Fully Vaccinated People Are Free to Fly Commercial Again

Last month I forecasted we'd see a travel boom this summer as newly vaccinated Americans book their first big trips and vacations since the pandemic began.

Last month I forecasted we’d see a travel boom this summer as newly vaccinated Americans book their first big trips and vacations since the pandemic began.

Today I’m even more convinced this will happen, following new guidance from the Centers for Disease Control and Prevention (CDC) saying that fully vaccinated people can travel “at low risk to themselves.” What’s more, travelers within the U.S. no longer need to take a COVID-19 test or self-quarantine afterward. The same goes for international travel unless the destination country requires it. You can read the full guidance for yourself by clicking here.

This is all very constructive news for travel and hospitality stocks in general, and airline stocks specifically.

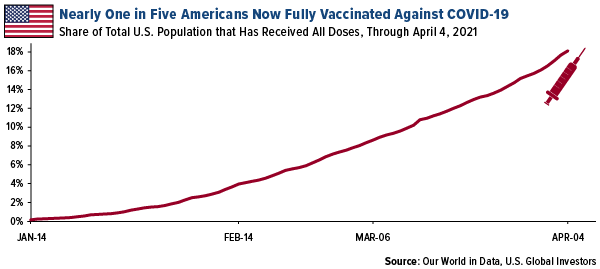

The recovery in commercial flight demand is already well underway as the vaccine rollout accelerates. This past Saturday, over 4 million doses were administered in a single 24-hour period for the first time. As of April 5, 18.8% of Americans over the age of 18—or nearly one in five—had been fully vaccinated against COVID-19, according to CDC data.

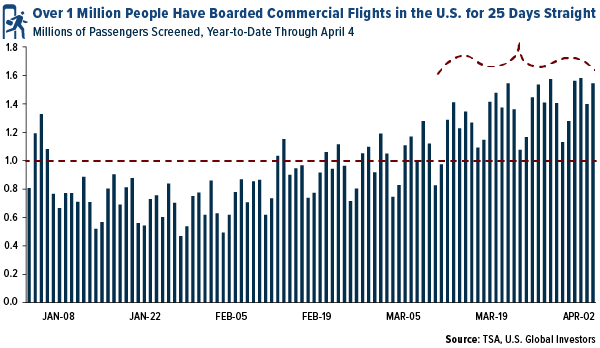

Consequently, more and more Americans are gaining the confidence to fly again, even though a number of studies have shown that there’s low risk of transmission during flights. For 25 days straight, as of April 4, over 1 million people per day have been screened at U.S. airports, a remarkable sign that people are ready to get back to life as they remembered it.

Airlines are in a good position to take advantage of the upcoming demand boom, with many carriers having already expanded their networks. Starting May 1, Delta Air Lines will begin selling the middle seat for the first time since April 2020, making it the last major U.S. carrier to do so. “Now, with vaccinations becoming more widespread and confidence in travel rising, we’re ready to help customers reclaim their lives, Delta CEO Ed Bastian said in a statement.

A New “Golden Age” of Travel?

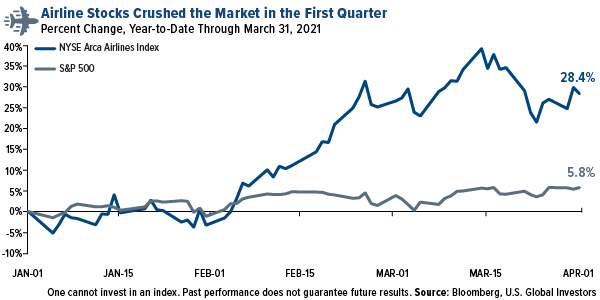

Taking these positive developments into account, a number of analysts have published bullish outlooks on the industry. This week, Morgan Stanley analyst Ravi Shanker said he sees 30% upside potential for select airline stocks in the near term, and 45% gains longer term. “We would not be surprised to see the return of the ‘golden age’ of travel in the 2020s,” he writes, likening today’s situation to the Roaring Twenties and Swinging Sixties.

In the first quarter of 2021, airline stocks soared close to 30%, handily outperforming the market. Among the best performing carriers were American Airlines, up 55.5%; JetBlue Airways, up 46.3%; and Alaska Air Group, up 42.5%.

Services Sector Expands at Fastest Pace on Record

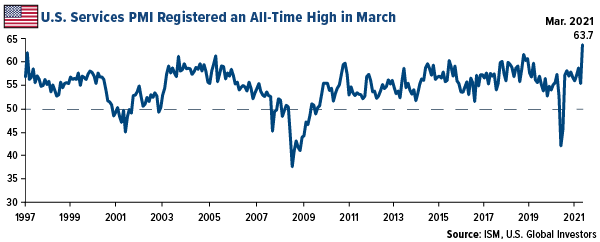

Another sign that the services sector, which includes airlines, has entered a high-growth period is the Institute for Supply Management’s (ISM) latest Report on Business. In March, the Services PMI clocked in at 63.7, the fastest rate on record, exceeding the previous record high set in November 2018.

The positive report comes as forecasts for U.S. GDP growth in 2021 continue to be revised up. Today the International Monetary Fund (IMF) updated its projection, saying it now believes the U.S. economy will grow at an annual rate of 6.4%, up 1.3 percentage points from its January forecast.

Frank Talk Turns 14

On a final note, I’m pleased to share with you that this month marks 14 years since I began writing Frank Talk. To give you some idea of how long ago that is, Twitter wasn’t yet a year old, Barack Obama had just announced his candidacy for president and Donald Trump was still hosting The Apprentice. Few people were talking about a subprime mortgage crisis.

I want to thank all of my readers, old and new. Without you, none of this would have been possible.

Having said that, if you find any value in Frank Talk, please consider forwarding it on to a friend or colleague you think might enjoy it also. Make sure you let them know they can subscribe by clicking here.

Some links above may be directed to third-party websites. U.S. Global Investors does not endorse all information supplied by these websites and is not responsible for their content. All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

The NYSE Arca Global Airline Index is a modified equal dollar weighted index designed to measure the performance of highly capitalized and liquid international airline companies. The S&P 500 Index is a market-capitalization-weighted index of the 500 largest U.S. publicly traded companies. The Services PMI is a composite index based on the diffusion indexes for four of the indicators with equal weights: Business Activity (seasonally adjusted), New Orders (seasonally adjusted), Employment (seasonally adjusted) and Supplier Deliveries.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. The following securities mentioned in the article were held by one or more accounts managed by U.S. Global Investors as of (3/31/2020): Delta Air Lines Inc., American Airlines Group Inc., JetBlue Airways Corp., Alaska Air Group Inc.