Atlas V rocket for the last time, marking the end of the Pentagon’s use of Russian engines for national security missions. The U.S. is transitioning to domestically made launchers.

- Russia released Wall Street Journal reporter Evan Gershkovich, former U.S. Marine Paul Whelan, and dissident Vladimir Kara-Murza in a major prisoner swap with the U.S., involving prisoners held by both countries. The prisoner swap followed extensive talks between both countries, according to anonymous sources.

- The U.S. will arm F-16 jets sent to Ukraine with American-made missiles and advanced weapons, addressing a key question about their capabilities, as Denmark and the Netherlands prepare to send the first jets this summer, with more to follow from Belgium and Norway. The move comes although challenges remain in training pilots, maintaining the aircraft, and ensuring a steady supply of munitions.

Threats

- Russia has started using a new type of drone in Ukraine, called “Gerberas.” These drones are much cheaper than the “Shahed” equivalents and have begun to exhaust Ukraine’s air defense.

- The risk of war between North and South Korea remains low, but Vladimir Putin’s recent alliance with Kim Jong Un adds a new layer of geopolitical tension. A conflict would have catastrophic human and economic consequences, with potential losses reaching $4 trillion in the first year, significantly disrupting global semiconductor supply chains and the broader economy.

- The Sudanese Armed Forces intercepted two drones targeting a military celebration in eastern Sudan attended by army chief Abdel Fattah al-Burhan. This resulted in five deaths and several injuries, amidst an ongoing deadly conflict between the SAF and paramilitary Rapid Support Forces.

Gold Market

This week gold futures closed at $2,478.80, up $50.90 per ounce, or 2.10%. Gold stocks, as measured by the NYSE Arca Gold Miners Index, ended the week higher by 0.68%. The S&P/TSX Venture Index came in off 4.10%. The U.S. Trade-Weighted Dollar fell 1.05%.

Strengths

- The best performing precious metal for the week was platinum, up 2.10%. Gold was the second-best performer as it climbed toward record-high levels on Friday as traders flocked to haven assets ahead of key U.S. economic data. The precious metal traded to an intraday high of $2,522.50 on Friday before falling back with the weak jobs report raising fears that the Fed has waited too long and a potential recession is now being contemplated, reports Bloomberg.

- Soaring gold prices are hobbling demand for traditional applications like jewelry and dentistry, but wealthy Asian investors’ voracious appetite is more than offsetting the other declines. Strong physical bar buying in the over-the-counter market, particularly by family offices in Asia, helped gold demand register its best second quarter in data going back at least 25 years, according to the World Gold Council.

- Gold- and silver-backed exchange-traded funds have seen notable inflows this month, reports Bloomberg. If sustained, that trend could mark an inflection point for the holdings after a long stretch of declines and be supportive of the metals’ prices.

Weaknesses

- The worst performing precious metal for the week was palladium, down 0.44%. China’s gold demand has cracked in the face of record-high prices for the precious metal, with sales at the country’s jewelers in a funk as buyers hold off on purchases. Total demand for bullion fell almost 6% from a year earlier in the first half to 524 tons, the China Gold Council said in a quarterly report.

- Despite gold putting in its best performance since March, sales of American Eagle gold coins at the U.S. Mint only reached 19,555 ounces in July, which was a 43% drop from the prior month’s sales. Gold was up 5.2% in July; perhaps a reflection of some price sensitivity on the part of consumers who just saw the price hit an all-time high just two weeks ago.

- OceanaGold reported second quarter 2024 results with production of 98,200 ounces gold and AISC of $2,131 per ounce gold. Adjusted EPS for the quarter was $0.04 and CFPS was $0.14. The operational miss to Scotia’s expectations was driven by delayed access to high-grade breccia stopes at Didipio and lower mill throughput at Haile.

Opportunities

- Silver has underperformed gold recently amid broader selling pressure across industrial metals. JPMorgan continues to see a persistent deficit in the silver market driven by continued solar demand growth. Strong macro fundamentals and a supportive silver S&D backdrop drives JPMorgan’s forecast for silver prices to average $36 per ounce in 2025.

- Gold is the best portfolio hedge in the event Donald Trump retakes the White House, according to the latest Bloomberg Markets Live Pulse survey. Proponents of the precious metal as a haven play in case of Trump’s reelection outnumbered those picking the U.S. dollar two-to-one among the 480 respondents, according to Bloomberg.

- First Majestic announced the discovery of a new high-grade vein system at depth at Santa Elena, called Navidad. Drill results from six holes show strong gold and silver grades, and the system is approximately 500m southwest and 750m below Ermitaño and remains open in all directions, reports BMO.

Threats

- Elevation Gold, operator of the Moss mine in Arizona, announced it is seeking CCAA protection. Triple Flag maintains a silver stream on the Moss mine, reports RBC, which represented 6% of TFPM’s corporate production in 2023.

- Precious metals refiner Heraeus confirms that buyers have become more cautious, noting that “China’s jewelry demand is creaking under pressure from high prices. Elevated gold prices, particularly in yuan terms, persistently low levels of consumer confidence and uncertainty over the economic outlook are crimping gold jewelry demand in China.”

