5 Bitcoin and Digital Asset Predictions for 2024

If today were the last day of 2023, Bitcoin would have returned almost 155%, marking the best year since 2020, when it rose a phenomenal 305%.

Like the market in general, Bitcoin has notched a strong ending to 2023 after trading rangebound for most of the year. If today were the last day of 2023, the king of digital assets would have returned almost 155%, marking the best year since 2020, when it rose a phenomenal 305%.

With only two weeks remaining in December, I figured now would be an ideal time to share my top five Bitcoin and digital asset predictions for 2024. As a reminder, these are my personal predictions and do not reflect those of U.S. Global Investors.

1. A spot Bitcoin ETF will launch in the U.S., sparking a price revaluation.

There are no guarantees in life, but a U.S.-based spot Bitcoin ETF now appears to be imminent.

Bloomberg Intelligence puts the odds of the Securities and Exchange Commission (SEC) approving a filing by January 10 at 90%. It’s possible we’ll see back-to-back launches of Bitcoin ETFs in January—as many as 10, Bloomberg estimates.

How will this affect the price of the underlying asset? Spot Bitcoin ETFs are available in other markets, including Canada and Europe, but it’s worth noting that the U.S. accounts for approximately 60% of the total global equity market value. One data analytics firm says that the demand spurred by a spot ETF could push the price of Bitcoin to between $50,000 and $73,000. Some readers will find this estimate too conservative.

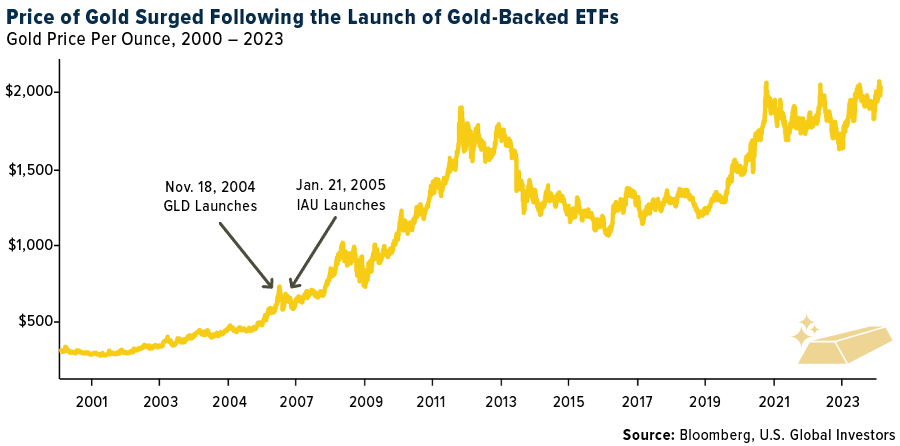

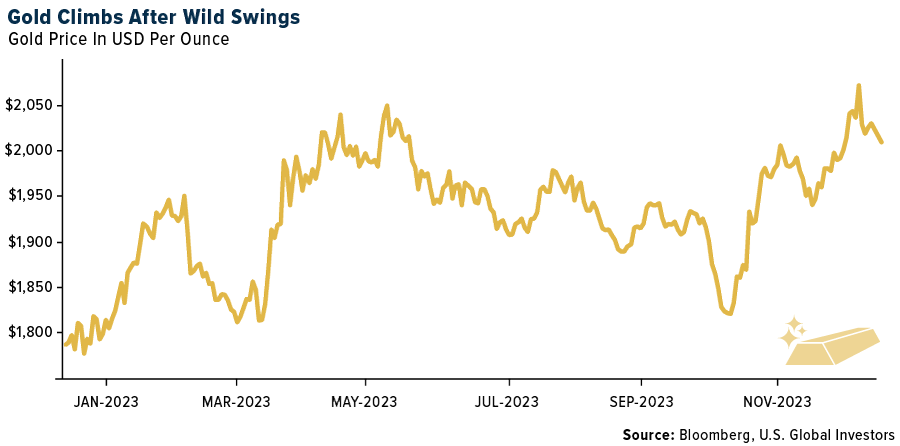

It may be instructive to review what happened to the price of gold—Bitcoin’s analog cousin—after the launch of the first U.S.-based gold commodity ETF, SPDR Gold Shares (GLD). Before GLD and the similarly gold-backed iShares Gold Trust (IAU), investors were limited to physical bullion (which can be costly to move and store) and the futures market (which may not be appropriate for every investor).

Making its debut in November 2004, GLD increased overall demand for gold by reducing the frictional costs associated with investing in the metal and making it more accessible to a broader investor base.

Since that time, the price of gold has increased nearly 360%.

While I’m on this topic, a spot Ethereum ETF could also be made available in 2024. The SEC’s decision on two specific filings, from VanEck and Ark/21Shares, is expected in May. Unlike Bitcoin, Ether is not considered a commodity, but I believe such an ETF will similarly drive demand for crypto.

2. Smaller miners will struggle to survive after the halving.

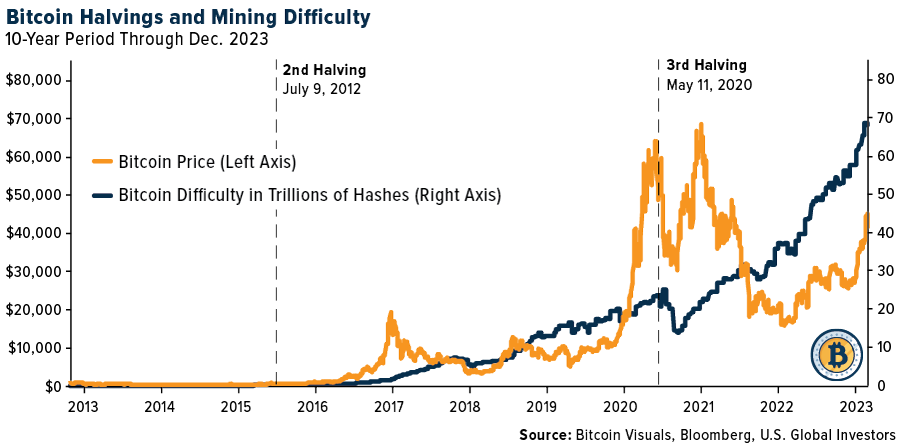

As many of you know, Bitcoin was programmed to have a limited supply. The number of tokens that will ever exist is capped at 21 million, and every four years, the digital asset undergoes an event called the halving. The next halving is expected in April 2024, after which the mining reward will be trimmed by 50%, from 6.25 BTC per block to 3.125 BTC.

