A New Commodities Supercycle Could Be Powering Up After a Long Freeze

As many of you know, I grew up in Toronto, where winters can be brutally cold. Like most people who live in northern U.S. states, I'm accustomed to driving on snowy, icy roads. But then, roads in the north are plowed, sanded and salted when there's snowfall. With rare exception, the roads here in sunny San Antonio, Texas, do not see that kind of maintenance. There are no snow plows or salt trucks. Driving, then, can be several times more precarious when we get the kind of extreme weather that hit us last week.

As many of you know, I grew up in Toronto, where winters can be brutally cold. Like most people who live in northern U.S. states, I’m accustomed to driving on snowy, icy roads.

But then, roads in the north are plowed, sanded and salted when there’s snowfall. With rare exception, the roads here in sunny San Antonio, Texas, do not see that kind of maintenance. There are no snow plows or salt trucks. Driving, then, can be several times more precarious when we get the kind of extreme weather that hit us last week.

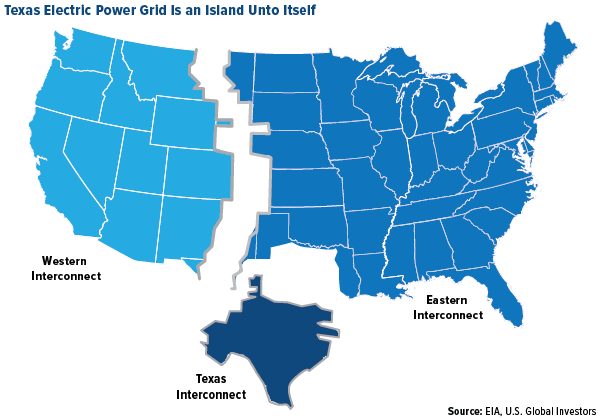

Similarly, our electrical power infrastructure was designed to withstand heatwaves, not blizzards. I think a lot of Texans last week learned for the first time that a large share of the Lone Star State’s power grid operates separately from the rest of the U.S. Because of this, much of the infrastructure, including plants and pipelines, has not been winterized, which contributed to the widespread outages that left millions without power and water for days.

That fact alone, I believe, presents a good investment case for commodities and natural resources.

A joint state and federal investigation into the outages has already been announced, and improvements to (and winterization of) aging infrastructure will likely be recommended, if not required, to prevent this from happening again. Such a massive overhaul would require an incredible amount of metals and other basic materials, which would be positive for miners and producers.

We’re particularly bullish on copper, used extensively in electrical wiring and circuitry. Our favorite explorer-producer is Ivanhoe Mines, which recently announced positive mining results at its Kamoa-Kakula project in the Democratic Republic of Congo (DRC). Ivanhoe is up about 116% over the past 12 months. Our favorite speculation play is CopperBank Resources, which offers investors optionality to higher copper prices. Shares of the company are up more than 200% for the 12-month period, and today they hit a new all-time high of C$0.61.

Texas is the ninth largest economy in the world, ahead of Canada, South Korea and now Brazil. It consumes more energy than any other U.S. state. Its residents and businesses deserve a world-class power grid that operates reliably in all weather conditions, even those that strike only once every 100 years.

No Energy Source Alone Is to Blame for the Outages

I want to briefly address something that I’ve been hearing and reading this past week. Some have used the outages as an opportunity to point fingers and criticize the reliability of different forms of energy, from fossil fuels to renewables.

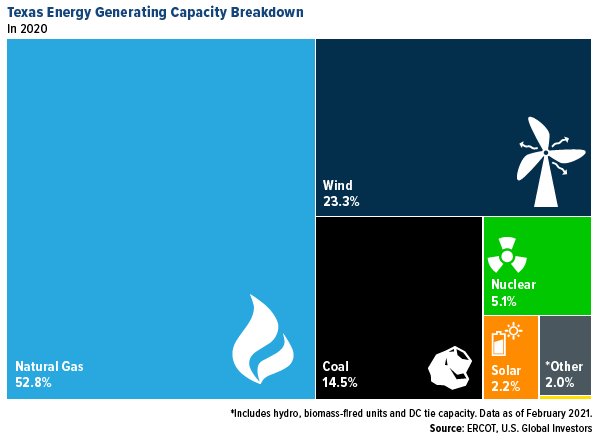

Not only is this kind of talk counterproductive, but it’s also simply not rooted in fact. No single energy source was responsible for bringing the whole system down. Texas is well diversified when it comes to electricity generation, as you can see below.

A little over half of Texas’s power comes from natural gas, which largely went down due to frozen wells and pipelines.

The state’s next biggest source, wind, also had issues, but these issues represented only around 13% of the blackouts. That’s according to Dan Woodfin, senior director for the Electric Reliability Council of Texas (ERCOT), which manages the Texas grid.

As I’ve pointed out before, Texas is the U.S. leader in wind energy, with close to 31,000 megawatts (MW) of installed capacity and 7,620 MW currently under construction.

However, another state’s wind capacity ranks higher in terms of percentage of its total energy. In 2019, wind accounted for 42% of Iowa’s net generation, the largest share of any other state.