- According to Canaccord, SSR Mining continues to expect that all displaced material from the Sabırlı Valley will be moved into temporary storage areas by the end of the third quarter 2024 and the estimated site remediation cost remains at $250-300 million to be spent over 24-36 months.

U.S. Global Investors, Inc. is an investment adviser registered with the Securities and Exchange Commission (“SEC”). This does not mean that we are sponsored, recommended, or approved by the SEC, or that our abilities or qualifications in any respect have been passed upon by the SEC or any officer of the SEC.

This commentary should not be considered a solicitation or offering of any investment product. Certain materials in this commentary may contain dated information. The information provided was current at the time of publication. Some links above may be directed to third-party websites. U.S. Global Investors does not endorse all information supplied by these websites and is not responsible for their content. All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. The following securities mentioned in the article were held by one or more accounts managed by U.S. Global Investors as of (06/30/2024):

Boeing

FedEx

ANA Holdings

Alaska Air

Southwest Airlines

Delta Air Lines

KKR

Dior

Amazon

Ferrari

Prada

LVMH

Anglo American Plc

Filo Corp

BHP Group

Oceana Gold

Triple Flag

*The above-mentioned indices are not total returns. These returns reflect simple appreciation only and do not reflect dividend reinvestment.

The Dow Jones Industrial Average is a price-weighted average of 30 blue chip stocks that are generally leaders in their industry. The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies. The Nasdaq Composite Index is a capitalization-weighted index of all Nasdaq National Market and SmallCap stocks. The Russell 2000 Index® is a U.S. equity index measuring the performance of the 2,000 smallest companies in the Russell 3000®, a widely recognized small-cap index.

The Hang Seng Composite Index is a market capitalization-weighted index that comprises the top 200 companies listed on Stock Exchange of Hong Kong, based on average market cap for the 12 months. The Taiwan Stock Exchange Index is a capitalization-weighted index of all listed common shares traded on the Taiwan Stock Exchange. The Korea Stock Price Index is a capitalization-weighted index of all common shares and preferred shares on the Korean Stock Exchanges.

The Philadelphia Stock Exchange Gold and Silver Index (XAU) is a capitalization-weighted index that includes the leading companies involved in the mining of gold and silver. The U.S. Trade Weighted Dollar Index provides a general indication of the international value of the U.S. dollar. The S&P/TSX Canadian Gold Capped Sector Index is a modified capitalization-weighted index, whose equity weights are capped 25 percent and index constituents are derived from a subset stock pool of S&P/TSX Composite Index stocks. The NYSE Arca Gold Miners Index is a modified market capitalization weighted index comprised of publicly traded companies involved primarily in the mining for gold and silver. The S&P/TSX Venture Composite Index is a broad market indicator for the Canadian venture capital market. The index is market capitalization weighted and, at its inception, included 531 companies. A quarterly revision process is used to remove companies that comprise less than 0.05% of the weight of the index, and add companies whose weight, when included, will be greater than 0.05% of the index.

The S&P 500 Energy Index is a capitalization-weighted index that tracks the companies in the energy sector as a subset of the S&P 500. The S&P 500 Materials Index is a capitalization-weighted index that tracks the companies in the material sector as a subset of the S&P 500. The S&P 500 Financials Index is a capitalization-weighted index. The index was developed with a base level of 10 for the 1941-43 base period. The S&P 500 Industrials Index is a Materials Index is a capitalization-weighted index that tracks the companies in the industrial sector as a subset of the S&P 500. The S&P 500 Consumer Discretionary Index is a capitalization-weighted index that tracks the companies in the consumer discretionary sector as a subset of the S&P 500. The S&P 500 Information Technology Index is a capitalization-weighted index that tracks the companies in the information technology sector as a subset of the S&P 500. The S&P 500 Consumer Staples Index is a Materials Index is a capitalization-weighted index that tracks the companies in the consumer staples sector as a subset of the S&P 500. The S&P 500 Utilities Index is a capitalization-weighted index that tracks the companies in the utilities sector as a subset of the S&P 500. The S&P 500 Healthcare Index is a capitalization-weighted index that tracks the companies in the healthcare sector as a subset of the S&P 500. The S&P 500 Telecom Index is a Materials Index is a capitalization-weighted index that tracks the companies in the telecom sector as a subset of the S&P 500.

The Consumer Price Index (CPI) is one of the most widely recognized price measures for tracking the price of a market basket of goods and services purchased by individuals. The weights of components are based on consumer spending patterns. The Purchasing Manager’s Index is an indicator of the economic health of the manufacturing sector. The PMI index is based on five major indicators: new orders, inventory levels, production, supplier deliveries and the employment environment. Gross domestic product (GDP) is the monetary value of all the finished goods and services produced within a country’s borders in a specific time period, though GDP is usually calculated on an annual basis. It includes all private and public consumption, government outlays, investments and exports less imports that occur within a defined territory.

The S&P Global Luxury Index is comprised of 80 of the largest publicly traded companies engaged in the production or distribution of luxury goods or the provision of luxury services that meet specific investibility requirements.

The Federal Reserve Bank of New York’s recession probability indicator uses the slope of the yield curve, or “term spread,” to calculate the likelihood of a recession in the United States in 12 months.

The Conference Board’s Leading Economic Index (LEI) is a composite index of 10 indicators that tracks economic activity in the United States.