This is a double-edged sword. On the one hand, the price of Bitcoin has historically rallied immediately before and after previous halving events as investors act on the reminder that supply is highly restricted.

On the other hand, smaller and less well-capitalized crypto miners will likely struggle to survive as the difficulty rate continues to climb and the mining reward is reduced by half. At the end of last month, crypto miners Hut 8 and US Bitcoin Corp completed their merger, and I expect to see additional business deals as the industry positions itself for this new era of mining difficulty.

3. The $84 trillion wealth transfer will greatly benefit digital assets.

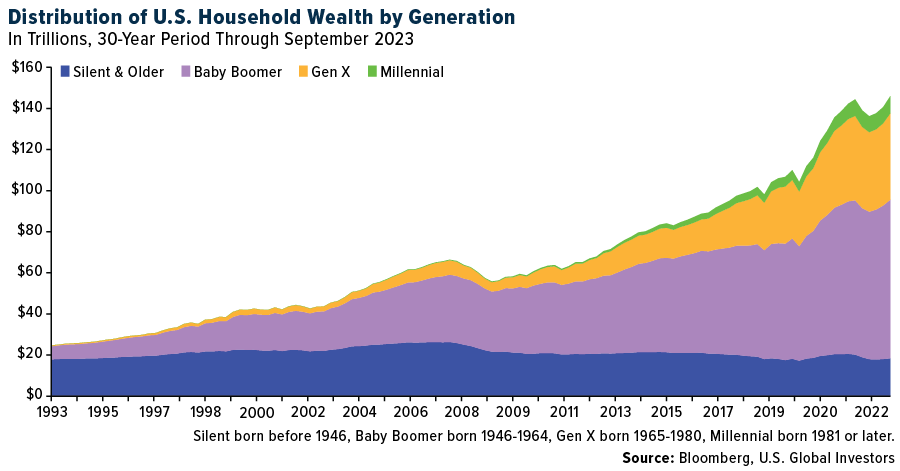

The world is about to witness the largest transfer of wealth in human history. Over the next two decades, members of the Silent Generation (those born before 1946) and Baby Boomers (1946 – 1964) will leave their heirs an estimated $84.4 trillion, with Millennials (1981 – 1996) being the primary beneficiary.

This will have a number of major ramifications, but as blockchain firm Galaxy reminds us, Millennials and younger generations “have a higher preference for crypto” than their parents and grandparents. Not only are members of this cohort “digital natives,” but they’ve also lived through a series of financial setbacks (the Great Recession, high inflation, restrictive borrowing costs) that, in many cases, have sullied their trust in traditional financial institutions and assets. A 2022 Investopedia survey found that Millennials as a whole were more likely to invest in cryptocurrencies than in stocks, mutual funds, ETFs, commodities and real estate.

Says Galaxy’s Charles Yu, “Shifting wealth from older generations into the hands of this crypto-friendly population is likely to result in greater inflows into Bitcoin and the broader crypto asset class.”

4. NFTs and Ordinals will make a huge comeback.

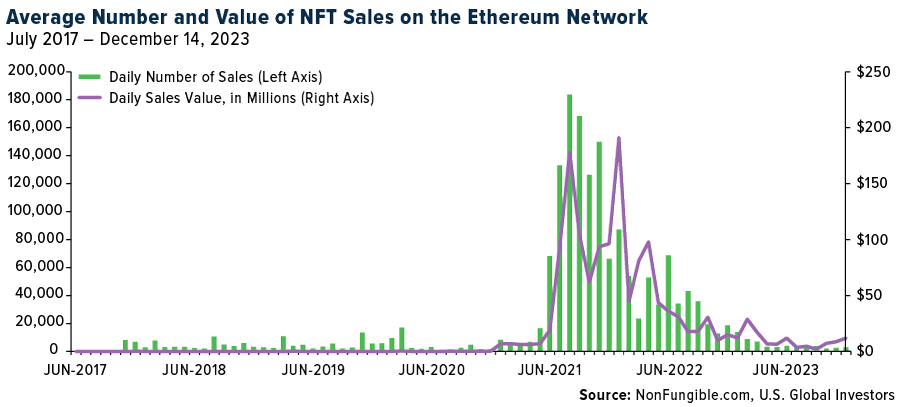

Non-fungible tokens, or NFTs, have lost much of their cache since the bull run of 2021-2022. Many of these digital assets, permanently inscribed on the Ethereum blockchain, used to trade hands for millions of dollars. Today, however, an estimated 95% of NFTs are “worthless,” according to dappGambl.

Is the market ready for a renaissance? I believe so, though the Bitcoin network is fast becoming the preferred platform. One year ago this week, people began inscribing text, images and other media on Bitcoin, and by May, it was being reported that the Bitcoin blockchain was the second-most popular NFT platform after Ethereum.

Ordinals, as NFTs on the Bitcoin network are called, now account for over half of all daily Bitcoin transactions, and trading volumes recently hit a new record high, soaring to $36 million on December 12.