We invest heavily in renewable energy, and we will continue to do so because that’s where the trend is headed. Among our largest holdings are Vestas Wind Systems, Canadian Solar and Plug Power. These positions have helped us crush the S&P Global Natural Resources Index over a number of time periods.

JPMorgan: A New Commodities Supercycle Has Begun

It’s not just renewables, though. We believe commodities as a whole look very attractive right now due to a number of factors.

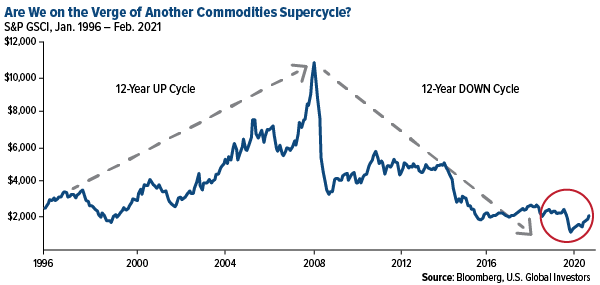

I believe we’ll see demand from China surge in the coming months and years as the country comes out of the pandemic as the only major economy to expand in 2020. Last Thursday, February 18, Chinese stocks, as measured by the CSI 300 Index, hit a new all-time high, exceeding the previous record set in October 2007.

That was near the end of the last commodities supercycle. One highly regarded quant analyst believes we may be on the verge of the next one.

In a note to clients this week, JPMorgan’s Marko Kolanovic wrote that he thinks commodities have finally turned after a 12-year down cycle. The potential drivers of a secular bull market, says Kolanovic, include the end of the pandemic and reopening of economies, fiscal stimulus, end of the U.S.-China trade war, ultraloose monetary policies and increased and “tolerated” inflation.

He also notes ESG investors, or those who put special emphasis on environmental, social and corporate governance concerns. President Joe Biden seeks to go big on an infrastructure package that’s expected to favor renewables, which is supportive of metals, electric vehicles (EVs) and batteries.

Kolanovic’s outlook is shared by many other analysts and investors, including Goldman Sach’s Jeff Currie, head of commodity research. In a recent interview with S&P Global Platts, Currie (who called the previous supercycle) said he’s bullish on oil and believes copper is likely already in a secular up cycle. “I want to be long oil and hang on for the ride,” he said in the February 5 interview.

HIVE Blockchain Valued Over $2 Billion

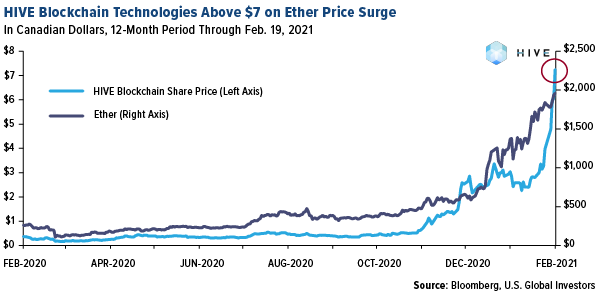

One year ago around this time, HIVE Blockchain Technologies had a market cap of about C$120 million. This week it soared past $2 billion. Today it sits at $2.4 billion.

I want to thank all of the investors who believe in HIVE’s potential and who have come along on this incredible journey. We took the company public in 2017 to give investors like you access to the emerging industry of cryptocurrency mining. We were the first to come to market, and today we’re the only one that mines both Bitcoin and Ether using all-green energy sourced in Sweden and Iceland.

On Friday, February 19, shares of HIVE smashed above C$7.00 for the first time ever. With a high of $7.25, the stock is up more than 1,500% over the past 12 months.

HIVE trades in Canada on the TSX Venture Exchange, over the counter in the U.S. and in Germany.

Many investors have reached out to me to ask when HIVE stock might become available on a bigger exchange, such as the Nasdaq. Such a move would naturally help it get more eyeballs.

I can’t say anything specific right now, but I will say that I hear you loud and clear. Getting listed on a new exchange is a process, and as soon as there’s something specific to share, I’ll let you know.

Speaking of cryptos, we have a webcast coming up on March 10 that I hope you’ll join us for. The topic will be gold and cryptocurrencies and how there’s room in your portfolio for both. Register for this free event by clicking here!

Some links above may be directed to third-party websites. U.S. Global Investors does not endorse all information supplied by these websites and is not responsible for their content. All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

The CSI 300 Index consists of the 300 largest and most liquid A-share stocks. The Index aims to reflect the overall performance of China A-share market. The S&P Global Natural Resources Index is comprised of 90 of the largest U.S. and foreign publicly traded companies, based on market capitalization, in natural resources and commodities businesses that meet certain investability requirements. The S&P Goldman Sachs Commodity Index (GSCI) serves as a benchmark for investment in the commodity markets and as a measure of commodity performance over time.

Mr. Holmes serves on the board as non-executive chairman of HIVE and held shares and options at December 31, 2020. Effective August 31, 2018, Mr. Holmes was named Interim Executive Chairman of HIVE while a search for a new CEO is undertaken.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. The following securities mentioned in the article were held by one or more accounts managed by U.S. Global Investors as of (12/31/2020): Ivanhoe Mines Ltd., Vestas Wind Systems A/S, Canadian Solar Inc., Plug Power Inc., CopperBank Resources Corp.