5. Bitcoin miners will continue to be good stewards of energy resources.

Bitcoin mining is often criticized for its energy consumption, but much of this energy comes from renewable sources such as hydroelectric power, wind and solar. What’s more, in the first half of 2023, the global Bitcoin network used only 0.21% of the world’s energy, an inconsequential amount, according to the Bitcoin Mining Council (BMC).

Another important development is the use of stranded gas, a byproduct of oil and gas operations, which is used in mining to prevent waste and reduce carbon and methane emissions. This approach is financially beneficial for miners, as it generates more revenue compared to selling the gas at market prices. It can also help comply with regulations limiting gas flaring.

On a final note, excess heat from Bitcoin mining can be recycled, as HIVE Digital Technologies is doing in Lachute, Quebec. Heat from its Bitcoin operations is being used to warm a neighboring facility, an approximately 200,000-foot swimming pool manufacturer.

Have a wonderful weekend, and happy investing!

Index Summary

- The major market indices finished up this week. The Dow Jones Industrial Average gained 2.92%. The S&P 500 Stock Index rose 2.61%, while the Nasdaq Composite climbed 2.85%. The Russell 2000 small capitalization index gained 5.66% this week.

- The Hang Seng Composite gained 2.49% this week; while Taiwan was up 1.67% and the KOSPI rose 1.82%.

- The 10-year Treasury bond yield fell 31 basis points to 3.911%.

Airlines and Shipping

Strengths

- The best performing airline stock for the week was Allegiant, up 10.2%. According to Bank of America, system net sales rose 10.7% for the week in the strongest datapoint since mid-August and ahead of the flat four-week average. Both pricing and volumes accelerated this week to -0.8% and 11.6%, respectively, compared to -4.6% and 8.4% last week. The data aligns with the strong holiday demand commentary the bank has been hearing from the airlines and is better than expected heading into the off-peak period between Thanksgiving and Christmas. Large corporate travel accelerated for the third consecutive week to positive 6.9%, the strongest datapoint since late April.

- According to Morgan Stanley, air freight rates from Shanghai to North America and Europe have increased 70-75% since September 2023. The group thinks China’s growing cross-border e-commerce has been one of the key drivers in addition to seasonality. In transportation, higher air freight rates should benefit players that own freighters, such as SF Holding, Cathay Pacific, and China Southern Airlines.

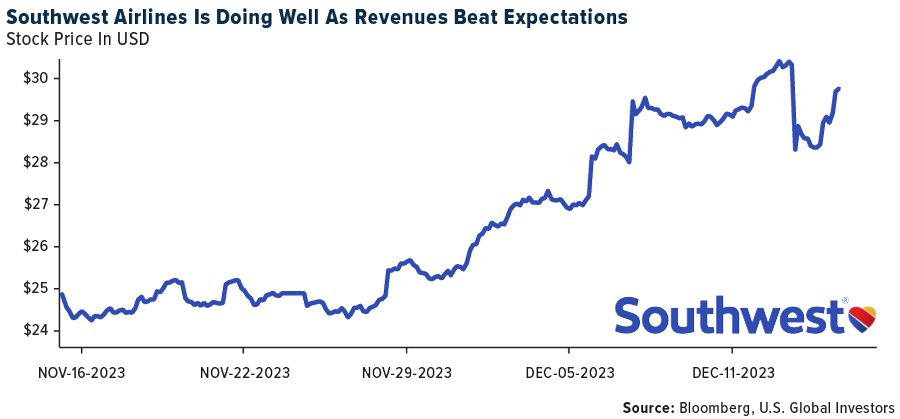

- Southwest Airlines published an investor update tightening its December quarter revenue outlook to the better end of its prior range due to stronger-than-expected close-in bookings (including managed corporate) in the second half of the quarter. The company now expects unit revenue to be down 9% to 10% year-over-year versus down 9% to 11% prior.

Weaknesses

- The worst performing airline stock for the week was Sun Country, down 5.2%. According to Bank of America, China’s air travel demand appears to be weaker than expected since November on both the domestic and non-domestic fronts. Non-domestic capacity resumption has been largely in line, and the bank expects 70% capacity by the end of 2023 and 80% by March of 2024. However, non-domestic demand resumption remains uncertain, considering headwinds from weak income outlook, RMB depreciation, and negative travel sentiment related to Southeast Asia and Japan. That said, it may take longer than expected for demand to recover from 70-80% of pre-Covid levels to a full recovery. The bank now expects a full non-domestic travel recovery to occur in the first half of 2025.

- Scorpio Tankers updated its mid-fourth quarter TCE rates, with charter rates that were slightly shy of its targets. Its rates imply a fourth quarter fleet TCE average of approximately $33,000 per day. This implies net voyage revenues of $330 million. It booked 92%, 87%, and 84% of its spot LR2, MR, and Handymax revenue days at $38,000, $32,500, and $30,000 per day, respectively.

- Southwest Airlines’ flight attendants rejected a tentative flight agreement as 64% of attendants voted against the proposal. The Transport Workers Union (TWU) represents 19,000 flight attendants seeking higher pay and better work rules. The five-year proposal included a 20% pay raise beginning next month and a 3% annual raise between 2025 and 2028, as well as parental leave with insurance coverage.

Opportunities

- According to Bank of America, United Airlines raised Atlantic capacity by 260/250 basis points (bps) in April/May bringing growth in those months up 5%, ahead of -1% in the first quarter of 2024, as the carrier allows 2023’s capacity growth in the region to mature. Delta Air Lines similarly added 120bps of Atlantic capacity in March and April while bringing May capacity up 70bps. In April/May, Delta’s Atlantic capacity growth is tracking 4% higher, only slightly ahead of the first quarter of 2024 at 3.5%.

- Star Bulk (SBLK) and Eagle (EGLE) are merging on a NAV-to-NAV basis. EGLE shareholders will receive 2.6211 shares of SBLK for each share of EGLE. That works out to a $52.60 per share valuation, a 17% premium. The new company will be owned 71% by current SBLK shareholders and 29% by EGLE shareholders. Both boards have agreed to the transaction.

- According to Morgan Stanley, the latest forecast of the Forward Leading Indicator Traffic Estimate (FLITE) index, the group’s proprietary short-term leading indicator of U.S. domestic air travel, predicts that RPKs will see a strong uptick in early 2024. As the Covid shock has faded significantly from 2020 peaks, the cycle component has dominated more heavily calling for a steady trend in the RPKs within the next six months, followed by a sharp inflection in March/April 2024. Normal seasonality accounts for an uptick during this time of the year, but the estimated 2024 uptick reaches pre-pandemic levels. The net result is that, per the index, demand in early 2024 is set to align with what normal growth trends from prior to the pandemic would have looked like, if the COVID pandemic had not occurred at all – a new milestone in the normalization of demand post-pandemic.

Threats

- Flight attendant contracts are another cost headwind for U.S. airlines in 2024, which could be up to a 1 ppt CASM-ex headwind. Currently, only DAL/LUV include higher flight attendant (FA) pay in earnings. United’s FA leadership requested mediation in a December 5 filing after 26 months of negotiations. American Airlines’ FAs remain in mediation while Southwest’s FAs voted against a TA by 64%.

- A relatively large part of the global container capacity will be affected by the EU’s requirement that shipping from the turn of the year must buy quotas for ships’ CO2 emissions. According to Alphaliner, the numbers from the end of November show that at least 10.5 million TEU, twenty-foot containers of the total global container capacity, move in and out of EU ports and will thus be affected. This corresponds to more than 37% of the container fleet.

- According to Raymond James, forecasting the standalone earnings outlook is particularly challenging for Spirit given the GTF engine issue. In late October, the company noted 10 AOG (aircraft on ground) in the fourth quarter of this year, with an average of 26 in 2024 (starting at 13 in January and stepping up to 41 in December). They are currently assuming an average of 17 AOG in 2025.

Luxury Goods and International Markets

Strengths

- November retail sales in the United States were reported at 0.3%, a surprise increase against the consensus for a 0.2% contraction. Annualized retail sales rose to 4.1%, up from the downwardly revised October 2.2% and the highest since February.

- Spanish luxury retailer, ITX (best known for its brand Zara), reported an earnings beat this week, along with Costco. Costco declared a special dividend of $15 per share, payable on January 12, 2024, to shareholders of record as of the close of business on December 28. Zara announced further expansion in the United States, with a focus on shoppers in Utah, Colorado, Texas, and Tennessee.

- RH, a home furnishing store, was the best performing S&P Global Luxury stock, gaining 27.52% in the past five days. According to a Seeking Alpha article published this week, the company transformed into a luxury brand under the leadership of CEO Gary Friedman. RH expanded into different areas such as travel and real estate and wants to grow revenue from $3 billion to $20-25 billion.

Weaknesses

- The Eurozone flash PMI for December weakened, implying a slowdown in manufacturing and service activities. The composite PMI (which combines the production and service activities in the Euro area) recorded a two-month low of 47.0 versus a consensus of 48.0 and prior 47.6.

- The New York Fed’s Empire State Index (a survey of business conditions in the New York region) dropped 24 points to -14.5 in December, hitting a four-month low, from a positive reading of 9.1 in November. Bloomberg economists expected a reading of 2.0. Any reading below 0 indicates worsening conditions.

- Farfetch, an online retailer, was the worst performing S&P Global Luxury stock, losing 47.74% in the past five days. According to a Sky News report, the company was in talks to secure emergency funding from a private equity firm due to financial trouble. UBS analyst Kunal Madhukar lowered the firm’s price target to 80 cents from $3.30 and kept a “neutral” rating on the shares. Shares of Farfetch closed at 64 cents on Friday.

Opportunities

- On Wednesday, the Federal Reserve acknowledged inflation has eased, saying that the central bank will not wait until inflation is back to 2% to start lowering rates. Rate cuts are widely expected now, with the first one as soon as March 2024. The stock market rallied, and the dollar weakened after Powell surprised with a dovish tone this week at the Fed meeting.

- Brunello Cucinelli released a year-end update to the market where the company upgraded its 2023 revenue growth guidance to 22-23% year-over-year (from 20-22%) and confirmed $10 revenue growth for 2024 and 2025. This became the fifth time that Cuccinelli upgraded current-year expectations when other luxury brands were experiencing much slower growth. Bank of America reiterated a “buy” rating for the company.

- Marriot International, the largest hotel chain in the world, partnered with a local hospitality company in Costa Rica, Enjoy Group, and is planning to open two luxury hotels in 2025. Marriot created two executive roles in its vacation ownership business aiming at driving the company’s long-term growth strategy. The hospitality industry continues to see strong demand for travel post-pandemic.

Threats

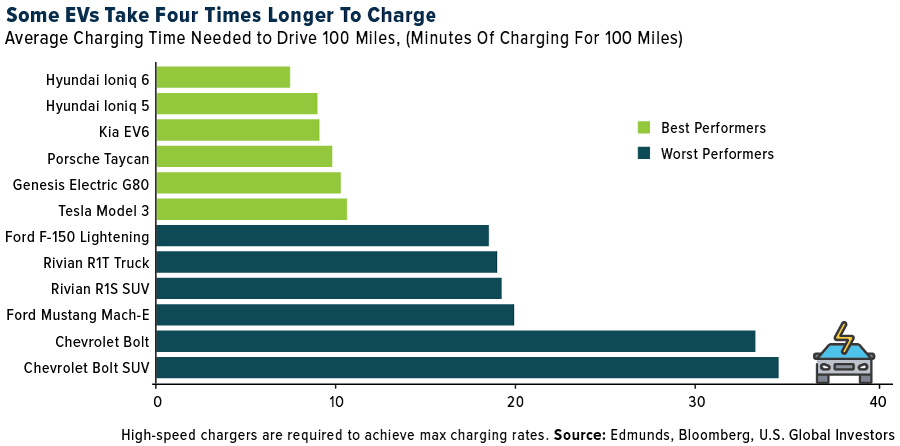

- Most electric vehicle (EV) makers will get access to over 12,000 Tesla Superchargers starting next year. EV buyers may start looking more favorably upon brands other than Tesla. According to an article published on Bloomberg, the Hyundai IONIQ 6 model can charge its battery needed to drive 100 miles in about eight minutes, beating Tesla’s Model 3 by three minutes. This week Tesla also announced recalling nearly all of its cars sold in the U.S. (more than 2 million) produced between Oct 5, 2012, and December 7 of this year, due to defective self-driving systems. The competition among EVs is growing.

- JPMorgan cut the rating on shares of luxury giant Louis Vuitton to a “neutral,” setting a price target of 790 euros, implying a 7.7% increase in the price. The broker warned about the first half of 2024 and is more optimistic about the luxury sector performance in the second half of next year. Kering and Ferragamo were both placed on a negative watch.

- This week China held the Central Economic Work Conference and investors were surprised by the lack of strong stimulus to boost the country’s growth. China’s top leaders vowed to make industrial policy a top economic priority for 2024 instead of any forceful stimulus. Fitch Ratings expects the growth rate for China to drop to 4.6% next year, from 5.3% this year.

Energy and Natural Resources

Strengths

- The best performing commodity for the week was coffee, rising 6.86%, to a seven-month high as inventories remain at 1999 lows while dry weather forecast in Brazil could potentially stress the crops and yield less to harvest this season. According to JPMorgan, in refining, gasoline cracks have improved, and inventory levels look tighter relative to seasonal norms than they did in the early fall, while diesel remains strong with tight inventories globally and resilient demand that has held up well despite issues in the global industrial economy and weather not being particularly accommodating to heating oil demand in late 2023.

- According to JPMorgan, for copper prices to break and rally above $9,000/mt in 2024, the group still thinks a recovery impulse in ex-Chinese demand is needed. Nonetheless, in the near term, the significantly tighter supply outlook will likely be reflected in a higher risk premium in prices in the coming quarters driving a higher forecast price floor around $8,500-$8,600/mt over the first half of 2024.

- Electricity generated from U.S. solar and wind systems will surpass power produced by burning coal for the first time next year, driven by surging panel installations. Coal will produce about 599 billion kilowatt-hours in 2024, according to government data released Tuesday. That will be down from 669 billion kilowatt-hours this year as utilities continue to shutter coal-burning power plants.

Weaknesses

- The worst performing commodity for the week was natural gas, dropping 4.42%. Consumption of coal is set to peak this year at 8.5 billion metric tons, according to the International Energy Agency (IEA). Demand is expected to slide to 8.3 billion metric tons by 2026. While demand is being replaced with cleaner energy sources, the IEA doesn’t see the use of coal going away soon.

- According to JPMorgan, LNG spot prices averaged US$17.02/MMBtu in November 2023, up a further 4% from the prior month but still 40% below the previous comparable period. Prices have subsequently fallen to US$15.75/MMBtu. Average prices in November implied a slope of 20% against the three-month lagged Brent price. The forward curve is now in backwardation. Contracts are currently trading at US$14.42/MMBtu in December 2024, and US$13.27/MMBtu in December 2025.

- Oil edged lower as continuous pressure from robust supplies globally countered curbs by the OPEC+ alliance. Global benchmark Brent traded near $76 a barrel. Futures last week dipped to a multi-month low on soaring output from producers outside of the Organization of Petroleum Exporting Countries and its allies.

Opportunities

- Global copper supplies are tightening fast after the shuttering of a major mine in Panama and drastic output cuts at operations owned by Anglo American Plc. That has contributed to a slump in the fees charged by smelters to their lowest since March last year. The treatment charges, which determine margins, have dropped by about a quarter since August to $66.50 a ton, according to data from Metal Bulletin. The fees fall when there’s not enough copper concentrate for smelters to refine.

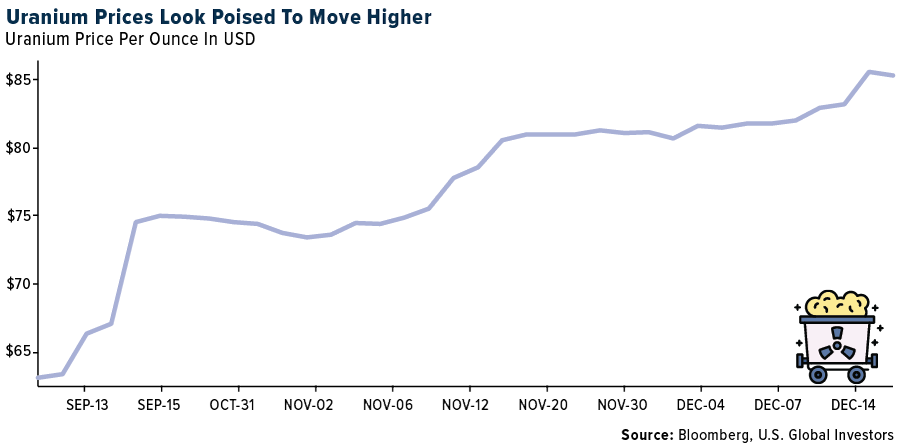

- According to RBC, the U.S. House passed a bill to ban Russian uranium imports today and a companion bill will now be considered by the U.S. Senate before being sent to the White House. RBC thinks a potential U.S. ban on Russian uranium imports, with temporary waivers until January 2028, would keep uranium markets tight long-term and there is potential for an immediate retaliatory Russian ban on uranium exports to the U.S. — Russia accounted for 24% of enrichment and 12% of uranium purchased by U.S. utilities in 2022. If Russia implements an immediate export ban, RBC expects uranium prices to rise near-term as U.S. utilities seek alternative supply in an already tight market.

- Occidental Petroleum Corp. agreed to acquire Texas shale driller CrownRock LP in a cash-and-stock deal valued at about $10.8 billion as consolidation heats up in North America’s most-prolific oil basin. The transaction is expected to close in the first quarter of 2024, subject to regulatory approvals, Occidental said Monday in a statement. The company has lined up $10 billion of committed bridge financing through Bank of America Corp., according to an investor presentation.

Threats

- Mining billionaire Robert Frieland commented that in order to meet the rising demand for critical minerals, copper prices forecasted to reach $9,000 a metric ton next year isn’t enough of a price incentive to bring on new production, considering the risks of huge capital-intensive mines, especially in Latin America. To spur new mine development, Frieland said the industry needs $15,000 a ton prices to spur the investment in new mines.

- According to JPMorgan, the spot prices for lithium carbonate and hydroxide have dropped significantly in the past month, by 34% and 26%, respectively, to Rmb100,000/ton. The bank maintains its bearish view due to ,1) larger surpluses across the forecast horizon, with weaker demand outweighing the impact of lower supply; and 2) marginal cost continuing to decrease. According to SMM, the China lepidolite cost curve is Rmb 70,000/ton on average, and there is no pressure to reduce supply, as miners and integrated refiners are still profitable.

- OPEC+ will need to carefully control oil supplies for another five years to avoid a “meltdown” in crude prices, according to Rapidan Energy Group. While global oil demand will not peak for at least another decade, supplies from outside OPEC — particularly the U.S. — are growing much faster than previously estimated, the Washington- based consultant said in its latest long-term report.

Bitcoin and Digital Assets

Strengths

- Of the cryptocurrencies tracked by CoinMarketCap, the best performer for the week was Bonk, rising 128%.

- The amount of funds that crypto projects have lost to hackers has declined by about half to around $1.7 billion so far this year, reports Bloomberg. This comes amid improved security measures and an uptick in law enforcement actions.

- A former private banking executive at Credit Suisse has launched a crypto trading venue targeting banks and securities firms as clients. David Riegelnig co-founded the Zurich-based startup Rulematch, which offers a crypto trading venue for financial institutions only, writes Bloomberg.

Weaknesses

- Of the cryptocurrencies tracked by CoinMarketCap, the worst performer for the week was Rocket Pool, down 14.68%.

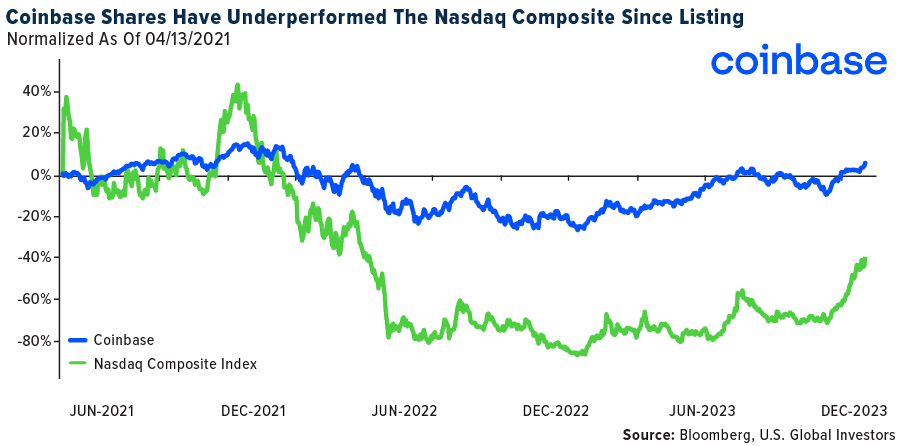

- Cathie Woods’ investment management firm ARK Invest sold Coinbase stock for a third straight day, as shares held steady within 5% of the year’s high, according to Bloomberg.

- Blockchain technology will be used to verify the real-name identities of China’s 1.4 billion people, according to an announcement from the Blockchain-based service network. This move is likely to spark concern among data privacy advocates, writes Bloomberg.

Opportunities

- Deutsche Bank’s DWS group, Dutch market maker Flow Traders, and crypto fund manager Galaxy Digital Holdings, are planning to form a company to issue a euro-denominated stablecoin with the goal of driving more mainstream adoption of tokenized assets. The company will be based in Frankfurt and led by Alexander Hoptner, a veteran exchange executive and former CEO of crypto platform BitMex, writes Bloomberg.

- Coinbase Global is rolling out spot crypto trading on its international exchange as part of a global expansion, saying some users are wary of U.S. venues due to the country’s uncertain regulatory backdrop, Bloomberg reports.

- Line Next, the South Korea-based NFT unit of a joint venture between SoftBank and Naver, has secured $140 million from a consortium led by Crescendo Equity Partners, even as hype around the digital collectibles has faded, writes Bloomberg.

Threats

- Sam Bankman-Fried’s (SBF) lawyer says his client was the “worst” witness he has ever seen, going off-script when he took the stand. That’s the view of David Mills, the behind-the-scenes architect of the FTX co-founder’s defense at trial, writes Bloomberg.

- KuCoin one of the largest and most popular cryptocurrency exchanges, has agreed to pay $22 million in fines and refunds and stop trading in New York to resolve a lawsuit by the state. The payments will resolve claims that KuCoin failed to register as a securities and commodities broker-dealer and falsely represented itself as a crypto exchange, Bloomberg reports.

- The latest crypto hack involved one of the industry’s top names in security: hardware wallet-maker Ledger. The Paris-based startup saw its Ledger Connect Kit software compromised, leading to hundreds of thousands of dollars being drained from users’ wallets early Thursday, writes Bloomberg.

Gold Market

This week gold futures closed at $2,033.00, up $18.50 per ounce, or 9.2%. Gold stocks, as measured by the NYSE Arca Gold Miners Index, ended the week higher by 4.38%. The S&P/TSX Venture Index came in up 1.24%. The U.S. Trade-Weighted Dollar fell 1.35 but closed up 0.63% on Friday.

Strengths

- The best performing precious metal for the week was palladium, up 24.32%. Palladium headed for its biggest gain since March 2020 as the United Kingdom government targeted Russian metals — but not palladium — with new sanctions. The metal, mainly used in catalytic converters, surged as much as 12% on Thursday after the UK published measures that ban British citizens and entities from buying certain Russian metals. Palladium is still down 38% this year, with manufacturers using the cheaper platinum as a substitute.

- Gold headed for a weekly gain in a market dominated by the Federal Reserve’s strongest indications yet that it will pivot to easing monetary policy next year. The precious metal surged 2.4% on Wednesday when officials at the U.S. central bank indicated they expect to cut interest rates by 75 basis points next year, which would be positive for the non-interest-bearing metal. Economists at some of Wall Street’s biggest banks are now calling for the Fed to ease policy earlier and faster.

- Loncor Gold announced it has entered into an agreement for the sale of Loncor’s Makapela property for CDN$13.5 million cash. The agreement calls for the sale price to be paid in a series of progress payments beginning with a deposit of $2 million. The balance of the progress payments, totaling $11.5 million, will be paid upon completion of the transfer of title to Makapela, which is expected to occur before the end of February 2024. Makapela was a noncore asset, and now Loncor is funded for 2024.

Weaknesses

- The worst performing precious metal for the week was gold, but still up 0.92%. Workers at a South African platinum mine returned to the surface after almost three days underground following what the company called an illegal sit-in. Employees at Wesizwe Platinum’s Bakubung operation northeast of Johannesburg resurfaced following discussions between management and union leadership, the company said, without elaborating on the content of the discussion.

- Petra Diamonds has entered into a non-binding term sheet on an exclusive basis with an interested party for the potential sale of its South African Koffiefontein Mine. There is the risk that the price may be less than expected as diamond prices and volumes are declining. The share price of Petra Diamonds is off slightly more than 40% year-to-date.

- The value of polished stone exports from India—a proxy for demand—was down 13% year-over-year, while volumes decreased by 7% YoY, implying aggregate prices remained increased by 2% month-over-month, but down by 6% year-over-year. The Indian diamond industry ended its voluntary suspension of rough diamond import this past Friday, as there as signs of stability emerging but need further confirmation on an improvement in market condition.

Opportunities

- According to Bank of America, gold remains a trade on rates. Thus, once the Fed announces a decisive end to the hiking cycle, expected in the second quarter 2024, new buyers should come into the market. If the Fed cuts earlier, gold could end the year at $2,400 per ounce versus spot around $1,980. The bank’s gold price model factors in changes in gold prices, rates and the U.S. dollar, not levels. The bottom line: rates and the dollar matter, with changes in direction more important than the actual levels. As such, Bank of America expects the next leg higher for the gold price will come when the Fed cuts rate, likely in 2024.

- Shares in Compania de Minas Buenaventura surged after Chilean copper producer Antofagasta unveiled a stake in the Peruvian miner, in an apparent move to diversify geographically away from Chile and add gold and silver exposure. Peru’s top publicly traded precious metals producer jumped as much as 27% in New York trading Friday. Antofagasta, the London-listed company controlled by Chile’s richest family, said it acquired a 19% stake and entered into discussions with Buenaventura to develop “a framework of collaboration,” including joining its board. “Our investment demonstrates the significant potential we see in Buenaventura’s asset portfolio,” Chairman Jean-Paul Luksic said in a statement.

- Cited on Barron’s favorite 10 stocks for 2024 is Barrick Gold. Gold mining stocks haven’t been able to keep up with gold prices, but 2024 may be the year that changes for Barrick. Gold miners are thought of as leveraged plays on the metal, yet Barrick shares are up just 3% this year while gold is up more than 10% to $2,036 an ounce. The company has some of the world’s best mines in spots like Nevada and the Dominican Republic, and it’s the top gold producer in Africa. It aims to boost its gold and to a lesser extent copper by 30% by the end of the decade. It has the industry’s most effective leader in CEO Mark Bristow, a hands-on manager who visits each major mine at least three times a year. He also has a knack for handling delicate relations with host countries in the developing world. “Barrick probably has the best management in the mining business, an excellent balance sheet with virtually no net debt, and a well-covered 2.3% dividend yield,” says independent analyst Keith Trauner. The stock trades for about 16 times next year’s projected earnings.

Threats

- Platinum group metals (PGM) prices have been under pressure, partially because palladium and platinum are key in auto catalysts, so the two metals are heavily exposed to cars with a combustion engine; under the technology status quo, palladium is one of the first commodities impacted by the energy transition. Anglo American notes that “The (platinum-group metals) basket price is now firmly into the cost curve, with sector returns at the lowest point seen in the last 30 years.” It remains to be seen how long these prices persist and its effect on several producers.

- Although gold finished the week up, profit taking at the end of the week on Friday trimmed the gains for the week as the Fed’s John Williams says talks of a rate cut in March are premature, tempering some of the enthusiasm the market has priced in. This lifted the dollar about 60 bp higher for the day but the 10-year yield displayed only a muted lift higher. Not a clear signal for the next direction in gold.

- Russian gold miners Highland Gold Mining, GV Gold, Trans-Siberian Gold and Kamchatka Gold were sanctioned by the U.S. government. The U.S. didn’t give any reason for the sanctions against the mining companies in an accompanying press release, but in February warned that any company or individual operating in the Russian metals and mining sector could be subject to sanctions.

U.S. Global Investors, Inc. is an investment adviser registered with the Securities and Exchange Commission (“SEC”). This does not mean that we are sponsored, recommended, or approved by the SEC, or that our abilities or qualifications in any respect have been passed upon by the SEC or any officer of the SEC.

This commentary should not be considered a solicitation or offering of any investment product. Certain materials in this commentary may contain dated information. The information provided was current at the time of publication. Some links above may be directed to third-party websites. U.S. Global Investors does not endorse all information supplied by these websites and is not responsible for their content. All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. The following securities mentioned in the article were held by one or more accounts managed by U.S. Global Investors as of (09/30/2023):

Southwest Airlines

American Airlines

United Airlines

Delta Air Lines

Costco

ITX

Brunello Cucinelli

Marriot International

Tesla

Louis Vuitton

Loncor Gold Inc.

Anglo American Platinum Ltd.

*The above-mentioned indices are not total returns. These returns reflect simple appreciation only and do not reflect dividend reinvestment.

The Dow Jones Industrial Average is a price-weighted average of 30 blue chip stocks that are generally leaders in their industry. The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies. The Nasdaq Composite Index is a capitalization-weighted index of all Nasdaq National Market and SmallCap stocks. The Russell 2000 Index® is a U.S. equity index measuring the performance of the 2,000 smallest companies in the Russell 3000®, a widely recognized small-cap index.

The Hang Seng Composite Index is a market capitalization-weighted index that comprises the top 200 companies listed on Stock Exchange of Hong Kong, based on average market cap for the 12 months. The Taiwan Stock Exchange Index is a capitalization-weighted index of all listed common shares traded on the Taiwan Stock Exchange. The Korea Stock Price Index is a capitalization-weighted index of all common shares and preferred shares on the Korean Stock Exchanges.

The Philadelphia Stock Exchange Gold and Silver Index (XAU) is a capitalization-weighted index that includes the leading companies involved in the mining of gold and silver. The U.S. Trade Weighted Dollar Index provides a general indication of the international value of the U.S. dollar. The S&P/TSX Canadian Gold Capped Sector Index is a modified capitalization-weighted index, whose equity weights are capped 25 percent and index constituents are derived from a subset stock pool of S&P/TSX Composite Index stocks. The NYSE Arca Gold Miners Index is a modified market capitalization weighted index comprised of publicly traded companies involved primarily in the mining for gold and silver. The S&P/TSX Venture Composite Index is a broad market indicator for the Canadian venture capital market. The index is market capitalization weighted and, at its inception, included 531 companies. A quarterly revision process is used to remove companies that comprise less than 0.05% of the weight of the index, and add companies whose weight, when included, will be greater than 0.05% of the index.

The S&P 500 Energy Index is a capitalization-weighted index that tracks the companies in the energy sector as a subset of the S&P 500. The S&P 500 Materials Index is a capitalization-weighted index that tracks the companies in the material sector as a subset of the S&P 500. The S&P 500 Financials Index is a capitalization-weighted index. The index was developed with a base level of 10 for the 1941-43 base period. The S&P 500 Industrials Index is a Materials Index is a capitalization-weighted index that tracks the companies in the industrial sector as a subset of the S&P 500. The S&P 500 Consumer Discretionary Index is a capitalization-weighted index that tracks the companies in the consumer discretionary sector as a subset of the S&P 500. The S&P 500 Information Technology Index is a capitalization-weighted index that tracks the companies in the information technology sector as a subset of the S&P 500. The S&P 500 Consumer Staples Index is a Materials Index is a capitalization-weighted index that tracks the companies in the consumer staples sector as a subset of the S&P 500. The S&P 500 Utilities Index is a capitalization-weighted index that tracks the companies in the utilities sector as a subset of the S&P 500. The S&P 500 Healthcare Index is a capitalization-weighted index that tracks the companies in the healthcare sector as a subset of the S&P 500. The S&P 500 Telecom Index is a Materials Index is a capitalization-weighted index that tracks the companies in the telecom sector as a subset of the S&P 500.

The Consumer Price Index (CPI) is one of the most widely recognized price measures for tracking the price of a market basket of goods and services purchased by individuals. The weights of components are based on consumer spending patterns. The Purchasing Manager’s Index is an indicator of the economic health of the manufacturing sector. The PMI index is based on five major indicators: new orders, inventory levels, production, supplier deliveries and the employment environment. Gross domestic product (GDP) is the monetary value of all the finished goods and services produced within a country’s borders in a specific time period, though GDP is usually calculated on an annual basis. It includes all private and public consumption, government outlays, investments and exports less imports that occur within a defined territory.

The S&P Global Luxury Index is comprised of 80 of the largest publicly traded companies engaged in the production or distribution of luxury goods or the provision of luxury services that meet specific investibility requirements.

The S&P Global Luxury Index is comprised of 80 of the largest publicly traded companies engaged in the production or distribution of luxury goods or the provision of luxury services that meet specific investibility requirements.

Bitcoin difficulty is a measure of how many hashes (statistically) must be generated to find a valid solution to solve the next Bitcoin block and earn the mining reward.

The Empire State Manufacturing Index rates the relative level of general business conditions New York state.